BalkansCat

Note to the reader: most of the numbers provided by Suncor are in $CAD. We have manually converted them to $USD, and have noted when we are using $CAD.

Investment Thesis

Suncor Energy (NYSE:SU) is a Canadian oil extraction firm specializing in exploring and producing synthetic WCS crude from Canada’s vast oil-sands fields.

In recent months, Elliott Investment Management added 3 new directors to the board. Elliot is an activist investor focused on efficiency and performance improvements. Additionally, Suncor has announced its intent to review its operations, which may include selling the Petro-Canada line of retail gas stations.

We believe that Suncor is presently undervalued and is expected to pay out a 4.6% yield. Suncor beat revenue targets by almost $2.4 billion in 2Q22 (and $1.6 billion in 1Q22), with most analysts and Suncor themselves increasing earnings per share guidance by over 200% year over year for 2022.

|

Suncor Energy |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

1.1 |

1.0 |

0.9 |

|

Price-to-Earnings |

4.2 |

4.8 |

5.9 |

|

EV/EBITDA |

2.9 |

3.2 |

3.7 |

Estimated Fair Value (EFV) = PE of 8 times E24 EPS of $6.50 = 8 X $6.50 = $51 per share.

Summary of Operations

|

Type of Operation |

Production Guidance (mboe/d) |

Cash operating costs ($/bbl) |

Ownership |

|

Oil Sands Operations |

395-415 |

$20-22.5 |

100% |

|

Fort Hills Oil Sands JV |

85-90 |

$20-22.50 |

54.1% |

|

Syncrude Oil Sands JV |

175-185 |

$24-27 |

58.7% |

|

Other E&P (offshore rigs and FSPOs) |

75-80 |

$24.50-271 |

Varies |

|

Total |

730-770 |

– |

– |

1 Based on reported E&P costs for 1H22, estimate not provided by Suncor.

Oil sands are best described as what they sound like; sand and clay that is rich with bitumen. About 20% of Canada’s oil sands are close enough to the surface to be extracted in open-pit mines. The remaining 80% are extracted through in-situ production – a process similar to hydraulic fracturing. Compared to other forms of extraction, oil sands operations have a higher startup and operating capital required. However, this is offset by the very low decline rate of reserves and the very high oil-recovery rate.

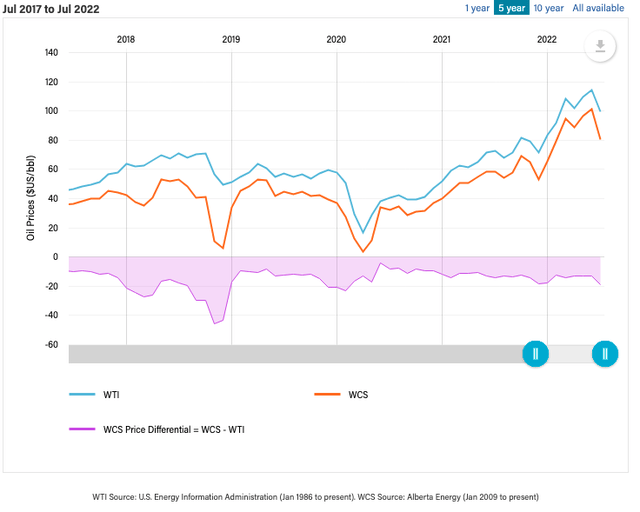

Suncor uses its extensive network of refineries to crack the bitumen-rich sand into synthetic crude (SCO) or into a Dilbit mixture (WCS) which can then be processed into traditional refined products like gasoline. Suncor’s operations produce a Dilbit mix which is still lower priced than West Texas Intermediate (WTI). Historically, the price difference has been 10-20%. On the other hand, while Synthetic crude does trade for a higher price ($3-6 more than WTI), it experiences a large amount of loss (15-20%) during the cracking process.

Suncor has a breakeven of $31.64/bbl for WCS. For refined products, Suncor uses its own spread model to incorporate refining, supply costs, and transportation costs. This model places the refined product (including SCO) breakeven at $41.90/bbl. Despite the tighter margins on crude products, refined products have similar pricing as the sector averages; hence, the refining segment has above-average margins. This allows Suncor’s overall profitability and cash flow to lead the industry, and the company has led cash returns to shareholders for the sector in 7 out of the last 10 years, returning 60% of funds from operations to shareholders.

