J Studios

Safety Insurance Group, Inc. (NASDAQ:SAFT) is a Boston-based company that provides automobile, home, and private passenger insurance in the US. It covers physical injuries and property damages of insured vehicles and houses. It employs independent agents to sell its insurance products. It has a market capitalization of $1.37 billion, making it a part of the S&P 600.

It remains a popular insurance provider in Massachusetts. But, it faces more challenges that hammer its core operations. Its growth has gone into a lull with lower revenues and margins. Even so, its strong positioning allows it to endure the blow of macroeconomic pressures. It also has an adequate financial capacity to cover its borrowings and dividends. Meanwhile, investors see a solid stock price rebound but must watch out for potential overvaluation.

Company Performance

Safety Insurance Group, Inc. was not an exemption from the pandemic disruptions in 2020. It could be attributed to the restrictions that limited business transactions. It was a horrible year for the auto industry. It was the most sluggish year since the Global Financial Crisis. So, it was not a surprise to see its spillovers on the auto insurance industry. But, its strong rebound in the latter part came as a surprise and extended to auto insurance providers. SAFT had the same trend, allowing it to bounce back to pre-pandemic levels.

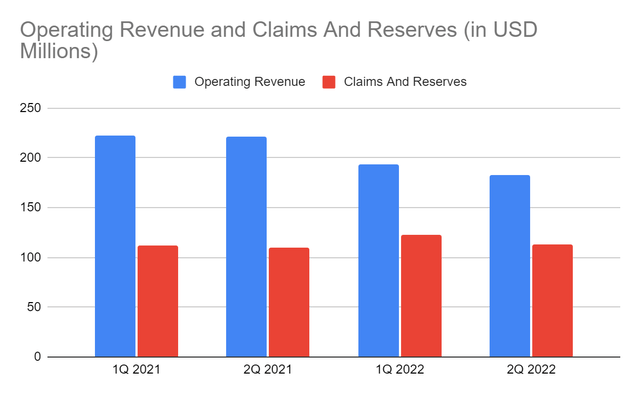

However, 2022 is another challenging year for Safety Insurance Group, Inc. As the economy bounces back and reopens, the demand across industries skyrockets. It leads to increased market activity where demand appears to exceed the supply. It is more evident in the house and auto industries, leading to high-flying prices. Although the demand is still high, sales are starting to cool down. But, inflation has an impact on the affordability of its products. Inflationary pressures pose more headwinds as its growth slows down. That is why the demand for premiums and renewal counts are lower than in the comparative quarter. Premiums earned amount to $188 million, a 4% year-over-year decrease. It is due to the decrease in policy counts both from lower purchases and renewals. It is more evident in the auto insurance segment. Amidst the slow-moving core operations, auto insurance in Massachusetts, including SAFT is raising rates to offset the lower demand.

Inflationary pressures are also downgrading its investment portfolio. In fact, the headwinds are more evident in its investment securities. These are mortgage and equity-based securities, but the impact is more visible in the latter. In general, these securities become less appealing during interest rate hikes. It decreases their fair value, leading to lower yields. The same goes for SAFT as its investment securities amount to $1.42 billion vs $1.57 billion in 2Q 2021. So, the unrealized valuation of its equity securities turns out to be a loss of -$28.9 billion vs $8.7 billion. The operating revenue of the company amounts to $182 million vs $220 million.

Operating Revenue and Claims and Reserves (MarketWatch)

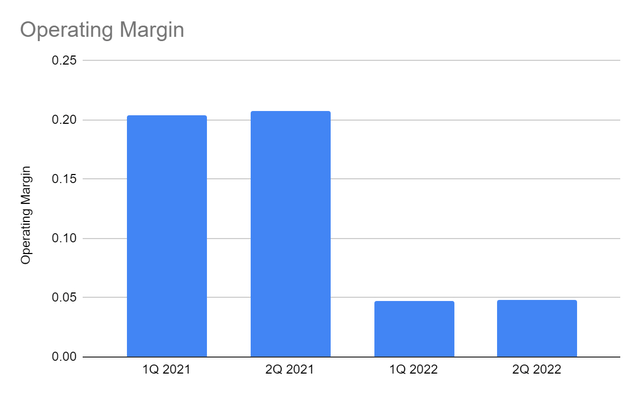

Despite the gloomy core operations and higher claims, the company exudes better expense management. Its underwriting discipline and efficient asset management help lower its operating expenses. But, its enhanced efficiency cannot offset the substantial decrease in revenues. The operating margin is only 4.8% vs 20.4% in 2Q 2021. The good thing about it is that it remains viable, better than in 1Q 2022. It shows that it now has a better grasp of its operations in a high-inflation environment. Its rebound may not be easy, but its fundamentals remain solid and intact. It may also improve and regain its footing once the macroeconomic indicators stabilize.

