naphtalina/iStock via Getty Images

Luxembourgeois fire company, Perimeter Solutions, SA (NYSE:PRM) is a small company with a monopoly on the fire retardants business. The company enjoys, therefore, significant pricing power, in a fast-growing market which, from a business perspective, has strong secular growth tailwinds, as climate change increases the risk of wildfires. While the company’s share price does not offer a meaningful margin of safety, the company belongs on an investor’s watchlist.

Poor Stock Market Performance

Since listing on the New York Stock Exchange (NYSE), Perimeter Solutions has declined by 13.14%, somewhat better than the S&P 500, which declined by 14.85%.

Source: Google Finance

The company’s share price performance is easy to understand. The company was bought and taken public by EverArc Holdings Ltd. , a publicly-listed acquisition company with fully committed capital. While EverArc is not a special purpose acquisition company (SPAC), its organization is very similar, although EverArc’s unique structure means that it gives shareholders full transactional certainty, full seller liquidity, and is less likely to overpay for a business. SPAC returns for post-merger shareholders have largely been negative, given the tendency to overpay, and the difficulty in finding an attractive investment target. With few quality targets and an era of eBay money, overvaluation and poor returns are the norm. With the demise of the SPAC boom, Perimeter Solutions seems to have suffered from a market that has lost sight of its quality and the differences between EverArc and other SPACs.

Strong Financial Foundations

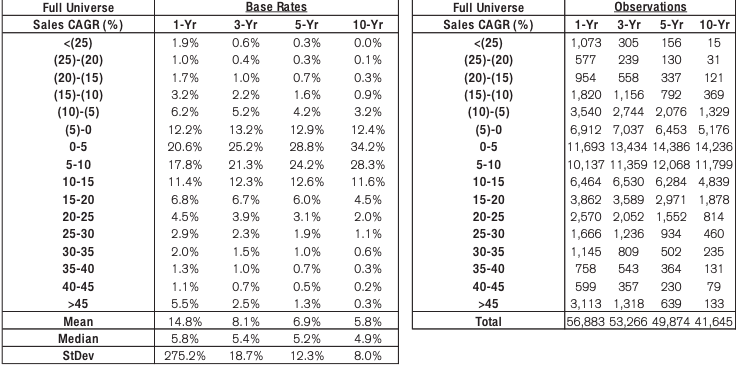

Perimeter Solutions earned $239.31 million in 2019, rising to $362.338 million in 2021, for a 3-year revenue compound annual growth rate (CAGR) of 14.83%. According to Credit Suisse’s (CS) The Base Rate Book, 12.3% of businesses achieved a similar rate of growth between 1950 and 2015. In the first nine months of the year, the company earned revenues of $316.46 million.

Source: The Base Rate Book

Revenue is derived from two segments: Fire Safety and Oil Additives. Fire Safety is the most important segment, making up over 60% of revenues, accounting for 76% of revenues in Q3 2022. The fire safety business formulates and makes fire management products (fire retardant, and firefighting foams), and offers specialized equipment and services. The oil additives business produces and sells phosphorus pentasulfide (P2S5) which is largely used in the preparation of lubricant additives. Most of the company’s revenue, about 73%, are derived from the United States, with 13% from Europe, about 7% in Canada, 2% in Mexico and the balance from the rest of the world.

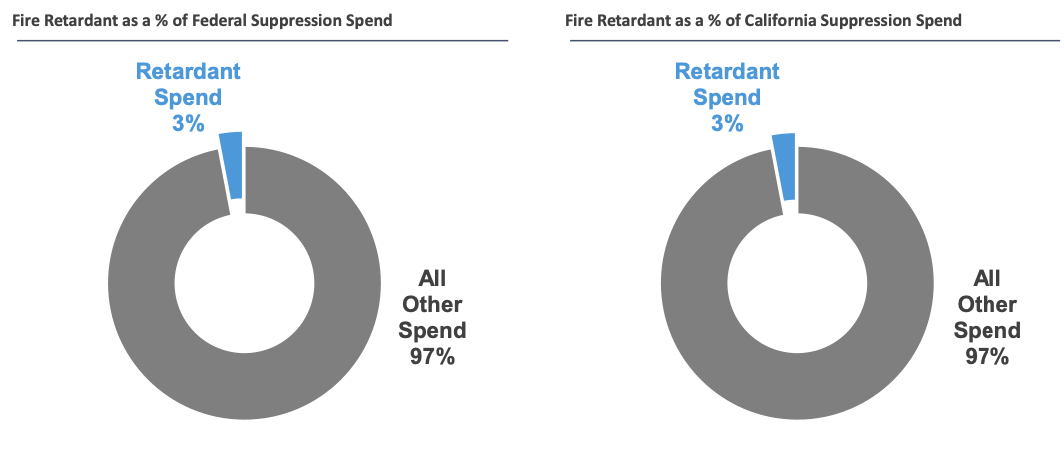

Fire retardants are essential for suppressing fires, and are used by government agencies to fight wildfires, but they are just 3% of suppression costs at the federal level, and in California. As we will discuss later, this allows the company to raise prices without much push-back, given the smallness of the financial outlay needed for retardants.

