Marcos Elihu Castillo Ramirez/iStock via Getty Images

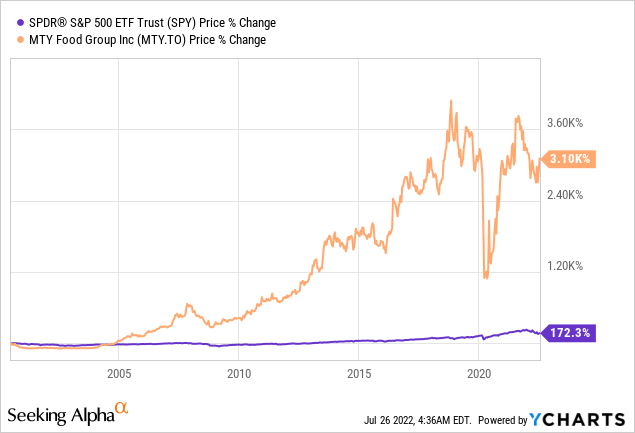

MTY Food (OTCPK:MTYFF) is a Canadian based company that operates in the franchised restaurant segment. Since its IPO, MTY has compounded value annually at a rate of 19.2%, while its revenues have grown exponentially, and their cash flows as well. The company has clearly outperformed all major US Indices in the long run.

This has been achieved through a good acquisition strategy combined with a well diversified portfolio of brands that has provided stability in periods of crisis. I personally believe that MTY can continue its path of growth and profitability due to the tailwinds that the sector currently has and the proven track record of the company with regard to the acquisitions they have historically made.

Business description

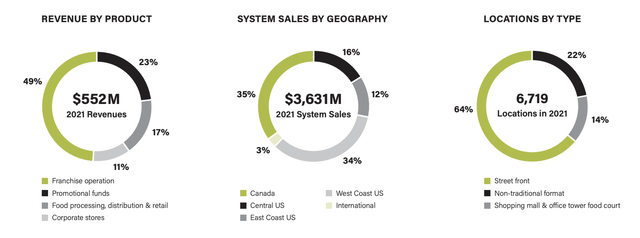

As previously stated, MTY is a franchise company whose brand is present is present in more than 6500 locations. The business model is indeed quite simple: the company provides brand, expertise, menu design and scalability and collects royalty fees which make up the main part of their revenue. The main sources of revenue are:

- Royalties: they make up most of MTY’s revenue. They are collected … and represent around 3-7% of the franchisee’s total revenue. Operating expenses related to franchising include salaries, general and administrative costs associated with existing and new franchisees and expenses in the development of new markets, among many other things. This segment makes 50% of MTY’s revenue.

- Promotional funds: they are made up of royalty income that the company then uses to design and fund promotional and marketing campaigns. They make up 23% of MTY’s revenue.

- Food processing, distribution and retail: the company operates two plants that produce various products that range from ingredients and ready-to-eat food sold to restaurants or other food processing plants to prepared food sold in retail stores. The plants generate most of their revenues selling their products to distributors, retailers and franchisees. They make up 17% of MTY’s revenue and have a lower profit margin than Royalties, due to their more capital intensive nature.

- Corporate stores: MTY also generates revenue from stores operated under their own brand. This is used to provide the franchisees with trust and confidence in the highly diversified portfolio that the company currently has. This segment makes up 11% of their revenue.

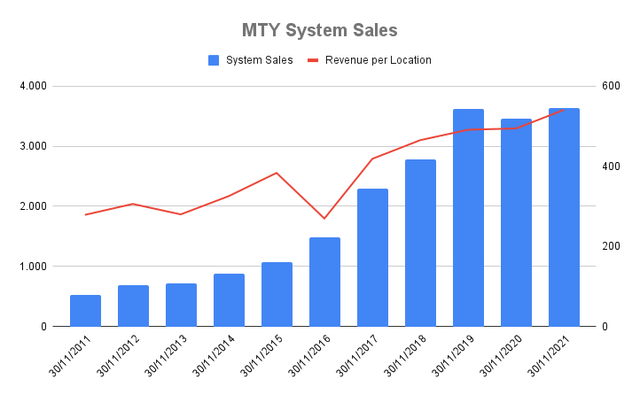

MTY has systems sales of around $3.6 billion, a number which has grown impressively over the last decade. In addition, the revenue per restaurant has also increased, due to the active policy of acquisitions that MTY has been performing.

