Khanchit Khirisutchalual

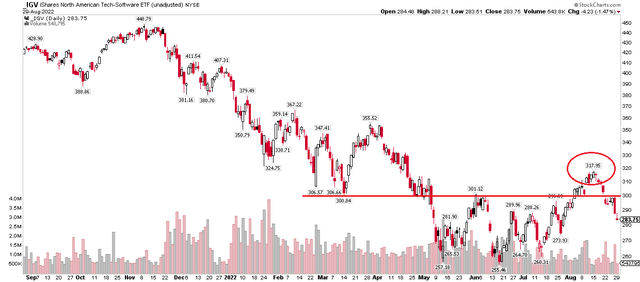

Software stocks have been one of the epicenters of selling since last November when so many speculative and high-duration assets hit a crescendo. The iShares Expanded Tech-Software Sector ETF (IGV) had a bearish false breakout earlier this month when the fund climbed above $300. A recent interest-rate rise brought about a swift 10% correction in IGV. Investors definitely want to see the fund climb above $300 once again. One small-cap software stock reports earnings later this week.

Tech/Software Stocks: Bearish August False Breakout

According to Fidelity Investments, Samsara Inc. (NYSE:IOT) provides solutions that connect physical operations data to its Connected Operations Cloud in the United States and internationally. The company’s Connected Operations Cloud includes Data Platform, which ingests, aggregates, and enriches data from its IoT devices and has embedded capabilities for AI, workflows and analytics, alerts, API connections, and data security and privacy; and applications for video-based safety, vehicle telematics, apps and driver workflows, equipment monitoring, and site visibility.

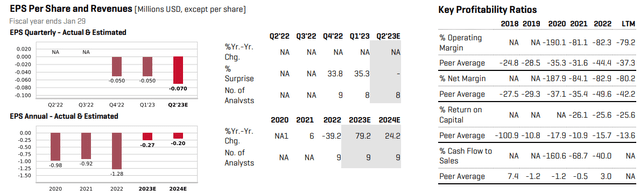

The California-based $8.0 billion market cap company in the Software industry, within the Information Technology sector, has negative earnings over the past 12 months and does not pay a dividend. Shares are down sharply from its IPO near the height of 2021’s late-year speculative frenzy.

The valuation and earnings pictures are not encouraging. According to CFRA Research, EPS is expected to drop to $-0.07 for this quarter about to be reported. Further out, earnings are seen as continuing to be in the red through 2024 as revenue growth stalls. Sluggish growth for a speculative high-duration stock is a recipe for a lower share price. IOT also has negative free cash flow. If we assume $593 million in sales for FY 2023, that means the company trades at a nosebleed 14-times forward revenue.

Samsara Earnings & Profitability Outlooks

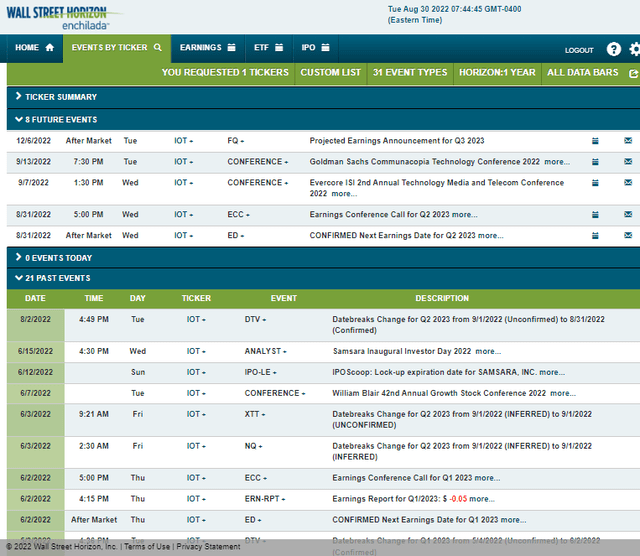

So while the earnings situation and valuation snapshots warrant caution, are there any potentially bullish catalysts ahead? I always turn to Wall Street Horizon’s corporate event calendar for a preview of key happenings. The corporate event data provider notes that IOT reports earnings after the bell Wednesday, August 31 with an earnings call to follow. You can listen live here.

Beyond this week’s earnings report, there is a pair of industry conferences at which Samsara’s management team is expected to speak (pending status). The first takes place on Wednesday, September 7 and the second is the following Tuesday.

Corporate Event Calendar: Earnings & Two Conferences

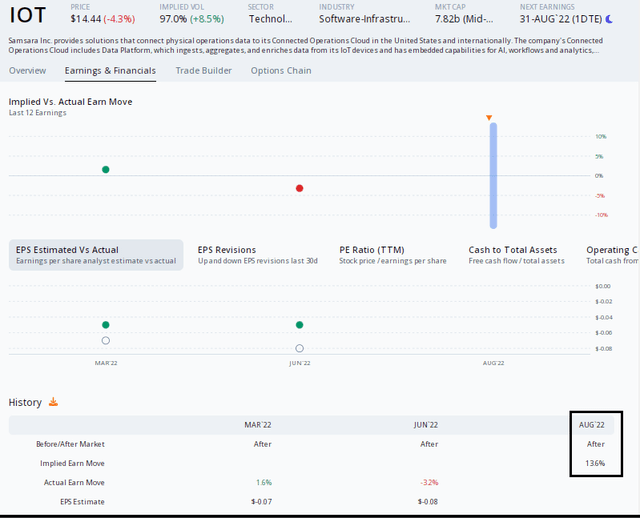

Digging into IOT’s Q2 earnings report and the expectations, analysts expect a per-share loss of seven cents. Traders see a big stock price swing post-earnings – on the order of 13.6%, according to data from Options Research & Technology Services (ORATS), using the nearest-expiring at-the-money straddle. ORATS data show just small stock price reactions in IOT’s previous two earnings reports.

ORATS: A Big Stock Price Move Expected, But Limited History

The Technical Take

While IOT’s valuation and fundamentals look sketchy at best, the technical setup is not awful. The stock bottomed well before the broad market, falling to a low under $9 back on May 12. After a dramatic 73% drawdown off its all-time high notched last December, shortly after the mid-December IPO, the stock just about doubled to the recent August peak. Notice lower volume in the last few months – that is a key indicator to monitor on a breakout or breakdown in the stock’s price.

There’s clear resistance in the $17.50 to $18.50 range while support comes into play in the $12.50 to $13.50 area. With IOT trading in the mid-$14s, if we get a pullback ahead of or just after earnings, it could be a buy-the-dip play. I’d take profits at $17.50, though. A close above $18.50 would be bullish.

IOT: Shares Dropping Back Toward Support On Declining Volume

The Bottom Line

IOT is an expensive high-duration software stock ahead of key earnings Wednesday. The valuation looks very questionable and long-term investors should steer clear, but a somewhat favorable technical setup offers traders a ‘buy the dip’ play.

Be the first to comment