Melpomenem/iStock via Getty Images

Financial technology companies, such as SoFi Technologies, Inc. (NASDAQ:SOFI), are at risk of seeing significantly lower valuation multiples in the future. The extension of the student loan repayment moratorium, which the U.S. government recently extended until the end of August 2022, is the catalyst for a lower valuation.

SoFi Technologies responded to the extension by slashing its EBITDA forecast by nearly half. Having said that, the stock is already significantly overvalued, and in light of new earnings headwinds related to the moratorium, I am lowering my stock price target for SoFi Technologies from $7.00 to $3.50.

Decelerating Member Growth

To be honest, I’ve never been a big SoFi Technologies fan, and I see far more risks than opportunities with the financial technology firm. The fact that the company’s member growth is slowing is the main reason I believe SoFi Technologies is overvalued.

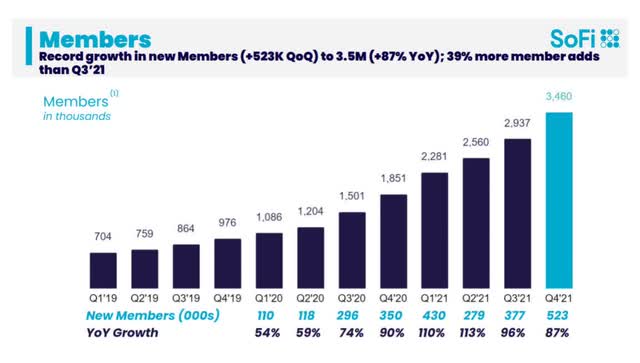

Despite the fact that SoFi Technologies attracted a significant number of new members (523K in the last quarter) to its website and app, growth has slowed significantly in the last two quarters.

Membership addition rates at SoFi Technologies fell from a pandemic high of 113% in 2Q-21 to 96% in 3Q-21 and 87% in 4Q-21. Assuming the current trend of declining membership additions continues in 2022, weaker growth prospects in terms of members and revenues could result in a much lower sales multiple that investors are willing to pay SoFi Technologies.

Extension Of Student Loan Moratorium Hurts Expected Earnings Growth

While I see slowing member growth as a significant risk factor for SoFi Technologies in the future, recent government actions suggest that the risk may be even greater than previously thought. The Federal Government recently decided to extend the student loan repayment moratorium from May 1, 2022 to August 31, 2022, implying that SoFi Technologies’ earnings will be significantly lower than anticipated.

At the start of the Covid-19 pandemic, the Federal Government allowed Americans with student loans to pause repayments, a policy designed to provide borrowers with relief during difficult times. Unfortunately, the extension of the student loan repayment moratorium means that SoFi Technologies’ customers with student loans will not have to make any payments until at least the end of August.

SoFi Technologies responded to the announcement by making an announcement of its own. The financial technology firm not only reduced its guidance for adjusted net revenue and adjusted EBITDA in 2022, but also stated that it expects a seventh extension of the student loan repayment moratorium due to the November midterms.

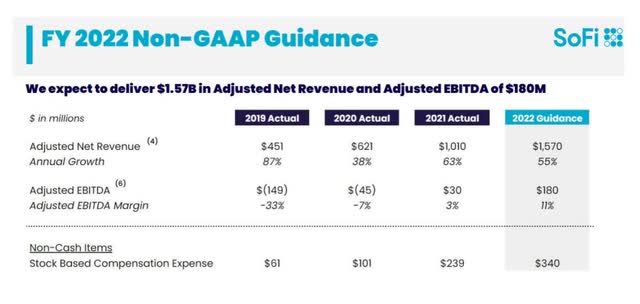

Before the Federal Government’s announcement, SoFi Technologies expected to have net revenue of $1.57 billion and adjusted EBITDA of $180 million in 2022. The earnings guidance table for SoFi Technologies for 2022 is available here:

FY22 Non-GAAP Guidance (SoFi Technologies)

SoFi Technologies now expects $1.47 billion in net revenue and $100 million in adjusted EBITDA due to changing circumstances. SoFi Technologies anticipated a student loan payment freeze in 2021, but was caught off guard earlier this year. The most recent extension of the student loan payment moratorium resulted in a loss of $30-35 million in revenue and $20-25 million in contribution profit. While the revenue impact is minor, the 44% decrease in adjusted EBITDA justifies a new price target for SoFi Technologies.

Adjusting Price Target

The student loan repayment freeze is a substantial setback for SoFi Technologies and particularly the company’s near-term earnings outlook.

SoFi Technologies’ previous price target was $7. Now that SoFi Technologies’ earnings are about to be cut in half, I feel compelled to reduce my price target on SoFi Technologies stock accordingly.

Due to a nearly 50% drop in 2022 estimated earnings and higher earnings risks associated with another moratorium extension next year, I am lowering my price target by 50%, from $7.00 to $3.50.

My Conclusion

SoFi Technologies lowered its adjusted net revenue guidance by $100 million (6%) and adjusted EBITDA guidance by $80 million (44%). Any future extensions of the student loan repayment moratorium may result in a lower-than-expected earnings forecast for FY 2023.

The estimated earnings decline in 2022 is too large to ignore, and it demonstrates how vulnerable SoFi Technologies has always been to student loan repayment freezes. With risks increasing and earnings declining significantly, the stock could fall even further than it has already.

Be the first to comment