Liudmila Chernetska

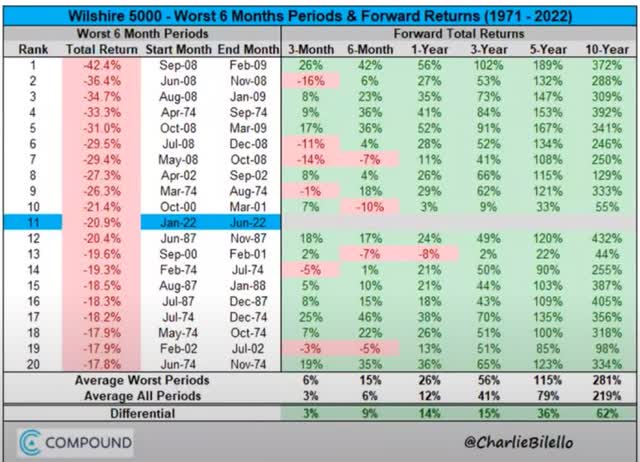

I know that the year’s first six months were scary for many investors. In fact, it was the 11th worst start to the year in history.

But following such market hells comes market heaven with investors buying stocks after a terrible 6 months, historically resulting in 4% to 6% higher annual returns for the next decade.

- an average 281% 10-year total return = 14.3% CAGR = returns on par with the greatest investors in history

That’s almost quadruple your money over the next decade if you can stay calm and look beyond the short-term fear, uncertainty, doubt, or FUD.

But aren’t we headed for a recession soon? Doesn’t that mean stocks could fall a lot lower? Indeed it could. The blue-chip consensus is that stocks are likely to fall another 10% to 41% depending on how bad the recession of 2023 that the bond market, most CEOs and CFOs, and several economists now expect.

But guess what? From an even deeper market hell comes an even better market heaven.

Volatility isn’t risk, it’s the source of future returns. – Joshua Brown, CEO of Ritholtz Wealth Management

Do you know what the historical 10-year forward returns look like from the end of the bear market if stocks fall another 10% to 40%?

- 4.5X to 6X returns within 10 years of the bear market low

- 9X to 24X for individual blue-chips

No one rings a bell at the top or bottom of the market, and that’s why the greatest investors in history didn’t even try to time the market.

Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested. – Peter Lynch

And do you know what makes it easier to look beyond the current economic uncertainty and market turmoil? Steady dividends that grow in all economic conditions.

As the saying goes, “the safest dividend is the one that’s just been raised,” and here are three blue-chip bargains that recently gave investors a raise.

That’s a clear signal that management is confident in the fundamentals of each company and that they can weather the “economic hurricane” that Jamie Dimon is preparing for.

Stanley Black & Decker (SWK): A Dividend King That Is Ready To Weather Any Economic Storm

- Stanley Black & Decker Is A Buffett-Style “Fat Pitch” Dividend Aristocrat Bargain

- a deep dive examination into SWK’s long-term growth thesis, risk profile, valuation, and return potential

SWK hiked its dividend by just 1.3% last week, disappointing some investors. However, management is being prudent ahead of a recession; what matters is that this marks the 55th consecutive year of dividend growth. That’s every year since 1967, which includes:

- eight recessions

- 13 bear markets

- two economic crises

- three major oil shocks

- inflation as high as 15%

- interest rates as high as 20%

- 10-year US Treasury yields as high as 16%

- 36 market corrections

- 110 market pullbacks

In fact, SWK’s history is even more impressive than the dividend growth streak lets on. SWK was founded in 1843 in New Britain, Connecticut. Since then, it’s survived and thrived, during which it has paid uninterrupted dividends for 146 consecutive years through:

- 43 US recessions

- eight depressions

- inflation ranging from -2.5% to 22%

- interest rates ranging from 0.0% to 20%

- 10-year US Treasury yields ranging from 0.5% to 16%

- dozens of bear markets

- 28 stock market corrections (since WWII alone)

- over 100 market pullbacks

SWK will almost certainly outlive us all and represents the ultimate “buy and hold forever and leave to your children” dividend blue-chip.

