cofotoisme/iStock via Getty Images

Investment Thesis

MercadoLibre, Inc. (NASDAQ:MELI) has one of the most well-recognized and most trusted brands in Latin America, whilst also dominating the ecommerce and fintech marketplaces. In recent quarters, the growth in its MercadoPago payment solution has been eye-watering. Given the huge opportunity ahead of it, I expect MercadoPago to drive this company on to even more success.

MercadoLibre Business Overview

MercadoLibre is a leading ecommerce platform in Latin America, offering a complete portfolio of services to facilities transactions both digitally and offline. The company has developed an ecosystem based on six integrated ecommerce and digital payment services: Mercado Libre Marketplace, MercadoPago Fintech platform, Mercado Envios logistics services, Mercado Libre Ads, Mercado Libre Classifieds service, and the Mercado Shops online storefronts solution.

Perhaps this is slightly lazy of me, but I believe it will help give anyone new to MercadoLibre the best understanding of what they actually do:

- Mercado Libre: the Amazon (AMZN) marketplace of Latin America

- Mercado Pago: the PayPal (PYPL) of Latin America

- Mercado Envios: the Amazon delivery network of Latin America

- Mercado Shops: the Shopify (SHOP) of Latin America

Further to the above, MercadoCredito is a credit solution for professional sellers and MercadoLibre buyers, and the MercadoLibre Ads enables advertisers to promote their brands and products within the MercadoLibre marketplace, which is also something that Amazon does.

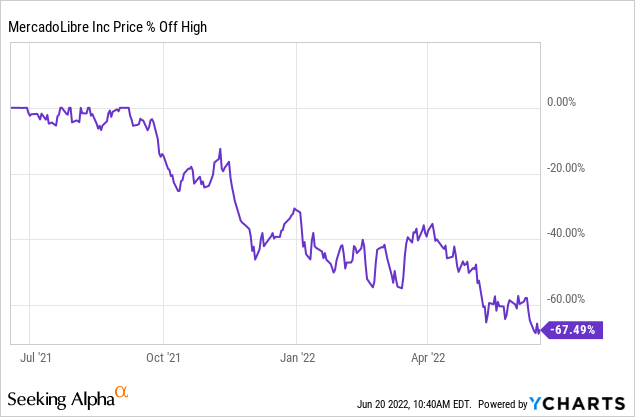

The company itself has seen phenomenal growth over the past decade, and its shareholders have been well rewarded – despite the fact that MercadoLibre’s share price is currently down almost 70% from its 52-week high.

Whilst there are a lot of different sides of the business to wrap your head around with MercadoLibre, in this article I will focus on the one that I believe will drive the most growth over the next decade – MercadoPago.

MercadoPago

Originally created to help facilitate transactions across MercadoLibre’s marketplaces, MercadoPago has evolved into a complete financial ecosystem, whose offerings include:

- Digital payment infrastructure for e-commerce websites in Latin America, whether that is branded or white label

- Peer-to-peer payments through the MercadoPago website or the MercadoPago app.

- The ability to pay in instalments through the MercadoPago platform for both on-and-off-marketplace transactions

- Pre-paid cards and debit cards for users to spend and withdraw their account balances from their Mercado Page wallet

- A money market fund enabling MercadoPago users to invest their balances stored in their accounts

- A cryptocurrency savings wallet in Brazil enabling users to buy, hold, and sell selected cryptocurrencies and stablecoins (hey, nobody’s perfect).

Once a tool used to help bolster sales and user experience on MercadoLibre’s e-commerce website, it’s clear now that MercadoPago has taken on a life of its own – and it has seen incredibly strong momentum.

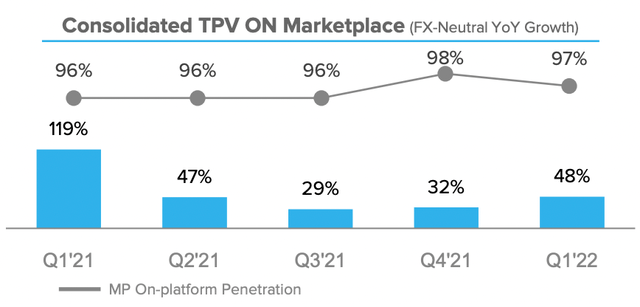

Taking a quick look at MercadoLibre’s Q1’22 investor presentation, it’s obvious that the business is growing at a rapid clip – the on-marketplace TPV (total payment volume related primarily to MercadoLibre’s e-commerce platform) grew at a pretty impressive 48% in Q1’22, coming off a couple of years where comparisons were always going to be difficult.

