4nadia/iStock via Getty Images

Investment Thesis

Geron (NASDAQ:GERN) is a Nasdaq-listed biotech that has been around a long time – its IPO took place in 1996 at $8 per share, although the company has never won approval for or commercialized a drug product, and its share price has not traded higher than its listing price since 2005.

In 2018, things looked promising for the company and its lead and only asset Imetelstat which was being developed in partnership with the big pharma Johnson & Johnson’s (JNJ) drug development subsidiary Janssen, with ~$900m worth of development and commercial milestone payments potentially on the table.

Imetelstat is a telomerase inhibitor – telomerase is a naturally occurring enzyme that is upregulated in many malignant tumor cells, enabling uncontrolled proliferation of further malignant cells – developed by Geron as a potential therapy for blood cancers, otherwise known as hematological malignancies.

The drug had received a Fast Track designation from the FDA in October 2017, and in the second quarter of 2018 data was released from a Phase 2, IMerge trial in patients with Lower Risk Myelodysplastic Syndrome (“LRMDS”), which showed that 34% (11/32) of patients achieved red blood cell transfusion independence (“RBCTI”) for at least eight weeks after treatment with Imetelstat, and 16% achieved TI for at least 24 weeks, with an average relative reduction in transfusion burden from baseline of 60%.

Anemia is a common side-effect of LR MDS, affecting ~70% of patients, and typically, it’s treated with an erythropoiesis stimulating agent (“ESA”), but some patients fail to respond to ESA treatment and others are ineligible – this population is Imetelstat’s target market. According to the company’s research, it is a ~33k patient market, which could result in peak sales of ~$1.2bn for the drug.

It may seem surprising then that in late September 2018 Geron announced that Janssen has terminated the partnership as a result of “a strategic portfolio evaluation and prioritization of assets within their portfolio.” Not surprisingly, Geron stock, which had risen to a price of >$6 on the positive IMerge study news, collapsed to <$1.

The stock price remained depressed throughout 2020 and 2021, but Geron did not give up on Imetelstat, taking over both funding and development of the drug, and guiding it into not only a Phase 3, potentially pivotal study in LR MDS, but also a Phase 3 study, as a monotherapy, in refractory myelofibrosis (“MF”), after a Phase 2 study showed that Imetelstat was able to improve median overall survival in MF patients relapsed or refractory (r/r) to standard of care Janus Kinase inhibitors (“JAKi’s”) to 29.9 months, versus historical survival rates of ~14-16 months.

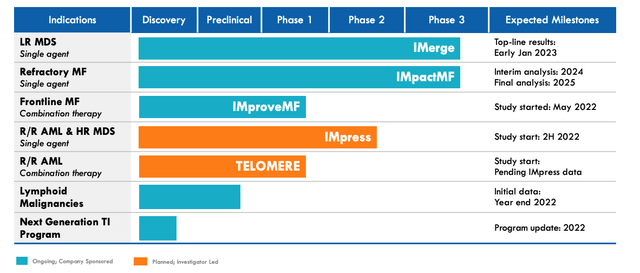

The 18,000 patients with r/r MF in the US, together with the ~33,000 in r/r LR MDS translates to a $3.3bn peak sales opportunity, Geron believes, and the company expects to have top-line data from the Phase IMerge study in early January 2023, and interim analysis from the pivotal MF study IMpactMF a year later, with final data arriving in 2025.

Geron’s plan – contingent upon positive results – is to file a New Drug Application (“NDA”) with the FDA in the first half of 2023, and a Marketing Authorization Application (“MAA”) with the European Medicines Agency, and launch commercially in the US in 1H23, and in Europe in 1H24, if approved to do so.

Across the past six months, Geron’s share price has risen in value by nearly 170%. In March, the company raised $75m via an at-the-market offering at $1.05 per share plus one warrant, diluting investors, but it has been generally positive news share price wise ever since. In June, the company named Faye Feller as its new Chief Medical Officer (“CMO”) – an intriguing move given Feller was formerly a Senior Director at Janssen, Geron’s one-time partner.

In August, Geron announced its Q222 earnings, revealing a cash position of $220m, and a net loss of $58m, while long-term CEO John Scarlett MD stated:

We continue to focus intently on our plans for a catalyst-rich next two years, during which we expect to transform Geron from a development stage to commercial company.

As such, with a major catalyst arriving as soon as January – a pivotal day in the entire history of the company – it seems that the market’s consensus opinion is that Geron is going to be successful in its efforts to secure approval of Imetelstat. The company’s market cap has risen above $1bn, but given management’s peak revenue targets for the drug of $1.2bn in LRMDS alone, that valuation could be set to increase when data is published in early 2023.

Naturally, given that Geron’s valuation is entirely tied up in Imetelstat, should Phase 3 data disappoint, the company’s valuation could drop by >50%, just as it did when Janssen pulled out back in 2018.

Some downside protection would be in place given the ongoing pivotal MF trial – as well as earlier stage studies in frontline MF, r/r Acute Myeloid Lymphoma and Higher Risk Myelodysplstic Syndrome (HR MDS), r/r AML as a combo therapy, lymphoid malignancies and even a next-generation Telomerase Inhibitor (“TI”) program – but investors ought to expect to either win big, or lose big when the January date arrives.

In the rest of this post, I will try to provide some further context, study detail, market and competitor analysis, and speculate about where the share price may end by 2025.

Geron and Imetelstat – Studies and Chances of Success

Geron – current pipeline. (Corporate Presentation)

Geron’s development path with Imetelstat has not been easy or straightforward. The company discontinued studies of the drug in metastatic breast cancer and solid tumors with short telomeres in 2012 and 2013, and in March 2014, the FDA placed a clinical hold on Imetelstat trials (according to the company’s 2021 10-K submission).

Finally, however, it seems Geron has the right indication in LR MDS. The Phase 2 data bore out the thesis around telomerase inhibition, which represents a bold and innovative approach to addressing a disease that is hard to treat effectively.

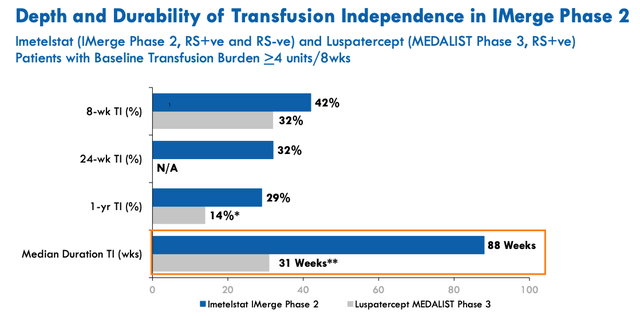

Imetelstat versus Reblozyl study results. (Corporate Presentation)

As we can see above, Imetelstat compares very favourably to Relozyl – a drug that earned revenues of $551m for Bristol Myers Squibb last year, which won approval to treat LR MDS in 2020.

The Phase 3 trial will use the same study population as the successful Phase 2, the same dose, and the same primary and secondary endpoints – Red Blood Cell Transfusion Independence (RBC-TI) ≥8 weeks, and RBC-TI ≥24 weeks. Geron will need to demonstrate a statistically significant difference between the Imetelstat arm and placebo arm, as well as an acceptable safety profile to get the drug past the FDA and onto the market.

Safety wise, cases of thrombocytopenia and neutropenia were high in the Phase 2 trial – 23 of 61 patients experiencing Grade 3/4 cases of thrombocytopenia, and 21 of 55 patients experiencing Grade 3/4 cases of neutropenia. That strikes me personally as a little concerning – there do not appear to have been such cases in the Reblozyl late-stage studies – and although Geron says there were “limited clinical consequences.”

The evidence seems to point to the likely success of the Phase 3 trial and validation of Imetelstat’s efficacy, at least on the efficacy front, and the MF data looks potentially encouraging also. The Overall Survival registered in the Phase 2 was apparently more than double compared to a real-world data (“RWD”) study of a Best Available Therapy (“BAT”) – 33.8 months versus 12 months.

