We Are

One of the biggest problems facing nearly everyone in the developed world today is the very high inflation rate, which is particularly high in the necessary categories of both food and energy. This has had the effect of straining the budgets of many people, some of whom have had to take on a second job to pay for the necessities of daily life. When we combine this with a generally declining stock market, even fairly wealthy investors are searching for extra sources of income that can be used to pay their bills and support their lifestyles.

Fortunately, there are some ways in which this extra-needed income can be generated. One way that works quite well is to purchase shares of a closed-end fund (“CEF”) that is focused on income generation. These funds provide easy access to a diversified, professionally-managed portfolio that will typically boast one of the highest yields available in the market today. In this article, we will discuss one of these funds, the AllianceBernstein Global High Income Fund (NYSE:AWF), which yields 8.72% at the current price. This is clearly a high enough yield to provide a nice supplementary source of income, so let us investigate and see if the fund could deserve a place in your portfolio.

About The Fund

According to the fund’s webpage, the AllianceBernstein Global High Income Fund has the stated objective of providing its investors with a high level of current income, with a secondary objective of seeking capital appreciation. This is not exactly unusual, as many closed-end funds have similar objectives, particularly ones that specifically state that they are seeking income in their name. In order to achieve this objective, the fund invests primarily in corporate debt securities from issuers located both in the United States and abroad. This is hardly surprising, either, as many funds that are specifically focused on income invest in debt as opposed to equity. There may be some advantages to this for conservative investors, such as retirees, as well. This is because debt is generally considered to be safer than equity because the creditors must be paid by the company before the common stockholders get anything. The creditors are also less likely to take a total loss in a bankruptcy.

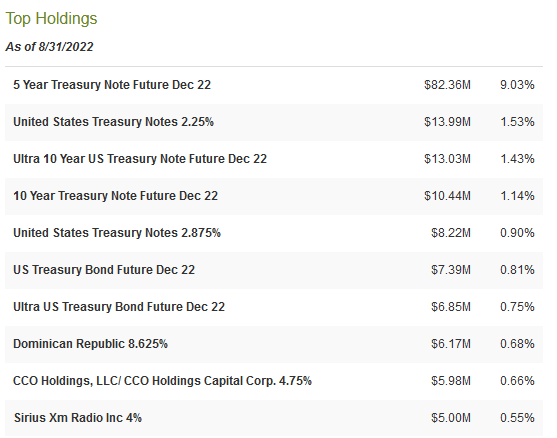

Although creditors are less likely to lose everything in bankruptcy or liquidation, it is not uncommon for them to take a partial loss in such an event. As such, we need to make sure that the fund is reasonably well diversified in order to limit our default risk. It does, fortunately, appear that this is the case, as the fund currently has 1,838 positions, which would ordinarily mean that it only has a very small exposure to any given entity. However, it does still have sizable positions in a few securities, as we can see by looking at the largest positions in the fund:

CEF Connect

We notably see that about 15.59% of the fund is invested in U.S. Treasury securities, either by the fund directly holding the security or through the use of futures. This seems like a very outsized position given the number of different things that the fund is invested in. However, the United States is generally considered to have no default risk, so we can assume that these securities are almost certainly very safe. In fact, despite the fund claiming that it focuses on corporate debt securities, we do not even see a corporate bond until we get to the ninth-largest holding in the fund, and that only accounts for 0.66% of the portfolio. Thus, we can clearly see that the fund’s exposure to any single corporation is quite low and it is unlikely to lose very much should any given company default on its debt. This is something that investors concerned with principal protection should appreciate.

With that said, as my regular readers on the topic of closed-end funds know that I do not typically like to see any given asset account for more than 5% of a portfolio. This is because this is about the level at which that asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is the risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio then this risk will not be completely diversified away.

Thus, the concern is that some event will cause a given asset to decline when the market does not, and if it accounts for too much of the portfolio, then it could end up dragging the entire fund down with it. Admittedly, this is less of a concern with bonds than with stocks since bonds typically move inversely with interest rates regardless of the issue. The biggest risk here is that some issuer that is highly weighted as a fund will be considered at high risk of default. As we can see, though, the biggest holding here by far is 5-year U.S. Treasuries, and these are considered to be risk-free. Thus, we probably do not really have to worry about idiosyncratic risk here, even though there is one position that exceeds that 5% threshold.

