Serenethos

Earnings of Home Bancshares, Inc. (Conway, AR) (NYSE:HOMB), adjusted for merger-related expenses, will likely be flattish this year. The acquisition of Happy Bancshares will likely be the biggest catalyst for the net interest income this year. On the other hand, higher operating expenses and provisioning for loan losses will likely limit earnings growth. Overall, I’m expecting Home Bancshares to report adjusted earnings of $1.93 per share for 2022, almost unchanged from last year. On a GAAP basis, I’m expecting the company to report earnings of $1.55 per share for 2022. Compared to my last report on the company, I’ve barely changed my earnings estimate. The year-end target price suggests a small downside from the current market price. Therefore, I’m maintaining a hold rating on Home Bancshares.

Organic Loan Growth to be Subdued

Home Bancshares completed the acquisition of Happy Bancshares on April 1, 2022, which boosted the loan book size by a hefty 36%, according to details given in a press release. These acquired loans will keep the net interest income for 2022 much higher than 2021. Apart from the acquisition, organic loan growth was also quite strong during the quarter. This growth will slow down in the remainder of the year partly due to high interest rates that will discourage borrowing.

Further, loan payoffs will most probably accelerate in the third and fourth quarters of 2022. As mentioned in the conference call, Home Bancshares has already received $200 million worth of payoffs in July alone. In comparison, the payoffs and pay downs in all of the second quarter were $190 million. The wavelike trend of payoffs is a feature of Home Bancshares’ portfolio.

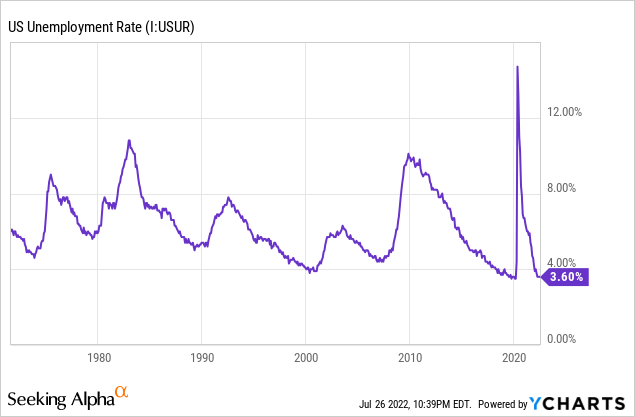

On the other hand, strong labor markets will likely support loan growth. Home Bancshares now operates mostly in Arkansas, Florida, and Texas. It also has some presence in southern Alabama and New York City. The economies of these states are quite varied; therefore, to gauge credit demand, it’s best to consider national averages. As shown below, the unemployment rate for the country is near multi-decade lows.

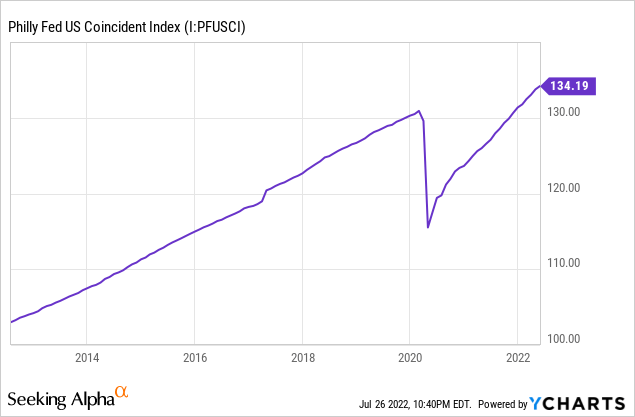

The coincident index also suggests that the current economic activity is quite strong, which bodes well for loan growth in the near term.

Overall, I’m expecting the loan portfolio to grow by only 1% in the second half of 2022, taking full-year loan growth to 43%. In my last report on Home Bancshares, I estimated a lower loan growth rate for 2022. I’ve revised upwards my growth estimate mostly because of the second quarter’s good performance. Meanwhile, deposits and other balance sheet items will likely slightly outpace loan growth in the year ahead. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||

| Financial Position | |||||||

| Net Loans | 10,963 | 10,768 | 10,975 | 9,599 | 13,766 | ||

| Growth of Net Loans | 7.3% | (1.8)% | 1.9% | (12.5)% | 43.4% | ||

| Other Earning Assets | 2,462 | 2,406 | 3,495 | 6,650 | 7,842 | ||

| Deposits | 10,900 | 11,278 | 12,726 | 14,261 | 19,974 | ||

| Borrowings and Sub-Debt | 1,985 | 1,140 | 939 | 912 | 987 | ||

| Common equity | 2,350 | 2,512 | 2,606 | 2,766 | 3,652 | ||

| Book Value Per Share ($) | 13.5 | 15.0 | 15.8 | 16.8 | 17.7 | ||

| Tangible BVPS ($) | 7.7 | 9.0 | 9.7 | 10.8 | 10.6 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Further Margin Expansion Ahead

Home Bancshares’ net interest margin jumped in the second quarter due to the acquisition of Happy Bancshares. The fed funds rate hike also played a part in the margin expansion. Going forward, the margin will likely expand some more due to the rising interest-rate environment. Home Bancshares’ legacy loan portfolio is quite rate-sensitive. The results of the management’s interest-rate sensitivity analysis given in the first quarter’s 10-Q filing showed that a 200-basis points hike in interest rates could boost the net interest income by a hefty 12.3% over twelve months.

