titoOnz/iStock via Getty Images

Investment Thesis

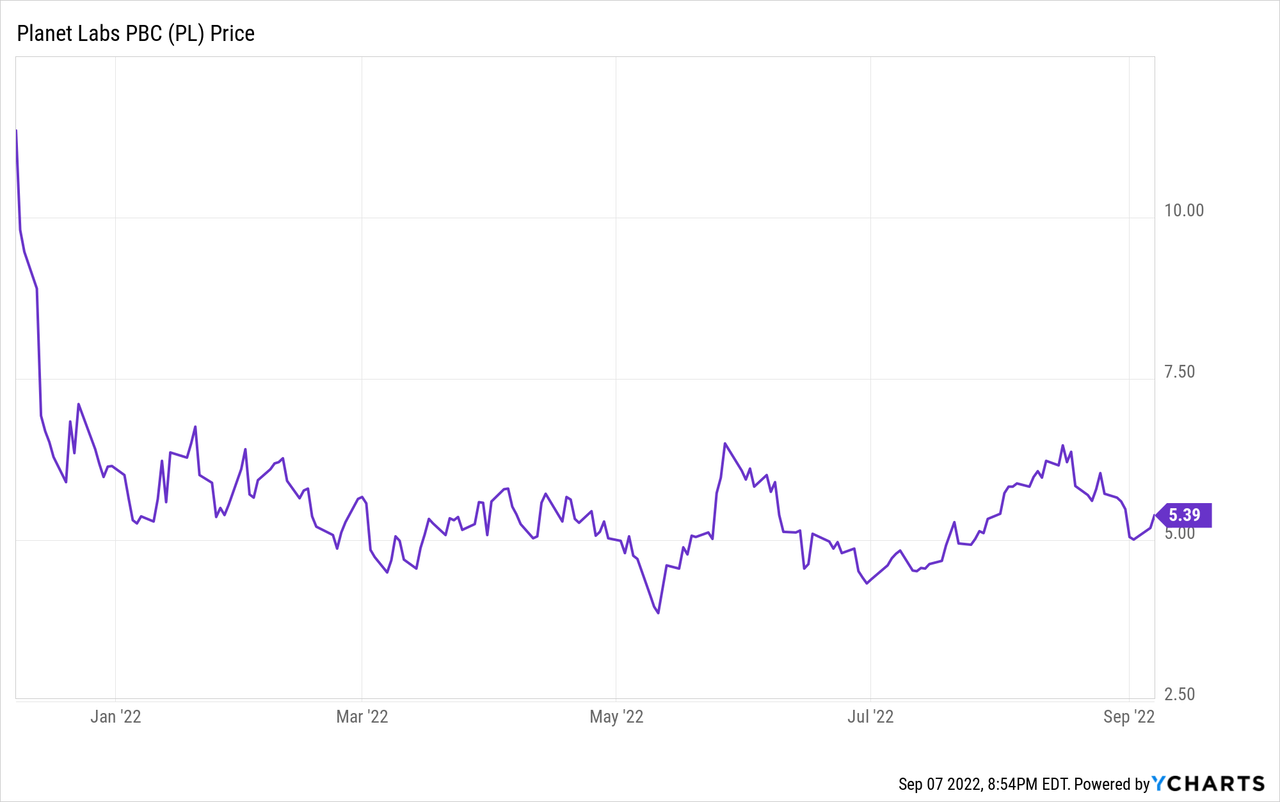

Planet Labs (NYSE:NYSE:PL) went public late last year via a SPAC combination with dMY Technology Group. Right after going public, the company got caught in the broad market sell-off, with shares now down over 45% from the IPO price. I believe the sell-off offers a great buying opportunity for long-term investors. The company has a large and growing addressable market, a strong moat, and a compelling business model. It is benefiting from the acceleration of digital transformation and sustainability transformation, as data becomes more and more important. Its growth rate and margins have also been accelerating in the past few quarters, demonstrating strong economies of scale. Therefore I rate Planet Labs as a buy at the current price.

Overview

Planet Labs is a US-based earth data and analytics company founded by current CEO William Marshall in 2010. It operates approximately 400 satellites that produce 25 terabytes of data per day, making it the largest earth imaging satellite owner in the world. The company’s products include Planet Monitoring, Planet Tasking, Planet Basemaps, Planet Analytic Feeds, Planet Archive, and Planet Platform. These products combined provide comprehensive monitoring, analyzing, and processing capabilities.

