DNY59

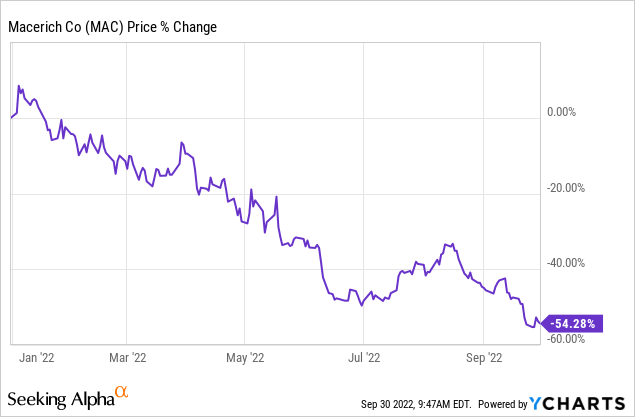

Macerich (NYSE:MAC) is a high-yielding REIT whose share price has gotten pummeled in the current bear market as recession fears soar. In fact, year-to-date it has lost more than half of its equity value:

While it is true that malls have some recession sensitivities and its balance sheet has a decent bit of leverage and lacks an investment grade credit rating, we believe it holds high-quality assets that are destined to not only survive but also thrive over the long-term. As a result, we believe that the market’s sentiment on MAC is not only too bearish but also bordering on the ridiculous. In this article, we will discuss our reasons for thinking this.

Why Mr. Market’s Treatment Of MAC Is Ridiculous

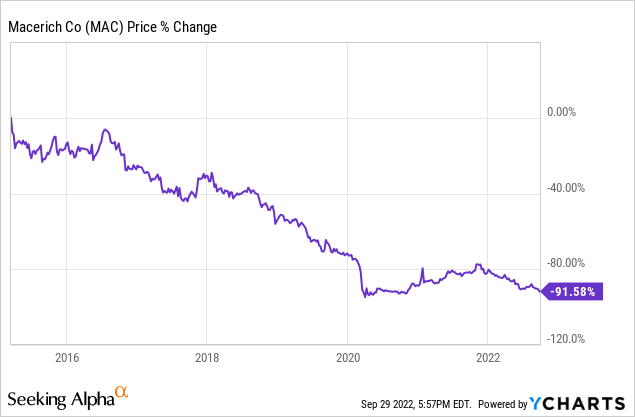

MAC stock has been on a very rough run ever since early 2015 due to two main reasons:

- E-commerce has been rapidly stealing market share from traditional brick-and-mortar retail. As a result, several of the big anchors and other tenants in MAC’s properties have gone bankrupt or at the very least have had to close a lot of stores.

- COVID-19 led to mass lockdowns and closures of brick-and-mortar retail. As a result, the REIT and its tenants suffered considerably in 2020 and even somewhat in 2021. Given that MAC was already fairly heavily leveraged and having to manage capital carefully in order to straighten out its balance sheet while simultaneously paying out a hefty cash dividend and redeveloping its properties, this black swan event forced them to slash the dividend. This sent the share price spiraling even lower.

With interest rates skyrocketing and a meaningful recession seemingly inevitable at this point, Mr. Market is once again panicking and selling off MAC stock with reckless abandon:

While these reasons were and are all valid areas of concern, the market’s valuation is getting to be ridiculous. Let’s look at a few reasons why.

Concerning e-commerce, while it is true that its share of total retail sales has increased by ~130% since MAC’s all-time highs in early 2015, it has actually declined since the COVID-19 peak of 16% in 2020 to 14.3% today. As a result, it appears to be stabilizing at least somewhat. Furthermore, Amazon (AMZN) has already admitted that it overestimated its e-commerce growth trajectory, and over-hired and overbuilt as a result. This means that bricks-and-mortar is hanging tougher as a component of the retail value chain than previously expected.