Reasons To Potentially Buy SWK Today

- 86% quality low-risk 12/13 Super SWAN (Sleep Well At Night) dividend king

- 89% dividend safety score

- 55-year dividend growth streak

- 2.8% very safe yield

- 0.5% average recession dividend cut risk

- 1.6% severe recession dividend cut risk

- 37% historically undervalued (potential very strong buy)

- Fair Value: $182.49

- 11.9X forward earnings to 16.5 to 18.5X historically

- 10.9X cash-adjusted earnings

- A stable outlook credit rating = 0.66% 30-year bankruptcy risk

- 71st industry percentile risk management consensus = good

- 6% to 12% CAGR margin-of-error growth consensus range

- 10% to 12% management growth guidance

- 13.3% CAGR median growth consensus

- 5-year consensus total return potential: 19% to 24% CAGR

- base-case 5-year consensus return potential: 20% CAGR (3X more than the S&P consensus)

- consensus 12-month total return forecast: 25% (factoring in recession)

- Fundamentally Justified 12-Month Returns: 61% CAGR

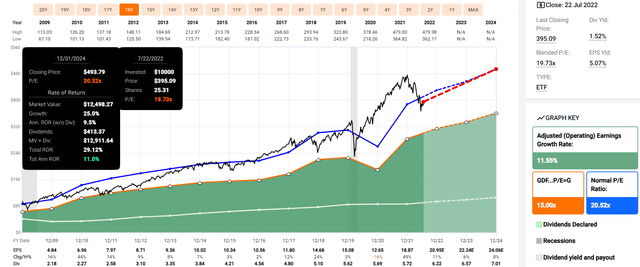

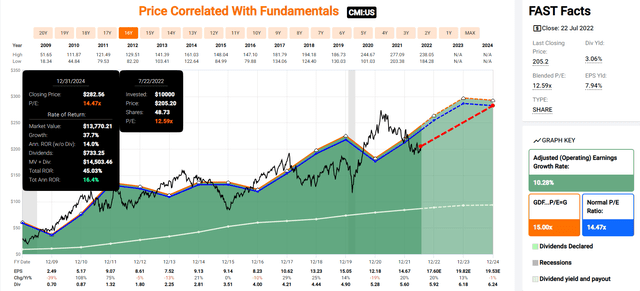

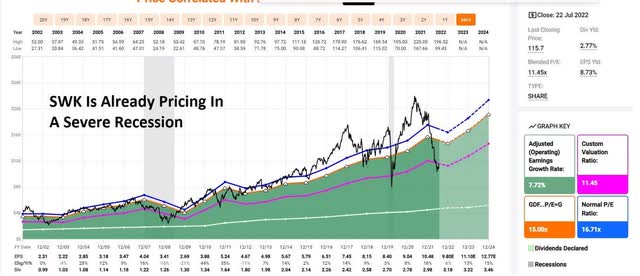

Stanley Black & Decker 2024 Consensus Return Potential

(Source: FAST Graphs, FactSet)

If SWK grows as expected and returns to historical market-determined fair value, then it could double in the next 2.5 years.

- 34% annual return potential

- more than 3X more than the S&P 500 consensus

- Buffett-like return potential from a dividend king bargain hiding in plain sight

Now compare that to the consensus for the S&P 500.

S&P 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Analysts expect about 29% total returns or 11% annual returns from the S&P 500 over the next 2.5 years.

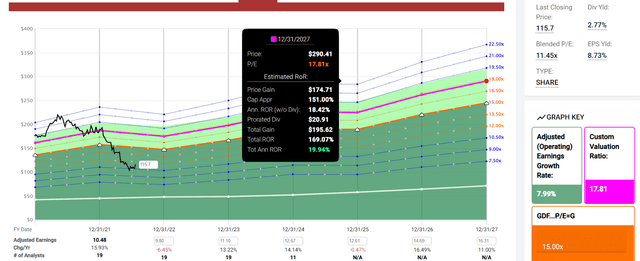

Stanley Black & Decker 2027 Consensus Return Potential

(Source: FAST Graphs, FactSet)

If SWK grows as expected and returns to historical market-determined fair value, then by 2027, it could deliver 169% returns or 20% per year.

