coldsnowstorm

Thesis

The Walt Disney Company (NYSE:DIS) delivered a solid FQ3’22 earnings card in August, showing that the recovery from its legacy park assets remains on track. A more robust slate of theatrical releases also helped its theatrical distribution notch another strong quarter of growth, even though it remains well below its pre-COVID highs. We are also impressed with its performance in its streaming subscriptions’ growth, demonstrating the robust portfolio of Disney’s streaming assets. Therefore, it also led to a post-earnings surge toward its August highs. However, the recent pullback has digested all its post-earnings momentum spike, as astute investors leveraged the momentum to take profit.

In our previous article (Hold rating), we highlighted that we didn’t think DIS was attractive. Notwithstanding, the market subsequently bottomed in July, which also helped DIS form its medium-term lows. As a result, we are confident that DIS has likely formed its medium-term bottom. Therefore, we posit that DIS is unlikely to break below its July bottom moving ahead.

Still, we remain tentative over Disney’s growth cadence moving ahead as the momentum in its “reopening assets” normalizes. However, Disney is not expected to regain its pre-COVID free cash flow (FCF) profitability through FY25. Consequently, we believe the market has de-rated DIS to reflect these uncertainties, even as Disney ramps its ad-supported (AVOD) offerings in Disney+ to improve its profitability profile. Coupled with what we postulate on the post-reopening normalization in growth, we are not confident that Disney has adequate structural growth drivers to sustain its current valuation.

Despite its medium-term bottom in July, we posit that DIS could be trading in a consolidation range moving ahead. Also, the rapid recovery from July is likely unsustainable, and we expect DIS to pull back further. Therefore, we will revisit our thesis depending on where we expect DIS to form its subsequent bottom moving ahead, even though we do not expect July lows to be breached.

Accordingly, we reiterate our Hold rating on DIS for now.

Expect Disney’s Growth To Normalize Through FY23

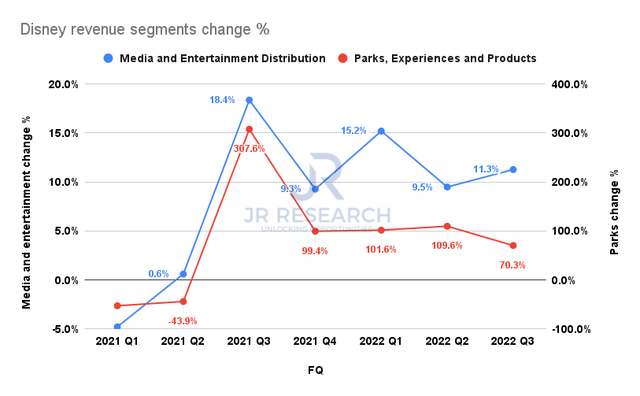

Disney revenue segments change % (Company filings)

Disney posted robust revenue growth of 26.3% YoY in FQ3 as the recovery in its legacy parks assets continued. Its park assets delivered revenue growth of 70.2%, down from Q2’s 109.6%, as it laps its pandemic lockdowns headwinds. However, we posit that Disney’s recovery from its park assets should normalize further through FY23, as it reached its pre-COVID levels. Therefore, it should proffer less of a growth tailwind moving forward.

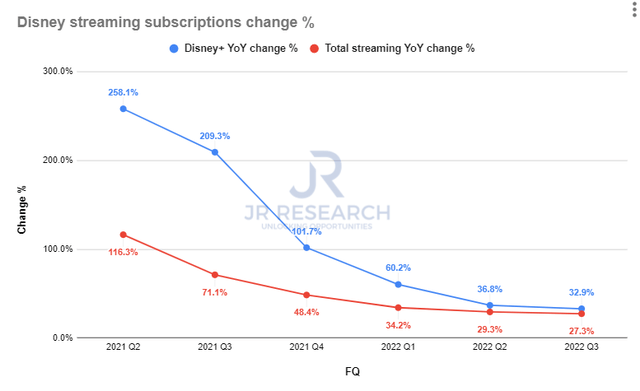

Disney paid streaming subscriptions change % (Company filings)

Notably, the growth in its paid streaming subscriptions has continued to stabilize in Q3, as it posted an overall growth of 27.3% YoY. Furthermore, Disney+’s growth also remained robust, as it delivered an increase of 32.9% YoY, down from Q2’s 36.8%.

However, we posit that Disney+’s growth should moderate further, coupled with the tightened guidance by management on its Disney+ subscribers’ target of 245M (midpoint) by FY24. Therefore, it represents a subscribers growth CAGR of about 23.6% through FY24, suggesting that investors should expect further slowdown ahead.

Therefore, we believe it’s critical for Disney to focus more on its profitability profile as it positions its ad-supported Disney+ offering, coupled with its price increases. The company has also been aggressively promoting its “superior portfolio,” as Insider reported:

Disney is making a big push to sell advertisers on its streaming services as the online video market heats up with Netflix and Disney prepping ad-supported tiers. In a recent presentation to advertisers that was obtained by Insider, Disney highlighted the growth in ad-supported streaming subscriptions and Hulu’s dominance in the advertising video-on-demand space as evidence of the opportunity for an ad-supported Disney+. It calls its streamers unrivaled by competitors like Netflix, Amazon Prime, and HBO Max. – Insider

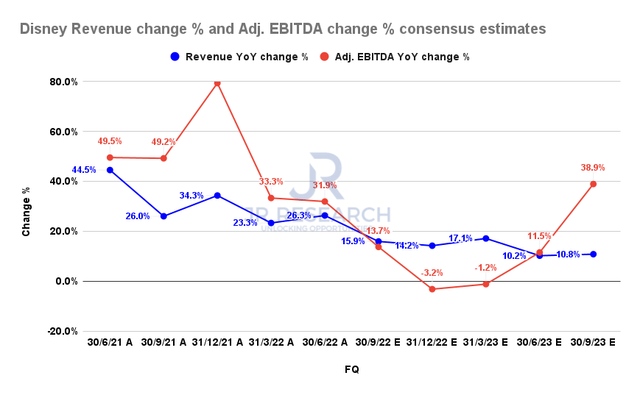

Disney revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (bullish) indicate that Disney’s revenue growth should continue to moderate through FY23, which should also impact its adjusted EBITDA growth cadence.

While we believe that the battering in DIS over the past year has been reflected in its valuation, we aren’t convinced that DIS is attractive for a long-term play despite its July bottom.

DIS Valuations Are Still Above Its Pre-COVID Levels

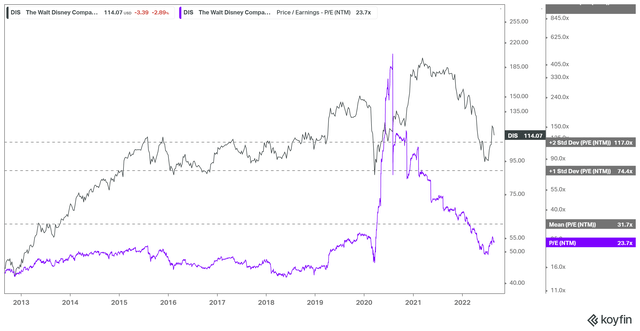

DIS NTM P/E valuation trend (koyfin)

As seen above, the de-rating in DIS stock has been well-deserved as it couldn’t sustain its premium valuation given its weak profitability. However, its NTM PE multiples remain well above their pre-COVID highs, even though it has likely bottomed in July. Therefore, we don’t consider DIS as attractively configured yet, as Disney still needs to prove that it can recover its pre-COVID profitability metrics.

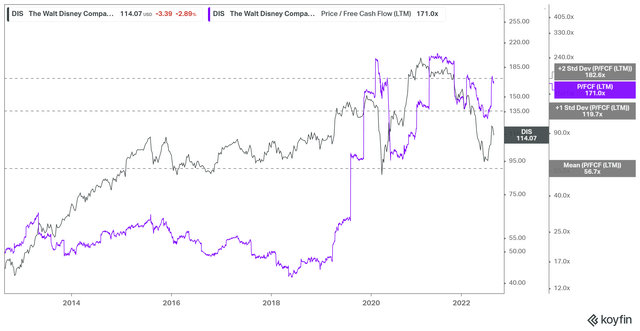

DIS TTM FCF multiples valuation trend (koyfin)

We also gleaned that its TTM FCF multiples remain at levels well above its pre-COVID highs. It last traded at close to two standard deviation zones above its 10Y mean.

Notwithstanding, we note that Disney should continue to improve its FCF profitability through FY25. As such, it last traded at an FY25 FCF yield of 5.6%, well above its 10Y mean of 4%. But, we believe the de-rating is justified given its much weaker FCF margins profile. Notwithstanding, we noted that DIS traded at an FY25 FCF yield of 7.1% at its July lows. Therefore, we posit that July lows should hold. If DIS falls further back closer to its July levels, we will reassess our rating.

Is DIS Stock A Buy, Sell, Or Hold?

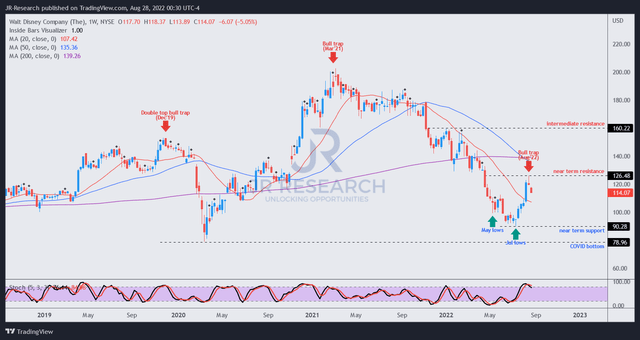

DIS price chart (weekly) (TradingView)

We gleaned that DIS had a momentum spike from its July lows, with buying upside extended further by its post-earnings surge.

However, the market has digested its post-earnings gains, as such spikes are often unsustainable. Therefore, it allowed astute investors who bought the July lows a fantastic opportunity to cut exposure and rotate, leveraging on investors who bought into such momentum breakout signals.

Our analysis suggests that its momentum spike has not been fully digested, suggesting a deeper pullback is still on the cards.

Therefore, we reiterate our Hold rating on DIS and urge investors to remain patient.

Be the first to comment