System Sales and Revenue per Location (Own Models)

Something that I believe to be quite disturbing is that organic growth has been very reduced over the last decade. Even though this has not been a top priority for the company, the current CEO Eric Lefebvre has stressed out that:

The strategy hasn’t changed. The goals haven’t changed. Obviously, how we get there might be slightly different today because a certain — I think, a certain number of metrics and parameters have changed and how we can get there. But it’s really the same it was. We want to achieve good returns on investments for our franchisees. We want to achieve organic growth. We want to have good same-store sales. We want to have positive EBITDA, and we want to have good mergers and acquisitions. So the strategy really hasn’t changed.

Their revenue origin by country is mainly mad up by two countries: the US and Canada, which represents 97% of the system sales they make. A small 3% of sales are made internationally. I personally believe that future international expansion of the company and consolidation in other markets could be a really positive catalyst for the company in the long term.

MTY Food Group is heavily diversified (MTY Food Financial Report)

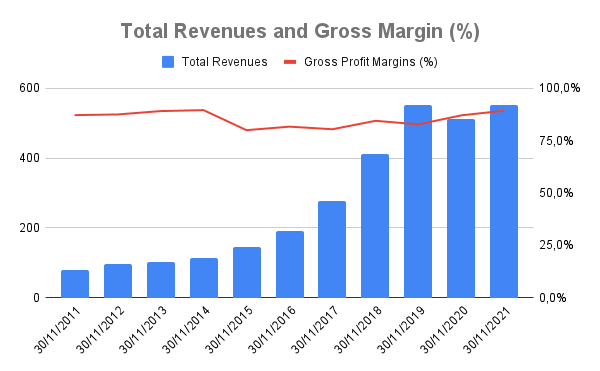

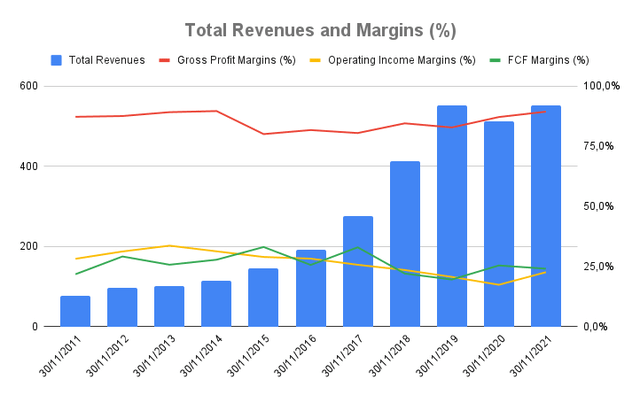

This business model allows MTY to have great gross margins that give them tranquility in a high inflation scenario, like the one we are living right now. The following chart shows the revenues of the company and the gross margins they have. Over the last decade gross margins have always been higher than 80%.

Total Revenues and Gross Margin (%) (Own Models)

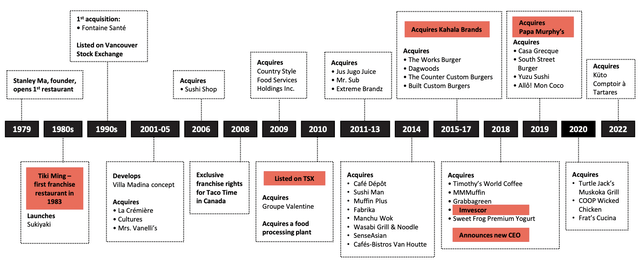

In addition, MTY has also grown significantly due to the active acquisition policy they have been developing since their inception. The company possesses a highly diversified portfolio brand that consists of Asian, Mediterranean, American and Mexican Food, alongside other concepts such as ice cream shops, as well as coffee and tea shops. MTY has a resilient and strong portfolio that will help them navigate through periods of economic crisis such as the one that we are about to enter.

Addressable market

It must be stressed out that MTY is a company which is present in a highly competitive market with low entry barriers. Nevertheless, MTY has prospered in this competitive environment for more than 50 years, and I believe it can continue to do so if the strategy does not change. Almost 97% of MTY sales come from the US and Canada, so I believe it interesting to study the possibilities of expansion all over these markets, as well as other markets such as the international one.

