photovs/iStock via Getty Images

“Generosity is giving more than you can, and pride is taking less than you need.” – Khalil Gibran

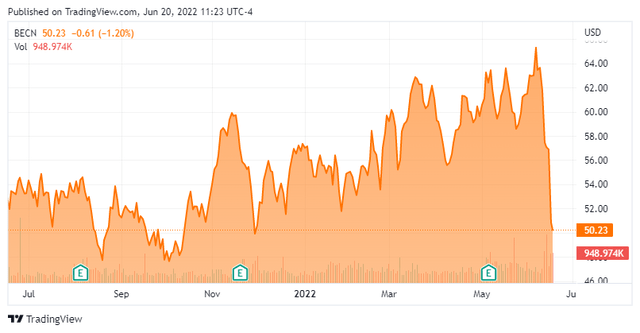

Today, we put Beacon Roofing Supply (NASDAQ:BECN) in the spotlight. The shares have sold off recently as 30-year mortgage rates have spiked to over six percent. The average 30-year mortgage rate for the week ending June 10th was 5.65%, the highest level since late 2008. The stock looks cheap on an earnings valuation, and the company has seen some significant insider buying from a beneficial owner here in 2022. Is the likely housing downturn already priced into these shares? We try to answer that question via the analysis below.

Company Overview:

Beacon Roofing Supply is headquartered just outside of D.C. The company distributes residential and non-residential roofing materials, and complementary building products to contractors, home builders, building owners, lumberyards, and a variety of different retailers. These products include gutters and sidings; building materials, such as lumber and composite, skylights and window, plywood and OSB, decking and railing, HVAC products and a variety of other materials/parts. The stock currently trades just north of $50.00 a share and sports an approximate market capitalization of $3.45 billion.

First Quarter Results:

