Darren415

This article was first released to Systematic Income subscribers and free trials on Aug. 21.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of August.

Be sure to check out our other Weeklies – covering the CEF as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

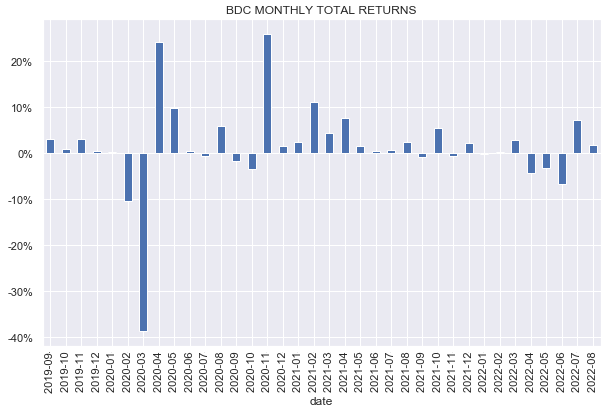

BDCs gave back some of their previous rally with a 2% drop on the week as all but two BDCs in our coverage universe moved lower. Month-to-date, the sector is still up about 2%.

Systematic Income

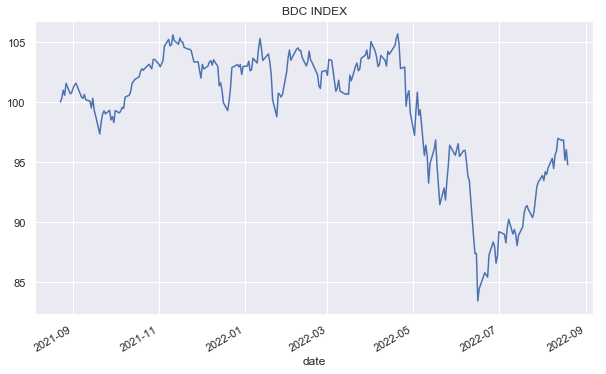

The sector currently stands about half-way between its peak and trough this year.

Systematic Income

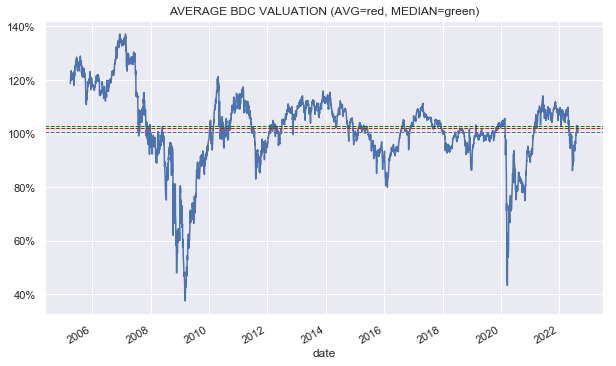

Sector valuation fell back to just above 100% which is slightly below the sector average. Our view remains that the sector, in aggregate, remains slightly expensive. However, given the huge valuation dispersion, opportunities remain.

Systematic Income

So far this year, BDCs are one of the best-performing income sectors despite their higher-beta profile. This is due to their floating-rate holdings as well as relatively sticky NAVs which are less susceptible to some of the liquidity and flow dynamics prevalent in publicly traded markets. A significant part of the sector hiked their dividends in Q2 which has also supported prices.

Market Themes

A couple of recent public offerings has focused investor attention on the impact of these events. Specifically, the fact that the price of the stock drops sharply after the announcement causes a lot of investors to grumble.

Public offerings cause the price of the stock to drop for the simple reason that they are executed significantly below the stock’s traded price. If investors were not offered a discount on the stock’s price they would instead (at least in theory) buy existing shares in the secondary market. For example, on 15-Aug Trinity Capital held a sizable public offering which was priced at $15.33 or close to 6% below the closing price of the stock that day. Apart from this very obvious impact, investors also worry about potential dilution.

It’s important to distinguish three types of impacts of dilution. The first one has to do with a given investor’s ownership percentage of the company which is the kind of dilution that seems to be the most cited in the internet even though it’s one that income investors need to worry about the least. It’s true that an investor’s ownership stake is diluted after a public offering (unless they participate in the offering in the right amount), however, unless the investor wants to exercise significant control on the board this is the kind of dilution they can happily ignore and this applies to all retail investors.

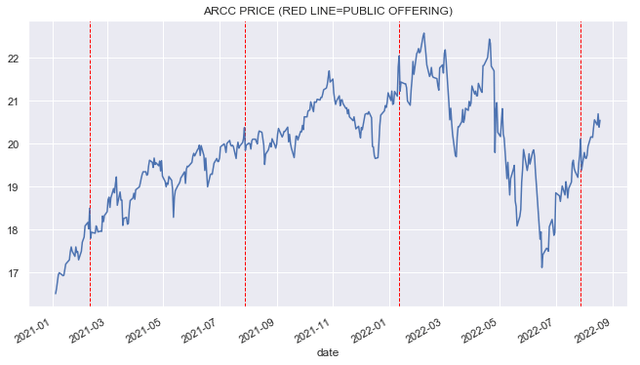

The second type of dilution has to do with the NAV. Specifically, stock that is issued at a premium to the NAV is accretive to the NAV (i.e. boosts the NAV) and vice-versa. A lot of the public offerings (or ATM sales) that we have seen recently in TRIN, ARCC, CSWC and others have been at a price above the NAV which is accretive to the NAV and something that investors should welcome. Often BDCs will ask for investor permission to issue stock at a discount to NAV but the reality is that the request is not always acted on – BDCs just want to have this in their back pocket.

The third type of dilution is income dilution. The idea here is the offering will cause the company’s net income to be distributed across more shares, meaning there is less net income to go around for each share. This is true, however, the additional share issuance also means there is additional capital to put to work. The BDC can, in theory, just let the capital sit there or it can be used to repay debt, however, more often than not it will be put to work and then leveraged with the net result being that the company will generate additional net income in line with the growth in additional shares, leaving net income per share at about the same level as before.

The obvious question for investors is whether the drop in price is permanent or not. Our view is that it should only be temporary and as the supply/demand dynamic wears off and the additional capital is put to work the stock should trade back higher. This is not a very scientific analysis but a quick look at ARCC which has done 4 public offerings in the last couple of years shows that after a brief drop the price tends to regain its former level in short order.

Net net we tend to view public offerings executed at a premium as a win-win for everyone. Investors can acquire additional shares at a temporarily depressed price, the company gets cash it can put to use to drive returns and everyone benefits from the accretion of the NAV.

A final point is that investors can often acquire the stock below its public offering price as was the case for TRIN which traded down pre-market to a sub-$15 level which, in our view, offered a nice entry point for new investors.

Stance & Takeaways

With the Fed making a strong point that it’s not about to make a dovish pivot, short-term rates will likely continue to rise higher and stay higher longer than the market consensus. It also means that financial conditions will tighten even further, with the knock-on negative impact on the economy. This means we remain focused on BDCs with higher-quality portfolios and lower historic levels of realized losses. We also continue to tilt to BDCs with a higher income beta to rising short-term rates as well as those that offer a margin-of-safety valuation. BDCs that tick these boxes include, among others, the Blackstone Secured Lending Fund (BXSL) and the Golub Capital BDC (GBDC) trading at 8.8% and 8.7% dividend yields respectively.

Be the first to comment