Samuel Corum/Getty Images News

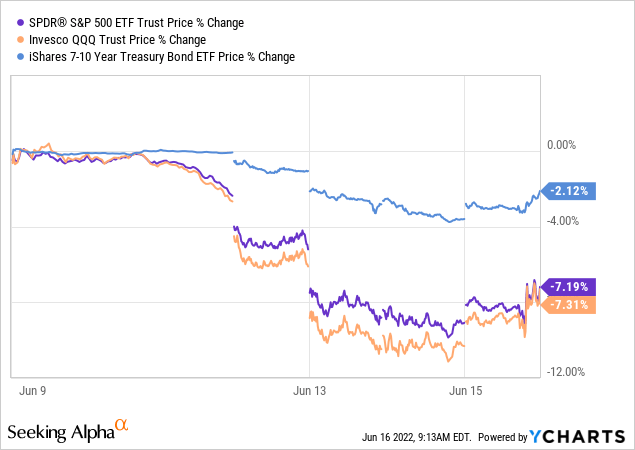

After the two-day FOMC meeting, the committee announced a ¾ percent increase of the Fed funds rate. It appears the market had started discounting a hike of that magnitude in the days leading up to the event as rates went up, and stock markets were down for several days in a row.

I currently follow the FOMC committee with great interest because I hold short bond positions and would like to have a good idea of when to take off equity hedges of my portfolio. I’m not sure the time to give up on these positions is now.

In the press conference following the FOMC announcement, Powell sounded highly determined on the subject of inflation. At the same time, he did not seem all that concerned about financial conditions or even unemployment.

The key to FOMC policy and likely FOMC future policy is how the committee thinks about inflation and why it is important to combat it.

They make it abundantly clear current inflation is far too high, and no one is disputing that. Powell also made it clear he’s aware that the Fed can’t really impact inflation driven by energy and food prices. These are major components of headline inflation. The Fed likes to talk about core inflation, excluding the above categories, because their policies have a larger impact there.

At the same time, Powell also realizes and spelled out in this press conference, that non-finance nerds don’t care about the difference between components of inflation and what the Fed can influence. If there’s high inflation, no matter the source, it is likely people start extrapolating that trend. Inflation expectations are then getting baked into the economy. Powell seems pretty horrified about that idea.

I’m reading between the lines a little bit but it appears to me; that he’s willing to slam core inflation hard if need be. His goal is to get inflation expectations down. I almost view yesterday as a “whatever it takes” type of moment (Mario Draghi’s famous words at a 2012 ECB meeting). He seems willing to overcompensate on monetary policy for what he realizes could be short-term inflated energy and food prices as well as the impact of supply chain problems.

Various commentators are arguing that’s a mistake because you potentially end up with the worst kind of outcome; you get a recession, AND you’ll still be left with fairly high inflation (because you simply don’t impact the supply side). Powell is obviously aware of that danger. He acknowledges the Fed is in a very tough situation but simply seems to put a very high value on getting inflation expectations under control.

It helps that the FOMC members view the economy as very strong. They see strong consumer spending and GDP actually picking up. They see somewhat of a slowdown in business investment and housing. Powell literally said he’d like to see demand moderating and more or less literally said he wants lower demand for employees. That’s surprising because the Fed has a dual mandate in price stability and employment. However, Powell believes price stability is essential to realize the highest levels of average employment. He seems willing to sacrifice jobs in the short term to have more jobs over the long term.

My interpretation of Powell is different from the market in that I see him being potentially more aggressive in the short term. The higher inflation remains, the more he’ll put the pedal to the metal. If the Fed drives the economy in a recession (which they don’t expect, but the market seems pretty adamant about it), I’m not sure that’s going to slow them down absent a decrease in inflation. Naturally, a recession is likely to curb inflation. However, this relationship can’t be relied on entirely because high energy prices (due to supply disruptions) and food prices combined with supply chain issues may levitate inflation even as the economy cools. That would be a fairly horrible scenario. It is not my base case but is clearly a possibility.

One of the most vulnerable asset classes seems to be high-yield and maybe investment-grade bonds. It is not free to short these asset classes. There is quite a bit of carry associated with these. However, they have duration risk and credit risk. I’m thinking about the credit risk coming into play as interest rates rise. Imagine the economy cooling and the Fed, for the first time in 14 years, not letting up. Revlon (REV) is an example of a company that just filed for Chapter 11. Bankruptcies have been few and far between in the last few years. As a result, I like and am short iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and SPDR Bloomberg Barclays High Yield Bond ETF (JNK).

I’m also keeping my hedges by shorting the S&P 500 (SPY). I call it a hedge because I have a greater amount of U.S.-centric equity long positions. I’m also interested in re-adding a hedge on Nasdaq (QQQ) in the coming weeks. Finally, I’m also long rates of the 5-year, 10-year and 30-year through futures. Similar positions are to short treasury ETFs like, for example, the iShares 20+ Year Treasury Bond ETF (TLT) and iShares 7-10 Year Treasury Bond ETF (IEF).

I want to add the caveat that I’m carefully monitoring how the real economy seems to develop by listening to companies, looking at the data, and following FOMC members. To me, the key here is not economic growth but how headline inflation is developing. As soon as it is clearly abating, as evidenced through multiple data points and by common sense interpretation of what’s happening in the world, Powell may find space to let his foot off the pedal. That’s when these positions become much less attractive.

Be the first to comment