Hispanolistic/E+ via Getty Images

Realty Income (NYSE:O) and Simon Property Group (NYSE:SPG) operate no moat businesses. Even so, each manages to dominate rivals. Furthermore, both of these REITs possess strong balance sheets, and each sports an impressive yield. However, the risk/reward investment profile of the two tickers is manifest and markedly different.

Realty’s business model tends to perform well during good times and bad. Even during the height of the pandemic, O continued to increase its dividend. However, the REIT’s stable revenue stream comes at a cost: Realty’s leases are lengthy and rent increases are small. Consequently, O relies on acquisitions to fuel growth.

On the other hand, SPG has a history of cutting the dividend during tough economic cycles, and bears claim the trend to ecommerce is sounding the death knell for investors in the stock.

My investigation for this article provided surprising insights. Over the long term, high interest rates and recessions can actually work to Realty Income’s advantage. Furthermore, ultimately the trend to ecommerce may benefit Simon Property Group.

Realty Income’s Strengths And Weaknesses

Realty is one of the few stocks that provide a monthly dividend payment. In fact, Realty has registered a trademark for the phrase “The Monthly Dividend Company”. O is also one of only two REITs that is a member of the S&P High-Yield Dividend Aristocrats Index with a credit rating of A- or better. It is a testimony to the strength of Realty’s business model that the company hiked its dividend three times in 2020, a period when COVID headwinds had many REITs cutting or suspending dividends.

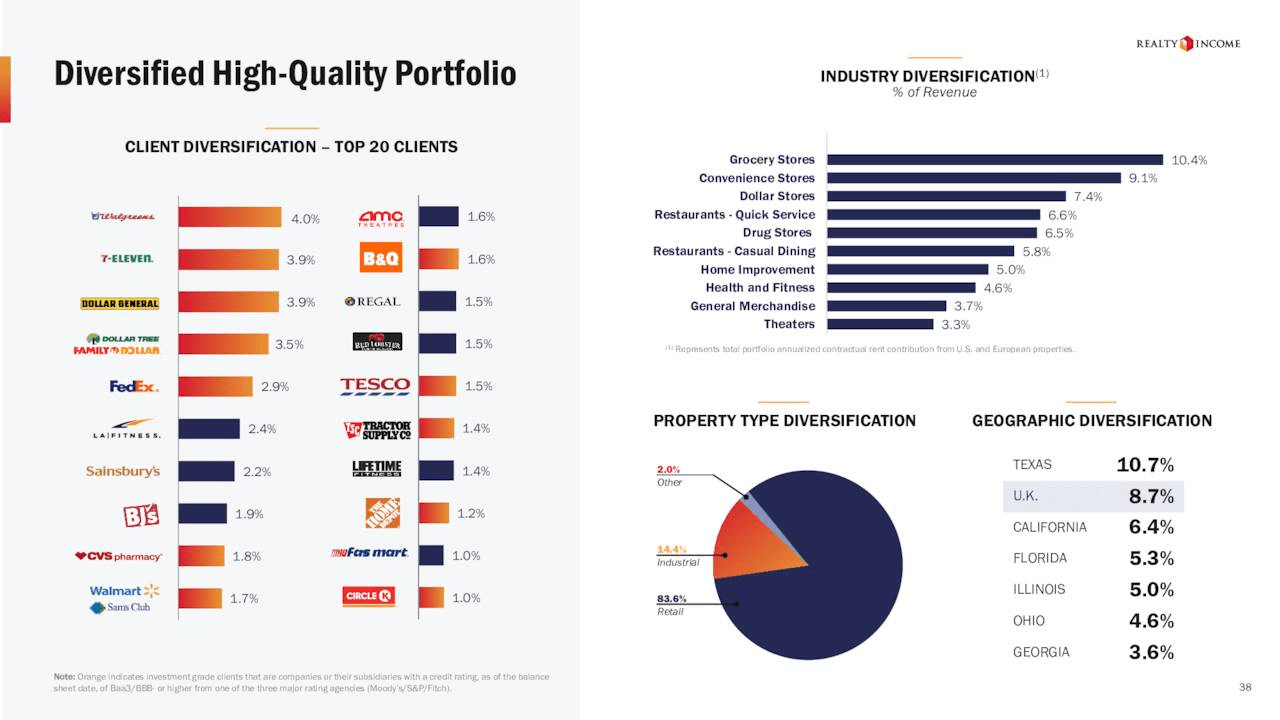

O operates 11,200 commercial properties leased to approximately 1,090 different clients in 70 industries. It has broad geographical diversification with properties in all 50 states and Puerto Rico, with no state contributing more than 10.7% of annual rents. Add to that properties in the United Kingdom that provide nearly 9% of annual revenue.

Although 84% of Realty’s tenants are in retail, most are in ecommerce resistant businesses or are in sectors that are insulated from economic downturns. Furthermore, 51% of tenants are investment-grade.

Around 41% of the REIT’s revenue stems from its top 20 tenants, while the top ten tenants collectively constitute just over a quarter of rents.

Realty’s initial leases are generally 15 years in length, and the remaining average term for the REIT’s current leases is 9 years.

The following chart provides insights into Realty’s tenant mix.

Seeking Alpha

O is also the largest triple-net REIT. For those new to the term, a triple-net lease requires that tenants shoulder the expenses for the properties, including building insurance, taxes, and maintenance expenses.

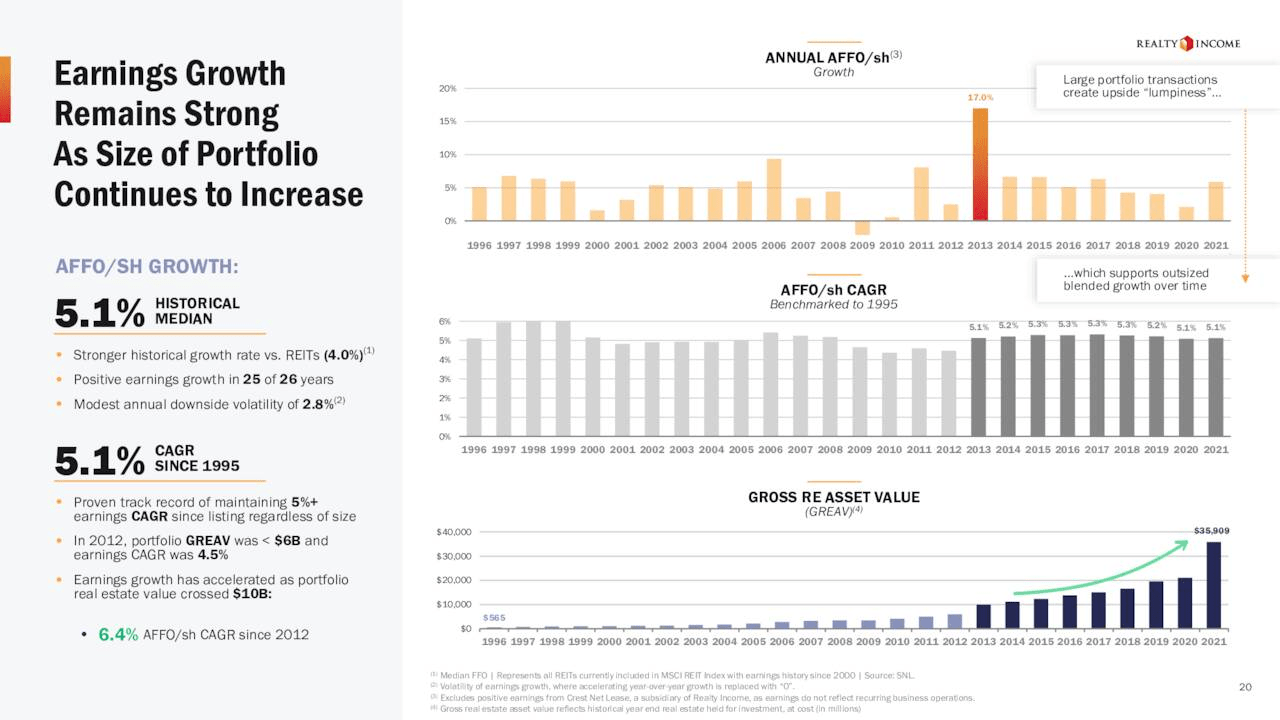

Realty possesses a remarkable quality among investments in that its AFFO increases during good times and bad. With a singular exception, and that was the result of the Great Recession, Realty has grown annual AFFO every year since 1996.

