D. Lentz/iStock Unreleased via Getty Images

Dear readers/subscribers,

Yeah, Fox (NASDAQ:FOX) might not be everyone’s cup of tea from a political angle – but I try to keep politics out of my investing. They don’t really matter one way or the other unless they start affecting profit and returns. Fox, as I wrote in my last article, is simply a good company that does good business.

By good business, I mean good profit. And in my last article, I also pointed out that the company was cheap.

And it still is.

Revisiting Fox Corporation

In my original article on fox, I made it clear that really no matter of how you slice the company, the Fox corporation is an attractive sort of business.

It’s a mass media company owned in part by Rupert Murdoch – at least he has almost 40% of the voting power – and headquartered in NYC. Its formation goes back to 2019, when 21st Century Fox was M&A’ed by Walt Disney (DIS), with the non-acquired assets spun off into a media company known as Fox Corp, which began trading in early 2019.

The company’s main activities are in Cable network programming and television, focusing on producing, licensing, acquiring, marketing, and distributing.

Plenty of very popular premium brands and shows are part of the Fox family, and with brands like Simpsons, Family Guy, Bob’s Burgers, Hell’s Kitchen, MasterChef, and Next Level Chef, the company owns some of the most-watched shows on television. The company is also a sports leader, enjoying leadership around news, sports, and entertainment.

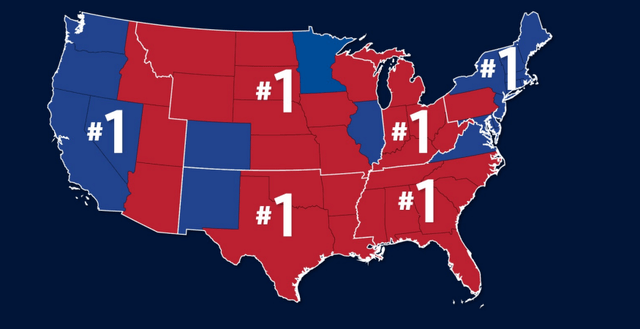

It’s one of the few legacy television companies that despite legacy TV decline, seems to have found a mix based on so-called appointment-based programming, that seems to work. The company has been on the leaderboard for 20 years straight based on Monday to Friday primetime numbers (Source: Nielsen), and finished 2021 as the #1 Cable Network in Mo-Fri primetime and total day viewers, cementing its track record for the 6th year running.

Outside of the USA, Fox is known, but not watched – even if its shows are licensed and some of its content is available. I personally follow the network – like I follow CNN and some other NA-based news outlets. However, its home market is impressive enough for the company to “live off of”.

Within the US, it has availability in 70 million households, for News and Business, with FOX Network being available essentially in every household in America.

The company’s historical growth rates are very impressive because the company has been able to deliver double-digit top-line growth in a pressured and softening media environment.

Fundamentals are solid as well. It has low debt, and a BBB credit rating – and more importantly, this is not expected to decline by any significant amount in the near future. Through its television station, the company has the ability to reach close to 39% of American households, and the company works well on capitalizing on the opportunities that come with such incredible possibilities.

As I said initially – you can dislike the politics – but have respect for the business savvy and the business that Fox is because it’s a positive one.

Now, I don’t particularly like investing in companies like this, despite being a major consumer of content, why is that?

Because of simple economics/bookkeeping. I don’t like how the depreciation and amortization of assets work in this segment of the business world. The depreciation of assets is faster than in nearly every industry when we look at broadcasters and streamers. That’s part of the reason I generally don’t like owning them. If you own a blockbuster show, sure. But for every blockbuster show, there are 10 or more that don’t meet the criteria and are essentially wastes of money, forgotten, and essentially worthless after a short time, and that gets thrown after networks for pennies on the dollar.

There is a lot of “waste” in industries like these, and I’m not a fan of waste.

Fox is a bit of an exception to this rule, because of its yield, because of its earnings, and because of the way I see it managing what it has – which is better than the average network I’m used to. The company is seeing improving advertising numbers.

The Cable Network programming segment is the one thing to keep in mind here. For the past few years, the company has done really a stellar job in growing not only revenues and sales, but the bottom line as well. Volatility is still part of things here – as it is for most of these content companies – but it’s far from as bad as, say, Netflix (NFLX).

Recent results for FOX continue the relatively positive trajectory we’ve seen. The 1Q23 period fiscal is out, and results here were very positive. The company delivered a 5% top-line revenue growth, led by 8% increase in advertising spend, and 3% affiliate growth due to strong pricing, record-level political revenues at the local-station level, and in the face of otherwise significant revenue pressures that the wider advertising industry seems to be facing.

The company has observed some softness in linear entertainment, but due to a good overall mix in company verticals, the impact on FOX here is limited as compared to other companies. Despite economic headwinds, numbers out of FOX are solid, with 2/3 of company advertising revenue either generated by live sports, or by news shows – where FOX is strong.