On top of that, the e-commerce disruption has already gone on in earnest for about a decade now, giving it plenty of time to become fully integrated into consumer behaviors, especially given the COVID-19 catalyst contributions. As a result, most of the weaker retailers have already been cleared out or downsized appropriately. This means that the prospects for further e-commerce fueled downside potential for retail landlords have diminished considerably.

This isn’t just conjectured either, as the numbers bear this out. For example, in 2021 retailer bankruptcies fell to five-year lows.

What’s more, in 2021, the number of retailer bankruptcies slumped to its lowest level in five years – a five-year period, mind you, that was marked by widespread store closures and major retailer bankruptcies. In fact, major retailer bankruptcies fell to lows not seen since 2012. Moreover, for the first time since the “retail apocalypse” fears spread like wildfire in the late 2010s, store openings outnumbered store closures in 2021. As if to add an exclamation point to that metric, there were more than twice as many store openings as store closures announced by U.S. retailers in 2021.

Moreover, Class A malls (which is primarily what MAC owns) are doing quite well in the current retail environment, with an average vacancy rate of just 5.6%, much better than 12.6% for Class C malls and 7.1% for Neighborhood centers and roughly in-line with the 5.3% vacancy rate for Power centers.

What about MAC in particular? Are they getting their slice of this retail recovery pie? Well, if their Q1 earnings call was any indication, they certainly are. Management stated:

We are pleased to report another outstanding quarter, with virtually all our operating metrics trending very positively. Retailer demand is at a level we have not seen since 2015. Tenant sales per square foot… came in at an all-time high of $843 per square foot…

Many retailers have strengthened their balance sheets and are financially in a much better position to expand their store openings than they were pre-COVID. Bankruptcies are at a record low. The combination of all these positive factors have us very optimistic about ’22 and ’23. We continue to expect significant gains in occupancy, net operating income and cash flow through the remainder of this year and into next year.

Clearly, MAC’s properties are thriving at the moment. Will a recession change this? Insiders don’t seem to think so. Not only are their comments indicating substantial bullishness, but they are putting their money where their mouth is too. Other than one small sale of 2,000 shares by the Chief Accounting Officer, insiders have only bought shares this year, including very heavy purchases by the CEO (70,000 shares) and President (162,000 shares), many of which were purchased at prices significantly higher than the current share price.

MAC’s leases are also generally longer-term than the average recession. Given that many of its weakest tenants have already been flushed out of its properties given the e-commerce and COVID-19 headwinds, its remaining tenants are generally much stronger and better positioned to weather a recession. As long as the tenants don’t default, MAC’s cash flows should not suffer too much. Yes, growth will likely slow, and occupancy may even dip a bit in a serious recession, but as long as it does not last for longer than 1-2 years and its tenants can remain solvent, MAC should be able to weather a recession with minimal issues.

With all this said, MAC’s current valuation at a ridiculously cheap 0.36x NAV appears to us to be absolutely absurd. On top of that, the price to AFFO ratio is only 5.59x, less than half its 5-year average of 11.24x and roughly one-third of its 10-year average of 16.63x. As a result, the value potential in MAC shares right now is highly compelling and – given the strength being demonstrated by its portfolio of world-class malls and strong insider buying – there is considerable reason for optimism about its long-term prospects.

Investor Takeaway

We understand Mr. Market’s increased bearishness on REITs, in general, given the one-two punch of increased interest rates (which should push cap rates higher in response) and the increasing inevitability of a meaningful economic downturn (which will likely pressure occupancy and rental rates). However, in the case of MAC, we believe Mr. Market has reached a level of being ridiculous.

MAC is seeing tremendous performance at its properties, providing strong evidence that it not only will be a survivor but also potentially thrive in the future of retail.

Granted, it is not a risk-free investment as it lacks an investment-grade balance sheet, and its tenants could face difficulties during a fierce recession. However, it also has plenty of liquidity to survive, owns highly valuable real estate, and trades at an incredible discount to Wall Street consensus private market value estimates as well as its historical cash flow and dividend yield averages. As a result, we rate it a speculative Strong Buy where investors can follow Warren Buffett’s advice to be greedy when others are fearful.

Be the first to comment