Dimas Ardian/Getty Images News

Introduction & Purpose

The Gap, Inc. (NYSE:GPS) reported earnings that underwhelmed analysts’ expectations. The company’s revenue declined materially from the prior year and GPS pulled its guidance for the remainder of the year. My recent article on GPS showcased a bear view, and this quarter reinforces my initial opinion. With the macro environment likely to remain challenged as rates rise, and an on-going search for a new CEO, GPS isn’t well-positioned to outperform on the stock market. I reiterate my “Hold” rating with an $11.50 USD price target over an 18-month timeline.

Q2 Review

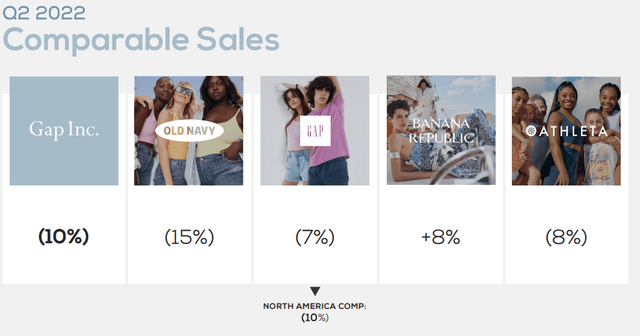

GPS announced quarterly earnings on August 25, 2022 that investors somehow cheered, with a sharp upward move after hours, before giving some gains back in the pre-market the following day. Total revenue fell sharply to $3.86Bn, while comparable sales dropped 10% year over year. The company reported a 34.5% gross margin, but noted that excluding a one-time impairment charge, it was 36%, down ~7% from the prior year period. The highlighted impairment charge was related to “unproductive inventory,” which was concerning, given overall inventory still jumped 37% this quarter. Given the track record of the company, I believe another inventory impairment will come in the near future. Online sales dipped 6%, and was a third of the sales mix, which was lower than Q1, where online sales were 39% of the mix. As other peers expand their online sales given the larger reach and lower overhead, investors can only hope this trend remains short-lived. GPS reported a net loss of $49MM, but highlighted that excluding the inventory and Old Navy Mexico impairments, they earned $30MM in the quarter.

GPS ended the quarter with $708MM in cash, but burned $208MM from operations. Inventory of $3.1Bn, up 37%, is concerning given the amount of discounting the company has engaged in. CAPEX, through two quarters, was $406MM, as the company retrofits its store fleet by shutting down 50 Gap and Banana Republic stores, and focusing their growth on Athleta and online Banana Republic channels. The company’s flagship brand, Old Navy, saw sales plunge 13% amid slowing demand from low-income consumers. GPS also pulled guidance for the remainder of the year, citing a difficult environment to predict. That said, they emphasized that they remain cautiously optimistic.

Katrina O’Connell, CFO, led the Q2 earnings call and highlighted the key differences in brand performance. Athleta, the company’s high growth women’s yoga & athletic brand, only rose 1% in the quarter. Katrina noted that GPS missed the mark on the summer inventory assortment, but held out hope that it would right-size next quarter.

While inflationary costs and higher air freight weighed on margins by about 200 basis points, promotional activities to sell discounted product were also weighted similarly, with the inventory impairment taking up the balance. These results show that operationally, GPS is still struggling to provide consumers with the apparel they need across all four brands. The company’s SG&A remained about the same, which was one positive to emerge from the conference call. In the Q&A session, Katrina noted that the internal full year forecast for SG&A is $5.6Bn, not too far off initial projections. Executives wrapped up the call with a share repurchase update and a note that their planned UK sale of a subsidiary should bring in $85MM next quarter; a one-time profit bump.

