grandriver/E+ via Getty Images

Since an emergence in popularity, RV sales have always been sensitive to economic changes. But, affluent retirees and youngsters continue to stimulate growth in the industry. REV Group, Inc. (NYSE:REVG) is one of the popular RV manufacturers in the US. However, its actual recovery and growth remain inconsistent and sluggish. Thankfully, its liquidity remains stable, allowing it to sustain its operations and dividends. It has adequate means to adjust its production amidst inflation and the pent-up demand for RVs. Meanwhile, the stock price stays in a downtrend. It has already been cut by 28% from the starting price. Yet, it is still not cheap as some price valuations show.

Company Performance

Rev Group, Inc. is now in a better position after its deep plunge in 2020. The easing of border closures and restrictions leads to increased outdoor activities. It matches the pent-up demand for leisure travels, which is very timely and logical. As such, it has benefited from the upsurge in RV demand since 2021. Today, its sales from RVs amount to $241 million, or a 2% year-over-year growth. The accumulated value of $444 million is 3.4% higher than in the first half of FY 2021.

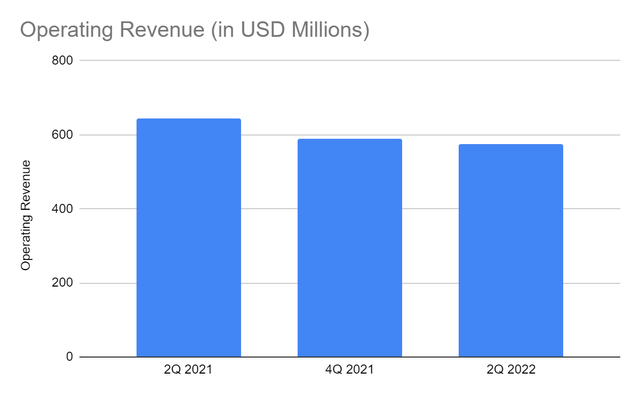

However, growth is not consistent across its business segments. RV growth is nothing compared to the substantial F&E segment drop. The supply chain remains a challenge to its fire apparatus and ambulance shipments. The total operating revenue of $576 million is a 10% YoY decrease from the previous year, but we have to note that there is still high demand for its vehicles. The supply chain delays affect its backlogs and the number of products available for sale, however.

Operating Revenue (MarketWatch)

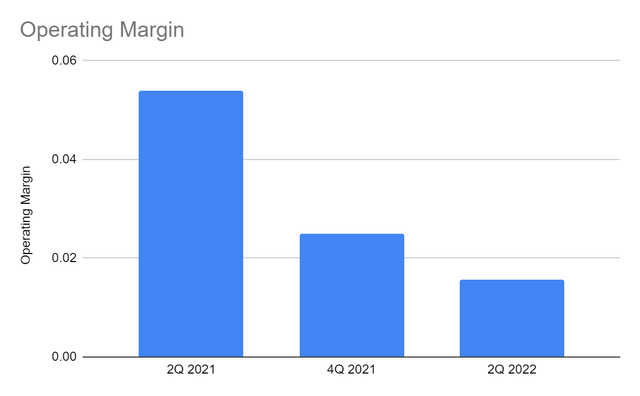

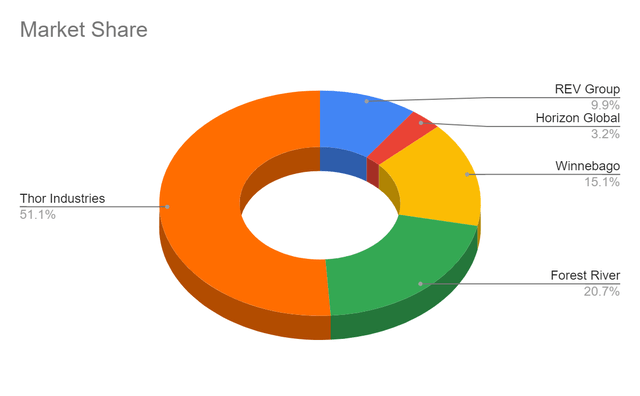

With regards to its RV competitors, REVG remains smaller than Thor (THO) and Forest River, but it still holds a market share of 9.9%, a YoY decrease from 10.5%. As such, the company must be prudent in its pricing to offset the impact of F&E backlogs. Its capacity to produce may become more consistent with the new and future demand. Moreover, these operational improvement initiatives and pricing strategies may help manage costs. Note that semiconductor and chassis shortages persist, leading to skyrocketing costs. Currently, its operating margin is only 0.0156 vs 0.054 in 2Q 2021. With the current delays amidst inflation, the rebound remains slow-moving, but it may continue to at least stabilize its financial performance.

