z1b

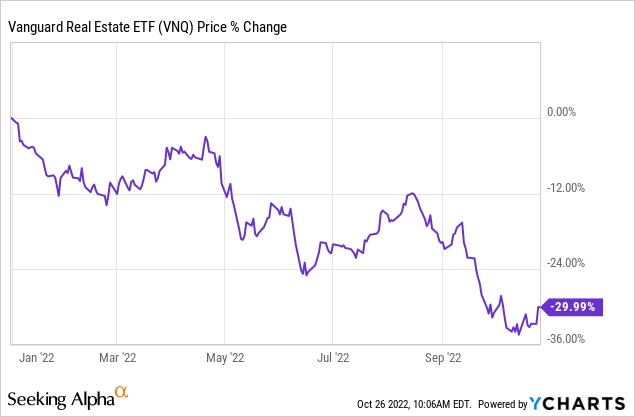

Lately, I have written a lot of articles about opportunities in the REIT sector (VNQ).

That’s because I think that it’s the best time in years to buy REITs while they’re temporarily discounted by the market.

Some REITs (NexPoint (NXRT), Medical Properties Trust (MPW), Global Medical (GMRE)) are down more than 50% and this is just because investors fear rising interest rates, but they have failed to recognize that REITs use little debt these days and most of it is fixed rate and long term. Therefore, the impact actually isn’t significant in most cases. Besides, interest rates are only rising because of inflation, which is very beneficial for REITs as it leads to growing rents and property replacement costs.

Therefore, I think REITs offer a historic opportunity and most of my capital has been going to this space following the recent sell-off.

But I am not just buying REITs.

I rarely discuss my non-REIT investments on Seeking Alpha since REITs are my main focus, but I have also been accumulating shares of other companies and that’s the focus of this article.

Typically, if I’m not buying REITs, I like to stick to businesses that enjoy some of the following characteristics:

-

Simplicity

-

High returns on equity

-

Barriers to entry

-

Shareholder-friendly management

-

Discounted valuation

-

Preferably, includes a real estate element (my circle of competence)

Below, I highlight a few such companies that enjoy those characteristics:

RCI Hospitality (RICK)

I have previously highlighted RICK as my single largest investment, and despite that, I have kept buying more shares because I think that it’s one of the most heavily mispriced companies in today’s market.

In short, RICK has a path to 15-20% annual FCF per share growth, but it’s currently priced at just ~8x its normalized forward FCF. In other words, it’s a growth stock that trades like a value stock.

Why is it so cheap?

We think that it isn’t because the business is of poor quality, but simply because most institutional investors can’t own it due to the nature of the business.

RICK is the only publicly-listed strip club company and that’s enough of a reason for lots of investors to not consider it as an investment opportunity.

RCI Hospitality

But if you think a little about it, this is actually a very compelling business.

Today, it’s nearly impossible to open new ones because no one wants a new strip club in their backyard, and as a result, existing clubs essentially enjoy a quasi-monopoly in their local markets.

It’s also a high margin business because you get to charge the entertainers for the right to perform at your property, and also the customers for the entry, drinks, and extra services.

The business is also relatively resilient to recessions because people still need an escape. Alcohol sales actually increase during most recessions.

Despite that, these businesses sell for only 3-5x cash flow because there aren’t many buyers and RICK is now consolidating the sector, earning high returns on its invested capital and growing at a rapid pace.

RICK is typically the buyer of choice because it has large scale, a great reputation, access to public capital, and it can structure deals that are more favorable to the seller (as an example: give some equity in the public company to defer taxes and/or give a seller notes to allow the seller to earn additional interest income).

Today, it still only has ~50 clubs and as increasingly many club owners are looking to retire in the coming years, RICK is ideally positioned to keep consolidating the sector.

It’s a simple story but it has powerful economics and a high likelihood of resulting in market-beating returns.

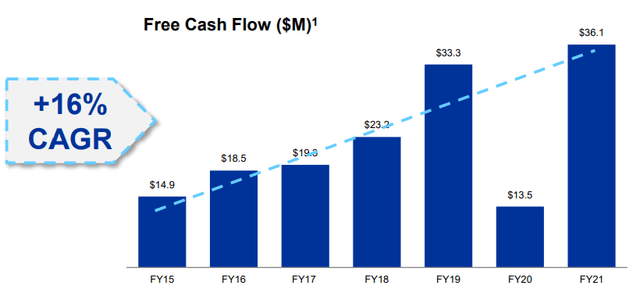

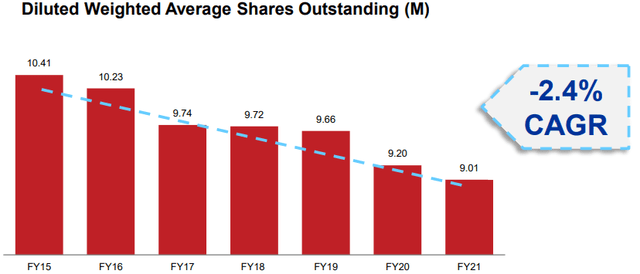

Ever since they began to follow this strategy, they have been growing their FCF per share at ~20% per year and they are still just getting started.