- literally, Buffett-like returns from a dividend king bargain hiding in plain sight

S&P 500 2027 Consensus Total Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) | Inflation And Risk-Adjusted Expected Returns | Expected Market Return Vs. Historical Inflation-Adjusted Return |

Years To Double |

| 2027 | 53.77% | 8.99% | 6.74% | 4.63% | 68.09% | 15.55 |

(Source: Dividend Kings Market Valuation And Total Return Tool)

Analysts expect 54% total returns or 9.0% CAGR from the market over the next five years.

SWK could deliver over 3X this amount.

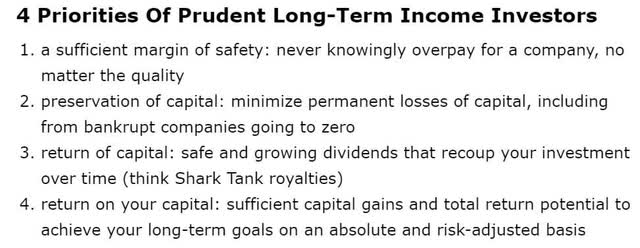

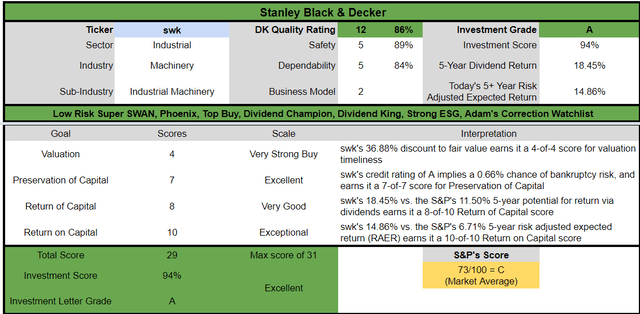

Stanley Black & Decker Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

For anyone comfortable with its risk profile, SWK is one of the most reasonable and prudent fast-growing dividend kings you can buy today.

- 36% better valuation than the S&P

- almost 2X the consensus dividend income over the next five years

- almost 40% higher long-term consensus return guidance

- more than 2X the risk-adjusted expected returns

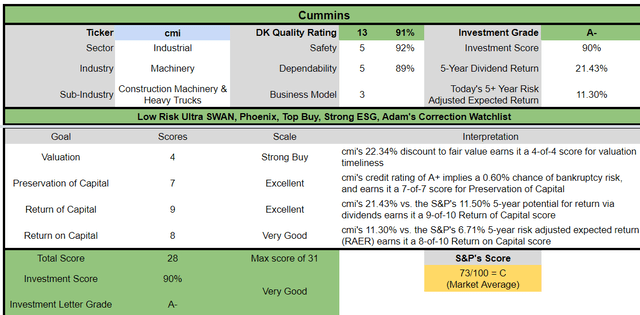

Cummins (CMI): Management Has An Eye On The Green Energy Future

- 3 Reasons Cummins Is A Classic Buffett-Style ‘Fat Pitch’ Blue-Chip Bargain

- a deep dive examination into CMI’s long-term growth thesis, risk profile, valuation, and return potential

Cummins isn’t a dividend aristocrat… yet. But it just hiked its dividend for the 17th consecutive year by a very solid 8.3%.

- its management isn’t worried about Jamie Dimon’s “economic hurricane”

Why?

- A+ stable credit rating from S&P = 0.6% 30-year bankruptcy risk

- A2 (A stable credit rating equivalent) from Moody’s = 0.66% long-term default risk

- bond market (via credit default swaps) pricing in 2.73% 30-year default risk (A- credit rating)

Because CMI has a rock-solid balance sheet.

- 1.4X debt/EBITDA vs. 3.0 or less safe according to rating agencies

- 1.0 consensus 2023 debt/EBITDA

- 21.8X interest coverage ratio Vs. 8+ safe according to rating agencies

CMI is well on its way to making the energy transition, and do you know how I know?

- is it that management has a plan to tap into a $3.5 trillion hydrogen market by 2030? That’s part of it.

