Underwater Fiber Optic Cable On Ocean Floor imaginima/iStock via Getty Images

Cogent Communications Holdings (NASDAQ:CCOI) is a company I’ve been following for a while. In my last article I rated the stock as (speculative) strong buy, and I still believe that CCOI will be able to deliver strong returns in the upcoming years. Nevertheless, given the latest insights after the Q3 2022 results and earnings call, I am now rating the company as a solid buy, with a slightly revised price target that is detailed below.

Cogent’s Business

You can find a more extensive explanation on what CCOI does in my last article, but in brief Cogent owns under-sea cables and other intercontinental fiber optic infrastructure that covers ~20% of all internet traffic over 51 countries in 217 markets.

The company classifies their customers into 2 types: NetCentric (access providers and content providers whose businesses rely primarily on Internet access) and Corporate (small businesses to Fortune 100 companies).

Cogent offers 2 service types: On-Net (internet access is provided through CCOI’s own infrastructure) and Off-Net (the company uses other carriers to cover the “last mile” of the link from the customers’ premises to CCOI’s network).The On-Net service is offered to both NetCentric and Corporate customers and carries a 95-100% margin rate, while the Off-Net service is offered to Corporate customers only and it naturally has a lower ~45% margin rate.

Cogent’s main competitors are Lumen Technologies (LUMN), Verizon (VZ), and AT&T (T).

Q3 2022 Results

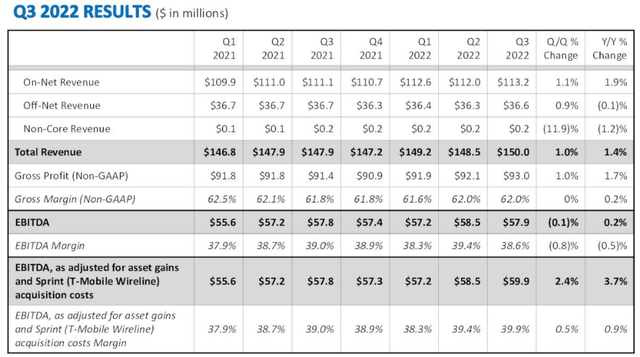

The total Q3 2022 revenue increased sequentially by 1% and by 1.4% on a yearly basis. However, on a constant currency basis, the revenue increased sequentially by 2% and by 4.3% on a yearly basis. Indeed, both the total and the Netcentric revenues continued to be negatively impacted by the strengthening of the US dollar.

Highlights of Q3 2022 results (Cogent Communications Holdings 2022 Q3 Results)

The company’s Corporate business continued to be impacted by the COVID-19 pandemic as well. The business represented 57% of the Q3’s revenue, declining by 4% on a year-over-year basis, but sequentially increasing by 0.4% for the first time since the start of the pandemic. However, if the increased USF rates (subsidies for under-served/sparse areas) were to be discarded, the Corporate revenues were flat on a quarterly basis.

The company’s Netcentric business is still driving Cogent’s growth thanks to a continued increase in video traffic of 2% and 21% on a quarterly and yearly basis, respectively. This resulted in a Netcentric revenue up by 1.9% and 9.6% on a quarterly and yearly basis, respectively. However, on a constant currency basis, these were up by 4.3% and 16.8%.

After adjusting for the extraordinary expenses ($2 million) associated to the recent acquisition of T-Mobile’s Wireline Business, the EBITDA increased sequentially by 2.40%, and its margins increased by 0.5% and 0.9% on a quarterly and yearly basis, respectively.

Long-Term Debt and Future Growth

In Q4 2021 the company entered into an interest swap agreement that modified the debt’s fixed interest rate associated with the company’s $500 million 2026 notes to a variable one. This was naturally executed with the intent to reduce CCOI interest rate, taking advantage of the low variable interest rate market (at that time). This agreement initially saved $1.8 million, but the last payment in November resulted in an expense of $3.4 million, given the increasing interest rate environment.

Overall, the gross and net leverage to EBITDA ratios were 5.31 and 3.93, respectively, representing a quarterly increase of 1.72% and 6.21%. This is well above the company’s target of 2.5 to 3 times on a net basis. However, the board, as stated during the Q3 2022 earnings call, is confident that the debt is at its peak, and it will start slowly declining.

In terms of future growth, the company has a constant currency revenue growth rate target of 10% with EBITDA margin rate increase of ~2% over a multi-year period. However, once the acquisition of the T-Mobile Wireline Business will be completed (by the end of 2023), the revenue is expected to increase by ~90%, with a (decelerated) growth rate between 5% and 7% and an EBITDA margin expansion of ~1% per year.

Cash Flow and Dividend

Cash and cash equivalents in Q3 2022 were of $323.7 million thanks to a record cash flow from operations of $53.6 million, which is a staggering increase of 55.7% on a quarterly basis and 13% on a yearly basis.

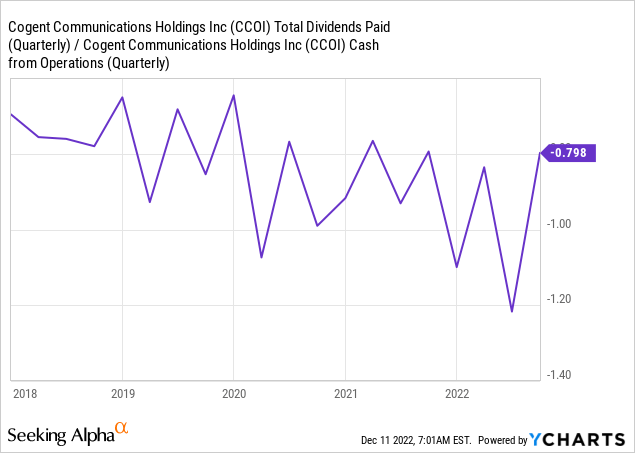

Using Cash Flow from Operations, the dividend payout ratio of the last quarter was ~80%. However, the ratio is on a worsening trend over the last 5 years and more.