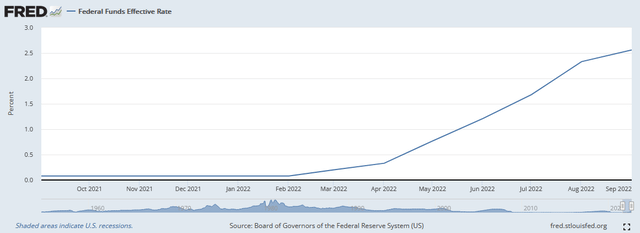

As just stated, bond prices tend to move inversely with interest rates. This is because older bonds will decline in price until they have the same effective interest rate for a new purchaser as a brand-new bond with the same maturity date. Over the past several months, the Federal Reserve has been rapidly increasing interest rates in a bid to fight inflation:

Federal Reserve Bank of St. Louis

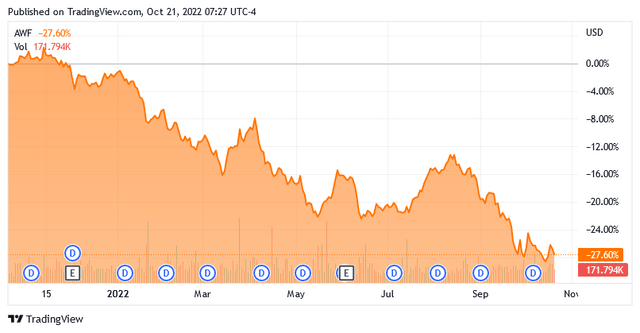

As of the time of writing, the effective Federal Funds rate is 2.56%, up from effectively zero at the start of the year. This has had a very noticeable impact on the AllianceBernstein Global High Income Fund, which is down 27.60% over the past twelve months:

Unfortunately, it does not appear that the Federal Reserve will change its interest rate policy anytime soon. In fact, it is expected that the central bank will continue to increase rates over the coming quarters. This is because inflation has still not been tamed yet. In September 2022, the Bureau of Labor Statistics stated that the inflation rate is at 8.2%, which is substantially above the Federal Reserve’s 2% target rate. Thus, it seems likely that the fund will continue to produce more capital losses for a while until inflation is tamed. This may be concerning, even though these would be unrealized losses as opposed to realized ones. As I have pointed out many times before, a loss is only a loss if you actually sell the position after it declines in price. The bigger question is whether or not the fund will be able to maintain its distribution, which we will investigate later in this article.

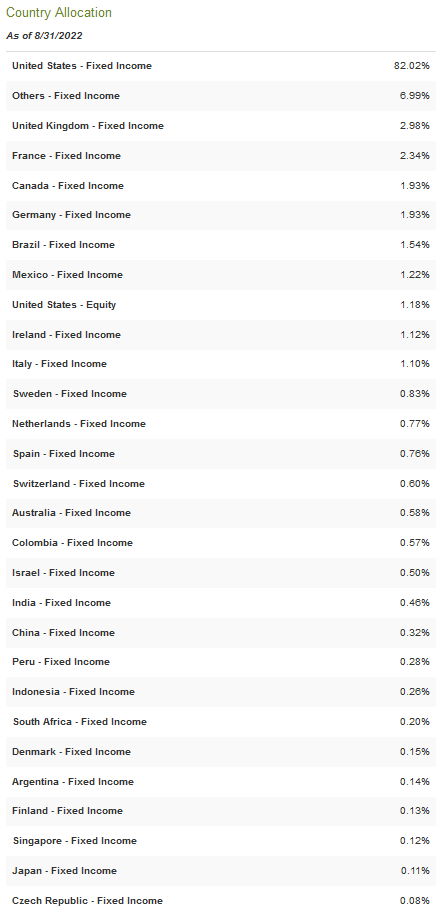

As the name of the fund implies, the AllianceBernstein Global High Income Fund invests its assets both at home and abroad. However, the overwhelming majority of the bonds in its portfolio are issued by American entities:

CEF Connect

As we can see, 82.02% of the fund’s assets are invested in American entities. This is a surprisingly high figure for a global fund, most of which only have a 60% to 70% weighting towards the United States. It is also well above the country’s representation in the global economy, which is just under 25%. It may make sense, though, as the Federal Reserve is being somewhat more aggressive about raising interest rates than many other nations, which is the reason for the current strength of the U.S. dollar.

The high weighting, unfortunately, does not provide us with much protection against regime risk, though. Regime risk is the risk that some government or other authority will take some action that has an adverse impact on an asset that we are invested in. The only realistic way to protect ourselves against this risk is to ensure that only a limited proportion of our assets is invested in any individual nation. This fund is not really doing that, so it may be a good idea to hold it along with a foreign bond fund in order to reduce your regime risk.

Distribution Analysis

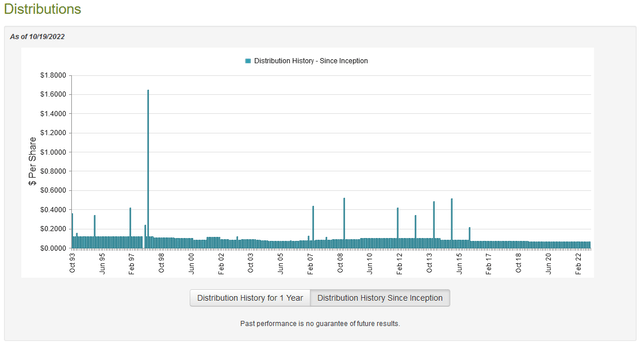

As stated earlier in the article, the AllianceBernstein Global High Income Fund has the stated objective of providing its investors with a high level of current income, which is not unusual since bonds tend to deliver most of their return through the interest payments that they make to investors. As such, we might expect that the fund would boast a fairly high distribution yield. This is indeed the case, as it currently pays a monthly distribution of $0.0655 per share ($0.786 per share annually), which gives the fund an 8.72% yield at the current stock price. It has, however, varied the distribution a great deal over the years:

The fact that the distribution has varied quite a bit over time may reduce the appeal of the fund in the eyes of those investors that are looking for a secure and consistent source of income to use to pay their bills or otherwise finance their lifestyles. However, it is important to keep in mind that the fund’s ability to generate income depends quite heavily on interest rates so we can expect a certain amount of fluctuation over extended periods. We do see that it has been able to maintain its payout since 2019 despite the wide changes in interest rates that occurred over that period, which does speak well for the ability of management to generate income through most economic conditions.

As is always the case, though, it is critical that we determine whether or not the fund can actually afford the distribution that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the distribution since that would both reduce our incomes and almost certainly cause the share price to decline.

Unfortunately, we do not have a particularly recent report to consult for that purpose. The fund’s most recent financial report corresponds to the full-year period ending March 31, 2022. As such, we have very little insight into how well the fund performed in the rising interest-rate environment since the Federal Reserve did not really begin that policy in earnest until the very end of that period. It should still tell us how the fund performs at generating income during low interest-rate environments though, which are much more challenging for a bond fund to navigate. During the full-year period, the AllianceBernstein Global High Income Fund received a total of $62,684,639 in interest and another $834,833 in dividends (net of foreign withholding taxes) from the assets in its portfolio. When combined with a small amount of income from other sources, the fund brought in a total of $63,521,933 during the year. It paid its expenses out of this amount, leaving it with $52,550,075 available for the shareholders. This was, unfortunately, not nearly enough to cover the $67,776,526 that it actually paid out to the shareholders in distributions. This is somewhat concerning as it clearly indicates that the fund cannot afford the money that it is actually paying out to the investors.

However, closed-end funds have other ways they can obtain the money that is needed to pay distributions to investors. The most common of these methods is through capital gains. Unfortunately, the fund generally failed at this during the full-year period as the fund realized $26,881,172 in capital gains but also took $77,241,510 of unrealized losses. Overall, the fund saw its assets under management decline by $65,586,789 over the year once all expenditures are accounted for. Thus, the fund overall could not afford its distribution. With that said though, it did have enough income and realized capital gains to cover the distribution with money left over that could be used to buy new bonds that likely have higher interest rates than many of the other things in its portfolio. Therefore, it probably can maintain the current distribution when we consider the income produced by these new bonds but this is still something that we will want to keep an eye on going forward.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the AllianceBernstein Global High Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market cap of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them for a price that is less than the net asset value. That is because such a situation implies that we are obtaining the fund’s assets for less than they are actually worth. That is fortunately currently the case with this fund. As of October 20, 2022 (the latest date for which data is currently available), the AllianceBernstein Global High Income Fund had a net asset value of $10.09 per share but it only trades for $8.92 per share. This gives the fund a discount of 11.60% on net asset value. While this is not as attractive as the 12.43% discount that the fund has had on average over the past month, it is still a very reasonable price to pay. Overall, the price seems right for investment.

Conclusion

In conclusion, the AllianceBernstein Global High Income Fund could be a way for an investor to generate extra income to help maintain their income in the face of today’s very high levels of inflation. The fund is fairly well diversified, which should help protect an investor against default risk. That is something that should appeal to most people that are depending on their portfolios to generate the income that they need to support a lifestyle. There may be some short-term declines in the share price, though, as the Federal Reserve looks likely to continue to hike interest rates over the next few quarters. The fund also is failing to generate sufficient income to maintain its distribution so we need to keep an eye on its financial statements.

The fund is trading at a very attractive valuation, though, which helps to offset some of these concerns. Overall, it might be worth thinking about if a small income-generating position is desired for a portfolio.

Be the first to comment