filadendron/E+ via Getty Images

Investment Thesis

Good Times Restaurants (NASDAQ:GTIM) is one of the few stocks with a buy rating at Unlocking Alpha in 2022 (you can read my previous article here). The reason is simple: it’s trading significantly lower than its intrinsic value. Following Q3 results published on August 11th, market repricing pushed GTIM into bargain territory once again. The company now trades at less than book value, despite no long-term debt and positive growth. On the flip side, deteriorating economic growth and negative sentiment are growing concerns for markets at this stage, and are weighing down on GTIM in the short term. I remain bullish on GTIM despite the pessimism thanks to the company’s positive fundamentals and low valuation. That said, position sizing is very important in this market environment, and it’s crucial for investors to be able to withstand and take advantage of short-term volatility.

An Update Following Q3 FY22 Results

GTIM published Q3 FY22 earnings on August 11th, 2022. Total sales increased by ~7.5% YoY to $36.5 million in the most recent quarter, which is lower than previous quarters’ YoY growth rates. Free cash flow reached over $4 million year-to-date, and over $6 million on a TTM basis.

Bad Daddy’s (“BDBB”) continues to be the main growth driver. BDBB’s revenue rose by over 11% QoQ growth, of which ~5% is attributable to same-store sales growth.

Total restaurant sales for Bad Daddy’s restaurants increased $2.8 million to $27.1 million for the quarter. Same-store sales increased 5.3% during the quarter with 38 Bad Daddy’s in the comp base at the end of the quarter.

Matthew Karnes – Senior Vice President-Finance – Q3 FY22 Earnings Call

As previously anticipated, Good Times (“GT”) sales remain sluggish, but positive comparable sales are definitely a good development. During the earnings call, management touched on their plan to rejuvenate the GT concept, although I believe the results of this strategy will take more than a few quarters to show up in the financials given the pace of the program.

Restaurant sales at Good Times were $9.1 million, a decrease of $0.2 million, driven by the closure of one restaurant at the end of March, mostly offset by the 1.6% same-store sales.

Matthew Karnes – Senior Vice President-Finance – Q3 FY22 Earnings Call

Both concepts faced unprecedented cost inflation, which pressured margins. GTIM generated ~$6.7 million in gross profit, compared to ~$8 million in the same quarter last year despite higher sales, for a gross profit margin of ~18.3% vs ~23.7%. While management sees some relief in some key products, chicken products remain “at stubbornly high levels”, and their price hikes have failed to preserve the same profitability levels so far. Labor is another key factor contributing to lower profits. In some instances, labor costs increased up to over 30% YoY in order to attract new talent. As a result, we are now seeing a normalization of both gross and operating profit margins.

We saw cost pressures across the restaurant P&L driven by high product costs, partially offset by a 6.8% year-over-year menu price increase at Bad Daddy’s and an 8.2% year-over-year menu price increase at Good Times. Protein costs, namely beef and bacon, have shown some price stability from last quarter, and we’ve seen improvement in the pricing of chicken wings. But chicken breast, which is our main shipping product of both concepts continues to remain at stubbornly high levels.$

We believe that the final quarter of this fiscal year will continue to show pressure on restaurant level margins with food and labor cost percentages that are higher than our long-term target.

Ryan Zink – President and Chief Executive Officer – Q3 FY22 Earnings Call

Refinitiv Eikon

On the balance sheet side, GTIM maintains a prudent approach to capital allocation. The company continues to operate without long-term debt, although it could be argued that leveraging the balance sheet in H2 2020 or in 2021 to lock in historically low interest rates could have been a good move given where yields are today. As a result, CAPEX continues to be entirely financed by cash from operating activities. That said, a strong balance sheet gives GTIM the upper hand in the coming 18 months over competitors using too much leverage.