Source: Q3 2022 Earnings Call Presentation

The revenues are predictable and recurring, given the importance of suppression tools. Perimeter Solutions is a monopoly supplier of fire retardant, being the only firm that sells a commercially significant amount of fire retardant, with best-in-class metrics in terms of customer retention and growth. While there is near-term volatility, the growth in prevention and protection measures, and in the company’s geographic diversification, has smoothed out this variability. It is unlikely that government agencies will switch to a new competitor, given the company’s pedigree. It is hard to envisage a fire retardant so good that government agencies would be happy to assume the costs of switching to a new fire retardant. It would not be enough to match Perimeter Solutions quality to win over government businesses, given that Perimeter Solutions would still have the benefit of a longer history of success. Furthermore, because the company’s value chain involves the whole process of supplying the retardant, the switching costs are made even greater. The company not only has a superior product, but it can also deliver quickly across the country, thanks to its vast supply chain. Again, a new market entrant would have to replace that network in order to deliver their product.

The company’s gross profitability declined from 0.14 in 2020 to 0.066 in 2021. This is well shy of the 0.33 threshold that Robert Novy-Marx’ research showed marked out a stock as attractive. In the first nine months of the year, gross profitability was 0.05.

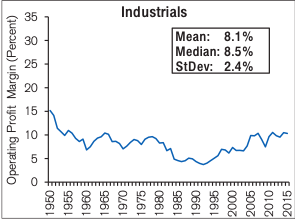

Perimeter Solutions’ operating margin declined from -2.41% in 2019, to -399.35% in 2021, purely because of the founders’ advisory fees ($652.990 million) that the company paid when it went public in late 2021. operating for 2021 up until Nov. 8 2021, was 47.65%, with the slump in operating margin arising from the listing of the company. In the first nine months of the year, operating margin shot up to 54.78%. According to The Base Rate Book, the average operating margin for industrial companies was 8.1%, while the median was 8.5%, between 1950 and 2015.

Source: The Base Rate Book

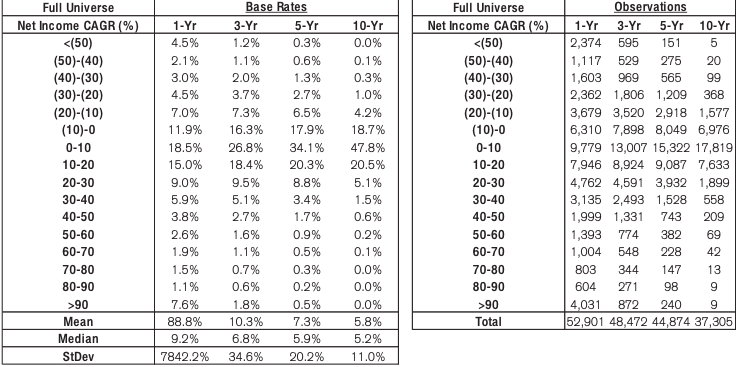

Perimeter Solutions’ net income declined from -$42.037 million in 2019, to -$659.828 million in 2021, for a 3-year net income CAGR of -150.38%. According to The Base Rate Book, just 1.2% of firms had a net income decline of that extent. This decline is largely due to the aforementioned fees the company had to pay. Until Nov. 8, net income was -$20,629 million. In the first nine months of the year, the company’s net income was $123.745 million.

Source: The Base Rate Book

In 2019, Perimeter Solutions made -$6.19 million in free cash flow (FCF), rising to $63.33 million in 2020. The company’s annual FCF is usually about $60 million. FCF is generated on about $110 million of tangible capital.

Management uses return on tangible capital (ROTC) to assess its capital allocation. Perimeter Solutions’ ROTC averages at over 50%. Capital expenditure is about 2% of revenue, according to the Q3 2022 Earnings Call presentation.