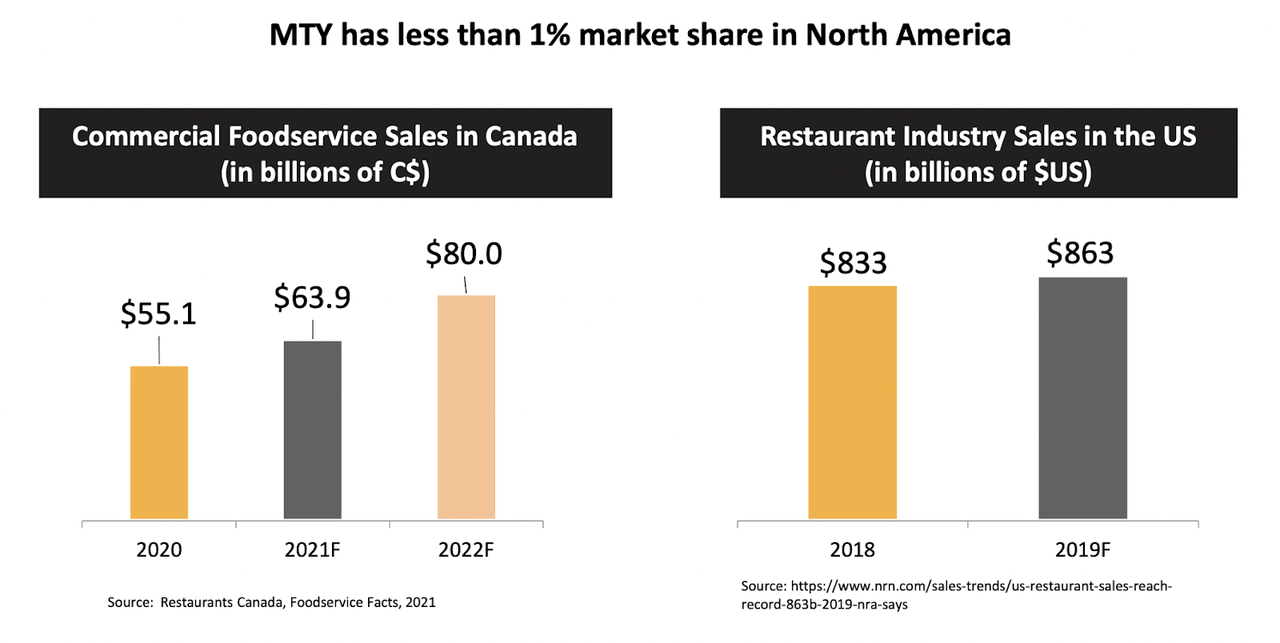

Food Processing Market Size (US & Canada) (MTY Investor Deck)

The current addressable market is almost $1 trillion in the US & Canada, and MTY has a 1% market share in these territories. Because MTY is a company that has a very high inorganic growth component, the company can continue to increase its market share through an acquisition policy executed thanks to good purchase prices.

