MarsBars

The recent market rally has lifted a lot of beaten down names, but the recovery has been rather uneven. This is especially true in the BDC sector, in which names such as Hercules Capital (HTGC) have seen a solid rebound while others like Capital Southwest (NASDAQ:CSWC) remains underappreciated. This article highlights why value investors should take a look at CSWC for potentially strong returns from income and potential capital appreciation.

Why CSWC?

Capital Southwest is one of just a handful of internally-managed BDCs and is based in Dallas, Texas. It carries an investment portfolio with a $1.0 billion fair value that’s well-diversified across 39 investments, with each investment averaging just 2.6% of the total portfolio.

Notably, CSWC is focused on the highly fragmented and less competitive lower middle market, and the investments are spread across everyday industries, with media/marketing, business services, consumer products & services, and healthcare comprising its top sectors, representing nearly half (46%) of portfolio fair value.

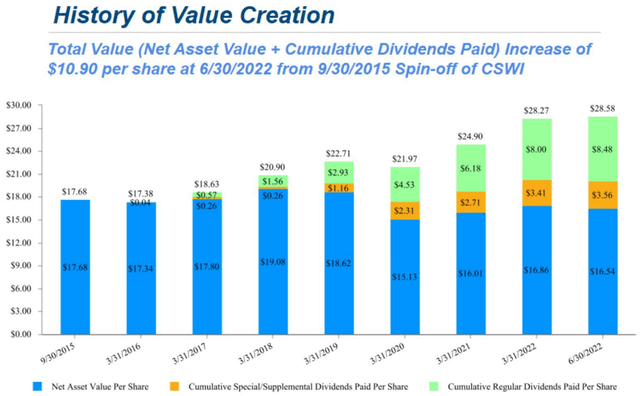

CSWC has undergone a portfolio transition in recent years, with management positioning the company for economic adversity. This is reflected by the fact that 94% of CSWC’s portfolio is in the safer first lien debt, as opposed to 86% back in 2018. CSWC also has a strong track record of value creation. As shown below, CSWC has given its investors a 62% total return since September of 2015 through a combination of NAV per share and cumulative regular plus special dividends.

CSWC Total Returns (Investor Presentation)

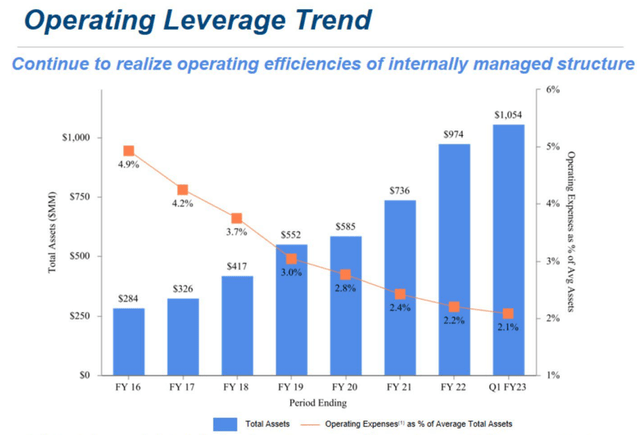

While no two companies are the same, CSWC does have some parallels to Main Street Capital (MAIN), as it seeks to gain operating efficiency through scale, thereby enabling more efficient returns to shareholders. As shown below, CSWC’s operating expense as a percentage of total assets has trended down every year and currently sits at 2.1%. While MAIN has an industry leading efficiency ratio of 1.5%, I do see a pathway for CSWC to get closer to that as it continues to scale in a prudent manner.

CSWC Operating Leverage (Investor Presentation)

It’s also worth mentioning that CSWC partners with Main Street Capital to manage the I-45 Senior Loan Fund (in a reference to the freeway that runs between Dallas and Houston, where MAIN is headquartered). The I-45 SLF portfolio represents 5% of CSWC’s portfolio, and consists of $173.5 million in invested capital with an average hold size of just 2.6% and is 95% comprised of first lien senior secured debt.

Meanwhile, CSWC is growing its NII per share nicely, with it landing at $0.50 for the first fiscal quarter of 2023 (ended June 30th), up 11% from $0.45 in the prior year period. Also encouraging, management has telegraphed a strong Q2 FY23, by giving estimated NII per share in the $0.52 to $0.54 range, and boosting its dividend to $0.52, equating to 11.5% yield at the current price of $18.03.

This is rather encouraging for income investors, especially considering that nonaccruals remain low, representing 1.6% of portfolio fair value and debt to equity stood at 1.1x, sitting well below the 2.0x regulatory limit. Management highlighted the importance of having dividend coverage and the tailwind from higher interest rates in the recent conference call:

Maintaining a consistent track record of meaningfully covering our dividend with pre-tax NII is important to our investment strategy. We continue to maintain our strong track record of regular dividend coverage with 105% for the last 12 months ended June 30, 2022, and 106% cumulative since the launch of our credit strategy in January 2015.

Given the floating rate nature of our credit portfolio, rising interest rates will be a significant tailwind to our net investment income. In fact, the index used to calculate interest on a majority of our loans reset in early July to 2.29%, up from its early April reset at 96 basis points. This significant increase quarter-over-quarter will provide an immediate step-up in portfolio income in the September quarter.

Meanwhile, CSWC trades cheaply compared to its two internally-managed peers, MAIN and HGTC. As shown below, CSWC carries a price to book ratio of just 1.09x, which sits at the low end of its 3-year range and well below that of its peers.

CSWC Price to Book (Seeking Alpha)

While some may be turned off by the premium to NAV, I believe efficiently managed BDCs such as CSWC should be measured on their earnings power. The efficient structure of BDCs like CSWC and HTGC is a key reason for why they are able to pay an equivalent or higher dividend yield than their externally-managed peers despite trading at a premium.

Investor Takeaway

In summary, CSWC remains rather cheap considering its quality and growth trajectory, especially compared to its internally-managed peers. Management has pre-communicated strong earnings for the upcoming Q2 FY23 results. CSWC is an underappreciated buy for value and income investors.

Be the first to comment