twohumans

Financial markets in the first six months of 2022 broke many records, all of them bad. According to the New York Times:

- The stock markets suffered the worst January through June performance “since at least 1970,”

- The S&P 500 Index and other stock markets are now in a Bear Market, meaning they have declined 20% or more from a previous peak,

- Many bond markets suffered their worst declines in about 40 years and 10-year Treasury bonds suffered their worst declines since the late 18th century,

- Inflation is the worst it has been in more than 40 years, and

- Bitcoin is down more than 50%.

Some of these results from actions by the Federal Reserve to raise interest rates. The expectation is that higher interest rates will reduce inflation by slowing economic growth. That may cause a recession but the Federal Reserve sees that as a necessary evil.

According to the NY Times article: “The Federal Reserve’s determination to tame inflation by raising interest rates is a major factor in the current market turmoil. Jerome H. Powell, the Fed chair, said on Wednesday that the central bank’s efforts to fight inflation were ‘highly likely to involve some pain.’”

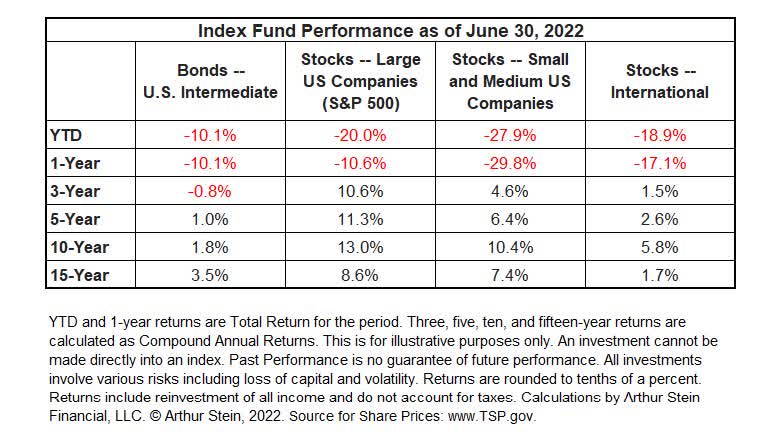

Well, those efforts have already caused quite a bit of pain. The table below indicates the depth of losses year-to-date and over the last 12 months. The bond fund is negative over the last three years, which is certainly unusual.

Other reasons for the declines include high rates of inflation, rising recession risks, the war between Russia and Ukraine, and a slowdown in the economies of China and other countries.

While past performance is no guarantee of future performance, there are historical patterns that are worth considering. Historically,

- It was not possible to consistently predict short-term performance, including the reactions of stock markets to negative events.

- Calendar year returns were much more likely to be positive than negative.

- Major market declines (Bear Markets) were followed by large market increases (Bull Markets) that were greater on a percentage basis and lasted longer.