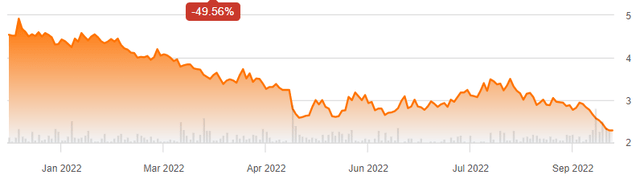

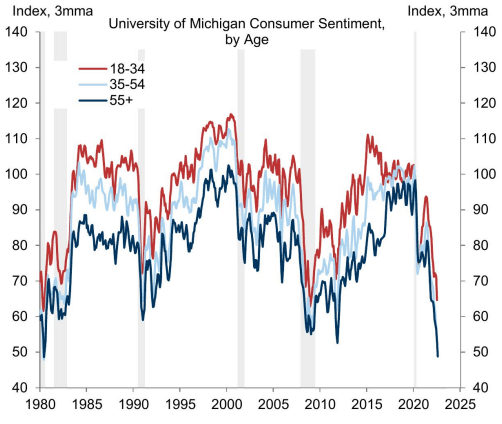

The year-to-date returns are the big elephant in the room. The stock price nearly halved since early January 2022 and the market has been repricing GTIM lower in light of disappointing economic data. It’s impossible to time the bottom, but I am confident that the lower GTIM goes, the higher the returns. To be fair, the abysmal consumer sentiment data is a clear red flag for consumer discretionary stocks such as GTIM and should be taken very seriously by potential buyers. However, the same data can be used to time a rebound. I believe that a prolonged recovery in consumer sentiment could serve as an indication of a nearing bottom.

Seeking Alpha

Goldman Sachs

Company Valuation

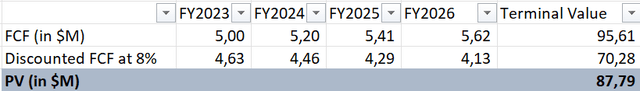

In this part, I will update my discounted cash flow (“DCF”) model to reflect some of my latest assumptions on GTIM. Based on 12.56 million shares outstanding, and a price of $2.32 per share, the company now has a market cap of approximately $29 million. In light of recent results, I have made the following adjustments to my model:

- Estimated free cash flow for FY23 of $5 million instead of ~$5.8- ~$0.8 million (~14%) lower than in April 2022 to reflect cost headwinds and lower profits.

- A growth rate of 4% until FY26 instead of 5% – 100 basis points lower to account for the challenging short-term macro outlook for consumer discretionary stocks.

- A 2% terminal growth rate – unchanged.

- A discount rate of 8% – unchanged.

Author’s DCF Model

According to my model, the fair value of the stock is around $7 per share, ~12.5% lower than my previous estimate. In any case, the stock trades well below any conservative fair value estimate, and I continue to believe there is a significant upside for buyers at today’s levels. The heightened volatility of the last couple of months provides a great opportunity for long-term investors to accumulate shares when prices decrease. For the same reason, I believe the market will present other buying opportunities at potentially lower prices in the months ahead. Therefore, it’s important to size up the position accordingly and keep some cash available to deploy when other buying opportunities emerge.

Risks

Some of the risks mentioned in my previous article have materialized, namely:

- Commodity and labor inflation hitting new all-time highs in Q2 and Q3 FY22. While the Fed is now fully committed to fighting inflation, upside surprises in the data are very unpredictable and I believe this risk persists until year-end, negatively affecting GTIM’s margins.

- While BDBB is still growing at a double-digit YoY rate, the growth is starting to slow down. Negative consumer sentiment could impair the short-term prospects of this brand compared to current market expectations.

I continue to believe that these two risk factors remain relevant for GTIM in the current market environment.

Key Takeaways

Despite no long-term debt and healthy growth, the firm currently trades as a distressed asset. I believe this gives value investors a good opportunity to buy an undervalued business with significant upside. I maintain my buy rating on GTIM, although I have lowered my fair value estimate from $8 to $7 per share to account for deteriorating economic conditions. Position sizing is critical in this market, and investors must be prepared to tolerate and capitalize on short-term volatility.

Be the first to comment