MercadoLibre Q1’22 Investor Presentation

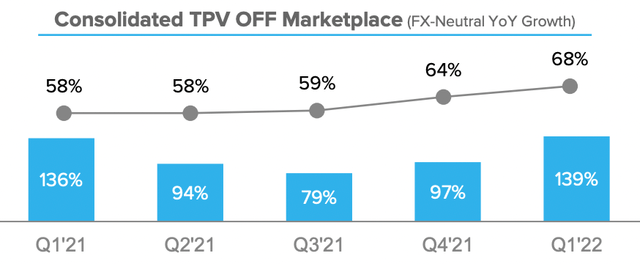

Yet turn your attention to the off-marketplace TPV, referring to any payments that did not relate to MercadoLibre’s e-commerce website. The figures are, quite simply, staggering.

MercadoLibre Q1’22 Investor Presentation

Growth of 139% in Q1’22 came off the back of 136% growth in Q1’21! This is comprised of both the MercadoPago app payments as well as any POS transactions, but the growth is outstanding.

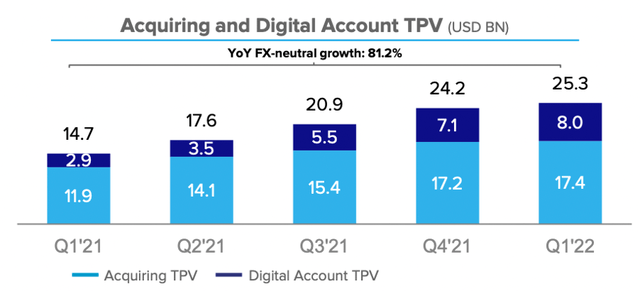

In order to get a clearer picture of the MercadoPago view, take a look at the Digital Account TPV growth. This relates to Wallet payments, P2P transfers between MercadoPago Wallets, and prepaid, debit and credit cards – so, pretty much everything covered by MercadoPago, and the growth here is nothing short of phenomenal.

MercadoLibre Q1’22 Investor Presentation

The total payment volume has grown 180% on an FX neutral basis to reach $8 billion; such staggering growth indicates that MercadoLibre is still at the very early stages of this trend, but it is already the clear leader in the space.

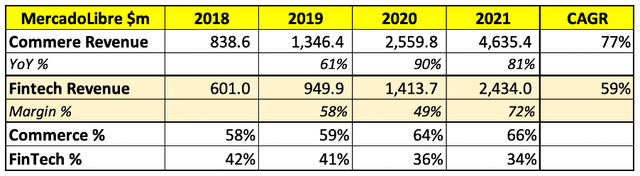

Perhaps the most exciting aspect of this is the fact that the Fintech side of MercadoLibre’s business is already significantly contributing to the total revenues, making up 34% of all revenue in 2021.

The recent acceleration in Fintech revenues has been driven by this growth in off-platform payments, and this is where the huge opportunity lies for MercadoPago.

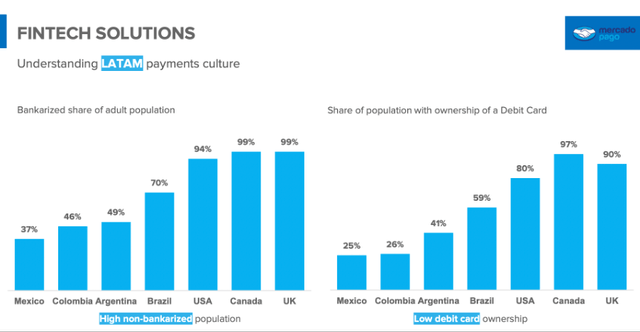

It’s also worth highlighting that Latin America is still substantially non-banked when compared with the likes of the UK, and debit card ownership is low. With such a strong brand, MercadoPago is as the forefront of this substantial opportunity over the upcoming decades.

MercadoLibre Q3’21 Business Overview Presentation

Conclusion

My biggest takeaway from all these figures is that MercadoPago is growing very, very quickly outside of the MercadoLibre marketplace. It is becoming the go-to digital wallet for those living in Latin America, and this is a market opportunity that is both large and growing. As I write this, MercadoLibre has a market capitalization of $32 billion, and I believe that the market is failing to appreciate the potential that this business has. There are plenty of reasons to be optimistic as a shareholder, but the potential off-platform expansion of MercadoPago is reason #1 for me.

There are clear parallels between MercadoPago and PayPal. It’s overly simplistic to compare MercadoLibre to PayPal, but the story is similar – PayPal was primarily used for eBay (EBAY) transactions originally, it had a lot of success, and then went on the be a world leading digital wallet provider (and at the time of writing, it has a market capitalization 3x the size of eBay). I could easily see MercadoPago achieving the same level of success, yet rather than being spun out, I would expect it to continue being an integral part of the ever-evolving MercadoLibre ecosystem.

Be the first to comment