Operating Margin (MarketWatch)

How REV Group, Inc. May Keep Driving

REV Group, Inc. does not seem to be as impressive as it was in 2021. But, we still have to account for the external factors that affect its production. We also have to check the segment where it remains at its best. Thankfully, the RV segment still shows a promise of sustained growth. This year, these luxury vehicles are more appealing amidst the rising costs of oil and fuel.

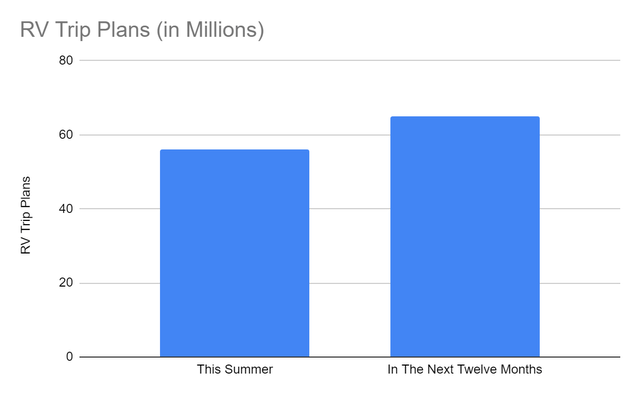

Recent studies show that RVs are a popular choice for summer trips. Respondents prefer staying domestic to going international. Also, 53% say they don’t want to fly while 47% say they avoid staying in hotels. In turn, 38% of Americans are geared towards camping in parks, campgrounds, and private areas. It is a 13% increase from the survey in 2020. RVs and camper vans are now a staple for many leisure travelers. Other surveys show affirmative results. For example, 56 million Americans say they plan to go on summer RV trips. Buying or borrowing money and renting RVs are the top choices for many. The typical reason is the increased interest in exploring outdoor activities. Change in the environment while working or studying and spending time with families follow. The figures may go up to 65 million in the next 12 months according to the same respondents.

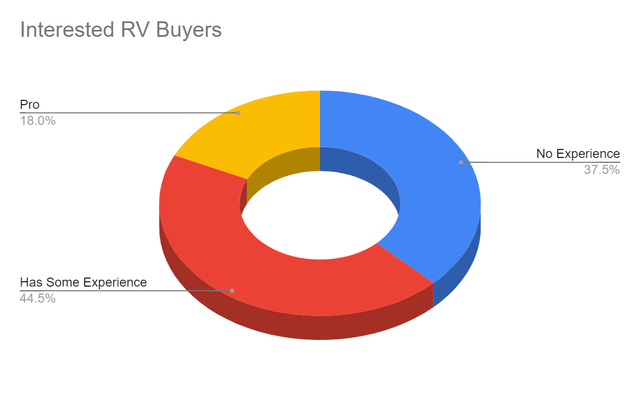

Among these leisure travelers, 45% say RVs are their preferred choice. Even better, 70% of millennials are planning an RV road trip in the next 12 months. This result is a testament to the flexibility and longevity of RVs. They are not confined to the Gen Xs, Baby Boomers, and the Silent Generation. The increased appetite for travel and leisure is making RVs more popular today. This part can be proven by another survey. It shows that 38% of interested RV buyers or renters have no RV driving experience.

Interested RV Buyers (Finance Buzz)

But of course, REVG must not rely solely on the upsurge in RV demand. Note that the inflation rate is now over 8%, which may affect the demand in the second half. Fortunately, REVG is coping with the industry trend with its new battery and all-electric vehicles. It is also in line with the green initiatives that call for lower emissions of gases. It may also be a strategic move, given the rising costs of fuel.