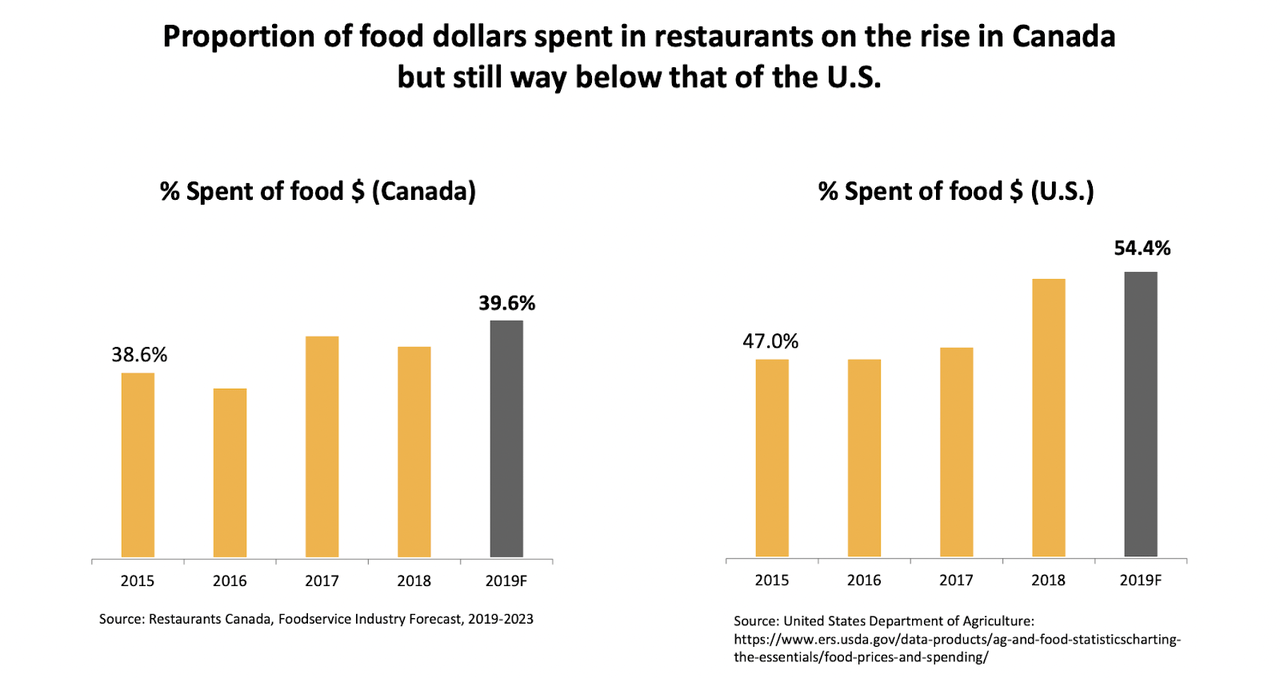

Restaurant Spending from Total Food Budget (%) (MTY’s Investor Presentation)

Another point in favor of the company is that the weight of consumption in restaurants is increasing over the total budget dedicated to food consumption. In Canada and internationally there is still a considerable difference with respect to the US, so this could be a catalyst that would have a positive impact on the future company’s sales.

Capital allocation strategy

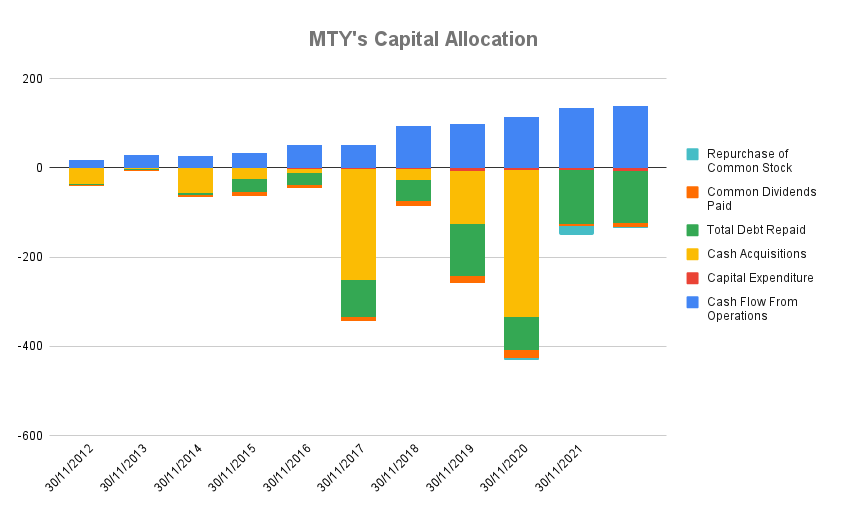

MTY belongs to the select club of Canadian serial acquirers, which includes companies such as Constellation Software (OTCPK:CNSWF) or Enghouse Systems (OTCPK:EGHSF). This set of companies are famous for having grown and created value through strategic acquisitions in the niche markets in which they operate. In MTY’s case, the capital allocation policy over the last decade has been fundamentally focused on generating cash flow to finance acquisitions of new brands and thus generate high returns for shareholders.

MTY’s Capital Allocation Strategy (Own Models)

The above image clearly shows that the main priority of the company has been using the cash flows generated by the franchisees, as well as debt, to fund new acquisitions. Over the last decade, MTY has deployed $848 million in acquisitions, and has generated an extraordinary FCF of more than $120 million, which yields a return on acquisitions of around 14%, which is higher than their cost of capital.