1. Predicting the Markets

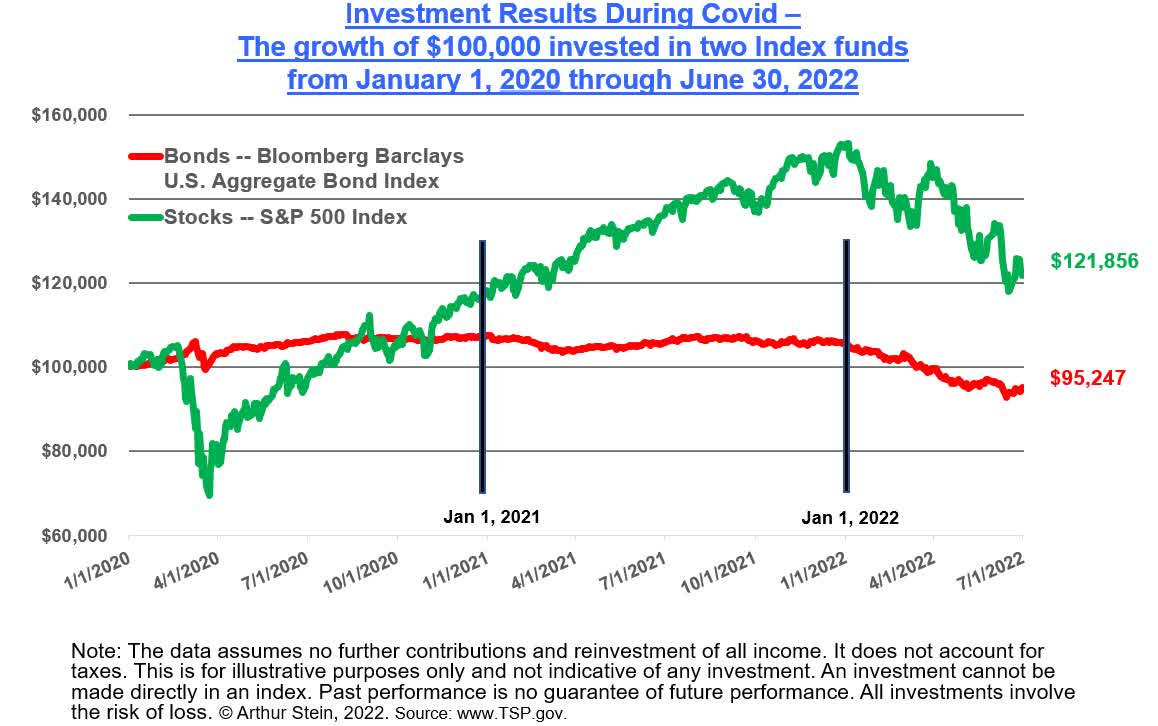

The graph below is an example of the difficulty of making stock market predictions. It illustrates the value of $100,000 invested in an S&P 500 Index fund and a bond fund that follows a widely used bond index from the beginning of Covid.

Note that:

- Covid caused the most economic damage during 2020 and there was a significant Bear Market. At its worst, S&P 500 Index funds had declined -34%. But at the end of that year, S&P 500 Index funds had increased 18% and the bond index fund by 7.5%.

- Economic damage continued during 2021, but at the end of that year, S&P 500 Index funds had increased another 29%. The bond fund had a slightly negative return of -1.5% but was still higher than at the beginning of 2020.

- Both stock and bond prices declined significantly during the first six months of 2022, but at the end of that period, stock prices were still 22% higher than at the beginning of the Covid Pandemic. Bond prices declined since the beginning of Covid, mainly because of actions by the Federal Reserve to lower the rate of inflation, which was partly a result of Covid disruptions to the world economy.

If forecasters knew in January 2020 that there would be a Pandemic and the economic damage it would cause, they would have predicted major, long-lasting stock market declines. And they would have been wrong.

The reality is that no forecaster has a consistent, successful record of predicting stock market returns.