A Team of Outsiders

EverArc’s team is made up of the renowned Nick Howley, who is co-chairman of EverArc while also serving as chairman of Perimeter Solutions; William Thorndike, co-chairman of EverArc and author of the book, The Outsiders, and Tracy Britt Cool, formerly of Berkshire Hathaway (BRK.A, BRK.B).

Howley is the founder and executive chairman of aerospace and defense company, the TransDigm Group (TDG). Since TransDigm was founded in 1993, it has returned 1,750x of its primary equity, and a median internal rate of return (IRR) of 36%.

Thorndike is an expert on capital allocation. His book, The Outsiders, has been recommended by Warren Buffett, and other CEOs, and details the common themes among the very best capital allocators of all time, showing how they were all “outsiders” in some way. In many ways, we can think of EverArc as the ultimate outsider among SPACs, so different from SPACs that they cannot even be considered in the same category. Howley and Thorndike formed EverArc to try and replicate TransDigm success.

Tracy Britt Cool was Buffett’s protégé, chairing four Berkshire Hathaway subsidiaries before leaving to co-found Kanbrick; a private equity firm, in 2020, where she aimed to acquire “businesses too small for Berkshire”.

Long-Term Secular Growth

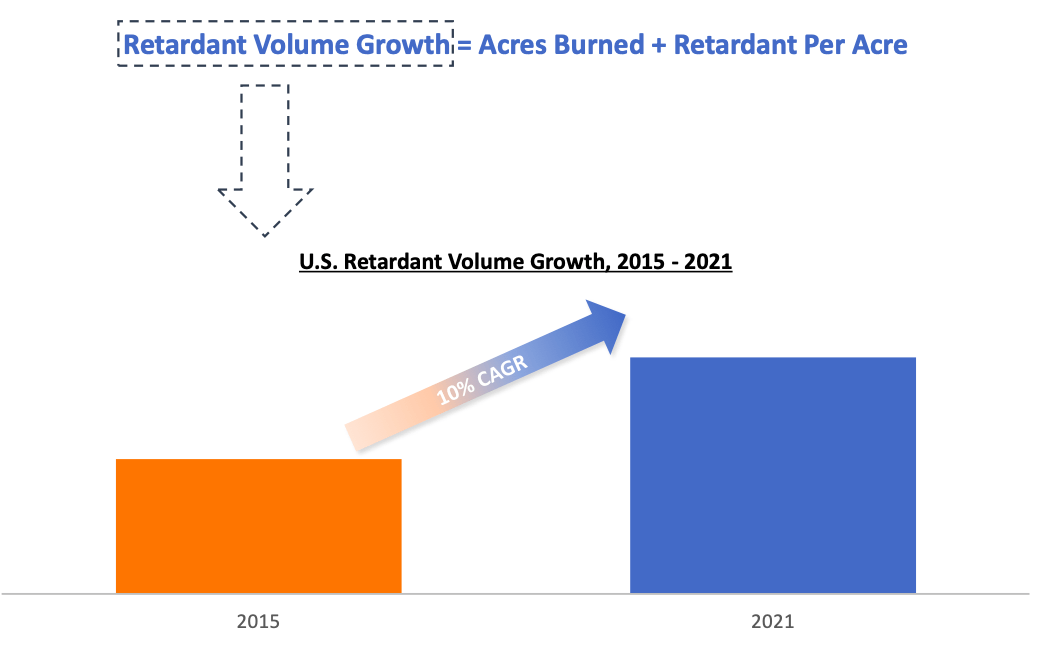

In the United States, fire retardant volume growth between 2015 and 2021 has a CAGR of 10%, reflecting the growth of wildfires, and the subsequent need to buy retardants to protect acreage and prevent fires.