Suncor also earns significant revenue (~$1 billion) in retail gas stations called Petro-Canada, which now includes several EV charging stations across Canada. Petro-Canada makes up 13% of domestic sales of gasoline in Canada. Suncor also holds interest in various offshore operations both in Canadian waters and in the North Sea. This is reported under the “exploration and production (E&P)” segment separately from Suncor-operated ventures.

Financial Health of Operations

|

Order of priority left to right |

||||

|

Annual Adjusted Funds from Operations Allocation (AFFO) |

||||

|

Net Debt, Including Capital Leases ($ billions) |

Sustaining Capital |

Dividend |

Development Capital |

Share Buyback / Debt Reduction (%) |

|

$9-11 |

$2.5 billion |

$1.41/share |

$1.2 billion |

50/50 |

|

$7-9 |

75/25 |

|||

|

$6.7 (debt floor) |

100/0 |

|||

Assumes CAD/USD .75. From 2Q22 Suncor Report

The capital allocation strategy of Suncor follows the chart above. The estimated capital to sustain present operational capacity is estimated at $3.4 billion for FY22. The remainder of the money is to dividend payouts, currently at $1.41/share (a 12% increase quarter over quarter, bringing the yield to 4.6%). After dividends are paid out, the money goes toward forwarding exploration projects and efficiency increases. This does not have a set amount or percentage payout but is calculated on a rolling basis for maximum efficiency. Finally, the remaining money is spent on buybacks and debt reduction. Presently, including leases, Suncor has roughly $11 billion in debt – for the time being, 50% of the remaining capital is deployed to reduce this debt figure (targeting $7-9 billion by 2H22). The percentages are staggered so that by the time the debt floor is reached, 100% of the remaining capital is deployed toward share buybacks. The debt floor of $6.7 billion would result in a debt to EBITDA ratio of 1.1x.

The major economic investment capital that Suncor is currently embarking on is a $1.3 billion project estimated to complete by FY25, with first improvements completed in FY23. These improvements are estimated to increase free cash by as much as $1.6 billion by project completion.

|

Project |

Project Cash Flow 2023 ($ millions) |

Project Cash Flow 2025 ($ millions) |

|

Supply and Trading Improvements |

68 |

101 |

|

Syncrude-Suncor interconnection |

75 |

113 |

|

Tailings Management and Reduction |

161 |

244 |

|

Edmonton Refinery and Burrard Terminal de-bottlenecking |

45 |

68 |

|

Optimization of Mine Operations |

161 |

188 |

|

Supply Chain Integration and Regionalization |

120 |

169 |

|

Business Process Digitization |

188 |

206 |

|

Replace Coke Fired Boilers with Cogeneration Plants |

0 |

188 |

|

Forty Mile Wind Project |

38 |

38 |

|

Digitization of Project Analytics |

131 |

300 |

Numbers provided from Suncor as-is converted assuming CAD/USD 0.75

Divestiture and Activism

Though the previous CEO stated that Suncor would not sell its retail unit, a management shuffle (3 board members replaced) in 1Q22 caused a change in view. Under pressure from activist investor Elliott, Suncor has begun to undertake a “strategic review” of retail operations erring on the side of selling the Petro-Canada chain of gas stations. The analyst consensus is that the Petro-Canada retail business is worth at least $6-7 billion.

Presently, Suncor does not separately report Petro-Canada sales but bundles them with rack-forward sales. Rack-forward is the price charged to deliver refined products to retail stations or private users. FY21 Suncor reported 20,430 million liters of products delivered at a margin of $0.05/liter (gross profit of $1.1 billion).

This comes along with a streamlining of the portfolio. Suncor plans to strengthen its hydrogen and bio-fuels investments while also divesting from solar and wind to streamline the portfolio.

Risk

One of the primary risks facing Suncor is Canada’s usage of carbon pricing, a levy on the per tonne emission of carbon. In 2023 this will be CAD$65/tonne and will step up CAD$15/tonne a year until it hits CAD$170 in 2030. While the increased costs associated with the carbon tax have proven to be a rallying cry for Canadian conservatives, it is unlikely they will take power before 2025. Additionally, the Canadian federal government is planning on cutting all subsidies from the fossil fuel industry starting in 2H22 and planned to complete by 2025.

It is important to note the large lengths the Canadian government will likely go to protect domestic oil sands industry, given it makes up just under 10% of total GDP. While the European energy crisis has given new life to North American oil and gas, it is unlikely that a large terminal/export project will be approved or built in the near future in Canada.

Be the first to comment