Seeking Alpha

In fact, Realty was one of only three net lease REITs that increased AFFO per share during the COVID pandemic. This was even though over 8% of the company’s revenues were from gyms and/or theaters, businesses that were hit hard by pandemic restrictions.

In part, this is because O maintains high occupancy rates. For a brief period following the Great Recession, occupancy rates dipped to 96.6%, the lowest level since at least 1992. In Q1 2022, occupancy stood at 98.6%.

Additionally, over the years, O increased the percentage of investment-grade tenants on its leases and diversified into more defensive industries.

During the latest quarter, O proved once again that the business has staying power: re-leasing spreads of 6.2% and same-store NOI of 4.1% were some of the best results in the company’s history.

Realty’s properties tend to be generic in nature. This results in both a strength and weakness: properties are easily leased, but it is also a simple task for rivals to construct similar structures nearby. This results in Realty operating a no moat business. Consequently, O has stable cash flow at the cost of lacking pricing power in any single market.

Another negative is that the lease terms have very low annual rent increases, on average they are about 1%. Therefore, Realty relies on acquisitions to drive growth.

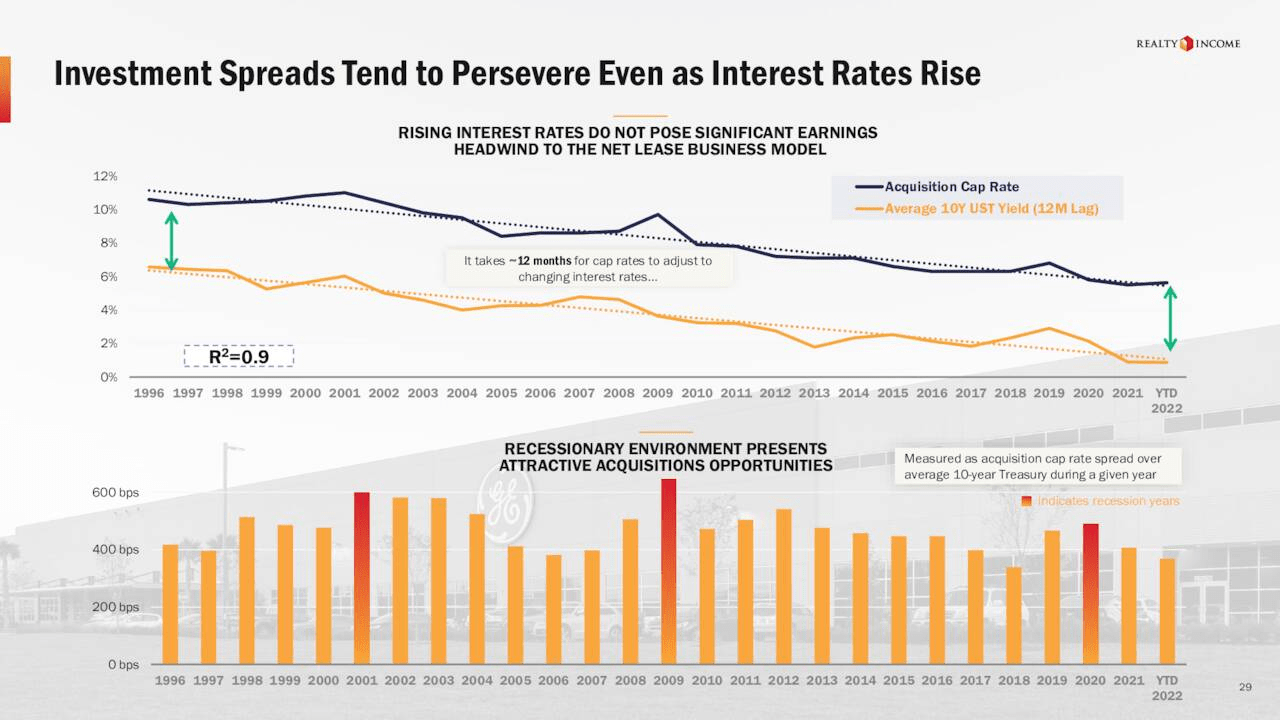

Over the past decade, the company’s growth was fueled by over $20 billion in acquisitions at cap rates of roughly 6%. This highlights a concern for many investors. Since O relies on acquiring new properties to fuel growth, will the current climate of increasing interest rates hamper Realty’s ability to grow through acquisitions?

