oatawa/iStock via Getty Images

It’s a good time to be re-investing in growth as market appetite for risk heats back up and concerns about inflation and rising rates fade to the background. Now is a rare opportunity, in my view, to buy into shares of very high-quality growth stocks that are still lingering at beaten-down values.

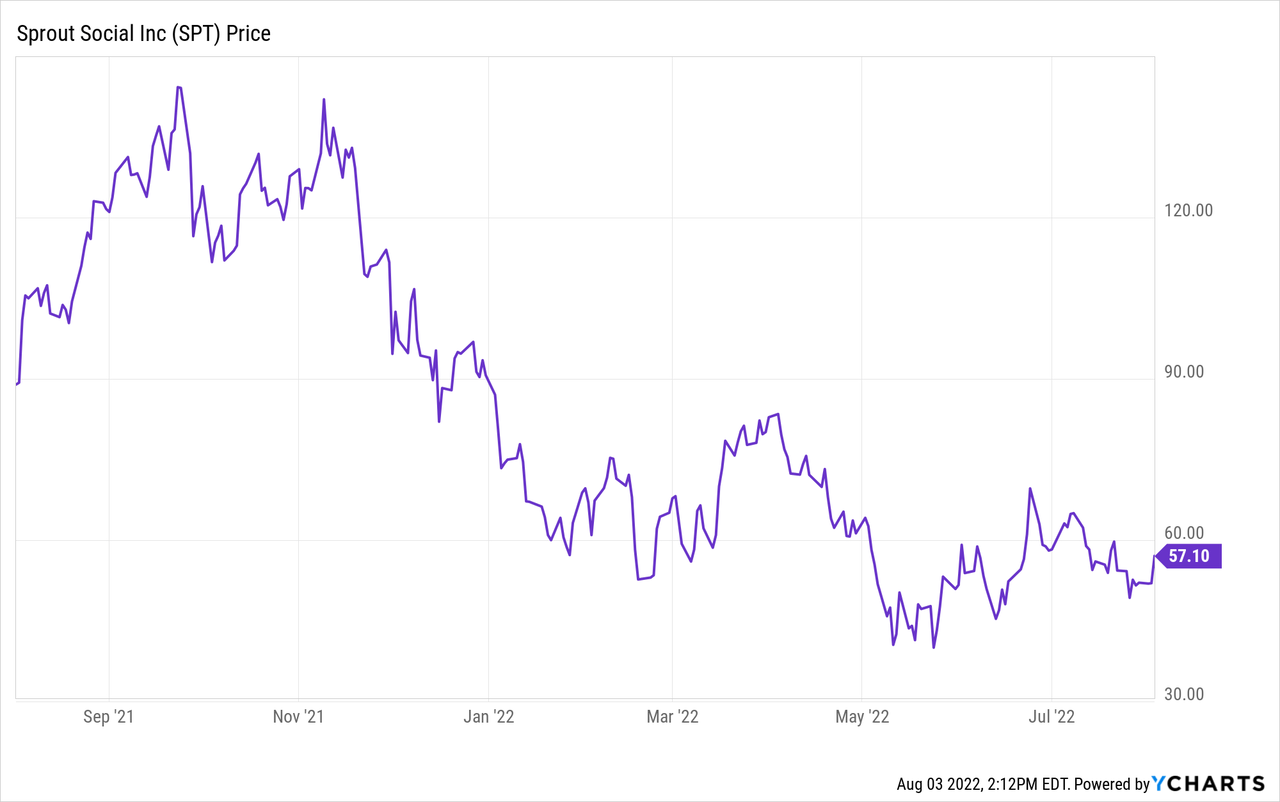

Sprout Social (NASDAQ:SPT) is an excellent example of this. The social media-management company, a relative upstart to the SaaS world, has seen its share price decline by 35% year to date. After recently posting a very strong Q2 earnings print, however, the stock rallied nearly 10% and is looking on track to recoup a good chunk of its losses.

We don’t really need to state the obvious, but we’ll do so anyway: traditional media advertising spend is giving way to social media, which is where all the eyeballs are these days. In order for brands to connect with their customers today, an effective and well-managed social media strategy is of paramount importance.

As social media managers gain prominence as a bona fide career path, specialized tools to manage social media are also attracting attention, and Sprout Social is one of the prominent names in this space. I remain bullish on Sprout Social, both for its strong execution to date plus the relative greenfield nature of its market opportunity.