Further, the acceleration of payoffs in the second half of 2022 will provide Home Bancshares with a good opportunity to increase the average portfolio yield. Home Bancshares can replace outgoing loans with higher-priced loans.

Overall, I’m expecting the net interest margin to grow by around 10 basis points in the last two quarters of 2022 from 3.64% in the second quarter of the year.

Cost Savings Already Ahead of Target

Home Bancshares reported merger-related expenses of $48.7 million in the second quarter of 2022, as mentioned in the earnings release. These expenses will taper off in the remainder of the year. The second quarter’s cost savings from the acquisition were already greater than the management’s previous guidance. Some of Happy Bancshares’ highly paid personnel left during the quarter, which helped spur the greater-than-expected drop in non-interest expenses, as mentioned in the conference call. Home Bancshares is currently working on contract renegotiations, which should help further reduce salary expenses.

Overall, I’m expecting the efficiency ratio to drop to 43% by the last quarter of 2022 from 45% in the last quarter of 2021. (Efficiency ratio is calculated as non-interest expenses divided by total revenues.)

Provisioning Likely to Return to a Normal Level

Home Bancshares reported a significant surge in net provision expense for the second quarter of 2022 due to the acquisition of Happy Bancshares. At the end of the second quarter, the nonperforming loans stood at 0.44% of total loans, while allowances stood at 2.11% of total loans, as mentioned in the earnings release. As the loan portfolio appears well provided for, I’m not too worried that heightened interest rates could push up defaults. Further, the possibility of a recession doesn’t worry me too much thanks to the provision coverage.

Overall, I’m expecting provisioning to remain at a normal level for the second half of 2022. However, due to the acquisition of Happy Bancshares in the second quarter and the resultant jump in provisioning, the net provision expense for the full year will be much higher than the historical average. I’m expecting Home Bancshares to report a net provision expense of 0.57% of total loans for 2022. In comparison, the net provision expense average 0.29% of total loans in the last five years.

Adjusted Earnings Likely to be Flattish

Excluding the merger-related expenses, earnings for 2022 will likely be flattish this year as the surge in the loan portfolio size and the net interest margin will counter higher provision and operating expenses. Overall, I’m expecting Home Bancshares to report adjusted earnings of $1.93 per share for 2022. On a GAAP basis, I’m expecting the company to report earnings of $1.55 per share for 2022. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||

| Income Statement | |||||||

| Net interest income | 561 | 563 | 583 | 573 | 789 | ||

| Provision for loan losses | 4 | 1 | 112 | (5) | 79 | ||

| Non-interest income | 103 | 100 | 112 | 138 | 156 | ||

| Non-interest expense | 264 | 276 | 304 | 299 | 475 | ||

| Net income – Common Sh. | 300 | 290 | 214 | 319 | 302 | ||

| EPS – Diluted ($) | 1.73 | 1.73 | 1.30 | 1.94 | 1.55 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on Home Bancshares, I estimated earnings of $1.54 per share for 2022. My updated earnings estimate is barely changed because the upward revision in loan and margin estimates cancel out the upward revision in operating and provision expense estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

Current Market Price is Close to the Year-End Target Price

Home Bancshares is offering a dividend yield of 2.9% at the current quarterly dividend rate of $0.165 per share. The earnings and dividend estimates suggest a payout ratio of 43% for 2022, which is higher than the five-year average of 34% but easily sustainable. Therefore, I’m not expecting any change in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Home Bancshares. The stock has traded at an average P/TB ratio of 2.23 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 7.7 | 9.0 | 9.7 | 10.8 | ||

| Average Market Price ($) | 22.3 | 18.7 | 16.4 | 24.5 | ||

| Historical P/TB | 2.89x | 2.07x | 1.69x | 2.27x | 2.23x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $10.6 gives a target price of $23.7 for the end of 2022. This price target implies a 4.4% upside from the July 26 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.03x | 2.13x | 2.23x | 2.33x | 2.43x |

| TBVPS – Dec 2022 ($) | 10.6 | 10.6 | 10.6 | 10.6 | 10.6 |

| Target Price ($) | 21.6 | 22.6 | 23.7 | 24.8 | 25.8 |

| Market Price ($) | 22.7 | 22.7 | 22.7 | 22.7 | 22.7 |

| Upside/(Downside) | (5.0)% | (0.3)% | 4.4% | 9.1% | 13.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.3x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.73 | 1.73 | 1.30 | 1.94 | ||

| Average Market Price ($) | 22.3 | 18.7 | 16.4 | 24.5 | ||

| Historical P/E | 13.0x | 10.8x | 12.6x | 12.6x | 12.3x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.55 gives a target price of $19.0 for the end of 2022. This price target implies a 16.5% downside from the July 26 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.3x | 11.3x | 12.3x | 13.3x | 14.3x |

| EPS – 2022 ($) | 1.55 | 1.55 | 1.55 | 1.55 | 1.55 |

| Target Price ($) | 15.9 | 17.4 | 19.0 | 20.5 | 22.0 |

| Market Price ($) | 22.7 | 22.7 | 22.7 | 22.7 | 22.7 |

| Upside/(Downside) | (30.1)% | (23.3)% | (16.5)% | (9.7)% | (2.9)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $21.3, which implies a 6.1% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 3.1%. Hence, I’m maintaining a hold rating on Home Bancshares.

Be the first to comment