- is it that analysts think it will grow at 11.6% over the coming decades, similar to the rate it’s grown at for the last 20 years? That’s also part of it.

- is it that S&P and Moody’s estimate a 1 in 159 chance that CMI goes bankrupt in the next 30 years?

These are all reasons why I trust CMI, and so can you. But the biggest reason why I’m not worried about CMI failing to transition to a green energy economy is this:

- bond investors are willing to lend to it for 76 years at 5.56% interest rates

- CMI’s longest duration bond matures in March 2098

- the “smart money” on Wall Street literally thinks CMI will outlive us all

Reasons To Potentially Buy CMI Today

- 91% quality low-risk 13/13 Ultra SWAN (Sleep Well At Night) industrial

- 92% dividend safety score

- 17-year dividend growth streak

- 3.0% very safe yield

- 0.5% average recession dividend cut risk

- 1.4% severe recession dividend cut risk

- 22% historically undervalued (potential strong buy)

- Fair Value: $266.68

- 11.8X forward earnings to 14 to 15.0X historically

- 7.9X cash-adjusted earnings = anti-bubble blue-chip pricing in -1.2% growth

- A+ stable outlook credit rating = 0.6% 30-year bankruptcy risk

- 82nd industry percentile risk management consensus = Very Good

- 7% to 16% CAGR margin-of-error growth consensus range

- 11.6% CAGR median growth consensus

- 5-year consensus total return potential: 13% to 18% CAGR

- base-case 5-year consensus return potential: 15% CAGR (2.3X more than the S&P consensus)

- consensus 12-month total return forecast: 15% (including recession)

- Fundamentally Justified 12-Month Returns: 32% CAGR

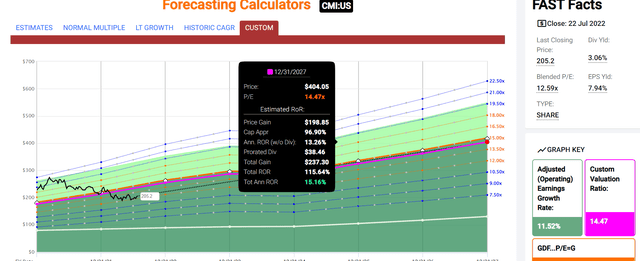

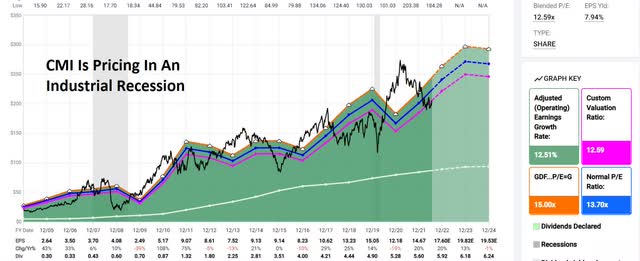

Cummins 2024 Consensus Return Potential

If CMI grows as expected and returns to historical market-determined fair value, then it could deliver 16% annual returns through the end of 2024.

- 50% more than the S&P 500 consensus

Cummins 2027 Consensus Return Potential

If CMI grows as expected through 2027 and returns to mid-range historical fair value, then investors could see 116% total returns or 15% annually.

- 2.3X more than the S&P 500

- what Cathie Wood at ARKK is trying to achieve long-term

- returns on par with the greatest investors in history

- from one of the world’s highest quality and safest companies

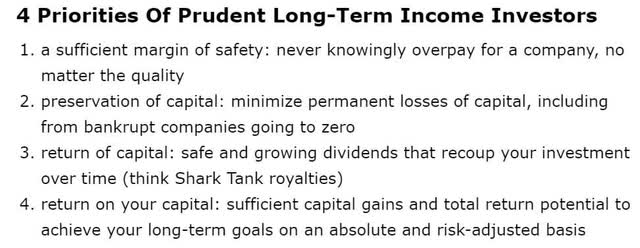

Cummins Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

For anyone comfortable with its risk profile, CMI is one of the most reasonable and prudent fast-growing industrials you can buy today.