The total free cash flow has grown at 16% per year, despite the pandemic, all while buying back shares at the same time:

RCI Hospitality

RCI Hospitality

Eventually, as they grow larger, and more investors become familiar with the company, I also expect its valuation multiple to expand closer to 15x FCF, which would result in ~100% upside from today’s share price.

Patria Investments (PAX)

Asset management businesses can be formidable because they essentially allow you to earn a return on capital that’s not yours.

If you can convince other investors to let you invest their money, in exchange for a fee, and you then manage to scale your assets under management, you can rapidly build a very profitable, high-margin, capital-light business.

And as you build your track record and reputation, you also will develop high barriers to entry for others to compete with. This is particularly true if you specialize in asset classes that are more difficult to access due to their lack of liquidity.

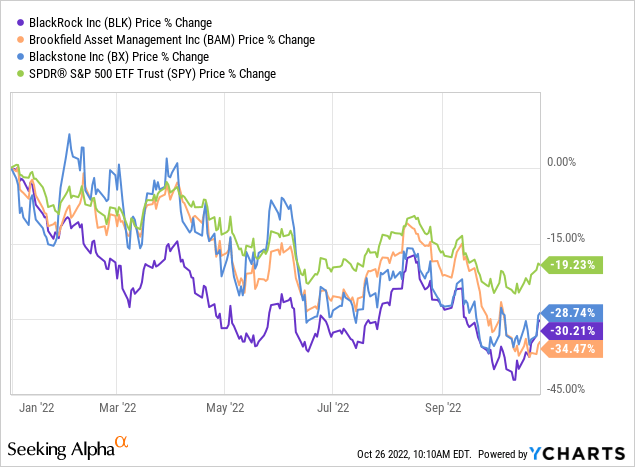

So these can be great businesses, but because they’re perceived to be more cyclical and sensitive to interest rates, they have sold off very heavily in recent months.

Both the major traditional asset managers like BlackRock (BLK) and the alternative asset managers like Blackstone (BX) and Brookfield (BAM) are down much more than the average of the market (SPY):

I think that most of these names are today undervalued and likely to deliver above-average returns in the coming years.

But if I had to pick one, it probably would be Patria Investments.

Patria Investments

PAX is the biggest alternative asset manager in Latin America. It’s commonly perceived to be the “Blackstone of Latin America” because they used to be partners and to this day, Blackstone is still one of the biggest shareholders of PAX.

But we think that PAX is a more compelling investment opportunity than Blackstone because of five key reasons:

Reason #1: Faster growth prospects – Today, PAX still only has about $30 billion of assets under management, which compares very favorably to Blackstone’s $800 billion. The simple rule of big numbers would tell you that it’s easier to grow from 30 than from 800. Moreover, competition for capital is today getting greater in developed countries, which makes it harder for asset managers to grow. At the same time, increasingly many investors are starting to look into Latin America as they seek to better diversify their portfolios in today’s uncertain world.

Reason #2: Lower competition – The alternative asset management space is today getting more competitive in developed countries. However, it’s still a new and emerging space in Latin America. PAX has established itself as the leader and it has a multi-decade track record of superior returns and has developed relationships with most major investment groups, in part thanks to its links to Blackstone. As such, it enjoys even greater barriers to entry and lower competition.

Reason #3: Greater pricing power – Because there’s less competition, and PAX is providing a service that’s increasingly in demand, it also enjoys superior pricing power in terms of fees.

Reason #4: Superior macro tailwinds – Latin American economies are today performing quite a bit better than the rest of the world. Besides, it’s expected that increasingly many companies move greater portions of their supply chains to the region following the pandemic because China’s zero COVID tolerance policy has made it impossible for them to operate efficiently, and Russia’s invasion of Ukraine has caused significant uncertainty in Europe and Euroasia. Latin America is emerging as a Safe Haven with superior growth potential.

Reason #5: Lower valuation – Despite all of that, PAX is today priced at a hefty discount relative to its larger, slower-growing American peers. PAX is currently priced at just x its FCF, which compares very favorably to Blackstone’s x FCF. I think that both are discounted, but PAX offers better risk-to-reward given its superior growth prospects and lower valuation.

All in all, PAX has exactly what I look for. Its business is simple, its economics are advantaged, it has high barriers to entry, and it enjoys high returns on invested capital, which puts it on a path to rapid growth in the years ahead.

I believe that its fair value is at least 50% higher, but quite possibly closer to 100% higher, especially after another few years of rapid growth.

Bottom Line

Today, the most obvious opportunities are in the REIT sector, in my opinion.

REITs are priced at huge discounts relative to the value of the real estate that they own, and that’s despite continuing to grow their cash flow.

But there also are opportunities in other sectors of the market. RICK and PAX are two good examples that I hold in my portfolio.

Be the first to comment