zavatskiy/iStock Editorial via Getty Images

It has been a busy time at high end carmaker Aston Martin (OTCPK:AMGDF). There has been a leadership change and also a sizeable new investment, further diluting shareholders. I continue to see no compelling investment case here given my risk appetite.

Aston’s Recovery Has Lost Some Steam

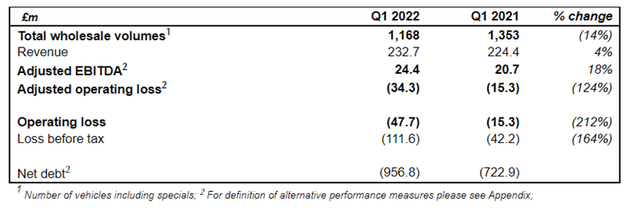

The company’s first quarter results were described as in line with expectations. It affirmed its guidance for the year, of over 6,600 wholesale sales. It did not provide an earnings forecast. Cash interest forecasts moved up by £5m from the original forecast and P&L interest cost by £25m based to exchange rate movements.

However, I find it hard to get excited by the figures. Sales fell and the operating loss more than tripled compared to the same period a year before. Net debt was substantially higher.

The company has a plan to tackle the debt issue, as below. But the underlying sales performance does not seem that compelling to me. Aston Martin wants to get from c. 6,600 wholesale volumes this year to c. 10,000 by 2024/25. Over three years, that requires CAGR growth in wholesale volumes of almost 15%. But total wholesales grew last year by 5%, and in the first quarter of this year they declined by 14%. That looks like a sizeable gap versus expectations to me.

Aston Martin has a New Chief Executive

The company changed management in 2020 and much was made of him. He stepped down in May with immediate effect. That was not a surprise and one has a sense from a distance that egos are not small at the top of the firm.

Lawrence Stroll appears to remain highly engaged as executive chairman, so we’ll see how long the ex-Ferrari chief executive taking the driver’s seat stays in it. I do not see the change as positive for the investment case and if the new chief executive is not as determined as the old one it could be negative in my view.

The Fundraise is Good for Aston Martin but not its Investment Case

The company announced this month a proposed £653m equity raise with the investment fund PIF set to become the company’s second biggest shareholder. The move is planned to help clean up the balance sheet, with an anticipation that it will support positive free cash flow generation from 2024. Mercedes-Benz was also set to participate in this latest fundraise.

This followed a proposal earlier in the month from a consortium of Investindustrial Group Holdings S.à r.l. and Geely International (Hong Kong) Limited for an equity investment of up to £1.3 billion in aggregate. That would have comprised a £203 million firm placing and subsequent £1,105 million underwritten rights issue.

The market reacted positively to the news of the latest fundraise although that positive momentum has since died away. It involves yet more shareholder dilution but Aston Martin has massively diluted shareholders already in under four years as a listed company so sadly the dilution is no surprise and I would also not be surprised to see yet more in future.

I also think the ongoing involvement in the company of Mercedes along with the arrival of Geely sniffing around point to one potential ultimate endgame here. Is Aston Martin a desirable marque that other auto groups would like to include in their portfolio? Clearly the answer is yes and some may now be positioning themselves for that as a possible eventuality. But does that improve the investment case for retail investors? I do not think so. Aston has been and continues to be a money pit. The turnaround in place takes big money, and that has now turned up in the form of Saudi Arabia’s sovereign wealth fund PIF. That further reduces liquidity concerns, can help fix the balance sheet, in turn that will improve the company finances and meanwhile good sales progress could boost revenues. Three to five years from now, Aston could be in good form – but the money to do that so far has come at the expense of shareholder dilution and I expect that to continue. The ultimate recovery here (which increasingly I think could foreshadow a takeover by a large car group) will have little to do with ordinary shareholders and I see little or no reward in it for them worth the risks.

This is a share that in less than four years has lost 96% of its value. I take that as a fair warning of what I see as a money pit. As a retail investor, I would still not touch it myself with a bargepole.

Be the first to comment