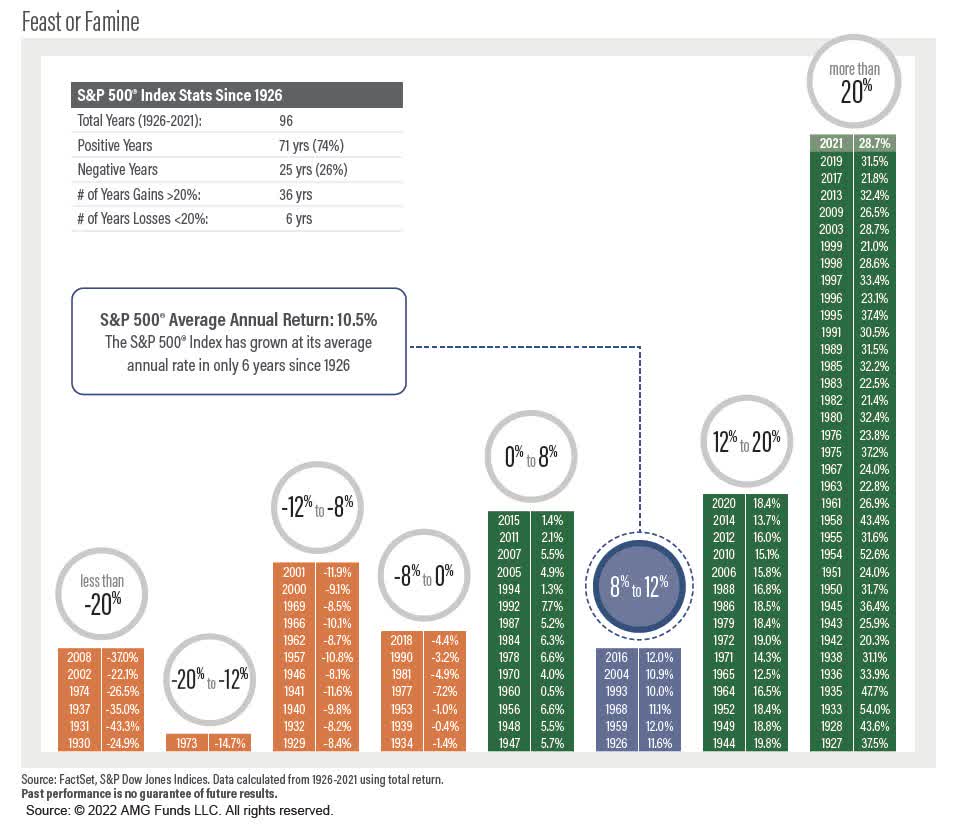

2. Calendar Year Returns Were More Likely to Be Positive Than Negative

The biggest fear of many stock investors is a major market decline; a crash or Bear Market. Historically, they were not common. This was especially true over twelve-month periods.

For instance, here are calendar year returns since 1926.

During this 96-year period, calendar year stock returns (based upon the S&P 500 Index with reinvested dividends):

- Were almost three times more likely to be positive than negative (74% positive and 26% negative).

- There were six times as many large increases (Bull Markets) than large decreases (Bear Markets), when “large” is defined as greater than 20%.