- 21% better valuation than the S&P

- 2X the consensus dividend income over the next five years

- 40% higher long-term consensus return potential (and historical returns)

- almost 2X the risk-adjusted expected returns

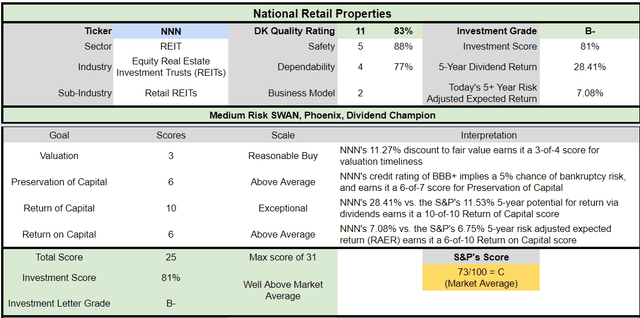

National Retail Properties (NNN): A Dividend Aristocrat Ready To Help You Sleep Well At Night Through Any Recession

- National Retail Properties: Durable Portfolio And Dividend Growth

- an introduction to NNN’s investment thesis

NNN just raised its dividend 4% to mark its 33rd consecutive year of annual dividend growth. That’s every year since 1989, including:

- four recessions

- two economic crises

- a financial crisis (just seven REITs avoided cutting their dividends)

- three major oil spikes

- inflation as high as 9.1%

- interest rates as high as 9.4%

30% of its top tenants are recession-resistant. What does that mean for cash flow stability in recessions?

- -6% in the Pandemic

- -1% during the 2001 recession

NNN has a strong BBB+ stable credit rating from both S&P and Moody’s.

Its 5.7 debt/EBITDA is safe based on the 6.0 or less guideline rating agencies, and next year, analysts expect 5.5X debt/EBITDA.

- 3.4 interest coverage vs. 2+ safe according to rating agencies

Reasons To Potentially Buy NNN Today

- 83% quality medium-risk 11/13 SWAN (Sleep Well At Night) triple-net lease REIT

- 88% dividend safety score

- 33-year dividend growth streak – dividend champion

- 4.8% very safe yield

- 0.5% average recession dividend cut risk

- 1.65% severe recession dividend cut risk

- 11% historically undervalued (potential strong buy)

- Fair Value: $52.08

- 14.9X forward FFO to 17.5 to 18.0X historically

- BBB+ stable outlook credit rating = 5% 30-year bankruptcy risk

- 55th industry percentile risk management consensus = average

- 3% to 5% CAGR margin-of-error growth consensus range

- 8% to 9% management growth guidance

- 4.0% CAGR median growth consensus

- 5-year consensus total return potential: 10% to 12% CAGR

- base-case 5-year consensus return potential: 11% CAGR (about 20% more than the S&P 500)

- consensus 12-month total return forecast: 9%

- Fundamentally Justified 12-Month Returns: 18% CAGR

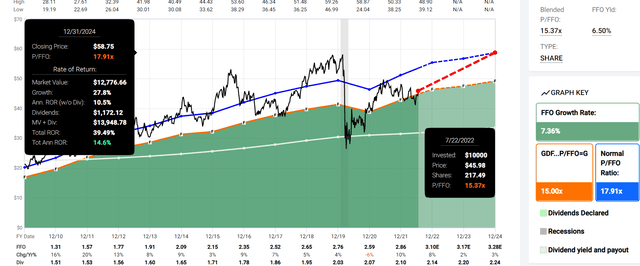

National Retail Properties 2024 Consensus Return Potential

If NNN grows as expected and returns to historical market-determined fair value, then it could deliver 15% annual returns through the end of 2024.

- 33% more than the S&P 500 consensus

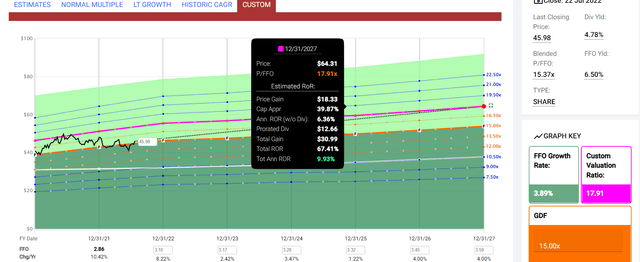

National Retail Properties 2027 Consensus Return Potential

If NNN grows as expected through 2027 and returns to mid-range historical fair value, then investors could see 67% total returns or 10% annually.

