mi-viri/iStock via Getty Images

Mirum (NASDAQ:MIRM) continues to convince market participants on all fronts; since the approval of Livmarli in the USA, commercialization is being driven forward with overwhelming success. As a result, Mirum can already achieve its own annual target of at least $50 million in net product sales in the next quarter. Although annualized sales of 70 million were already generated in this quarter, the full potential is far from being realized. The anticipated approval of Livmarli in ALGS in Europe is expected to be the starting point for the global roll-out of Livmarli. In addition, two ongoing studies are currently investigating an indication expansion of Livmarli to more than double the addressable patient population. In addition to Livmarli, Mirum is conducting potential registration studies with Volixibat, a second compound in clinical development for adult liver disease.

In my last article, I already addressed the significant undervaluation of Mirum. Although Mirum’s market capitalization has nearly doubled since my last article, I continue to believe Mirum is undervalued due to Livmarli’s great sales launch in ALGS and the potential that can be verified by upcoming milestones.

For interested readers, I recommend to closely follow Albireo (ALBO) as a fierce competitor. In addition, I can recommend the content of individual articles that I have written in relation to Albireo, but which apply to both companies. For example, this article describes the reimbursement and pricing process in Europe, while this article provides an overview of Volixibat’s market environment in adult liver disease.

Business of Mirum Pharmaceuticals

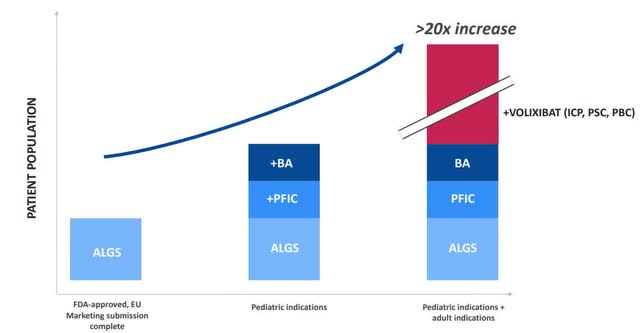

Mirum is a commercial stage rare liver disease company in the midst of a very exciting launch and has gotten off to a great start. The company’s value driver is Livmarli, currently the only approved product in Alagille Syndrome, a greater than $500 million US market opportunity. Moreover, there are plans to expand Livmarli globally and across other pediatric cholestatic liver diseases following ALGS. In addition to Livmarli, Mirum has another product candidate in the pipeline, Volixibat, to address the severe itching and progressive liver damage associated with cholestatic liver disease in adults.

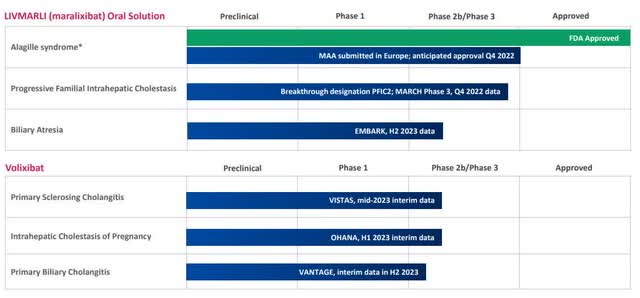

The successful distribution of Livmarli lays the foundation for upcoming milestones to bring additional life-changing medicines to rare disease patients. For both programs, five major data readouts in late-stage clinical trials are planned over the next two years, paving the way for potential regulatory approval.

Mirum’s pipeline includes more than just Livmarli in ALGS (Company Presentation)

Sales Progress and Potential of Livmarli

ALGS is a genetic disease and affects about 2,000-2,500 children in the U.S., nearly 90% of them suffer from severe itching and the majority of children will need a liver transplant or die by the age of 18. Livmarli is the only product approved to date in this indication for the reduction in pruritus. However, long-term data also show the positive effects on quality of life, including the prevention of liver transplantation.

From a commercial perspective, ALGS is a highly effective market to launch into. Due to the obvious symptoms, the disease is detected and diagnosed relatively early. Due to the high medical need and rapid, life-changing medical benefit, patient compliance is very high and discontinuation rates are very low. If patients do not take the drug for a few days, symptoms return very quickly.

I am particularly convinced by the long-term synergy effects. ALGS is a chronic disease, patients take the drug continuously until liver transplantation or death. As long as the drug is effective and safe, patients have little incentive to switch drugs, since the patients would have to actively change the medication during the period of use. In addition, as Livmarli is a weight-based dosing therapy with high gross margins, each patient represents a significant growth annuity, and as age and weight increase, so do dosing and annual treatment costs. This ultimately leads to steadily growing quarterly revenues as both the patient base and annual treatment costs per patient increase.