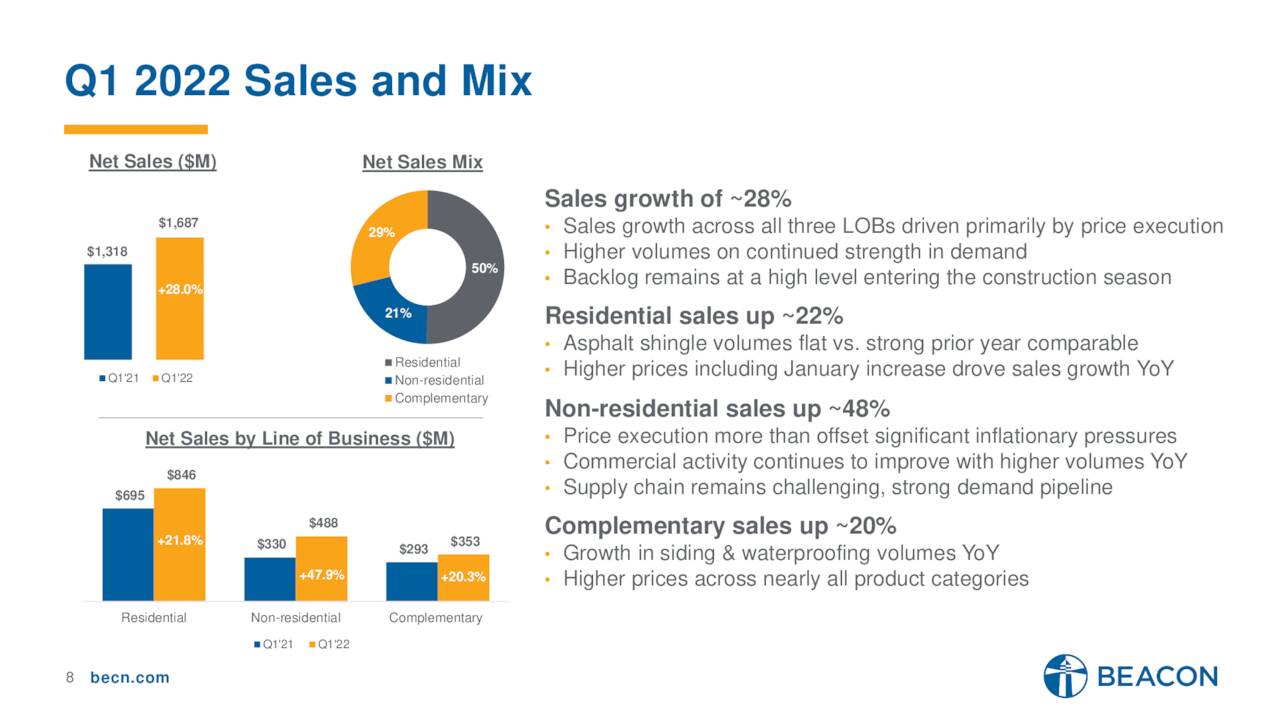

On May 5th, the company reported first quarter numbers. The company earned 61 cents a share on a GAAP basis as net sales rose 28% from the same period a year ago to just under $1.7 billion. Both top and bottom line numbers easily beat analyst expectations.