Realty provides ample evidence, as documented in the following chart, that rising interest rates and recessions do not have a negative effect on the firm’s ability to execute acquisitions.

Seeking Alpha

As a matter of fact, it appears as if the opposite is true. In part, Realty’s ability to navigate through economic headwinds can be attributed to the company’s large scale and strong balance sheet. In effect, recessions and escalating interest rates result in barriers for smaller companies with lesser resources that seek to acquire or build properties.

Simon’s Pluses And Minuses

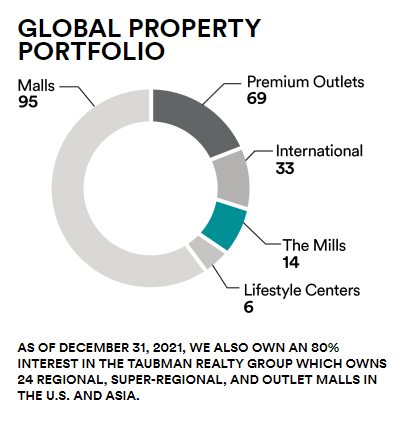

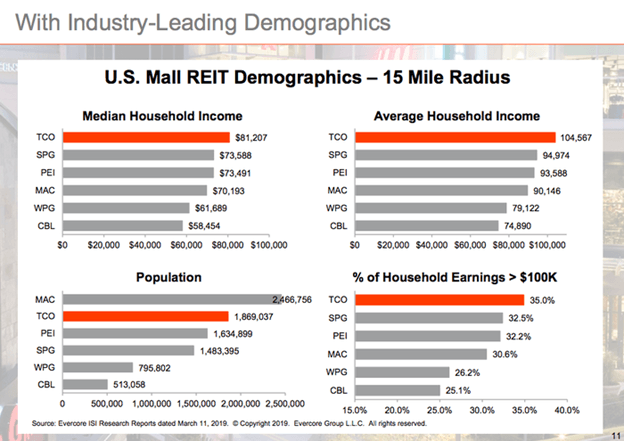

SPG is the largest mall REIT in the US. It is important to note the company’s malls are located in areas with high population densities and high household incomes. Like Realty Income, SPG also has an A- debt rating from S&P.

The graph below provides an overview of Simon’s property portfolio.

Seeking Alpha

The US has approximately 1,100 traditional malls. Of those, around 400 are Class B malls, and 350 are Class C and Class D malls. Few of the class C and D malls are expected to survive the trend to ecommerce.

SPG derives over three fourths of net operating income (NOI) from its class A malls and nearly 90% of NOI from malls that are rated as B+ or better. Simon’s malls rated C+ and below provide less than 1% of the REITs NOI.

The well-known mantra regarding the value of real estate, “location, location, location” springs to mind when assessing Simon’s property portfolio.

Seeking Alpha

While there has been a plethora of commentary regarding the death of brick and mortar retail, there is also substantial evidence that the premium properties operated by SPG will fare well.