The company was coy when asked about the CEO search. Former CEO, Sonya Segel, abruptly departed in July and Bobby Martin, Chairman of GPS, was appointed interim head in the meantime. GPS also introduced Haio Barbeito, a former Walmart Canada executive, the new leader of Old Navy. Dana Telsey from Telsey Advisory Group pressed Bobby on a timeline to announce the next CEO, but Bobby remained vague, stating that GPS is an attractive company to lead and that a decision would come in due course. With so many moving parts regarding leadership, and such large structural operational deficiency given the high retail overhead and low margin brands, this turnaround, if it even occurs, will take a while.

Model Says Be Patient

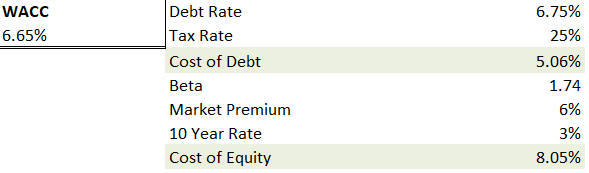

I don’t foresee positive momentum for GPS, though investors saw something, as the stock price jumped to almost $11 after hours. I think it’ll come down in the near term, but the market can remain irrational longer than any one investor can remain rational. The company’s cash position is likely to somewhat stabilize, as management didn’t hint at another stock buy-back on the conference call. The model forecasts a WACC of ~6.7%, up 50 basis points from my previous analysis, with minor updates to the debt rate, the market premium and the 10-year paper. Given their weak Q1 performance, I anticipate the cost of debt rising to 6.75% should they attempt to add leverage in this environment.

Author WACC

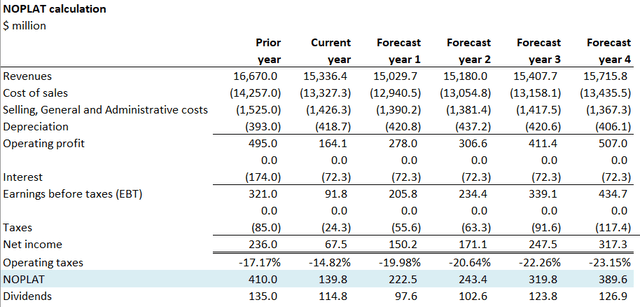

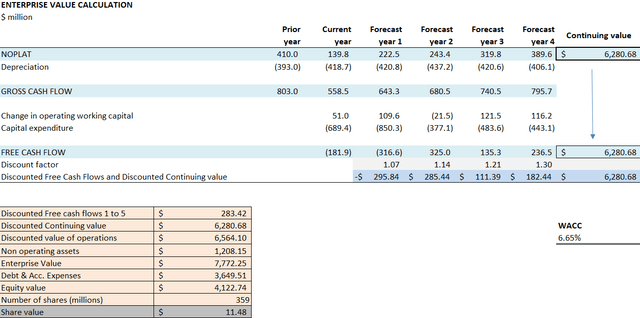

I forecast the continuing value above $6.2B, given a 8% revenue decrease this year and blended revenue growth of ~1.25% for three years after that. I reduced my gross margin given the updated guidance from management. I hold other cost ratios mostly equal as a percentage of revenue from the previous forecast. As the retail space retrofit encounters some growing pains, I believe CAPEX spend will rise to $689MM vs. the expected $650MM. As the margin dips, a $11.50 share price (see below) can be supported with fundamentals. I project a CY2023 EV/EBITDA model forecast of 11.1. In today’s price target, I estimate 359MM shares outstanding given the share buyback in Q2 – though I don’t believe that will materially continue given operational struggles. I also anticipate a dividend cut next year, as the current payout ratio given earnings is too high to remain sustainable.

Author Forecast Author EV Calculation

Conclusion

As GPS flounders with revenue declines and operating efficiency challenges, the company will remain an underperformer. GPS has too many moving parts regarding leadership and, more importantly, the flagship brands are falling out of favor with consumers. Investors are in limbo as they await the next CEO to be announced. The company reported sluggish earnings in my view and also removed full year guidance. I project an $11.50 price target with a “Hold” rating.

Be the first to comment