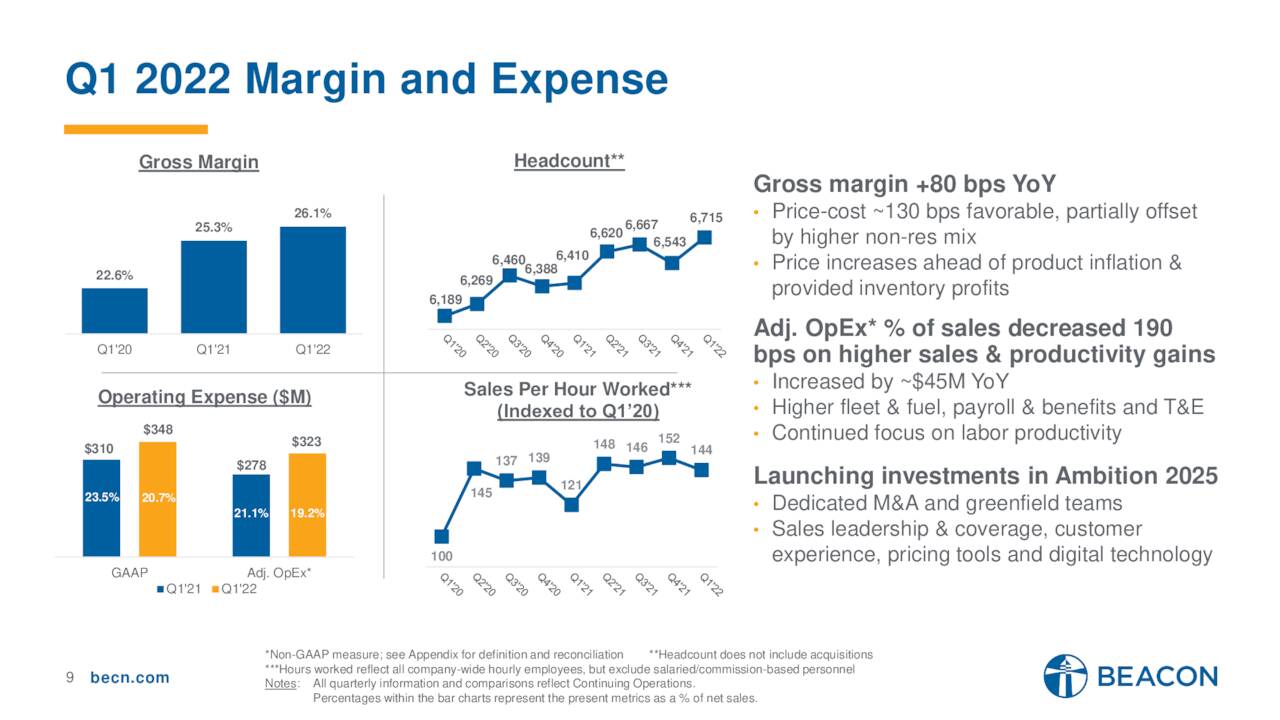

May Company Presentation

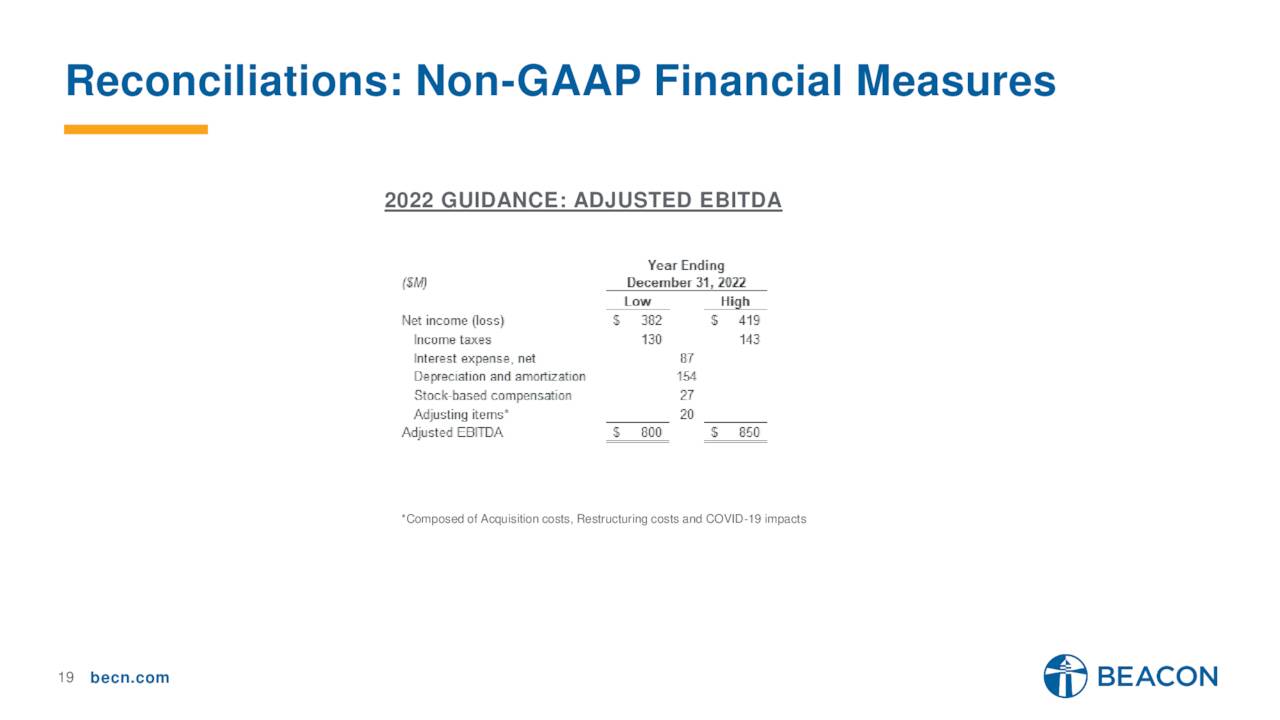

Margins improved in the quarter from 1Q2021, and management believes they will hit 27% in Q2 of this year. Leadership guided to 20% revenue growth in FY2022 and expects EBITDA to come at $800 million to $850 million for the fiscal 2022 year.

May Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community is mixed on the prospects for Beacon at the moment. Over the past two months, four analyst firms including Wells Fargo and Jefferies have reissued Hold or Neutral ratings on the stock. Price targets proffered range from $60 to $72 a share. Meanwhile, a half dozen analyst firms including RBC Capital and Stifel Nicolaus have reiterated Buy ratings with price targets between $70 to $83 a share.

A beneficial owner added $6 million to their holdings in BECN in late April. This follows another $6 million purchase in late January. A division president sold just over $250,000 worth of stock in mid-March. Those have been the only insider transactions in these shares so far in 2022. Just over four percent of the outstanding shares are currently held short.