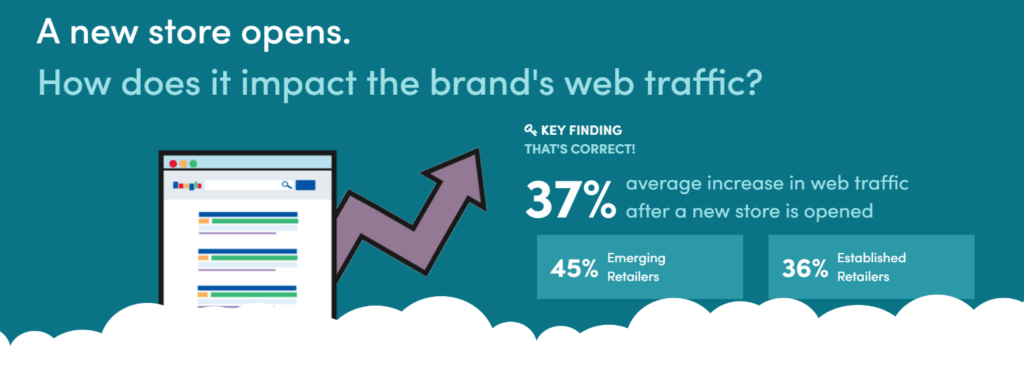

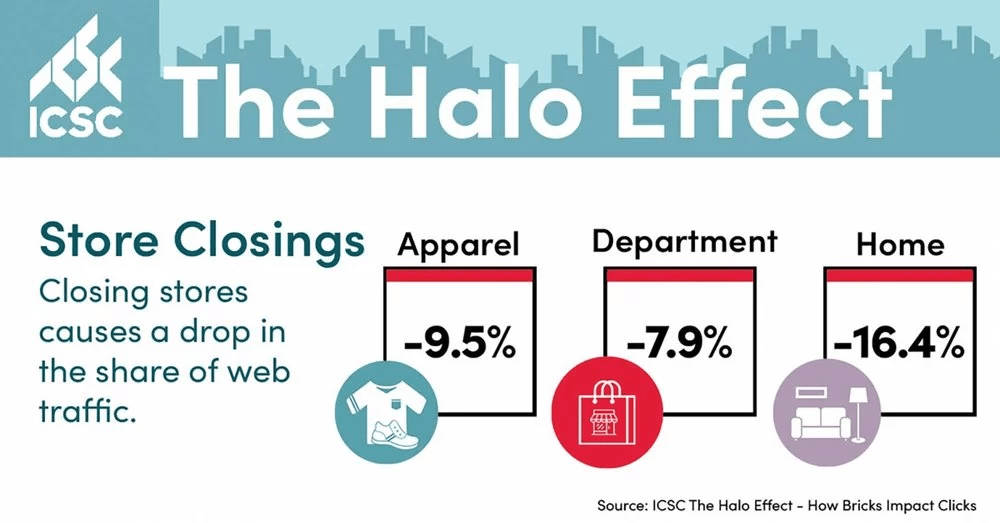

A study by ICSC determined that opening physical stores increases web traffic by 37%. Furthermore, closing brick and mortar stores results in a drop in local ecommerce traffic from 7.9% to 16.4%. Now consider that for every $100 a customer spends online with a retailer, they also spend $131 in-store with the same retailer within a 15-day period, according to the ICSC report.

Retail Insider

Admiral Real Estate Services

Retail Insider

That data is buttressed by the results of a Shopify survey that found 54% of shoppers find a product online and buy in-store, while 53% discover a product in-store and buy online.

The ICSC study results also underline the advantages inherent in teaming ecommerce with physical stores. The relatively recent understanding of this phenomena is resulting in a metamorphosis, whereby retailers of both ilk are finding brick and mortar stores are needed to maximize sales.

Of course, this advantage is not lost on the CEOs of the leading retail businesses.

Stores continue to be an integral part of our overall strategy as data indicates that digital sales are higher in markets where we have a strong retail presence.

Molly Langenstein – CEO, Chico’s FAS (CHS)

Our data validates that in markets where we have a physical presence, our online business is stronger. The interplay between our digital and physical assets is more important than ever, and we are focused on establishing an appropriate footprint in markets that drive our sustainable and profitable omnichannel rep.