- 20% more than the S&P 500

- vs. 8.9% that analysts expect over the long-term from this modestly growing defensive REIT

National Retail Properties Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

For anyone comfortable with its risk profile, NNN is one of the most reasonable and prudent high-yield aristocrats you can buy today.

- 10% better valuation than the S&P

- almost 3X the consensus dividend income over the next five years

- similar risk-adjusted expected returns over the next five years

- but with a much safer yield that’s nearly 3X higher than the market’s

Bottom Line: Dividend Growth Blue-Chips Can Help You Get Through Market Hell So You Can Profit From Market Heaven

Wouldn’t it be smarter to wait for a recession when stocks are likely to fall even lower and then buy these dividend blue-chips?

Don’t try to buy at the bottom and sell at the top. This can’t be done – except by liars.” – Bernard Baruch

Market timing works great in theory and nowhere else. Consider these examples.

- Altria (MO) bottomed in November 2008 at a very safe 15% yield (and 20% long-term return potential) – the S&P bottomed 5 months later

- Amazon (AMZN) bottomed in January 2002, 10 months before the S&P did

- and it had nearly doubled by the time the market stopped falling

The market doesn’t bottom because bad news stops coming; it bottoms when the bad news is priced in. And individual stocks bottom on their own schedules, which no one can know ahead of time.

SWK is already priced as if were in a severe recession.

CMI is priced as if we were in an industrial recession and could already be priced for a mild recession, just like the one Bank of America expects to be starting soon.

- -0.2% GDP growth in 2023

- the mildest in history

- milder than even 2001’s -0.4% GDP growth

I can’t tell you what is or isn’t priced into the market as far as inflation, interest rate, or growth expectations are concerned; no one can.

All I can tell you is that after a historically hellish start to the year, stocks are historically likely to stage a decade-long bull market that could triple your money over a decade.

Individual blue-chips like CMI and SWK are likely to do even better, thanks to stronger growth rates and more attractive valuations.

Meanwhile, NNN, a slow-growing defensive REIT, isn’t likely to make you rich, but it offers a very safe and attractive yield nearly 3X that of the market.

Together these are the kinds of dividend hiking blue-chips that you can rely on in all economic conditions, not just in 2023, but for decades to come.

My goal isn’t to score you a quick 30%, 40%, or 50% gain, though SWK and CMI are capable of that in the next year.

My goal is to help you retire in safety and splendor, awash in steadily growing dividends while you sleep well at night in all market conditions.

Don’t fixate on whether the market bottoms in 10%, 20%, or has already bottomed.

Don’t risk missing out on amazing blue-chip bargains that have the potential to deliver 9X to 24X returns in the next decade, trying to score an additional 11% to 25% upside in the short-term.

Or, to put it another way, don’t try to double your money quickly, at the cost of potentially missing out on low-risk/high probability dividend opportunities to grow your wealth 20X to 50X over the next 30 years.

You don’t have to be a stock market genius to retire rich, and stay rich in retirement. You just have to focus on the fundamentals that drive 97% of long-term returns.

- the right asset allocation for your goals

- the right companies in your portfolio

- decent to strong long-term growth prospects

- attractive yield for your needs

- reasonable to attractive valuations

And above all, remember that a long time horizon is crucial to achieving your long-term financial goals.

If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. – Warren Buffett

The biggest reason investors mess up with investing isn’t that they own the wrong companies; they are impatient and think that what happens over the next year or two matters.

When you own the world’s best dividend growth blue-chips, who give you a raise every year, through good times and bad, it’s a lot easier to focus on the truly long-term.

And that, my friends, is the true secret to retiring in safety and splendor. Of letting the world’s best blue-chips work hard for you so that one day you don’t have to.

Fortunes are made by buying right and holding on. – Tom Phelps

Be the first to comment