Operating Margin (MarketWatch)

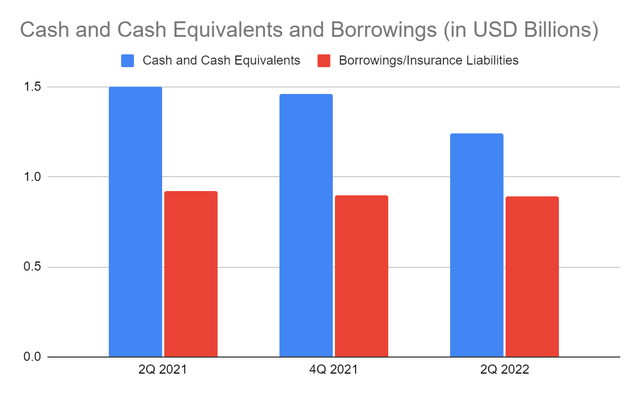

Why Safety Insurance Group, Inc. May Still Bounce Back

Inflationary pressures are causing massive headwinds in the insurance industry. But, its impressive expense management and maintained viability show resilience. SAFT remains enduring despite the interest rate hike that lowers policy counts and investment security valuation. Despite the decrease in cash inflows, cash levels and borrowings remain stable. It maintains a solid liquidity position with cash and investments comprising 74% of the total assets. So, it may have more yields once the interest and mortgage rates become more stable. Their combined value is higher than the combined value of borrowings and insurance liabilities. So, it can make a single payment to all its lenders and policyholders. Even so, their differences narrow, leading to a lower book value.

Cash and Cash Equivalents and Borrowings and Insurance Liabilities (MarketWatch)

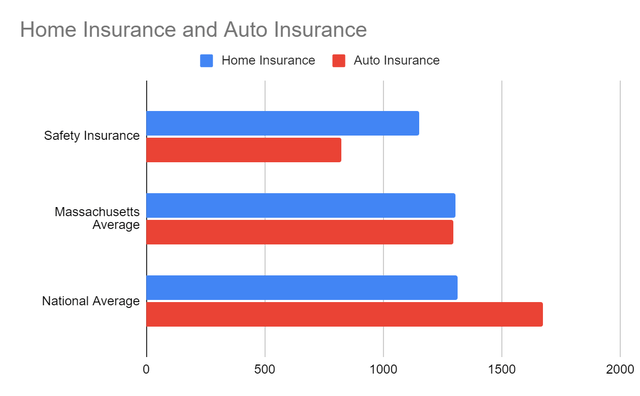

Another thing to consider is its competitive advantage. With the increased house and auto demand and prices, home and auto insurance go with the same trend. The cool down and house and auto sales and the decrease in affordability of home and auto insurance lower its demand. This factor provides SAFT with a competitive advantage. Its home and auto insurance prices are $1,153 and $824, respectively. Both segments have lower prices than the state and national average. Its auto insurance price is less than half of the national average. So, SAFT has more flexibility to adjust its prices and offset the lower policy counts. Its demand may improve faster than its peers.

Home Insurance and Auto Insurance Prices (Bankrate)

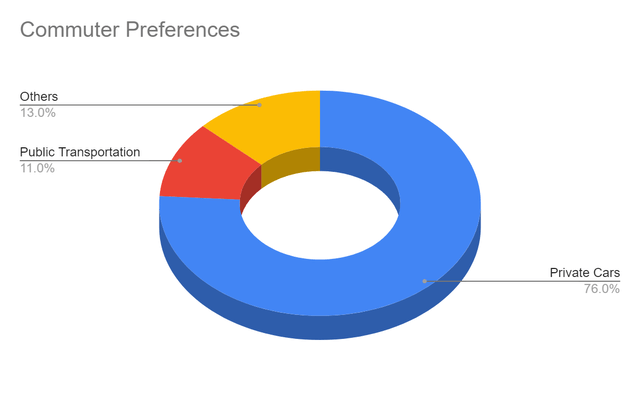

Aside from its prices, the preference for private cars may help maintain its market positioning. Although auto prices and sales are higher, the demand may remain high. The restrictions and pandemic fear make driving a private vehicle more convenient. Note that many businesses are either requiring employees to return to the office or implementing hybrid work setups. These increase the number of passengers in the US. In a survey, 76% choose cars, 11% use public transportation, while 13% use bicycles, and other options. Many auto owners in the US may treat auto insurance as a staple.

Commuter Preferences (Statista)

Stock Price Assessment

The stock price of Safety Insurance Group, Inc. remains in an uptrend. The upward momentum of the bullish stock price is visible. At $93.76, it is now 13% higher than the starting price. But, the P/E Ratio of 22.79, the PTBV Ratio of 1.67, and the Price/Cash Flow of 17.45 all convey potential overvaluation.

On the other hand, dividend payments are consistent despite economic uncertainties. Its yield of 3.89% is more than twice as much as the S&P 600 and NASDAQ components with 1.41% and 1.51%. Also, its FCF is more than enough to cover dividends. To assess the stock price better, we may use the DCF Model and the Dividend Discount Model.

DCF Model

FCFF 58,180,000

Cash 35,080,000

Outstanding Borrowings 35.350,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 14,740,000

Stock Price $93.76

Derived Value $92.54

Dividend Discount Model

Stock Price $93.76

Average Dividend Growth 0.0517

Estimated Dividends Per Share $3.6

Cost of Capital Equity 0.09288

Derived Value $90.44

Both models show the potential overvaluation of the stock price. There may be a 2-4% upside in the stock price in the next 12-18 months. So, investors must keep a keen eye before making a position.

Bottomline

Safety Insurance Group, Inc. is hammered by inflationary pressures. But, its sound fundamentals and competitive advantage make it a durable company. It is also an ideal dividend stock, given the impressive dividend yield. SAFT is potentially overvalued, so one must find a better entry point before buying the stock. The recommendation, for now, is that Safety Insurance Group, Inc. is a hold.

Be the first to comment