Jeff Gennette, CEO, Macy’s

Rebecca Fitts, director of real estate at Leap also notes a surge in demand from ecommerce companies desiring to open brick and mortar stores. Here is Fitts view of the trend:

It’s really come full circle. It’s been shot out of a cannon this year. There’s a point you’re going to hit online where you can’t go any further with folks … when you’re going to need stores. These brands want to make money ultimately, and this is certainly a huge, huge part of the pie.

Warby Parker (WRBY) is an example of a company that was born of ecommerce but has adopted a strategy to grow through brick and mortar. WRBY plans to open 30 to 35 stores annually. With around 160 locations at the end of FY 21, WRBY’s goal is to ultimately increase its store footprint to 900.

I’ll add that when using Warby Parker’s store locator, you find a number of locations in malls.

A well-known ecommerce company, Wayfair (W), is moving to open brick and mortar stores. While I was unable to uncover the number of stores management hopes to open, the following comment during the most recent earnings call speaks volumes.

Physical retail will take a long time before it’s substantial, and yet there’s a very substantial sized team working on it today, because you need the team to build the offering and you need that in order to have one store. But one store doesn’t move our P&L. But then one day, decade from now you have many, many stores that could be meaningful, right?

Niraj Shah, Co-Founder, CEO & Co-Chairman, Wayfair

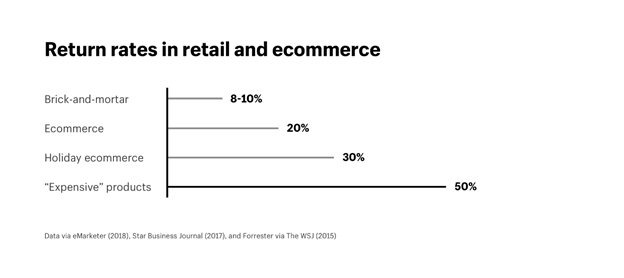

Another motivating force behind ecommerce’s move to brick and mortar is the cost of returns. Merchandise return rates for ecommerce far exceed those of brick and mortar, which in turn results in a corresponding demand for logistic centers.

Morningstar estimates e-commerce requires 3X the distribution space of brick and mortar retailers, and It represents a hidden cost to ecommerce sales that often results in very low margins.

Shopify

Now, stores are not just places where things are hanging on hangers. They’re showrooms. They’re places where you go in to learn about the brand. And now they’re even fulfillment centers. … On top of being a place where you sell things [stores] can help ease that burden, that e-commerce burden”

Brandon Isner, head of Americas retail research at CBRE.

Arguably the hardest hit by ecommerce among the traditional brick and mortar retailers are department stores, and this is a continued concern for those investing in SPG. In my article that appeared in late 2020, I delved into the possible losses Simon would suffer due to the wave of department store closures sweeping the US. This excerpt from that piece speaks to the strength of Simon’s property portfolio:

Considering the specter of ailing anchors, one has to wonder how the department stores in Simon’s portfolio are managing. Macy’s and J.C. Penney (JCPNQ) combined represent over half of Simon’s anchors.

J.C. Penney announced the closure of over 150 stores (18% of that company’s portfolio). I compared that roster to Simon locations. (Penney later announced 242 closings, but I could not find a list of those stores). The result? None of the 150 stores is in a Simon property.

I conducted a review of 31 stores Macy’s plans to shutter. I found one in a Simon mall.

So, of 181 planned closures of J.C. Penney and Macy’s anchor stores, only one is operated in a Simon mall. This is testimony to the resilience of Simon’s properties.

When I wrote that piece, Ascena Retail Group was Simon’s third largest tenant in terms of the percent of total net rent paid. At that time, Ascena leased 435 stores in SPG malls. Today, Ascena is bankrupt, and the name has disappeared from SPG’s top ten list of tenants.

However, during the Q1 earnings call, management reported sales per square foot growth of 19% to a company-record $734. That compares well to the $693 per square foot figure reported in the fourth quarter of 2019.

Once again, this points to the value of premium real estate. Brick and mortar retail is not dying, it is evolving. SPG possesses malls in the best locations, something retailers understandably desire. It is that straightforward.