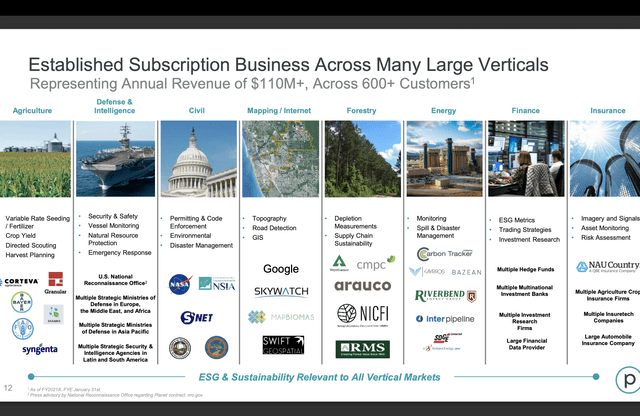

The company provides data and analytic solutions to customers across different industries such as mapping, government, agriculture, defense, and more. Unlike most SPAC companies, Planet Labs has real revenue from real customers. The company’s current clients include household names like Google (GOOG), Bayer (OTCPK:BAYRY), Moody’s (MCO), NASA, and more. Last month, the company was selected to provide real-time data and connectivity solutions for NASA’s CSP. It is also worth noting that Google currently owns 10% of Planet Labs, making it one of the largest shareholders of the company.

Large Addressable Market

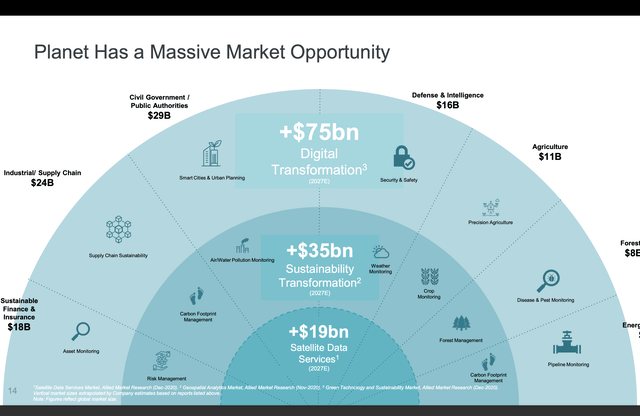

There’s a lot to like about Planet Labs. The company has a large and growing TAM (total addressable market). According to the company, the TAM for satellite data services is estimated to be over $19 billion by 2027. While sustainability transformation and digital transformation may open up a further $56+ billion in TAM. The company’s solutions have a wide range of use cases. This includes harvest planning for agriculture, disaster management for government, topography for mapping, asset monitoring for energy, and more.

Recently, Planet Labs has been offering satellite images of Ukraine and Russia, allowing different departments and entities to keep track of the latest progress of the war. Planet Labs’ valuable data is able to help its clients increase their operational efficiency with mission-critical insight while reducing costs. Data is the new gold and Planet Lab is the terminal for earth data. As the demand for data continues to increase, the TAM for Planet Labs will also continue to increase.

Niccolo de Masi, CEO, on Planet Labs

“We believe Planet is a new kind of data company, delivering mission-critical insights and solutions to some of the world’s most influential companies and governmental organizations. The Company’s daily, global dataset is impressive and we believe serves as the foundation of a rapidly growing and scalable data-as-a-service subscription business, which we believe is poised for significant growth as data increasingly becomes the fuel that powers the global economy.”

Strong Moat

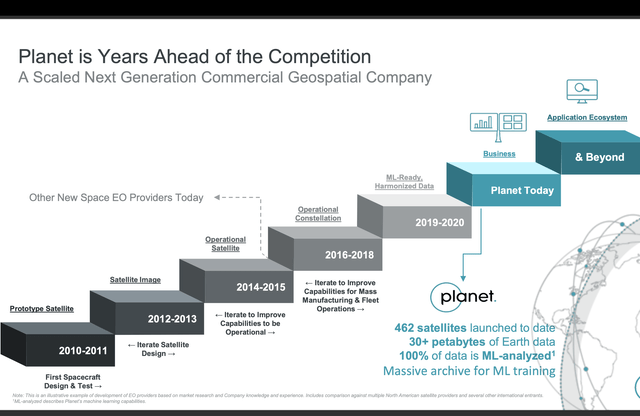

Planet Labs has a very strong moat. The company has a strong head start compared to its competitors such as Maxar (MAXR), BlackSky (BKSY), and Spire (SPIR). Planet Labs currently has the largest satellite fleet with over 462 launched to date, 62% more than Maxar’s 285 and 312% more than BlackSky’s 112. It will be hard for these companies to catch up as launching satellites take a lot of preparation and planning. For example, Maxar’s Legion satellite launch kept on delaying due to supply chain and software issues. Planet Labs also has a data advantage as it is able to collect more data and images with its larger satellite fleet, which results in having a much larger data archive and better machine learning training.

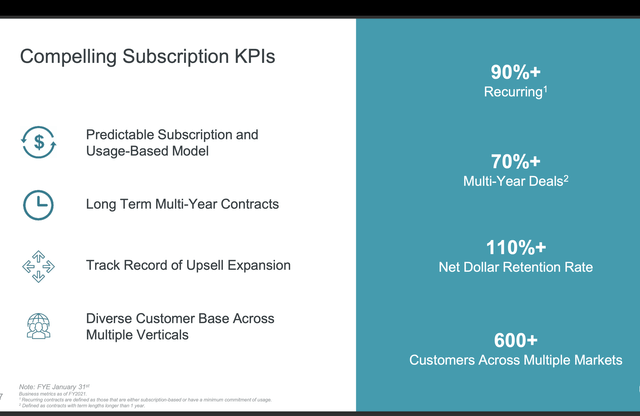

Compelling Business Model

The company also has a compelling business model. It operates with a unique SaaS (space as a service) model, in which it offers subscription plans to businesses for its proprietary data feeds. Currently, over 90% of total revenue is recurring and 73% has a long-term multi-year contract, which offers great revenue stability. It also sells other data and analytic solutions to customers on a stand-alone basis based on usage that generates additional revenue. This creates upselling opportunities for existing clients which boosts the net dollar retention rate. The subscription based model also allows Planet Labs to benefit from economies of scale and generate significant operating leverage moving forward.

