Dmytro Skrypnykov/iStock via Getty Images

Micron Technology, Inc. (NASDAQ:MU) has dropped more than 40% from its 52-week highs to a market cap of $65 billion. This weakness is partially due to overall weakness in the markets, but also due to the company’s poor guidance. However, as we’ll see throughout this article, despite that weakness, the company has the ability to drive substantial shareholder returns going forward.

Micron Performance

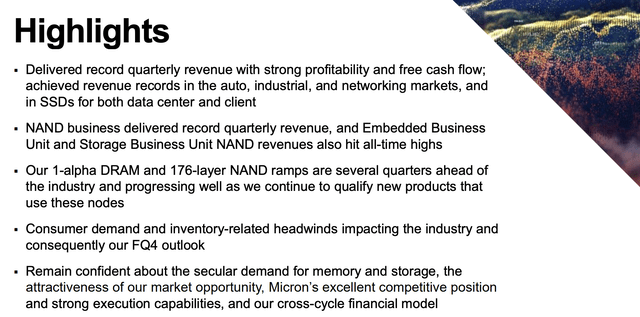

Micron had a volatile quarter, but the company has continued to perform well.

The company generated record quarterly revenue, although free cash flow (“FCF”) was below “record levels.” The company has continued to invest heavily from a capital perspective. The company is continuing to ramp new technologies, and with a smaller peer group, is continuing to remain competitive among its peers. Its latest NAND and DRAM technology continue to ramp.

The company has highlighted weak FQ4 guidance. However, in the long-term, we expect the volatile market to remain financially profitable for the company. The company expects its technology lead with a 1-alpha node to ramp-up over the next several quarters, and it expects its overall technology lead to last at least through CY23.

Micron Outlook

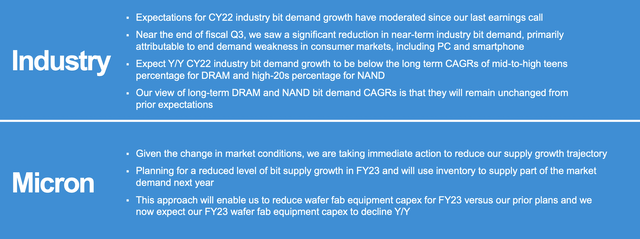

Micron has long highlighted that the company no longer cares about rapidly capturing market share, but rather maintaining its existing market share.

Micron’s expectation for industry demand growth has slowed down with consumer market weakness. Arguably, inflation in the markets is slowing down people’s willingness to make large purchases. With the same goal to maintain market share, the company is forecast to decrease supply growth, which will actually help the company reduce FY23 capex forecasts.

That means the company is actually likely to have stronger FCF and margins through 2023.

Micron Financial Performance

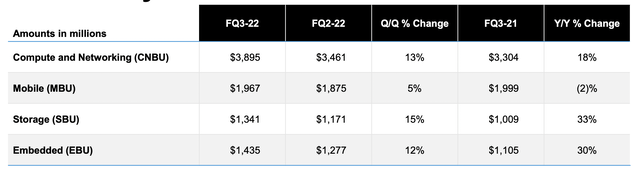

Micron saw strong financial performance in FQ3-22.

The company earned $8.6 billion in revenue, up 16% QoQ and 11% YoY. The company’s mobile segment is already showing signs of weakness, however, its storage and embedded divisions especially have managed to perform incredibly well. We expect these businesses to be more resilient than the company’s other businesses.

The company had a 47.4% margin in the quarter, with $953 million in operating expenses and $2.9 billion in net income. That net income puts the company at a mid-single-digit P/E ratio, a low level. Financially, though, continued capex to maintain market share meant the company’s FCF was much lower at $1.3 billion, giving an FCF yield of ~8%.

The company bought back roughly 1.5% of its shares throughout the quarter, and with minimal debt, we expect the pace of buybacks to continue. The company continues to have $5 billion of net cash and substantial liquidity.

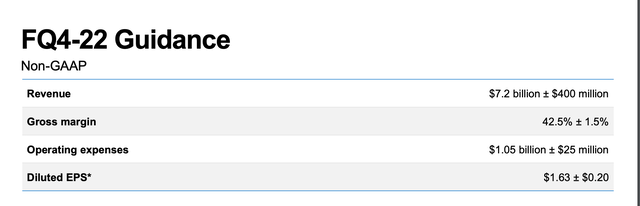

Micron Guidance

Of course, there is the downside that Micron has forecast a double-digit QoQ revenue decline.

The company EPS is set to drop almost $1/share at the midpoint, showing the volatility of the industry as its P/E goes from ~5-6 to ~10. We expect FCF to be much lower, at several hundred million $ or roughly $0.5 billion, giving an FCF yield of ~3-4%. This also helps highlight the volatility in the markets and why we think now, after recent declines, the company is a good investment.

The reason for the company’s decline is already priced in, and with lower capital obligations in 2023 and recovering earnings from built-up stockpiles, we expect 2023 to be a much stronger financial year versus 4Q 2022 would indicate.

Our View

Our view is that Micron will continue to remain an incredibly volatile investment. From a fundamental financial point of view, we expect the company’s financials to recover from their 4Q 2022 weakness and continue to outperform in 2023. That outperformance makes investing at a $65 billion market cap a unique time.

Micron stock remained volatile through 2019-2020, and the company set numerous bottoms in the mid-$40s per share. The company’s 52-week low was just over $50/share. We see these levels as a good level and price to invest into the company. Technically, we see these levels to be the upper level of a good entry point.

Financially, the company has cleaned up its balance sheet, and it’s committed to shareholder rewards. We expect the company will continue to pay a modest dividend and aggressively repurchase shares driving overall shareholder rewards.

Thesis Risk

The largest risk to our thesis is capital obligations. The company has roughly $12 billion in capital obligations for 2022, and even with a 2023 drop, it’s expected to remain quite high. The company’s financials are expected to remain strong, but a small drop in revenue can cause a much larger decline in FCF, and therefore the company’s ability to generate shareholder returns.

We expect, over time, the company’s financials to outperform. However, volatility will remain in this commodity-like industry.

Conclusion

Micron has a unique portfolio of assets as the company builds up one of the most impressive asset portfolios in the DRAM industry. The company has suffered from weak 4Q 2022 guidance. However, we expect the company’s overall financials to remain strong, and the weakness will enable it to cut 2023 capital spending.

DRAM is a volatile market, but, financially, Micron is in a much stronger position than it has been in the past. The company has a strong net cash position, it’s actively generating shareholder rewards, and the market is less competitive than it has been before. All of this, together, makes Micron a valuable investment in our view.

Be the first to comment