From my perspective, those pointing to malls as ailing dinosaurs are underestimating the potential premium properties have for marrying brick and mortar with ecommerce. Digital sales, the force that delivered a death blow to many class C and D malls, is now beginning to strengthen class A malls.

Yes, there are legitimate concerns for those considering an investment in SPG, and problems associated with The Gap (GPS) may stand at the top of that list. The Gap is the number one inline store tenant for SPG, and that retailer contributed over 3% of base rent last fiscal year,

The last earnings report for The Gap revealed that revenue fell 13% and comparable sales dropped 14%. Online sales also fell double-digit percentages. Freight costs and merchandise discounts were cited as factors leading to poor margins. Management guided for a drop in revenue in the low- to mid-single-digit percentage range.

Macy’s, the number one anchor for SPG, is also struggling.

O and SPG Stock Key Metrics

As reported in the body of this article, both companies have very strong financial foundations, with solid investment grade credit ratings.

Each REIT has a well-funded dividend. Realty Income’s forward AFFO payout ratio is a hair above 76%. Simon’s is even more conservative. SPG has a forward AFFO payout ratio just below 63%.

The projected forward AFFO growth rate for O is 5.91%, and for SPG the forward AFFO is 8.09%.

Realty Income’s current price/AFFO of 18.75x is nearly two points above that of the sector median.

Simon’s price/AFFO is 8.81x. SPG has historically traded for a price/AFFO of roughly 15x.

Realty Income currently trades for $69.36. The average one year price target of the 9 analysts that rate the stock is $77.14. The price target of the 5 analysts that rated O following the most recent earnings report is $76.60.

SPG currently trades for $97.08. The average one year price target of the 14 analysts that rate the stock is $155.36. The price target of the 5 analysts that rated the stock after the most recent earnings report is $137.00.

Is SPG or O Stock The Better Buy?

The specter that hangs over both stocks is macroeconomic in nature. As REITs that rely on retailers, SPG and O can experience sharp downturns in the event of a recession.

Herein, however, is where my research for this article awakened me to strengths each company possesses that I, and I would wager most investors, were unaware of.

Realty has a clear advantage over smaller rivals during tough economic cycles. Due to its scale and investment grade credit rating, recessions and/or periods in which interest rates are rising present a window of opportunity for O. It is then that the REIT can pursue accretive acquisition opportunities that are not always available during a booming economy.

It is of value to recall that there has only been one year when O did not grow AFFO, and that was at the back end of the Great Recession.

On the other hand, SPG is much more likely to suffer in the event of an economic downturn. Shares of SPG dropped precipitously during the Great Recession, and the REIT suffered a dividend cut. However, Simon also has an underappreciated strength.

Traditional retailers are embracing an omnichannel business model as ecommerce companies seek to expand into brick and mortar. I contend this will result in an increased demand for Simon’s properties, as they are located in areas with both high population density and greater disposable income. A recession will slow the evolution to omnichannel retail, but it will not derail it.

I rate both companies as a BUY, but with caveats, and it is here that I will address whether SPG or O is the better buy. The answer to that question is dependent upon one’s investment philosophy.

Realty Income appeals strongly to risk-averse investors seeking a passive income stream. Over the long term, it is very unlikely that you will lose your principal investing in Realty. Based on its current yield, O is marginally undervalued, so adding to or initiating a position with a relatively small tranche is warranted here.

SPG appeals to investors with a differing risk/reward profile, especially those that eschew market timing. I contend SPG is undervalued by a wide margin. While it is true that the share price will likely drop markedly in the event of a recession, I will opine that the current valuation may largely reflect that eventuality.

I will also note that Simon has a history of cutting the dividend during periods of market turmoil, but management restores the payout in short order, once headwinds subside. Therefore, I see SPG as appropriate for buy and hold investors seeking a high yield investment.

I will add that I believe we are on a cusp of a recession, and that the most likely scenario is for markets to head lower for longer. However, I am acutely aware that no person can time the market on a consistent basis. My strategy in this situation is to continue to invest, albeit in smaller tranches.

Be the first to comment