Livmarli was launched on the same day with approval on September 29, 2021 in the US. After the first 3 full quarters, it is clear that Livmarli has been well accepted by physicians, payers and patients. In the first three quarters, Mirum has steadily increased its patient base as well as net sales and over 90% of Livmarli dispenses are being reimbursed.

Typically, patients are reached in multiple waves. Mirum started with the rollover patients who already had gained experience with Livmarli in clinical trials. However, the majority of the approximately 200 patients who are on drug were prescribed after approval. Many physicians initially prescribe the drug to patients with the most severe symptoms. After physicians become familiar with the drug and have gained positive patient experiences, they also move to prescribe the drug to patients with less severe symptoms. For this reason, Mirum expects continued patient growth in the United States compared to the previous quarter and expects Livmarli to become the new standard of care.

In the first 3 and 6 months of 2022, Mirum generated $17.5 and $10.9 million, respectively, in net product sales of Livmarli and already reached the breakeven point as a commercial organization. I expect Mirum to reach its target of at least $50 million net sales in 2022 as early as next quarter, and could even achieve $80 million in total sales in 2022 – with further significant room for growth in the U.S. in 2023 and beyond.

The LIVMARLI opportunity for cholestatic pruritus and Alagille syndrome is only the beginning of what’s possible for Mirum. Source: Peetz, Q1 Earnings Call

First Growth Driver: Global Roll Out in ALGS

Mirum expects further international approvals of Livmarli in the coming months, which will secure growth in 2023. While Mirum will be responsible for the commercialization of Livmarli in Europe, renowned partners such as Takeda for Japan have been secured for licensing and distribution models in many other countries with potential approvals starting as early as this year.

The next major milestone for the global launch of Livmarli in ALGS is the expected approval in Europe in the fourth quarter. I personally expect a positive CHMP opinion in September and the official EC approval in November. The team in Europe has already engaged intensively with physicians, payers and other key stakeholders. In Germany, the launch is expected shortly after EMA approval, while other European countries will follow in the next two years, as reimbursement and pricing negotiations need to be conducted first. Overall, Mirum is confident that a strong price can be achieved in Europe which will be comparable to other rare disease medicines.

Second Growth Driver: Indication Expansion

The second huge value driver for Livmarli is the potential indication expansion in PFIC and BA. First, the indication expansion significantly increases the addressable patient population; while PFIC is roughly half the size of ALGS, BA compromises more patients than ALGS and PFIC combined. Secondly, the existing distribution and cost structures can be leveraged, as there’s 100% call point overlap between indications.

The indication extensions are the first step to increase the addressable patient population (Company presentation)

While BA comprises the larger patient population, the road to approval is still long; Livmarli is currently being studied in a phase 2b trial. For this reason, I will focus on PFIC for today.

Mirum expects results from the largest ever Phase 3 study in PFIC before the end of the fourth quarter of this year. After unblinding, the topline results will be presented at the next conference that would make sense. If the initial data is positive, Mirum will submit a regulatory label expansion relatively quickly beginning of next year.

This study includes more than 90 patients and is evaluating all PFIC subtypes, with the primary endpoint being a change in pruritus. Compared to previous studies, higher doses at 570 microgram per kilogram BID are now being investigated with the expectation of increasing the response rate and surpassing the tremendous effects observed in the Phase 2 study.

Based on Phase 2 results, the focus is on the PFIC2 subpopulation. However, due to the same mechanism of action, Mirum expects responses across all subtypes comparable to Albireo’s approved product Bylvay. For this reason, a hierarchical approach will be used; after the PFIC2 patients have been analyzed, the totality of the PFIC population will be examined.

Mirum estimates about 500-800 PFIC patients in the U.S., but given geographic differences, they are much more difficult to reach. In addition, Mirum is in the Fast Follower role at PFIC, as Bylvay has already been approved for a year. However, the indication expansion will pay off for Mirum. On the one hand, Mirum already has access to around 100 potential rollover patients, and on the other hand, the sales launch of Bylvay has not been very successful yet.

For a comparison of Livmarli and Bylvay I think it is too early at this point, first I want to wait for the final study results. In addition, I have already made a brief comparison of the drug profiles in this article.

Expansion in Adult Liver Disease

Volixibat is another IBAT inhibitor progressing in clinical development. Volixibat is being investigated in three indications of adult cholestatic liver disease: Primary Sclerosing Cholangitis (‘PSC’), Intrahepatic Cholestasis of Pregnancy (‘ICP’) and Primary Biliary Cholangitis (‘PBC’).