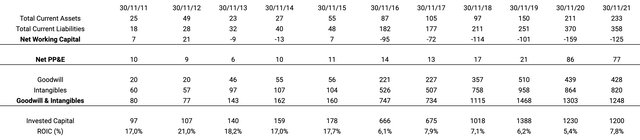

MTY’s Return on Capital (Own Models)

The previous image shows how efficient has been MTY on performing acquisitions. In recent years, MTY has made a number of moves that have spooked investors, and the decline in ROIC is a clear indicator that the company has overpaid for acquisitions. I expect that in the near future, due to valuation compression and tighter monetary policy, the company will be able to continue with its strategy and manage to increase its returns on invested capital.

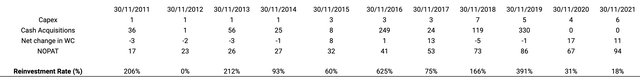

MTY’s Reinvestment Rate (Own Models)

The previous chart shows MTY’s reinvestment rate, defined as all cash reinvested into growing the business divided by the net operating income used to fund those reinvestments. Normally this variable is defined only using net capital expenditures and working capital, but due to MTY’s acquirer nature, I believe it logical to introduce the acquisitions they make into the equation.

MTY’s Timeline of Acquisitions (MTY Investor Presentation)

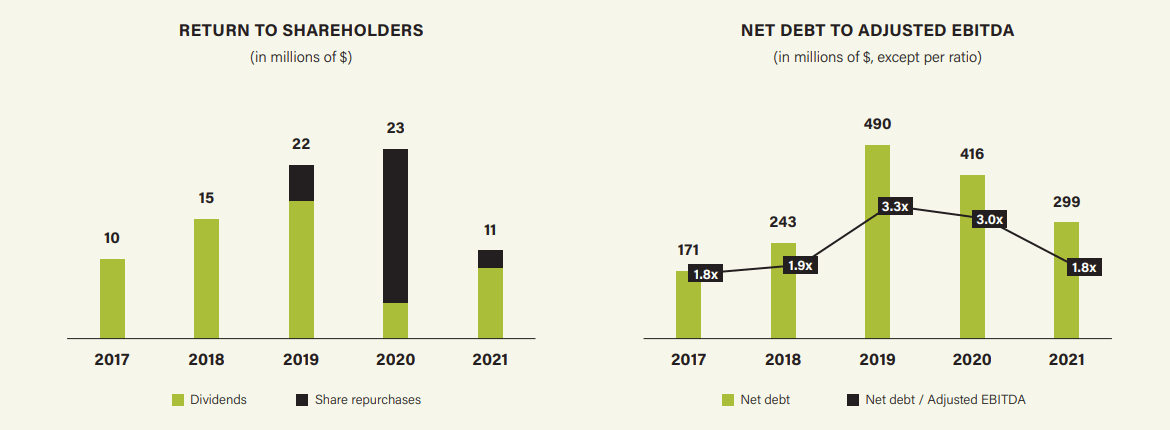

In addition to allocating a large part of the capital to strategic acquisitions that increase the company’s operating cash flow, repaying debt has been another of MTY’s priorities in recent years. The leverage ratio has been reduced from 3x Net Debt/EBITDA to 1.8x Net Debt/EBITDA, which places the company in a strong financial position to increase its debt to be used in new business acquisitions.

MTY’s debt and returns to shareholders (MTY’s Investor Presentation)

Returns to shareholders have also been intense over the last years. The company has aggressively bought back shares and granted generous dividends in a context in which their restaurants were closed and the continuity of the business was not 100% guaranteed. The current dividend yield of MTY is of 1.6%, the highest yield of the decade without considering the hardest months of 2020. This could be a very interesting opportunity for a dividend growth investor, as MTY is expected to grow its distributable funds at rates higher than 15%.

Management team & Insiders

MTY was founded by Stanley Ma, a Canadian entrepreneur who got his start in the restaurant business a long time ago. Stanley had an eye for acquisitions and from scratch started acquiring different brands integrating them into the MTY business model. After many years, Stanley Ma still holds more than 16% of the outstanding shares and, although removed from the day-to-day management of the company, he still remains on the company’s board of directors.