While there is plenty of unrestricted cash ($207.4 million) that can be used to cover the dividend or buybacks, the company is now targeting a 4.4% annualized dividend growth rate in order to be in line with the current growth rate in free cash flow generation. Indeed, the last dividend increase in November has been of a modest 1.1%, but it allowed the company to continue the impressive streak of 41 consecutive quarterly increases.

Given the circumstances and reassurances from the board, I do not expect a dividend cut in the upcoming quarters.

Valuation

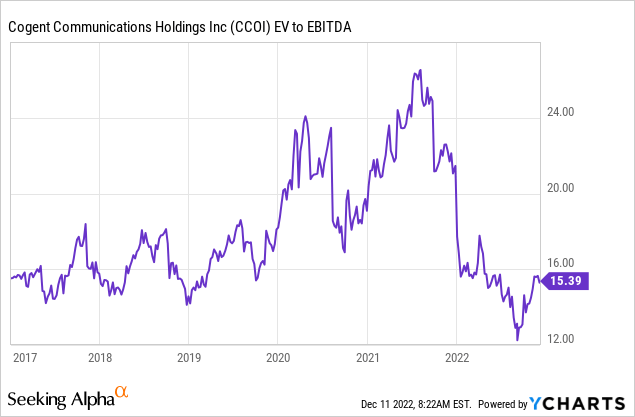

Looking at the Enterprise Value (EV) to EBITDA ratio (since the earnings per share don’t tell much due to depreciation and amortization charges for the installed infrastructure), CCOI still appears to be undervalued.

Indeed, the company averaged a 18.8x EV/EBITDA ratio from 2017 to the end of 2021, which is ~22% higher than the current 15.39x ratio.

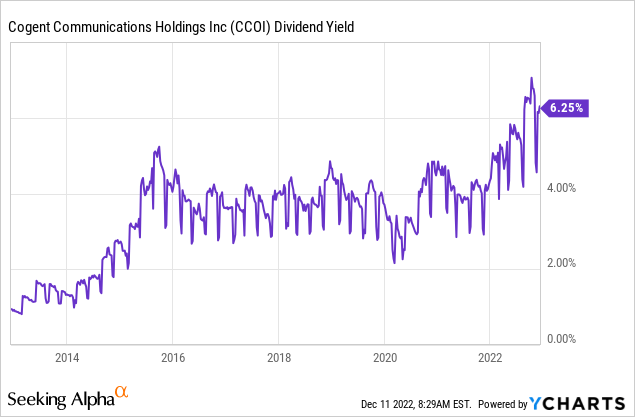

Moreover, the current dividend yield of 6.44% (considering a share price of $56.84) is ~40% higher than the average yield of 3.88% over the past 10 years (note: the graph below incorrectly states a yield of 6.25%).

Given the average/current valuation and dividend yield, the company looks like a strong buy below $60 and a buy below $65. Indeed, if CCOI were to return to its historical average valuation, its share price would be about $70, and this is without even considering the targeted 5-7% annualized growth rate or any dividend payment.

Moreover, the company still has $30.4 million available to buy back shares, which may represent ~1.1% price appreciation.

Including the forecasted growth, dividends and buybacks, using a very simplistic Dividend Discount Model results in a reasonable price target of $75 in 12 months (revised from $80 of my previous quarterly analysis).

Risks

Foreign exchange movements continue to represent a negative impact for the company, and especially for its NetCentric revenue. A significant strengthening of the U.S. dollar against the Euro may heavily impact future revenues.

The COVID-19 pandemic has and will still have a negative impact on the company’s Corporate business, as office activity remains below pre-pandemic levels. As noted by the board during the Q3 2022 earnings call, “leasing activities for commercial office space have begun to rebound”, but the shift in dividend growth rate demonstrates that the recovery of the Corporate business will take longer than expected.

An upcoming recession and higher interest rates may impact CCOI’s financials. However, its business fundamentals seem to be safe, as the board noted that “the NetCentric business appears to be counter-cyclical, as during a recession (and including COVID-19) people tend to stream more videos, increasing the traffic volume, which in turn generates more revenue for CCOI”. Moreover, Cogent’s tenants appear to be more recession proof than the average business.

The average selling price per megabit is declining, which impacts the profit’s margin. However, this should be compensated by a higher demand for larger connections.

The high dividend payout ratio, together with an increasing long-term debt, may make the dividend at risk. Nevertheless, as mentioned above, the board has taken appropriate measures to keep the dividend growing (just at a more moderate rate).

Investor takeaway

While in Q2 2022 CCOI appeared to be a speculative investment, the situation changed after the Q3 2022 earnings call. The management provided some clarifications on upcoming risks, more accurate forecasts on long-term growth, and reassurances on shareholders returns.

Indeed, the consistent dividend increase, together with a shift in growth rate, demonstrates management’s capability and confidence in both keeping shareholders happy and ability to generate increasing returns.

While there are still headwinds ahead, the company and its management looks more prepared to provide both stability and growth in the long-term.

This is why I consider CCOI as a Buy below $65, with a potential return of ~30% in 12 months (given the current share price of $56.84).

Be the first to comment