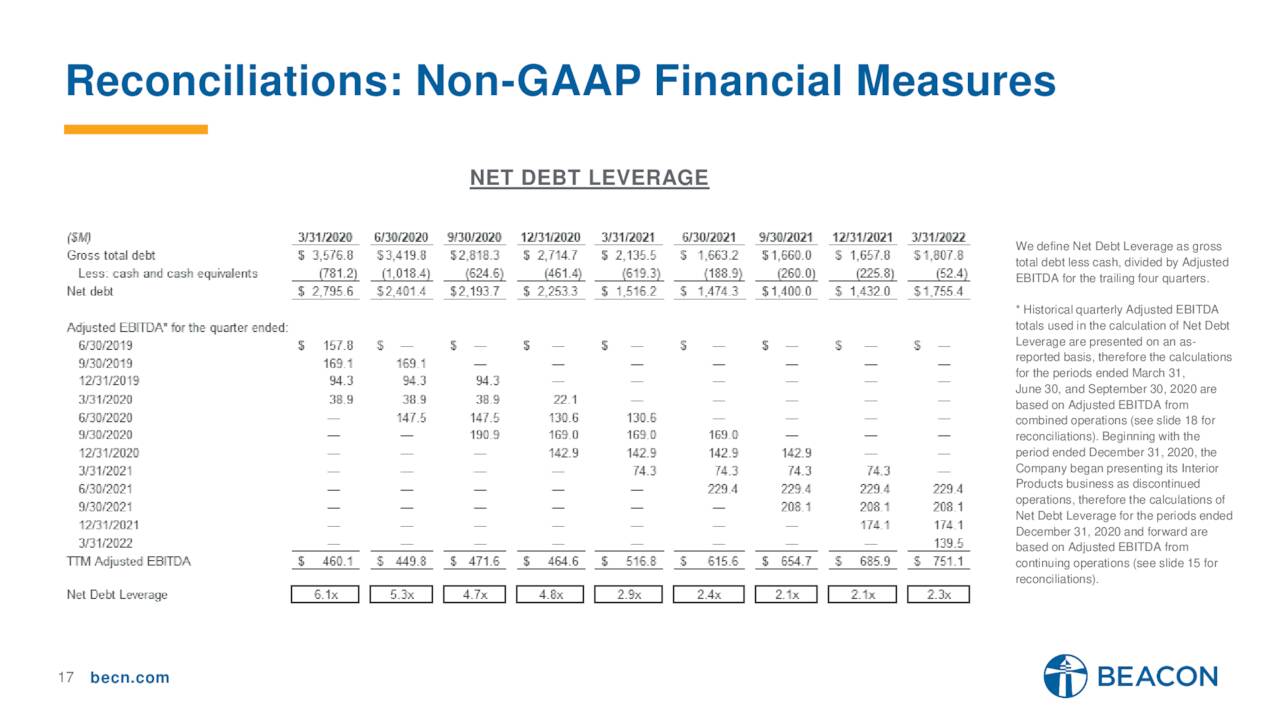

May Company Presentation

The company ended the first quarter with just over $55 million of cash and marketable securities against approximately $1.75 billion in long-term debt. The company’s balance sheet is in good shape with net debt leverage of 2.3, which is down from 6.1 at the start of the pandemic. No meaningful tranches of debt are due until 2026. The company is in the early stages of executing a $500 million stock buyback authorization. Beacon retired $113 million worth of stock in the first quarter under this program. Leadership expects to execute three-quarters of this authorization in FY2022.

Verdict:

The current analyst firm consensus has the company earning some $6.80 a share in FY2022 as revenues rise some 20% to $8.2 million. Next year, they see relatively flat earnings growth as revenues rise only in the low-single digits.