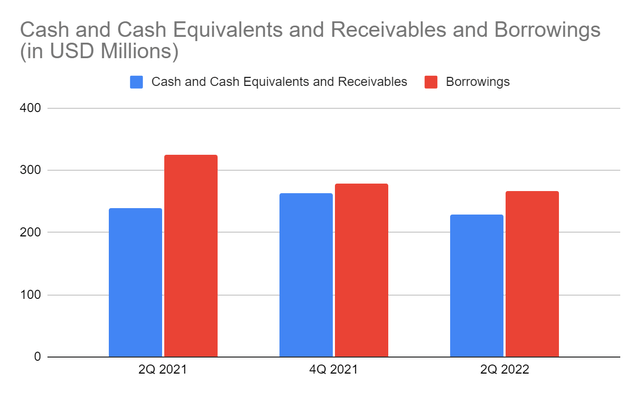

Moreover, REV Group, Inc. does not rely solely on market demand. It also ensures its capacity to sustain its operations while managing its financial leverage. Currently, the value of cash and receivables is $228 million vs $238 million. Its borrowings are lower than in the previous year at $226 million vs $326 million. So, the percentage of cash and receivables to borrowings is 86% vs 73%. However, its cash levels are low but stable. It has high receivables so it must still be careful and efficient in collecting them. Its success in collecting its receivables is crucial, given that it has moderate capital intensity. Its Net Debt/EBITDA is very high at 15x, so REVG does not have enough income to pay off its borrowings. But suppose that its sales receivables are collected, Net Debt/EBITDA will drop to 2.24x. The company may not be as profitable as in 2021, but it is more liquid.

Cash and Cash Equivalents and Borrowings (MarketWatch)

Stock Price Assessment

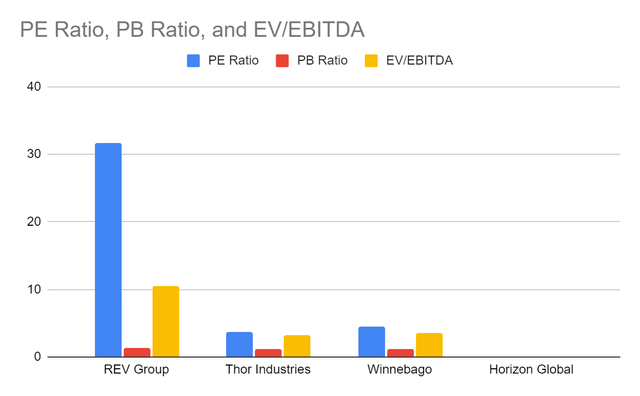

The stock price of REV Group, Inc. remains in a bearish pattern. It has been evident in the last year. At $10.36, it has already been cut by 28% from the starting price. But, it does not appear to be cheap and undervalued. Price metrics show potential overvaluation of the stock price. The figures are far higher than THO and Winnebago (WGO).

PE Ratio, PB Ratio, and EV/EBITDA (Yahoo Finance)

With regards to dividends, the company has been paying dividends since 2017. But, the dividend yield of 1.9% is lower than the market average. To assess the price better, we will use the DCF Model and the Dividend Discount Model.

FCFF $8,148,000

Cash and Cash Equivalents $5,900,000

Outstanding Borrowings $12,700,000

Perpetual Growth Rate 4.80%

WACC 9.80%

Common Shares Outstanding 61,448,000

Stock Price $10.36

Derived Value $7.44

Stock Price $10.36

Average Dividend Growth 0.08333333333

Estimated Dividends Per Share $0.20

Cost of Capital Equity 0.1088383526

Derived Value $8.49

The two models affirm the potential overvaluation of the stock price. These prove that the stock price is not cheap despite the continued decline. As such, there may be a 20-26% downside in the next 12-24 months if the financials stay that way.

Bottomline

REV Group, Inc. is faced with challenges in its supply chain in the F&E segment. But, RV remains its cornerstone to stabilize its core operations. It remains promising as the demand for RVs and camping goes up. Also, it remains liquid, showing it can cover its operations, borrowings, and dividends. The company may also rebound, but inflationary pressures may continue to hamper it. Meanwhile, the stock price is relatively lower but not a bargain. Investors must still consider the potential overvaluation. The recommendation is that REV Group, Inc. is a hold.

Be the first to comment