Financials

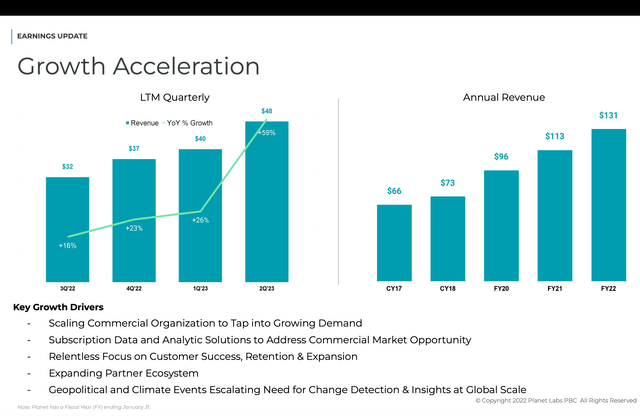

Planet Labs reported its second-quarter earnings yesterday. The results are very impressive with revenue and margins continuing to grow rapidly.

Will Marshall, CEO of Planet Labs, on second-quarter results

“Planet’s results for the second quarter exceeded expectations across the board and demonstrate the continued acceleration of our growth rate and robust demand for our unique Earth data solutions, In addition to the strength of our revenue and gross margin expansion during Q2, we’re also pleased with the meaningful increase in net dollar retention rate, which we believe demonstrates that our investments in product and customer success are yielding results.”

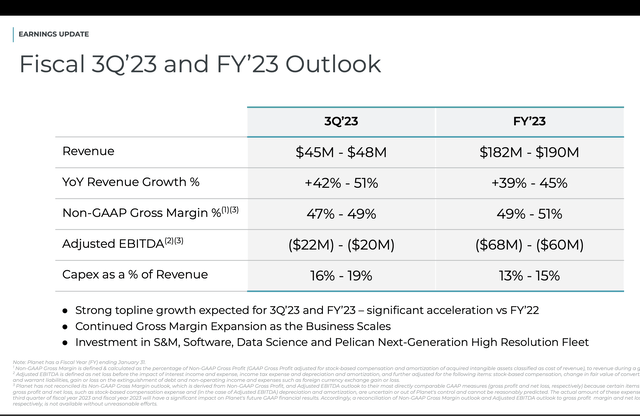

The company reported revenue of $48.5 million, up 59% YoY (year over year) from $30.4 million. The growth rate continues to drift higher, compared to the 26% growth reported in Q1. Percent of recurring annual contract value for the quarter was 93%. The acceleration of growth is driven by the strong demand for its mission-critical solutions. The company continues to increase customer count and spending from existing customers. It ended the quarter with 855 customers, up 17% YoY. While the net dollar retention rate was 125%, the highest in the company’s history. Gross profit for the quarter was $23.5 million compared to $10.6 million, up 122%. This is attributed to the increase in gross profit margin, which was up significantly from 34.9% to 48%.

The bottom line loss continues to widen as Planet Labs continues to aggressively invest in growth. Loss from operations widened from $(24.3) million to $(42.6) million While the net loss widened from $(20.2) million to $(39.4) million. This is due to a significant increase in R&D and S&M expenses, which was up 115% and 85% respectively. The company also grew its software headcount by over 55% in order to keep up with increasing demand. Operating cash flow went from negative $(8.3) million to $(28.8) million, largely due to the widened net loss. I am not too concerned about the bottom line as the company is still in a hyper-growth stage. I expect profitability to improve as the company continues to scale.

The company’s balance sheet continues to be very healthy. It ended the quarter with $458 million in cash and equivalents and only $9.5 million in debt. This provides the company ample amount of buffer for its cash burn. As demand continues to ramp up, Planet Labs increased its revenue guidance for FY23 to be between $182 million to $190 million, representing a 42% growth at the midpoint.

Conclusion

In conclusion, I believe Planet Labs has a strong potential moving forward. The company is the leader in the earth data and analytics space which has a large and growing TAM. Sustainability transformation and digital transformation are significantly increasing the demand for data. The use cases for Planet Labs solutions are also broadening. The company has a very strong moat as it currently has the largest satellite fleet, allowing it to have the best data archive. Its SaaS business model also provides high revenue stability and visibility. Revenue growth is accelerating rapidly while margins continue to expand significantly, as shown in the latest quarterly earnings. Therefore I rate the company as a buy at the current price, as fundamentals and financials continue to impress.

Be the first to comment