Thomas Barwick

Published on the Value Lab 10/24/22

Adecoagro (NYSE:AGRO) has been the way we’ve been following some key inflation factors, i.e., food prices. They have three businesses: sugar (which includes ethanol production), crops, rice and dairy. The price picture certainly points to inflation, although the data is more mixed than we expected. The issue is volumes across all the businesses, with various environmental factors having affected available food, and also meaningful cost inflation. Cash flows have fallen meaningfully but are still quite high. On a more positive note, the company is less exposed to rate increases at this point, where its proportion of fixed debt has gone up from 73% to 78% to insulate from risks of further rate hikes.

Q2 Discussion

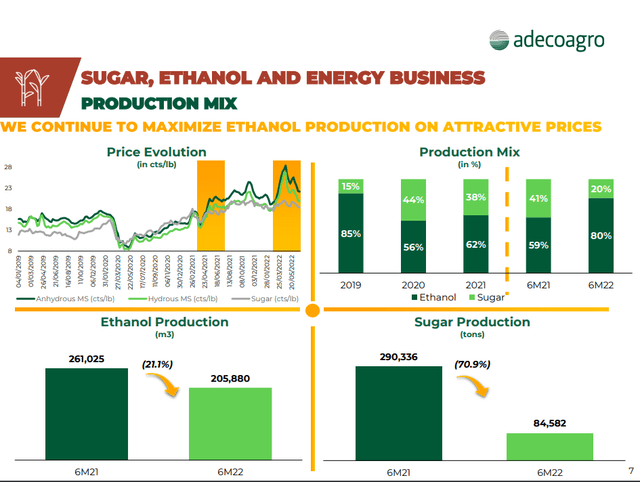

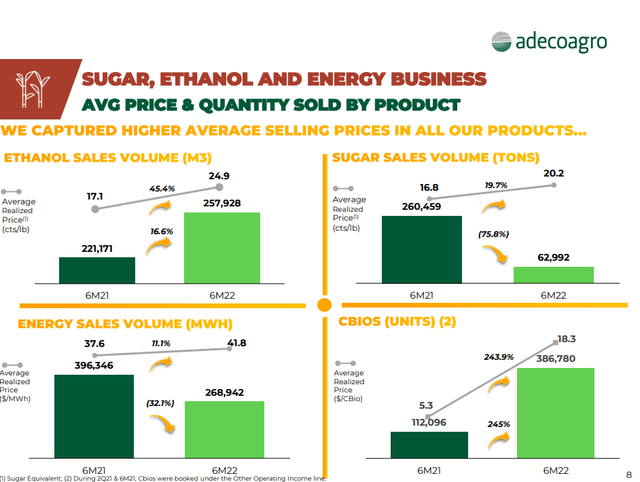

The most recent results were this August. The big saviour in cash flows this quarter has definitely been the ethanol business. There were not many contracts to supply sugar, so a lot of sugar was, therefore, possible to realise by producing ethanol, and selling it to a larger degree this quarter in export markets to capture the largest prices possible. Despite the volume declines due to frost damage to sugarcane, cash flows grew here and it’s thanks to both serendipity but also wise moves the company took to build sugar inventory in previous quarters and quality assets that produce sufficiently high-grade ethanol for European markets.

It was because of our high degree of asset flexibility and our low sugar commitments that during the quarter, we were able to divert 80% of our TRS to ethanol.

Declines in total ethanol production (Q2 2022 Pres) Increases in ethanol prices (Q2 2022 Pres)

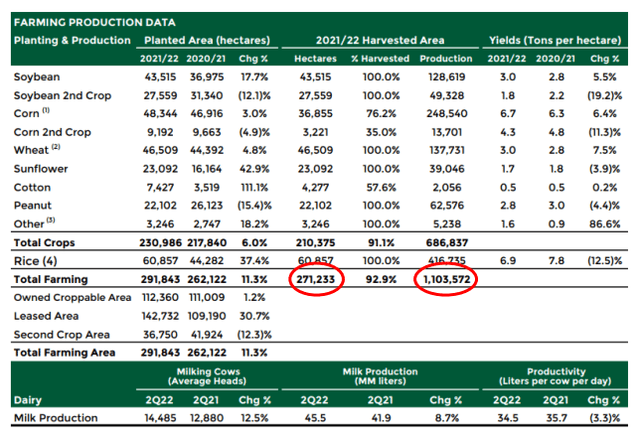

The farming business similarly saw issues in terms of yield and volumes across most of its products. Weather issues impacted rice volumes, and across all farming businesses except dairy fertiliser cost inflation was a major problem for the bottom line.

Farming volumes (Q2 2022 Pres)

Rice saw pretty constant prices. In general, rice has been very unvolatile these last few years due to particular market dynamics. Most are exported from India, but because of the large population, they don’t make an effort to price for export markets which to them are marginal. The prices have therefore essentially stayed where they are. Some limits on exports are increasing prices outside of India, however.

Dairy saw favourable pricing evolutions, but the issues were in crops. Soy was somewhat stronger, but corn saw pressure YoY, with declines around 15%. However, current prices are ahead of where they rapidly went in the latter half of 2021, so things don’t necessarily look so bad here. Peanut prices have risen. However, the combination of volume declines (especially in corn by 11% which is the biggest crop) and not strong price evolutions across the board on top of skyrocketing fertiliser prices has meant pretty severe declines in cash flow generation from these businesses.

Remarks

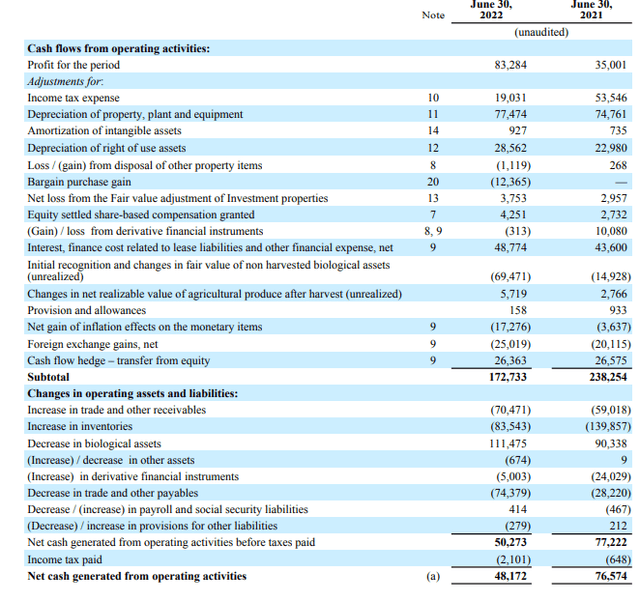

The company is not well evaluated on provided EBITDA or GAAP EBIT because of the impacts from crop revaluations. It is best to look at cash flows from operations in the business.

Cash Flow Statement (Q2 2022 PR)

Pressure is visible on this front, even when not accounting for details in working capital effects, which are in part driven by the fact that inflation is growing the payables and receivables and making WC movements more dramatic on cash flows.

Levered free cash flow yield is currently about 11%, which seems rather high, and we calculated this ignoring WC evolutions for now and on the lower market cap since our last coverage. There is clearly scope for more volatility in the company’s financials, especially as input prices are taking their toll on top of volatility in the prices for end markets. We think however that the 11% FCFY is not high enough in the current economic regime. With risk-free rates exceeding 4%, and the business being very commodified, a 7% premium on the risk-free rate appears small, especially when WC considerations should come home to roost. There are continuous environmental pressures, and climate change as we understand it to be going will have a secular negative effect on Adecoagro’s volumes. Farmers benefit to an outsized degree from scale, so this is not good. Overall, an interesting stock to keep following, but not a particularly compelling investment proposition at the moment.

Be the first to comment