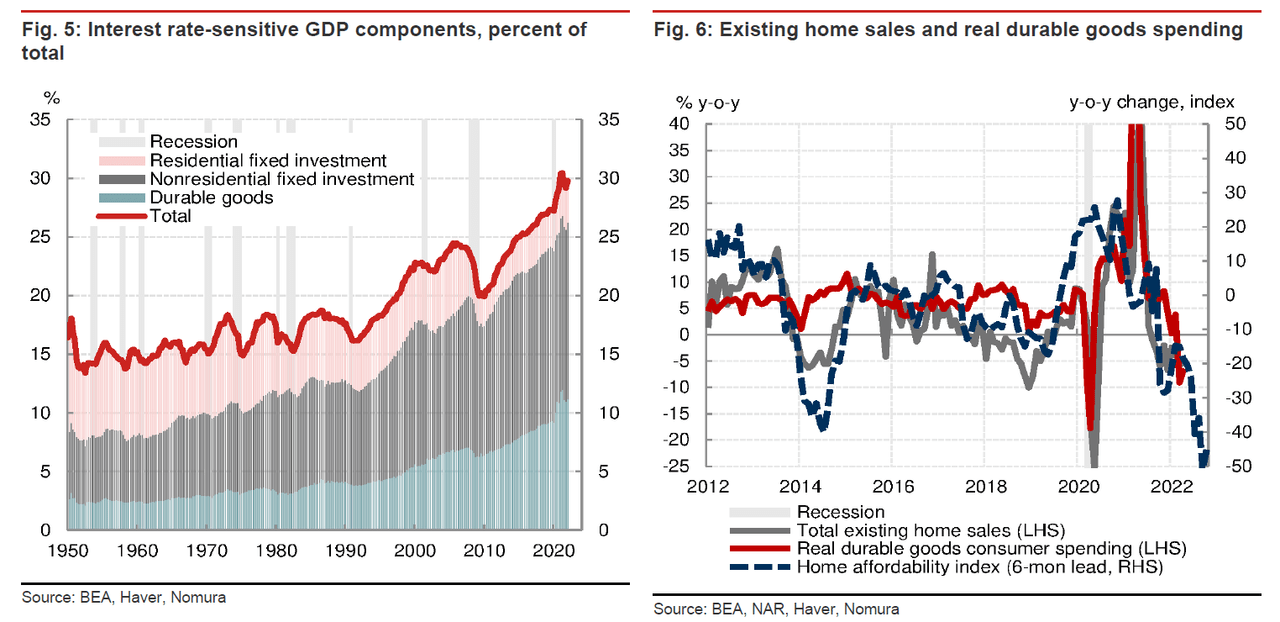

Beacon will obviously be hurt by any sustained downturn in the residential housing market, which is likely if mortgage rates stay at these levels. It needs to be noted that this is not the same scenario as the Housing Bust fifteen years ago. The country had seen years of overbuilding before that event occurred. Housing starts have run below long-term historical trends since then, and housing inventory remains anemic.

May Company Presentation

In addition, approximately 50% of the company’s sales come from non-residential and complementary products business, which should hold up better in a recession. In addition, while housing starts are likely to fall, given the lack of inventory, they are not going to drop off a cliff. Housing starts dropped 14.4% in May from the prior month to a 1.55 million annualized rate, the lowest in more than a year.

Zero Hedge

A recession will also likely see interest rates recede eventually, and input costs will fall as decreasing demand should help resolve global supply chain issues. Lumber is down by approximately two-thirds from their all-time high late last year as one example that is already happening. This should help gross margins.

The question for investors is how deep a recession will be and what impact will it have on Beacon’s earnings. Even if one slashes earnings projections by 25%, the stock sells for just under 10 times pessimistic profit projections. The shares also trade at just over 6 times EV/EBITDA. Not ‘back up the truck‘ cheap but reasonable valuations in a mild recession scenario. A beneficial owner sees the shares as a good long-term value judging from recent purchases. I will probably wait for the next sell-off in the overall market to take a small ‘watch item‘ position in Beacon Roofing Supply via covered call orders.

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like.” – Will Rogers

Be the first to comment