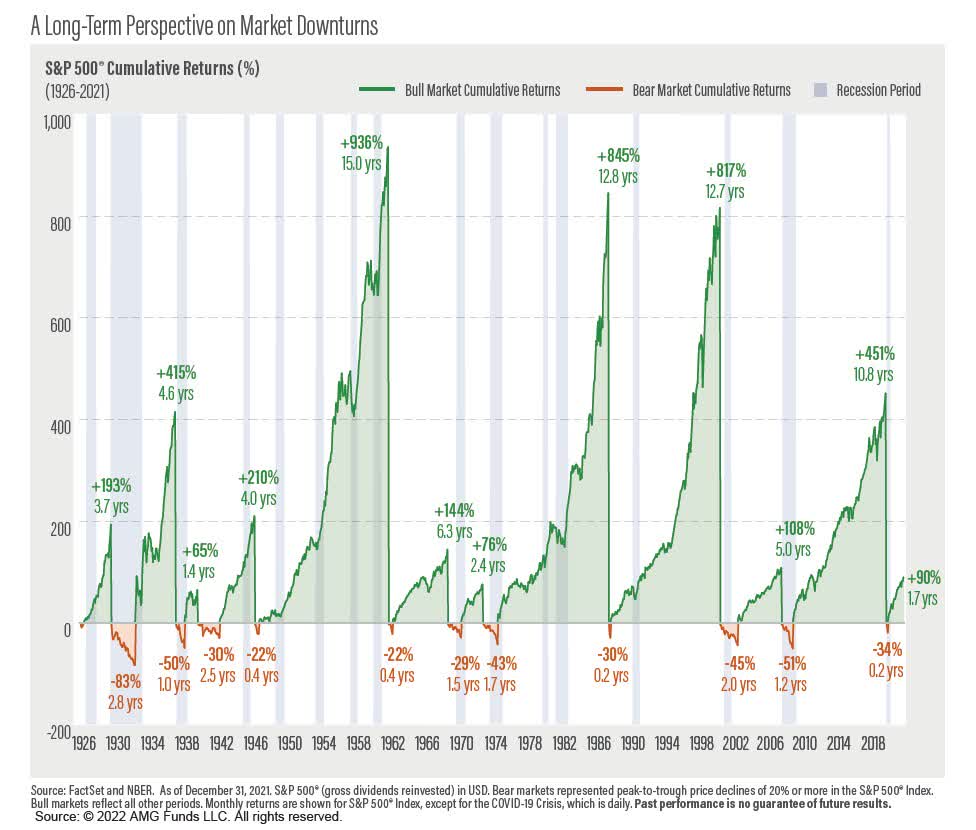

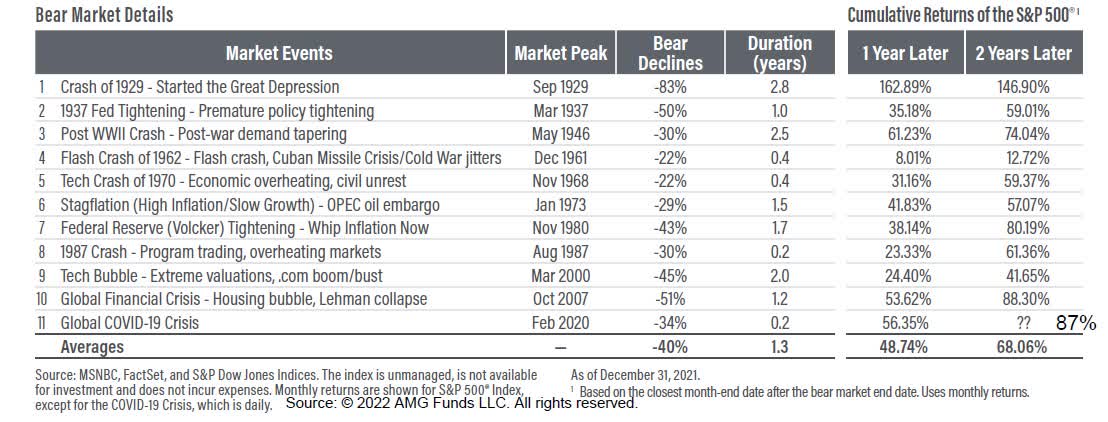

3. Bear Market Declines Were Followed by Much Larger Bull Market Increases

The most striking pattern is the size of the Bull Markets that followed Bear Markets, illustrated below. In this graph, Bear Markets are red, Bull Markets green.

On average, the S&P 500 Index:

- Declined 40% during Bear Markets but increased 362% during Bull Markets.

- The average duration was 1.3 years for the Bear Markets and 6.7 years for the Bull Markets.

Conclusions

Declines in stock and bond investments are unpleasant. But all investments go through cycles and sharp declines are always somewhere in the future. Investors can prepare for these declines by having an emergency fund that can be used instead of investment withdrawals when markets are down. The emergency fund could include bank accounts, CDs, a Home Equity Line of Credit and Series I Savings Bonds (I Bonds).

Historically, stock market corrections are always coming. There has never been a time when a market correction wasn’t in our future. So, it is easy to predict that there will be a future decline but very hard to predict when the decline will occur. This year may be the beginning of a larger market crash or just a temporary blip. But the larger market crash will come, eventually.

At Arthur Stein Financial, LLC, we accept that risks continue. However, we believe that creating well-diversified Portfolios and sticking to a plan will help investors prosper over longer periods of time. We also work with clients to prepare them for investment withdrawals that they may need in the next 1-10 years.

Successful investing is a marathon, not a sprint. It’s important to stay invested, remain patient, and stick to a plan; a plan that includes a personalized allocation target based on your financial position, risk tolerance, and investment timeline.

Disclaimers:

This is for educational purposes only. To learn more about the topics mentioned and if they are suitable for you, consult an appropriate professional. Tax laws can change at any time.

Any information provided in this presentation has been prepared from sources believed to be reliable, but is not guaranteed and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for information purposes only and does not constitute a recommendation.

Arthur Stein and Arthur Stein Financial, LLC are not authorized to give legal or tax advice. For information on your specific situation, please consult your tax advisor regarding any tax implications and your attorney for legal implications. As required by the US Treasury Regulations, you should be aware that this presentation is not intended to be used and it cannot be used for the purposes of avoiding penalties under federal tax laws.

Keep in mind that:

- Past performance is no guarantee of future performance;

- Investments involve the risk of loss of principal and earnings;

- ETFs, mutual funds, money market funds, etc. are not guaranteed by the US Government, the FDIC, a bank, or anyone else.

- “Average annual return” evens out variations in the actual year-to-year returns.

- ETFs, mutual funds, and individual stocks and bonds fluctuate in value and there will always be times when they lose value.

- None of the information provided is necessarily relevant to anyone’s personal situation. Circumstances differ among individuals and you should not assume that these generalizations or information apply to you.

- Investments mentioned may not be suitable for all investors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment