Anna Koberska

Vladimir Putin has threatened to turn away from a deal agreed to earlier this year that allowed the export of agricultural products from Ukraine’s Black Sea ports to resume. He called the deal a scam. “It may be worth considering how to limit (food exports) along this line”, Putin stated.

“UN data shows that from 87 cargoes, 57 went to non EU countries including China, Egypt, India, Iran, Lebanon and Turkey.” FT reported. Basically Putin is lying.

“Turkey’s president Recep Tayyip Erdoğan echoed Vladimir Putin’s criticism of a grain deal that he helped to broker between Moscow and Kyiv, as he vowed to discuss the issue with the Russian leader at an upcoming summit.” was the news on FT.

Ukraine forces seem to be advancing, pushing Russian troops away from their territory. Russia called for a UN security council meeting to stop arms exports to Ukraine two days ago. A strange act by an aggressor.

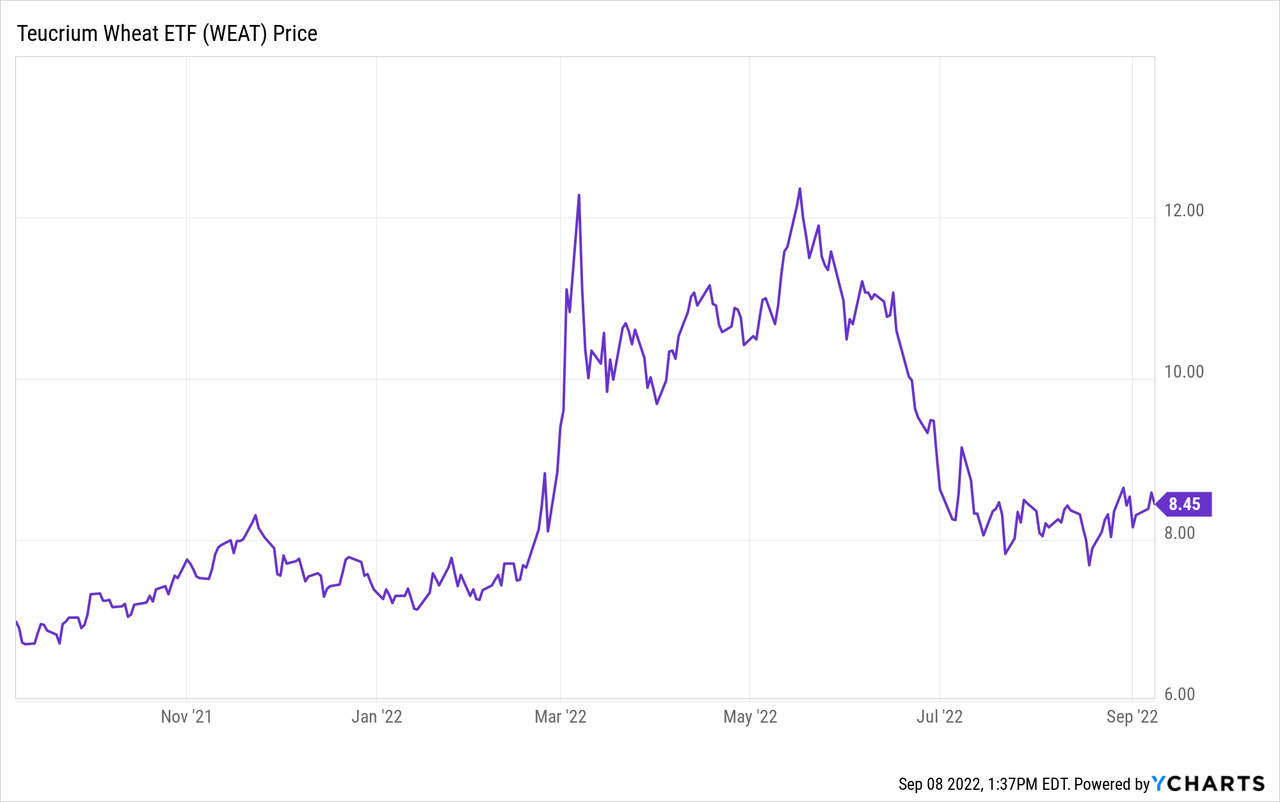

We may see some actions from Russia against the EU. Stopping grain exports would cause food crises in poor countries, which would result in migrant exodus to the EU. That could destabilise the EU political situation. My base case is that Russia will stop Ukraine sea grain exports. We bought the Teucrium Wheat Fund (WEAT). The ETF is down 50% since the exports were restarted. This indicates the upside.

WEAT tracks an index of wheat futures contracts. It reflects the performance of wheat by holding Chicago Board of Trade wheat futures contracts with three different expiration dates.

WEAT avoids the front-month contract in its aim to provide exposure to wheat futures. Instead it holds the 2nd to expiration, 3rd to expiration and the subsequent December contracts to mitigate the impact of contango, weighting the contracts 35%, 30% and 35%, respectively. This approach should have some success in contango mitigation but may lag front month at times. The fund’s structure means a K-1 at tax time and a blended tax rate.

Source: ETF.com

Other ideas how to trade Putin’s war against Ukraine

We remain long LNG tankers through COOL and GLNG. They are the beneficiaries of the Russian gas blackmail. We are up 50% on the positions in a few months and believe in plenty further upside.

We remain long product tankers through HAFNIA. We increase our position today in the block trade and also bought more on today weakness. Russia is the major producer of diesel for Europe. The diesel will stop flowing from Russia in December. Product tankers should benefit. Brokers are increasing their Price targets for Hafnia and other product tankers almost on weekly basis.

We are long Norway gas production through Var Energi. Var is top pick of several Scandinavian brokers as gas represents over 30% of their hydrocarbons production.

We also bought Palladium producer Sibanye (SBSW). Russia is a major palladium producer. Russia is the world’s largest palladium producer with 25-30% market share. Palladium could be next in the Russian sanction list against the West. SBSW is down 50% since the war started. The market sold off as Palladium was included in the war sanctions. SBSW has been stable for weeks at current levels. Downside limited, if palladium is drawn into the war, the share price should double.

Be the first to comment