Source: Q3 2022 Earnings Call Presentation

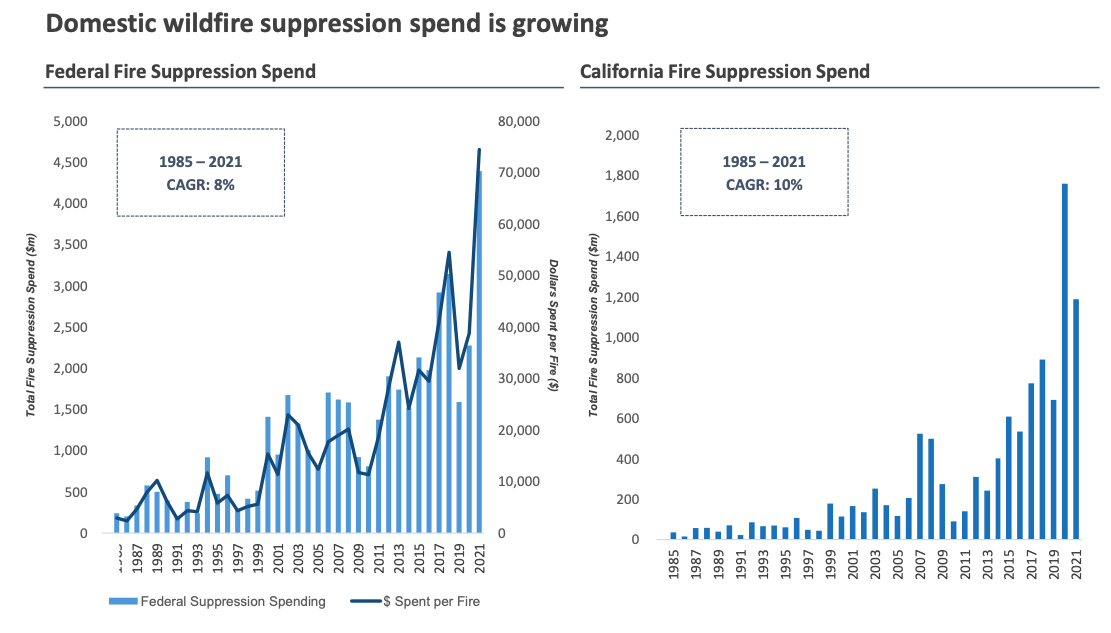

Federal fire suppression spend has risen by an 8% CAGR between 1985 and 2021, while in California, fire suppression spend in that period was 10%.

Source: Q3 2022 Earnings Call Presentation

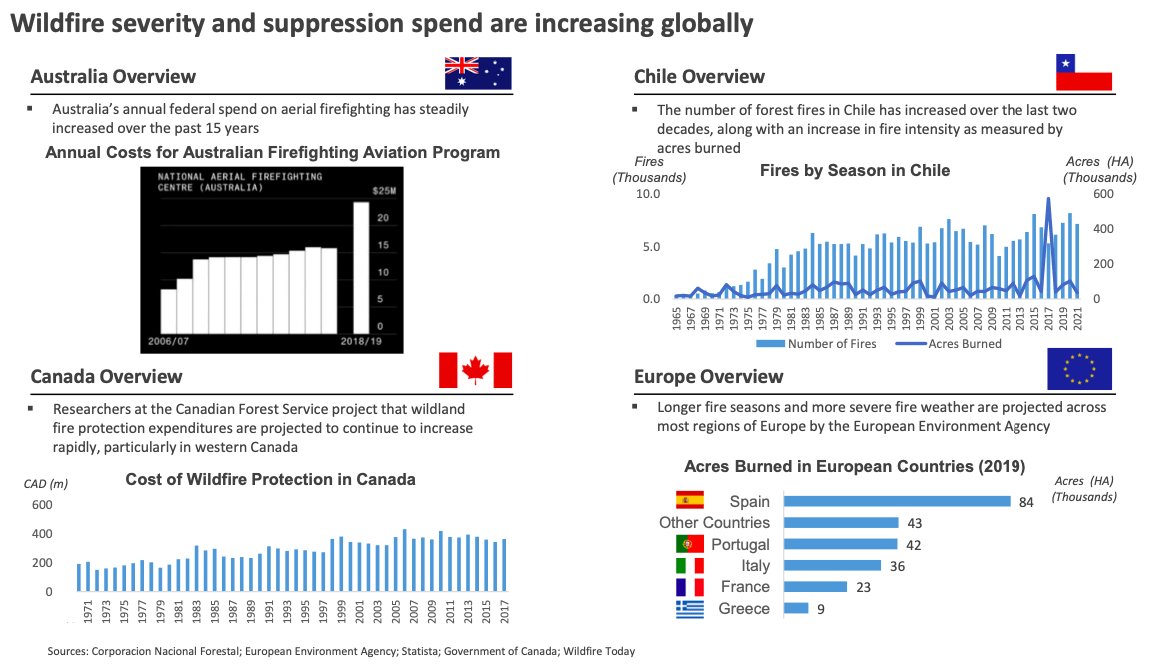

Increase in wildfire suppression spend is mirrored in the company’s key markets.