For all three programs, Mirum expects important trial data in 2023 that will have a major impact on the path to approval. While there were delays during the initiation of the studies due to hangover from COVID and supply chain issues, most sites are now up and running and Mirum does not expect any further delays.

All studies are potential registrational studies and consist of a proof of concept and dose selection study in the first half, which will transition to a confirmatory phase in the second part of the study.

There’s a prespecified threshold that does mean that if the results remain blinded, there’s an effect in there. And if that’s not the case, we’ll have an open analysis and share the findings with you. Source: Peetz, Q1 Earnings Call

The data readouts are indicative for the further course of the studies and allow initial conclusions to be drawn about the likelihood of success. However, the final data, which will be used to submit an application for approval, will not be available in 2023.

Volixibat is the next potential blockbuster in the pipeline (Company Presentation)

Financial Situation

In particular, in the case of biotechnology companies, the financial position is one of the most important fundamental factors. Although the last dilution came as a surprise to most investors, the cash runaway of 12 months can be significantly extended. Following the dilution, in which Mirum raised $92 million through the issuance of new shares at $23, Mirum now has cash of roughly $325 million. However, Mirum does not have access to $100 million under the terms of the Revenue Interest Purchase Agreement with Oberland Capital. Mirum is sufficiently funded to continue to advance both the sales launch of Livmarli and the development of the clinical pipeline to profitability and no further dilution is expected in near future. With the acquisition of its licensing partner Satiogen, Mirum has also reduced its long-term royalty and milestones obligations for Livmarli and Volixibat.

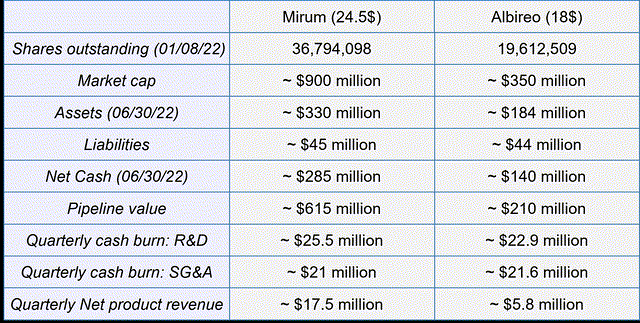

Overall, Mirum has a market capitalization of $900 million, with the pipeline and its assets valued at approximately $615 million. It is clearly evident that Mirum needs to continue to significantly increase its revenues to reach profitability. For a better overview, I have included Albireo’s latest figures as the only relevant peer. Looking at the figures, it is clear that Mirum has clearly overtaken Albireo due to its excellent sales start in the bigger indication.

Financial overview and peer comparison (Author’s Chart)

In summary, Mirum has great financial strength. With the growing revenue contribution and efficient business model, all critical milestones can be achieved and the global commercial presence can be expanded in the coming months.

Risks

Mirum’s main risks are related to the sale and clinical development of its drugs and to the emerging competition from Albireo.

- It is uncertain how successfully Mirum can distribute Livmarli in the future. Although the breakeven point as a commercial organization is already reached, Mirum is not yet profitable due to the high research and development costs.

- Furthermore, the assessment of clinical studies is always exposed to risks.

- Although Livmarli is currently the only approved product in ALGS, Albireo is expected to report Phase 3 results this fall, which could provide the basis for regulatory approval of Bylvay in ALGS. There may be no medical benefit or there may be side effects, which means that the asset must be discontinued in this indication.

Summary

Mirum is currently valued at around $900 million. The entire pipeline including Livmarli is valued at $615 million. Overall, Mirum’s market capitalization has almost doubled since my last article. Nonetheless, I still believe Mirum is undervalued.

In contrast to my last article, many uncertainties have been resolved and Mirum has proven it can successfully commercialize a product. Currently Mirum addresses a rare pediatric disease market worth $500 million. For the coming quarters, I expect consistent growth, both by increasing the patient base and due to the long-term synergy effects from weight-based dosing. If growth rates continue at this rate, Mirum could reach profitability as early as 2023.

Further growth potential will soon be uncovered through the global rollout of Livmarli and the potential indication extension in PFIC. Last but not least, the clinical development pipeline is progressing steadily and important data readouts are expected in the coming months.

Due to the recently completed public offering, the share price is consolidating and provides an excellent entry opportunity for shareholders.

Chart of Mirum Pharma (Stockchart.com)

Be the first to comment