Other categories that have been strong are the automotive industry and pharma. All of the company’s brands and segments delivered either great or at least acceptable quarterly numbers, leading to the solid start to the new fiscal that we’re seeing – even if there was a positive impact from political ad spends during this quarter.

The company generated $1.21 in EPS on a quarterly basis, which is up 9% YoY, with growth really across most areas. FOX also generated upwards of $200M of positive free cash flow, consistent with the seasonality of its WC cycle, where the first part of a fiscal is characterized by a concentration of payments due to sport rights, and the buildup of ad receivables. These numbers are then reversed during the second half of the fiscal.

The company also bought back shares.

From a capital deployment perspective, fiscal year-to-date, we have repurchased a further $300 million via our share buyback program. We remain committed to utilizing our full buyback authorization of $4 billion. Having now cumulatively repurchased $2.9 billion, representing approximately 14% of our total shares outstanding since the launch of the buyback program in 2019.

(Source: FOX 1Q23 earnings call)

The company has no fundamental or capital/balance sheet issues, ending with around $5B available in cash. The company’s new fiscal 2023 is underway, and it should be an exciting year for the company.

And, an exciting year for FOX investors, based on the following valuation trends.

Valuation for FOX

Now, first off, most conservative analysts following the company view FOX as a double-digit undervalued here. Even with targets cut a couple of dollars due to rate changes and macro, and the current average S&P Global PT down to $37.5, out of 19 analysts having the coverage, 10 are at “BUY” or equal recommendations, with an upside of 15.2% based on the current share price of around $32.5.

The lowest any analyst is willing to go for FOX is $27/share.

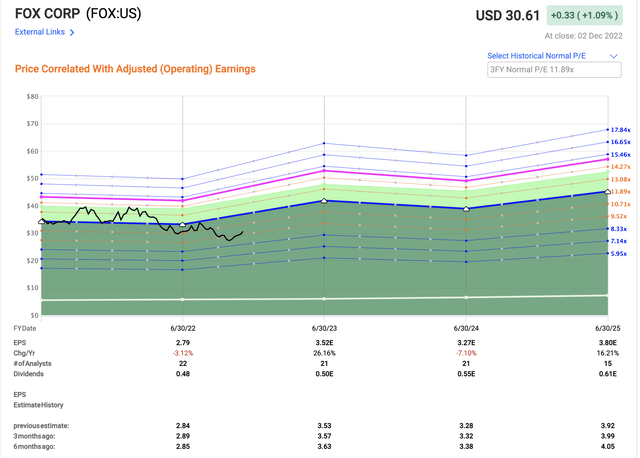

Current valuation trends have the company trading at a sub-10x P/E multiple, around 9.87x normalized, and expecting the year of 2023 to generate a 26.16% increase in adjusted EPS, and an increase in the dividend of around 2 cents.

FOX valuation/Upside (F.A.S.T Graphs)

While not troughing any longer – which would be around 9x P/E -, the company is still being undervalued for the double-digit EPS growth that it is expected to generate until fiscal 2025 ends.

I forecast no less than a 15% annualized RoR minimum for FOX at this point, which translates to a 50%+ total RoR until fiscal 2025 from this BBB rated media giant. It’s well-managed, well-capitalized, and doesn’t suffer from the same degree of “identity” crisis that CNN seems to currently be undergoing. FOX knows its viewership, and the viewership knows FOX.

And it’s working.

And contrary to popular belief, it’s not even necessarily a political thing. Progressives and Liberals watch FOX as well. I believe anyone should consume a myriad or mix of media to make sure to get a nuanced picture of things, if one decides to view media at all – I know plenty of investors that only watch economic news, and skip most of the rest.

Just as before, given a choice between broadcasters, I would go for investing in Fox Corp – without question – especially at this valuation. This is not because the others are not attractive – but FOX is simply better as a business, and better value.

This forms most of the bullish thesis for FOX here – good fundamentals, mixed with a good valuation. The yield isn’t great, nor is the DGR, but Fox might be able to offer stability in a communications market that’s otherwise marked by churn. Fox doesn’t have the same amount or sort of churn, this is clear.

All of this means that I’m maintaining my coverage on Fox Corp with a “BUY” and a price target of $38/share (lowered by $2 for some of the macros), implying a conservative mixed upside at an 11-13x 2025E level. I believe FOX can give you a total RoR of 50% easily, in 2025E.

Thesis

My thesis for Fox Corp is as follows:

- Fox is one of the more appealing broadcasters and television companies in all of the US. It has fundamentals, it has a history, and it seems to have a great future, going forward. Its solid fundamentals and growth prospects make me consider it a “BUY” at a conservative share price.

- The current targeted share price I would consider fair based on targets and estimates is around $38/share.

- I consider Fox Corp a “BUY” here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment