Kevin Winter/Getty Images Entertainment

Co-produced with Treading Softly

Have you ever watched the A-Team? A team of specialists who were on the run from the military police after being convicted of a crime they didn’t commit?

They were specialized, skilled, and adept. They had supporters and detractors. They were a little bit crazy at times, and the TV show ran for five seasons.

In my income portfolio, it feels like I have a few “A-Team” members. People are deriding them publicly, chastising them wrongly, and laying “crimes” at their feet – like claims of potential dividend cuts – without any truth to back up their proclamations.

If you’ve been hearing these voices and selling these companies, I’ve been buying them from you – more likely than not! I like to call them my A-Team picks as they are specialized, skilled, and adept at making me more money every month and quarter while others miss out on their powerful income generation abilities.

In the end, I’m not a trader. I don’t sell and buy and buy and sell. I don’t brag about my trades or rag on others for not being “cool like me”. I try to be like a humble, honest farmer. I do my work, get my returns from my holdings in the form of income, and let others worry about themselves.

It’s not much, but it’s honest work.

So I’ve been adding to my A-team of picks while others try to game them, or play games around them

Let’s dive in.

Pick #1: AGNC – Yield 18.2%

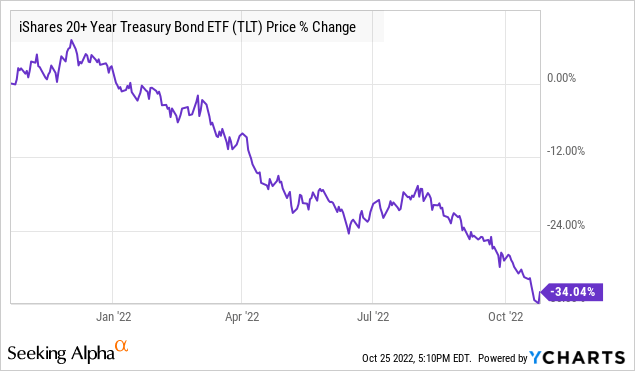

The market continues to obsess over the book value of AGNC Investment Corp. (AGNC). Why is the book value down? It is simple. AGNC owns agency mortgage-backed securities. Agency MBS are trading at the lowest prices relative to U.S. Treasuries that they have in modern history, even though U.S. Treasuries are down.

So Treasuries are down, and MBS is down relative to Treasuries. The “spread” between MBS and Treasuries is what AGNC profits from. The wider that spread, the more money they are capable of making. The rates they borrow at are tied to Treasuries, and the rates their assets pay them are tied to MBS. When MBS prices are down, it is bad for book value, but it is great for the yield that AGNC earns.

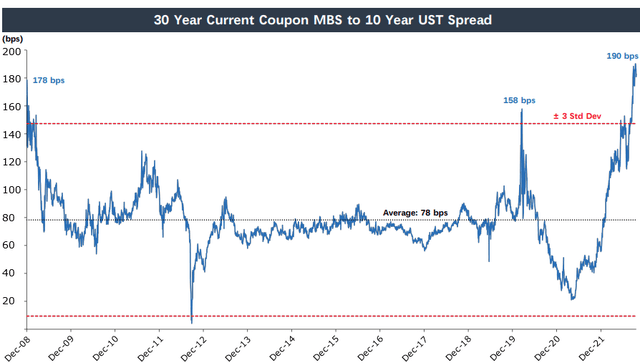

Here is a look at what MBS are paying relative to the 10-year Treasury:

At 190 bps, this spread is over 100 bps above average. Prior spikes have happened, but the spread always tightened back up. With AGNC’s current portfolio, a 50 bps tightening of this spread would lead to a 37.5% increase in book value: (Source)

AGNC Q3 Investor Presentation

Even with 50 bps of tightening, spreads would be significantly wider than at any time except the GFC and COVID. So yes, book value can recover and probably will.

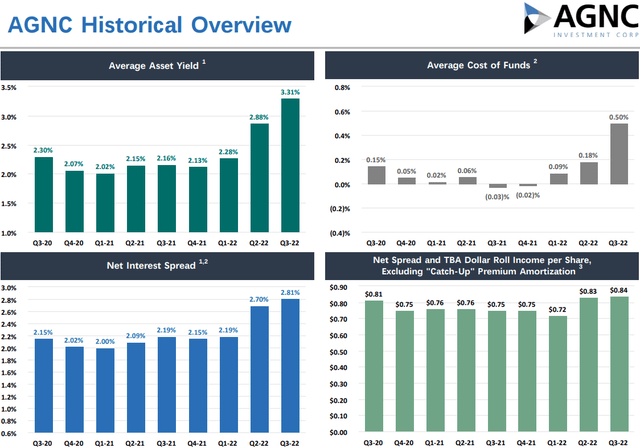

While we wait for that, cash flow has been very strong. AGNC just reported its highest quarterly earnings since 2014. Their average asset yield has gone up to 3.31%, while their cost of funds only went up to 0.5% thanks to their interest rate swaps which have a good 3.5 years to average maturity.

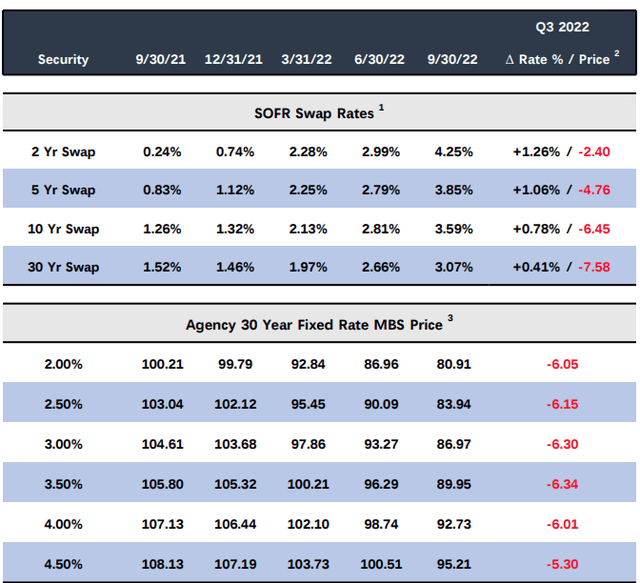

We’ve seen a lot of people running around talking about how AGNC would be “forced” to sell MBS at low prices. This is simply false. MBS prices had a terrible quarter. They were down approximately 6%.

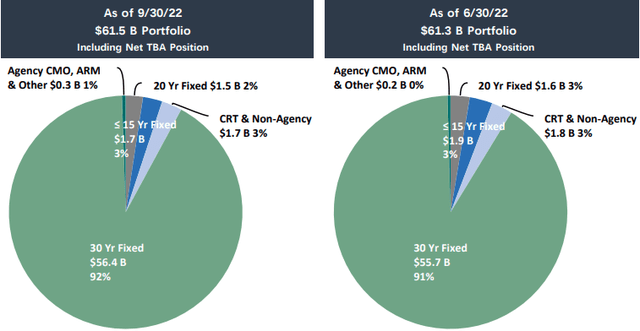

6%, for a zero credit risk security like Agency MBS is a huge swing. Was AGNC forced to sell? No. AGNC ended Q3 with $59.8 billion in agency MBS compared to $59.5 billion.

They ended the quarter with roughly the same amount – but this is by market value, and market values fell over 6%. AGNC bought more MBS. And they are prepared to leverage up and buy even more as prices remain weak. Nor are they likely to ever be “forced” to deleverage since AGNC has more than 50% of its equity in cash and unencumbered agency MBS, which can be used as collateral. AGNC has been building up cash, waiting for a buying opportunity. Last quarter they increased their holdings slightly, and now they are watching the technicals to decide when to buy more.

What about the dividend? Dividends are paid out of cash flow, not book value. Book value has declined, but the returns on equity that AGNC is receiving have gone up. Management made no bones about it in the earnings call – the current dividend is consistent with the forward earnings of their portfolio.

Agency MBS has a high yield, relative to other credit-risk-free investments. It’s an asset class that has seen a lot of sellers and few buyers, allowing the yield to reach historic heights relative to Treasuries. Forward returns from MBS today are higher than they have been since before the GFC, without assuming any recovery in prices. AGNC has spent the past two years deleveraging and is well-positioned to be a buyer at these historically high yields.

Pick #2: ACRE – Yield 11.8%

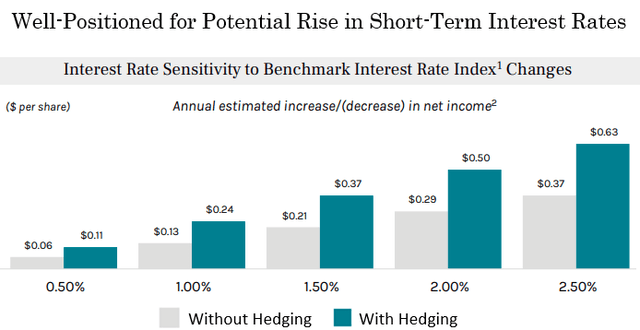

When interest rates are rising, one way you can directly benefit is by owning floating-rate debt. It seems like common sense, yet the market has been selling off companies that collect interest on floating-rate debt just as aggressively as it has sold off everything else.