Once again, Grade 3 or above thrombocytopenia and neutropenia cases seem quite high to me – 24/41 in the former and 19/32 in the latter – but management says the median duration of events was less than two weeks, and once again there were “limited clinical consequences,” meaning 2% Grade febrile neutropenia, 5% Grade 3/4 hemorrhagic events, and 10% Grade 3/4 infections.

The Phase 3 IMpactMF study is the only MF pivotal study to be conducted with OS as a primary endpoint, and once again, the Phase 2 data does seem to suggest that Imetelstat will meet the required standard.

Markets and Competition

I would broadly agree Geron’s assessment of its target markets but I would be a little concerned about the competition. In LR MDS Geron lists Bristol Myers Squibb’s (BMY) Revlimid, Reblozyl, and Vidaza, Otsuka’s Dacogen, and Astex Pharmaceuticals Inqovi as competitors, whilst the likes of Novartis (NVS) and BMY are said to be working on new drugs, as are a host of smaller biotechs.

Relapsed/refractory is likely a harder market to pitch your product into than first line, and Geron may have its work cut out competing against larger pharmaceuticals as a <100 employee company at present, with comparatively limited financial resources, as well as ~$50m of debt to pay back to creditors.

Myelfibrosis is in my opinion an even tougher market, in which there are the JAK inhibitors Jakafi (ruxolitinib) from Incyte Corporation (INCY) and Inrebic (fedratinib) from BMY, plus CTI Biopharma’s Vonjo (pacritinib), and several other drugs pitching themselves as therapies either complementary to or distinct from these three, such as Sierra Oncology’s Momelotinib – Sierra was recently brought out by GlaxoSmithKline (GSK), and Morphosys’ Pelabresib – for which the Munich based biotech paid $1.7bn for, via its acquisition of Constellation Pharmaceuticals.

I will be curious as to what the FDA will make of the OS endpoint, although in fairness to Geron, it seems in many ways a better evaluator of efficacy than say, spleen volume reduction, or transfusion independence. The patient population available to treat may be somewhat lower than Geron estimates however, given the competition, and with so many differentiated yet imperfect treatment options available, physicians may be scratching their heads over what to prescribe, making Imetelstat a potentially tricky sell in this market also.

Conclusion – A Potentially Good Short-Term Investment But The Long-Term Commercial Opportunity May Be Overstated

To summarize the contents of this post, after a long and difficult road, Geron finally finds itself at a major inflection point, with the opportunity to progress from a clinical to a commercial pharmaceutical very much in play.

That has been to some extent reflected in the rising share price in recent months, although it had become perhaps too depressed after Janssen withdrew from its partnership with Geron back in 2018.

Did Janssen know of or suspect something that could derail the 2023 approval shot in LR MDS? Could it be safety related? I’m not sure such a conclusion can be drawn – Geron’s Chief Medical Officer is an ex-Janssen employee for example – and in the pharma industry it’s not necessarily uncommon for a drug discarded by one big pharma to be picked up by a biotech and turned into a blockbuster (>$1bn per annum sales) drug.

Geron, therefore, appears to have a good chance of delivering a pipeline-in-a-product with Imetelstat, based on some apparently strong Phase 2 data, with perhaps an element of risk on the safety front.

There’s a seemingly high unmet need for the types of symptom relief the drug offers, although Geron is going to need to raise substantially more funding if it wants to be successful in a real-world setting, as the hematological oncology markets are filling up with a variety of different therapeutic options and it will need to make its voice heard. Cell therapy, for example, which has had great success treating blood cancers, could prove to be a major threat to Imtelstat, and will the drug’s unique mechanism of actions put physicians off?

M&A is not unusual in this field of science either – with GSK picking up Sierra Oncology, and Morphosys picking up Constellation in the past 18 months – could the fact that Geron has not been dogged by buyout rumours be a potential red flag.

Again, that’s probably too speculative a question to answer. I think shareholders in Geron are guaranteed some fairly wild share price swings across the next 12 months, and in the short term at least, with the IMerge data only a few months away, I’d speculate the upside case marginally outweighs the downside.

What happens after that initial surge I would be even less certain of, however, because there are a lot of variables in play. Sitting on the sidelines could be the best option amidst a fair degree of uncertainty, although the short-term upside case does look enticing.

Be the first to comment