For investors who are newer to this stock, here is what I consider to be the key bullish drivers for Sprout Social:

- Platform agnostic and technology that is one-size-fits-all- Sprout Social has expertise across all the major social media platforms, including Facebook (META), Instagram, Twitter (TWTR), Pinterest (PINS), Snap (SNAP), and even TikTok. Sprout Social’s technology also uses a single code base that is applicable to all clients, meaning there is no need to custom-configure its solutions for any particular client.

- >$50 billion TAM, driven by still-nascent business adoption of social media- Many companies, especially SMB-type clients, are still figuring out social media for the first time, meaning that the majority of Sprout Social’s market is greenfield. The company estimates its current TAM at >$50 billion.

- Nearly pure recurring revenue- Nearly 100% of Sprout Social’s revenue base is SaaS, with its customers paying recurring fees to use Sprout Social’s post schedule, monitoring, and analytics tools.

- An eye for profitability- Sprout Social is in the low single-digit pro forma operating loss margins, and is looking likely to achieve above-breakeven margins either in FY22 or FY23 based on its long-term operating model.

- Founder-led- Sprout Social is still led by its founder Justyn Howard, which is typically a strong signal for smaller companies.

Sprout Social is also consistently staying ahead of social media trends and anticipating its clients’ needs across various popular platforms. In late May, the company partnered up with TikTok and introduced its first TikTok integration; and in August, it added Instagram Reels to its video management capabilities.

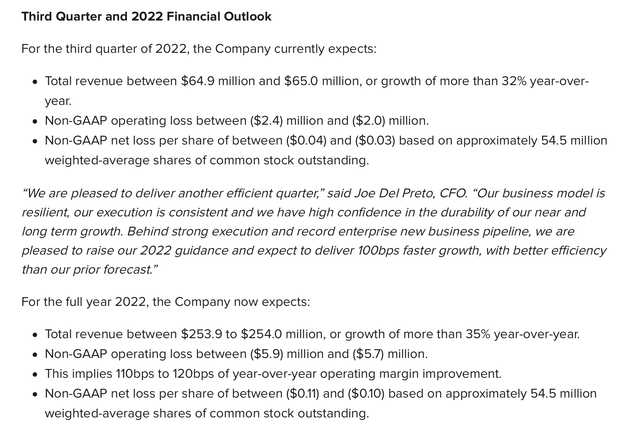

Also on the short-term side, we note that Sprout Social slightly boosted its outlook for the current year. It’s now guiding to $254 million in revenue (+35% y/y), versus a prior outlook of $252-$253 million (+34% y/y to +35% y/y growth), while also indicating it can raise its full-year operating margins by 110-120bps versus a prior guide of just 100bps. Given Sprout Social’s tendency to guide conservatively, there’s still likely quite a bit of upside left for the year.

Sprout Social Q2 outlook (Sprout Social Q2 earnings materials)

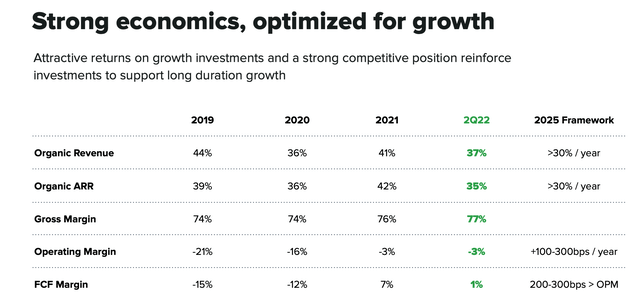

Note that the company’s long-term plan calls for sustained >30% y/y growth while delivering 100-300bps of operating margin expansion each year:

Sprout Social operating model (Sprout Social Q2 earnings materials)

The bottom line here: I consider Sprout Social to be an attractive SaaS vendor with great growth/profitability balance, strong sales execution and continued innovation, as well as very attractive secular market tailwinds. The stock is still down ~35% year to date and down 60% from all-time highs above $140, so now is an excellent time to buy this name on the upswing.