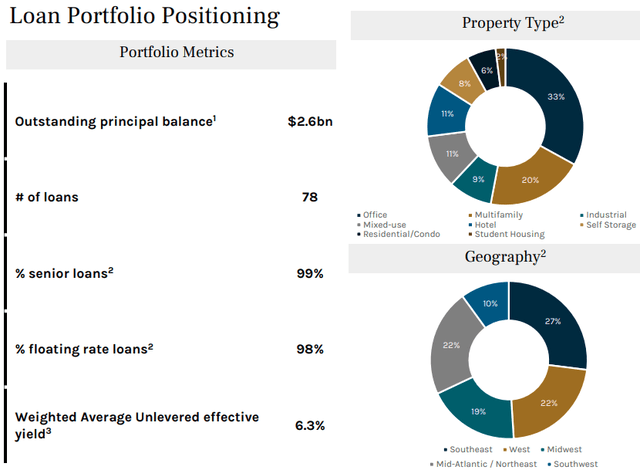

Ares Commercial Real Estate Corporation (ACRE) is one example. ACRE is a commercial mortgage REIT that is managed by Ares Management (ARES), the same manager of one of our favorite BDCs, Ares Capital (ARCC).

The business model is simple. ACRE lends money that is secured by a first-lien mortgage on commercial properties, 99% of ACRE’s loans are senior and 98% are floating rates. (Source: ACRE Q2 2022 Investor Presentation)

Ares Q2 2022 Investor Presentation

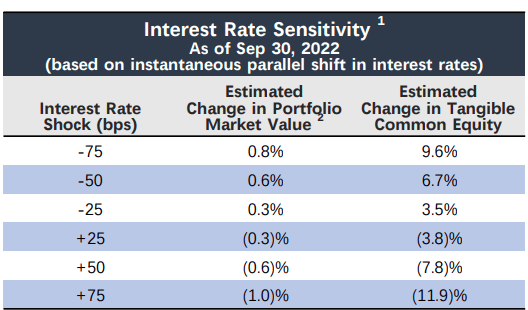

As interest rates rise, it means extra money straight to the bottom line. Here is a look at ACRE’s interest rate sensitivity as of June 30th:

Ares Q2 2022 Investor Presentation

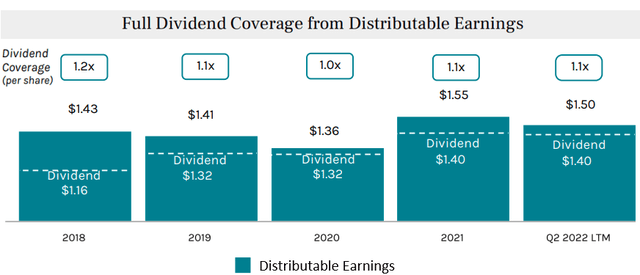

Interest rates are already up a lot since June 30th and are expected to go even higher. Even before interest rates started rising, ACRE was comfortably covering its dividend. Hiking it from $1.16/year in 2018 and paying out $1.40 last year.

Ares Q2 2022 Investor Presentation

We love when earnings are already covering the dividend and they go even higher!

Apparently, the market does not. The price of ACRE has come down, and it is now trading at a discount to book value. ACRE is very likely going to be raising its dividend or paying a larger supplement/special dividend next year.

Is it possible to get a +11% yield from a company that is likely to hike its dividend? These opportunities don’t come along every year, but when the market is selling floating-rate debt into a rising interest-rate environment, we are happy to relieve it of all those pesky dividends!

ACRE reports earnings on November 2nd.

Dreamstime

Conclusion

Both AGNC and ACRE have their detractors, you might even see some of them in the comment section below. They both also start with the letter “A” in their names and tickers. This makes them both great A-Team members in my personal income portfolio and the High Dividend Opportunities Model Portfolio.

They provide excellent recurring income which can meet the expenses you face in retirement head-on and help you overcome them. Don’t be overcome by expenses, but be an overcomer fueled by abundant income from your retirement portfolio.

I have been buying their shares and you can easily as well if you decide to do so.

Your retirement should be one of low stress and easy living. Money doesn’t solve problems, but it can make them easier to solve! This is why I like to use the market as a tool to leverage income from it for my retirement.

That way, as the weather gets cooler outside, I can sit by a fire with a warm beverage in hand and enjoy the crystal clear sky as the sun sets on another wonderful day. I hope you all can do the same as well!

That’s the beauty of income investing.

Be the first to comment