Source: Q3 2022 Earnings Call Presentation

According to the College of Natural Resources, climate change is making wildfires worse. Since 2000, the annual average of wildfires has been 70,072, burning an annual average of 7 million acres across the United States, double the 3.3 million acres burned during the 1990s, when there was a larger number of wildfires per year. The United Nations Environmental Programme (UNEP) believes that the number of wildfires will increase by 50% by 2021.

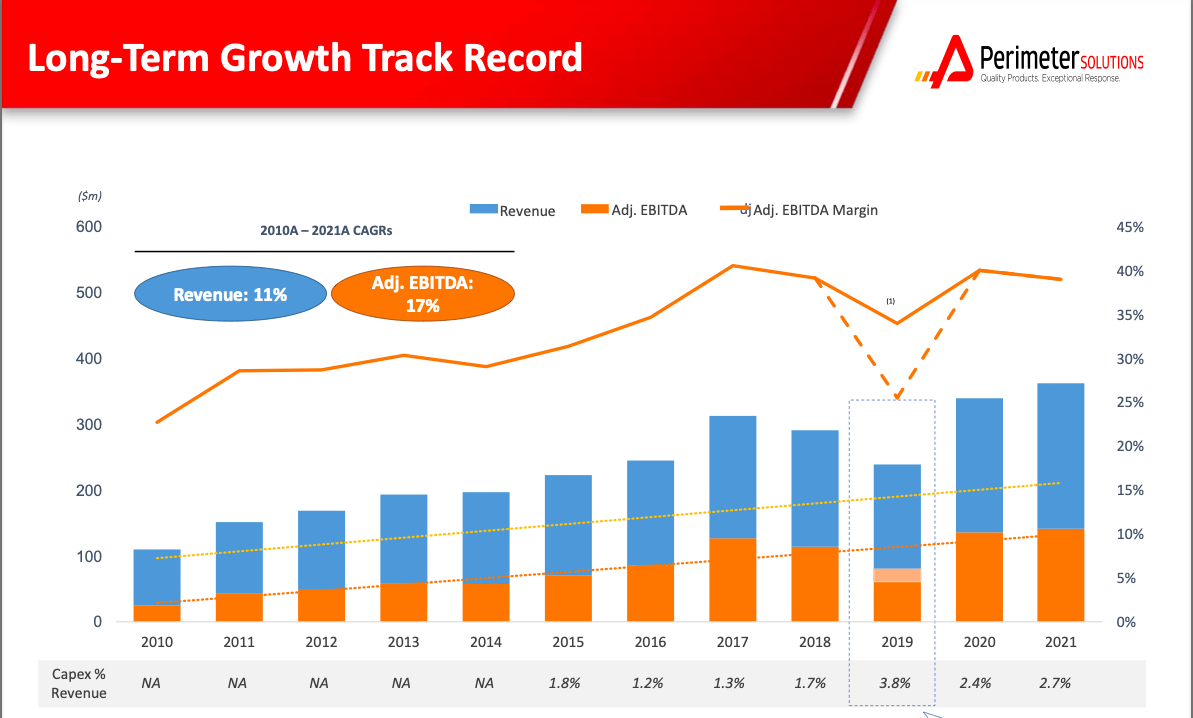

The company has benefitted from these secular trends, with revenue compounding at 11% per year and adjusted EBITDA at 17% per year, between 2010 and 2021.

Source: Q3 2022 Earnings Call Presentation

Pricing Power

The critical nature of fire retardants means that Perimeter Solutions has an enormous amount of pricing power. The company’s “value-based” approach to pricing allows it to enhance its margins, providing protection during downturns, and ensuring that it can always generate economic earnings. As we discussed above, because retardants are just a fraction of suppression costs, government agencies and other clients are not likely to feel a burden arising from rising retardant prices. This advantage is even more important during inflationary conditions. In the company’s Q2 2022 earnings call, management noted that,

We’re experiencing significant raw material inflation in 2022. As expected, we’re successfully passing on this inflation through contractual mechanisms in place across the vast majority of our Fire Safety business.

Valuation

Perimeter Solutions has a price-earnings multiple of 54.63, compared to 20.62 for the S&P 500. With around $60 billion in FCF and an enterprise value of $2.17 billion, the company has an FCF yield of 2.76%, compared to 1.5% for the 2,000 largest firms in the United States, as measured by New Constructs.

Conclusion

Perimeter Solutions is a high-quality business with a durable moat. The company supplies a highly critical tool in combating wildfires, and has extensive pricing power, which is particularly valuable given the inflationary environment. While the company is not trading at a significant margin of safety, it is a company that should be on an investor’s watchlist.

Be the first to comment