Q2 download

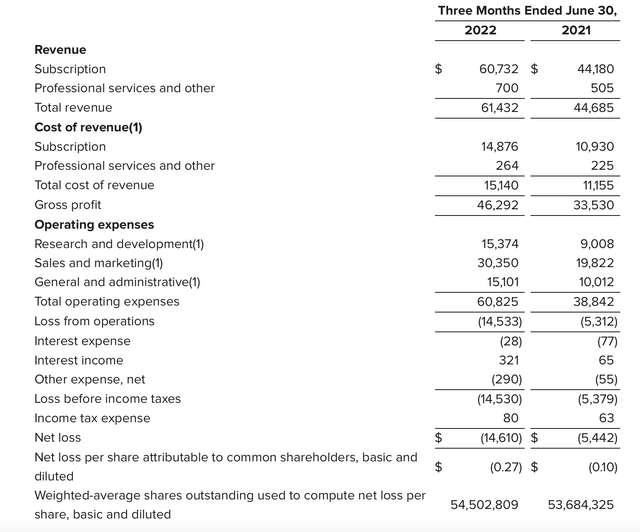

Let’s now go through Sprout Social’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Sprout Social Q2 results (Sprout Social Q2 earnings materials)

Revenue grew 37% y/y to $61.4 million, beating Wall Street’s expectations of $60.3 million (+35% y/y) by a two-point margin. Revenue growth did finally decelerate, however, from last quarter’s 41% y/y pace.

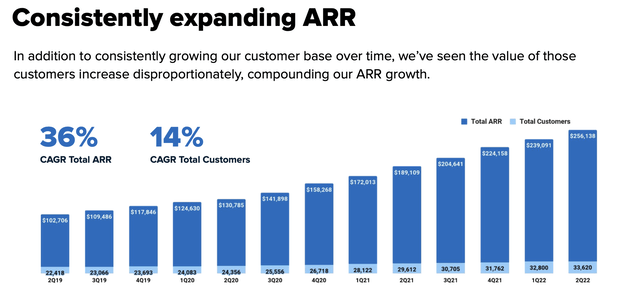

As a reminder, Sprout Social’s business is entirely subscription-based. In Q2, the company added $17 million of net-new ARR to its base, ending Q2 at $256.1 million in total ARR which is up 35% y/y. We do find it encouraging that Sprout Social’s ARR is greater than its current 2022 revenue guidance of $254 million.

Sprout Social ARR trends (Sprout Social Q2 earnings materials)

The company believes that sales execution hit a high mark in June (which hopefully bodes strong trends for Q3). Per CEO Justyn Howard’s remarks on the Q2 earnings call:

Net new ARR in the months of April and May was relatively consistent with our healthy trajectory, exiting Q1 across new business retention and growth. Our month of June, however, was one of our strongest ever. Retention and expansion trend line stayed consistent with April and May and we delivered a record new business month, including incredibly strong, large deal momentum in the enterprise.

As we look ahead, we currently see steady trends within customer retention and expansion as we remain mission-critical to our customer’s workflow. As our investments in mid-market enterprise sales capacity, lean into strong new business demand, and many of our partner and product initiatives begin to impact ARR, we believe we’re well positioned to deliver consistently healthy ARR growth into 2023.”

The company did not mention any macro-related slowdowns, and in anticipation of continued growth, it is not ratcheting back any of its hiring plans (which many companies in the software sector have started to do, in anticipation of weaker enterprise spend).

As a result, pro forma operating losses in the quarter widened to -$1.9 million, or a -3% margin, which is three points worse than approximately breakeven in the year-ago quarter. The company does aim to close out FY22 at a -2% pro forma operating margin, however, and improve at 100-300bps per year – indicating that it could hit breakeven on a full-year basis in FY23.

Valuation and key takeaways

The one potential drawback to Sprout Social is that it’s not exactly as cheap as other beaten-down SaaS names. At current share prices near $57, Sprout Social trades at a market cap of $3.08 billion. After we net off the $181.7 million of cash on Sprout Social’s most recent balance sheet, its resulting enterprise value is $2.90 billion.

Versus Wall Street’s consensus forward-year FY23 revenue estimate of $329.8 million (+31% y/y; data from Yahoo Finance), Sprout Social trades at 8.8x EV/FY23 revenue. Now, Sprout Social did use to trade at mid-teens multiples of revenue, so it’s down from its historical highs, but it would be a stretch to call Sprout Social a value stock.

That being said, given that Sprout Social is on a clear path to breakeven profitability while sustaining >30% y/y revenue growth in a very attractive and relatively new end-market, I’m willing to bank on further upside here.

Be the first to comment