The company’s current CEO, Eric Lefebvre, has been on the management team since before 2010, but has held his position since 2018, when Stanley Ma’s departure became effective. Eric currently has about 11,000 MTY shares, while that his salary is about C$1 million, something I see as a negative, since I personally would like him more if he had a much higher equity in shares than his salary. That would make it incentivized and aligned with the interests of all shareholders.

Financials & Valuation

MTY is known to have had an extraordinary behavior since its IPO more than 30 years ago. Remember: history doesn’t repeat itself, though it rhymes. MTY has increased their revenues at a rate of 21% per annum, while Free Cash Flow has grown at a similar rate, 22% per annum over the last 10 years. This clearly shows that MTY has been able to increase the profitability of the business even at a faster rate than the growth of revenues. The following chart shows the evolution of revenues compared to some profitability margins.

MTY Food Margins (%) (Own Models)

The graph clearly shows a reduction of FCF and operating margins due to MTY increased presence in the food processing segment that, as stated before, has lower margins than the franchise segment. Even though margins have gone down slightly, the strong increase in revenues has produced huge profits for the company. The FCF per share for MTY has grown at annual rates of 19.5%, which shows a high capacity to generate cash flows that can be reinvested in the business.

Valuation

To analyze the present value of MTY I will use a DCF analysis depending on two variables that I consider essential in the understanding of this business: the return on invested capital and the amount of capital deployed to increase their cash from operations. As you could see in previous charts and tables, the return on invested capital has been reducing over the last decade, due to operating difficulties and the increases of goodwill, which may indicate that MTY has been overpaying for the acquisitions made. Nevertheless, I believe that because of the compression of valuation multiples due to rising interest rates, MTY will be able to perform acquisitions at more reasonable prices and increase the free cash flows produced by the business.

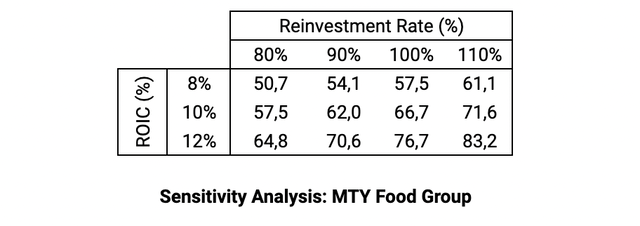

Sensitivity Analysis for MTY’s valuation (Own Models)

The following table shows the result of the valuation of MTY for different estimated values of ROIC and Reinvestment Rate. We have used the formula that states that:

Operating Growth = ROIC x Reinvestment Rate

In a very pessimistic situation, in which ROIC would be of 8% and Reinvestment Rate of 80%, the company’s estimated fair value would be around C$51, which is close to its current price. I believe that the most adequate ROIC for the coming years will be around 10%, while the reinvestment rate can take numbers around 100-110%. Using a terminal growth of 2% and a discount rate of 12% (due to MTY’s debt), this yields an estimated fair value of around C$67-72 per share, which would translate into a discount of 20% with respect to its fair value. I believe MTY is an interesting opportunity for the long term at these current prices.

Risks

It is quite obvious that MTY, alongside the rest of the equity market, is not a risk-free asset, due to its volatile nature. I consider that the following points must be watched if the company is to have a good long-term performance.

- Bad acquisition strategy: there is a clear risk of underperformance and negative growth if MTY is not able to continue incorporating new brands into their portfolio. Another clear risk is that the company overpays for the acquisitions and returns go down, producing a destruction of value that can produce negative returns over the long term.

- Negative same stores growth: historically, one of the main concerns of the market has been the negative organic growth of MTY, something that has been camouflaged with the active policy of acquisitions that the company has developed. I personally believe that the company is focusing on solving this problem by promoting the most profitable franchisees and closing the stores that generate the least income.

Conclusions

MTY is a wonderful business that can continue to outperform the market in the very long term. Even though the business is of great quality and has proven to be extraordinary, there are certain risks such as bad acquisition strategy and negative organic growth that must be watched in the short-medium term. I believe that MTY is currently an interesting opportunity for the long-term investor that surely will produce great returns in the coming years.

Be the first to comment