Kimberly White

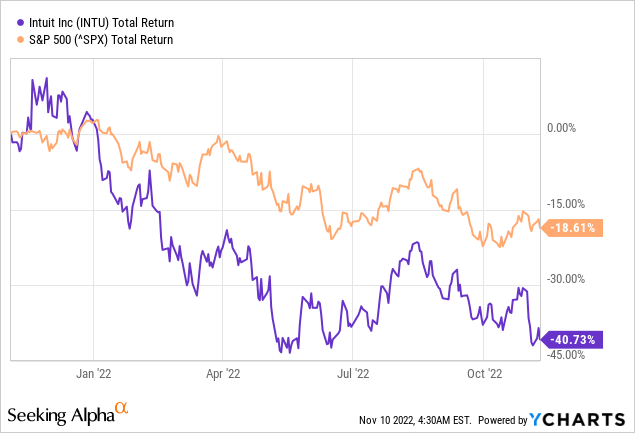

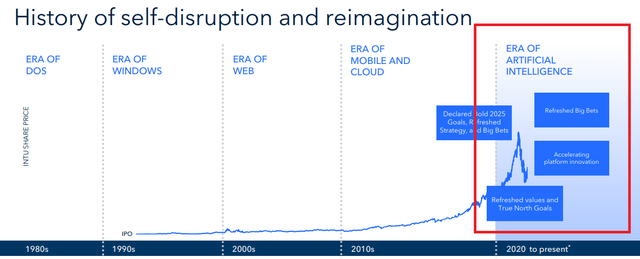

It has been a disastrous year for Intuit (NASDAQ:INTU), even as the business was supposedly entering a new and exciting era of artificial intelligence and other similar buzzwords.

Since I turned more cautious on the business in November of last year, Intuit has lost more than 40% of its value at a time when the S&P 500 fell by a bit more than 18%.

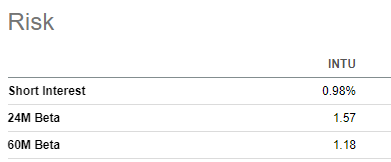

Even if we take into account market risk with Intuit’s 24-month and 60-month betas, the company still massively underperformed through this period.

Seeking Alpha

Following this massive drop, the INTU share price now appears increasingly attractive given the company’s solid business model. Its high momentum exposure aside, there is still one major reason why I am unable to turn bullish on the company.

Why I Have Hard Time Turning Bullish?

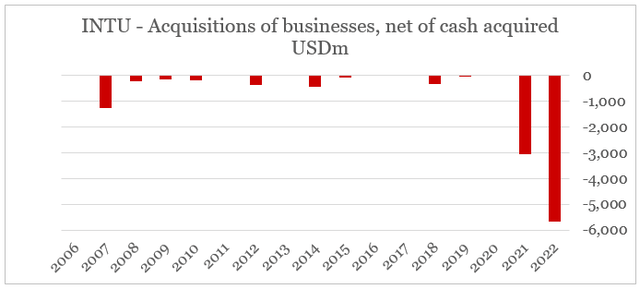

After decades of strong organic growth and solid profitability, Intuit’s management seems to have embraced a drastic shift in its capital allocation policies. This does not seem to be a one-off event and as the time goes on, it appears that INTU is all-in on this strategy of catering to short-term holders.

The sudden departure from organic growth to an extremely aggressive M&A strategy is worrisome.

prepared by the author, using data from SEC Filings

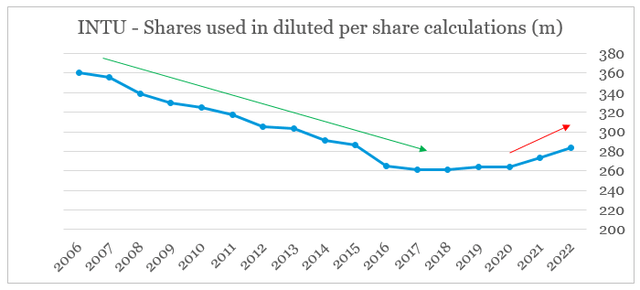

The massive deals for Credit Karma and Mailchimp also marked a bottom in the company’s total shares outstanding, which increased by nearly 8% in a matter of just two years.

prepared by the author, using data from SEC Filings

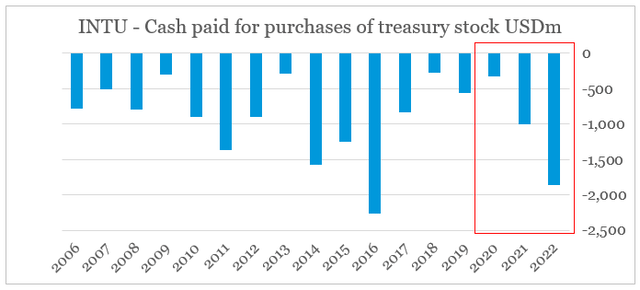

Usually, this is not a major red flag in itself, however, this increase comes at a time when Intuit’s management has dramatically expanded its share repurchase program.

prepared by the author, using data from SEC Filings

At the same time, insiders continue to sell their shares aggressively during this period when a more than a decade-long capital allocation strategy is coming to an end.

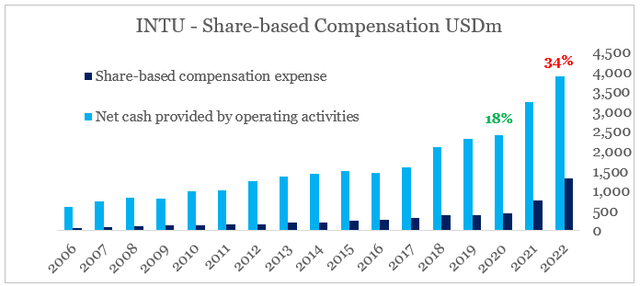

As if all that is not enough, but Intuit’s share-based compensation packages have skyrocketed in value, from $435m in FY 2020 to $1,308m during the last fiscal year. This increase puts the share-based compensation at around 34% of the company’s total cash flow from operating activities, up from 18% only two years ago.

prepared by the author, using data from SEC Filings

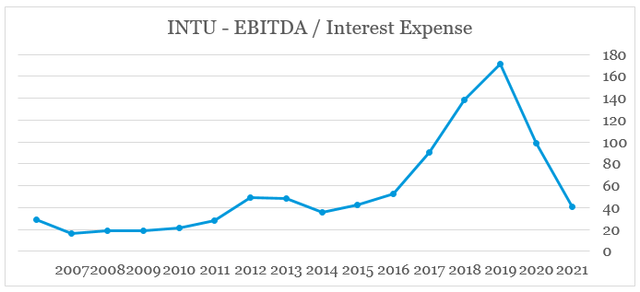

Borrowing also had to be increased and as a result of these two deals, Intuit’s interest coverage fell sharply.

prepared by the author, using data from SEC Filings

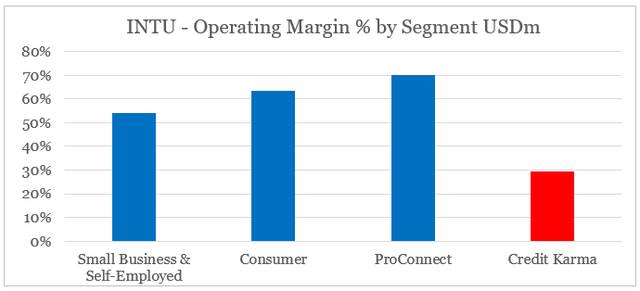

The issues I have with this rapid shift in Intuit’s strategy do not end there. Although, synergies cross-selling opportunities with Credit Karma are significant, the business is significantly less profitable than Intuit’s legacy services.

prepared by the author, using data from SEC Filings

The platform noted significant topline growth in fiscal year 2022, but the outlook has now worsened. Only two years into the deal and risks for the company are already mounting as we are likely entering a recessionary period.

Finally, turning to Credit Karma. This is the business that could be most impacted by weakening economic environment. As a reminder, this business represents 14% of Intuit’s revenue in fiscal year 2022. While we expect member engagement to be strong in any economic environment, our financial institution partners could tighten access to credit. In Q4, we experienced increased volatility in personal loans. Many partners that securitized loans are facing a more challenging funding environment as interest rates rise. For context, personal loans represent just over a third of Credit Karma’s revenue in fiscal year 2022.

Source: Intuit Q4 2022 Earnings Transcript

Given the exceptionally high multiple that the business was acquired at, this creates a major risk of goodwill impairment in the coming years. Such an event will be a major blow to Intuit’s M&A-based strategy.

Furthermore, Mailchimp problems also begin to surface and although Intuit’s management continues to praise its subscription-based model, investors should not forget that attrition rates for software services catering to individuals or small businesses are much higher when compared to large enterprises. Therefore, Intuit’s business model is at much higher risk should we enter a deeper than currently expected economic slowdown.

Speculative Metrics

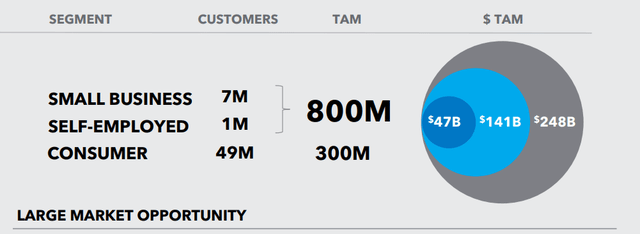

Intuit’s obsession with achieving high topline growth at any price is what bothers me, even as the legacy business model remains strong. The management also seems to be becoming increasingly obsessed with its Total Addressable Market, a metric that is ‘a black box’ dependent on vague assumptions about the future.

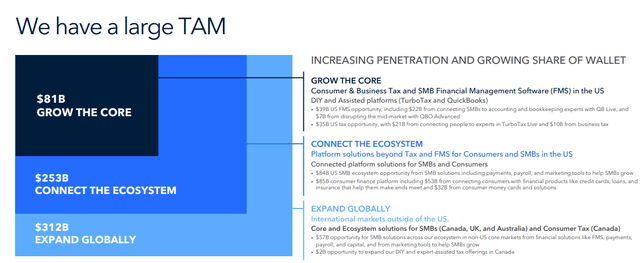

Only last year, when I first covered Intuit, the company’s self-assessed TAM stood at $248bn.

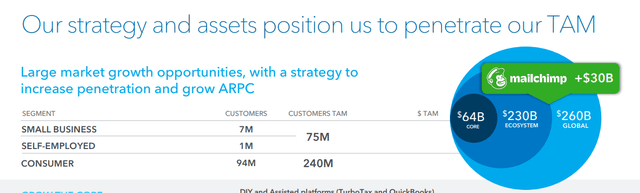

A couple of months later, at the end of fiscal year 2021, the TAM has increased to $260bn with Mailchimp adding roughly $30bn.

During the last conference call, when the company reported its fiscal year 2022 results, the global TAM already stood at $312bn.

All these vague metrics are increasingly used as the main selling point for the company’s positioning, which makes me even more vary of its current strategy. Building an exciting narrative around an ever-growing TAM was a good strategy to support valuations at a time of excessive liquidity in the markets. However, the recent bitter experience with Adobe (ADBE) and Salesforce (CRM) shows that TAM is unreliable metric for long-term success.

Conclusion

Even though Intuit’s share price lost nearly 40% of its value in a matter of just one year, risks associated with its high momentum exposure remain. More importantly, the rapid shift away from its more than a decade-long successful strategy of organic growth presents shareholders with additional risks related to future business performance.

Be the first to comment