Richard Drury

Introduction

I first covered Leggett & Platt (NYSE:LEG), the diversified consumer products company probably best known for its bedding products, in early February 2022, when the stock was still trading in the high $30 range. In the article, I argued that the company’s resilience during the COVID-19 pandemic and its ability to maintain its dividend during truly unprecedented times were two key reasons that Leggett qualified as a solid long-term investment despite its cyclicality.

After three quarters, the stock has returned -12.8% so far, still beating the S&P by a hair, but still miserable. However, one could argue that the world was a very different place nine months ago, as Russia had not yet invaded Ukraine and the ensuing energy crisis was not yet foreseeable. Nor were markets yet convinced that the Federal Reserve would raise interest rates at the pace to which we have now become accustomed.

Leggett reported its third quarter results on Oct. 31, and in this article I will give my thoughts on the company’s recent performance and, in particular, whether the dividend is still safe, given the apparent weakness in cash flow. A dividend cut, or a significant reduction, would obviously deal a fatal blow to my investment thesis.

A Deteriorating Macroeconomic Outlook, Increasingly Less Disposable Income And Operational Inefficiencies

The main reason LEG did not drop significantly after the release of the third quarter results is that management had already lowered its full-year guidance on Oct. 10 – when the third quarter had already been completed.

Sales guidance was lowered to a midpoint of $5.15 billion, representing 1.6% year-over-year growth, while management had originally expected revenue growth of 4.5% over the company’s historically best year. It seems worth noting that the guidance includes revenue attributable to recent acquisitions which were, however, longer planned as they were already included in the original guidance issued in February. In the third quarter, Leggett acquired a leading global manufacturer of hydraulic cylinders for heavy construction equipment with annual sales of about $65 million and two textile companies with combined sales of about $15 million to $20 million. Together, they will contribute about 1% of sales in 2022, which should roughly double in 2023 due to consolidation in the second half of 2022.

The earnings per share revision was more pronounced at -13% and is attributable to lower production, slower than expected cost recovery in the automotive segment, operational inefficiencies and, of course, lower volumes than previously expected. Cash flow from operations also will be far below the originally expected midpoint of $575 million, at only $400 million to $450 million. However, free cash flow is unlikely to decline at the same rate as the company has returned to cost-cutting programs, as evidenced by expected capital expenditures of $115 million for the full year, down from $150 million originally. Earlier, during the second quarter earnings conference call, Leggett & Platt management explained that there’s still plenty of room for cost savings without impacting operating performance.

Management sees a deterioration in consumer sentiment and lower discretionary income, but also attributes the weak performance to higher inventories (a problem experienced by most, if not all, cyclical companies coming out of the pandemic). As a manufacturer of mostly durable goods, it’s understandable that Leggett is among the first to report weaker results – it’s relatively easy to postpone purchases of such goods, especially from the perspective of consumers.

A Closer Look At Leggett & Platt’s Segments After Q3

As Leggett predominantly manufactures durable goods, it’s hardly surprising that the company expects volumes in the Bedding Segment to decline in the mid-teens in 2022. In the third quarter, bedding segment sales fell 12% against a backdrop of a 20% decline in volumes due to continued weakness in demand – particularly in European markets. The decline in volume was partially offset by higher raw material-related selling prices and sales growth in the Steel Rod and Drawn Wire businesses. Of course, Leggett also is feeling the effects of the strong U.S. dollar, which reduced segment sales by 1 percentage point. No one is in a position to predict the extent of the looming economic downturn, but I believe the U.S. is in a much better position than the Eurozone, which is currently fighting windmills. In addition to current problems such as a hot war, an energy crisis, and runaway inflation, the European Central Bank (ECB) has maneuvered itself into a corner where southern countries are overleveraged and the institution therefore has limited options for raising interest rates. Also, the increasing emphasis on planned economy approaches (e.g., Green Deal and the resulting Taxonomy Regulation) is setting Europe up for continued high inflation rates and thus lower disposable incomes. While Leggett’s will certainly suffer from what I expect to be a severe economic downturn in Europe, it should be remembered that the company generates only 11.6% of its total sales in this region – more than 64% is still generated in the United States (p. 90, 2021 10-K).

Leggett’s Furniture, Flooring & Textile Products segment performed surprisingly well, and the company was able to offset volume declines (6% year-over-year) and currency impacts (-1%) with commodity-driven selling price increases, resulting in flat quarterly segment sales compared to the third quarter of 2021.

The Specialized Products segment (automotive and aerospace parts and hydraulic cylinders) is expected to post very healthy growth in the low double-digit percentage range in 2022, mainly due to the ongoing (but slower than originally expected) recovery from the pandemic. I discussed this aspect in my previous article on Leggett & Platt. The strong recovery is underlined by quarterly sales growth of 24% year-over-year, largely due to higher volume (+22%) but also to price increases (+5%). Currency effects were most pronounced in this segment at -8%, underlining the segment’s international focus. However, with revenues of $999 million in 2021, it’s Leggett’s smallest segment (19.7% of total 2021 revenues). The segment still lags behind pre-pandemic sales of $1.07 billion in 2019, and it should also be noted that Leggett has acquired businesses consolidated in this segment since 2019, so the comparison should not be viewed on a like-for-like basis (pp. 7 f., 2021 10-K).

Overall, Leggett was able to largely offset declining volumes through price increases, but operating profit will still be lower than previously expected. For the full year, management now expects an EBIT margin in the range of 9.5% to 10.0%, about 100 basis points lower than originally expected in February (p. 3, 2021 full-year earnings release). Leggett has never been a particularly strong company in terms of gross margin, but admittedly it’s run very efficiently and management has good control of costs. The team is very experienced and has successfully weathered several recessions. Leggett is occasionally criticized for still not performing optimally since its bold acquisition of Elite Comfort Solutions in 2019. I take a different view because, first, the company has been fighting windmills (pandemic, lockdowns, supply chain issues, inflation, workforce shortages) since 2019, so the true underlying results may not be fully visible. More importantly, however, ECS and the subsequent acquisition of Kayfoam in the second quarter of 2021 have made Leggett a vertically-integrated manufacturer of bedding products, putting the company in a very good position in an increasingly deglobalized world.

With Lowered Cash Flow Expectations – Is LEG’s Dividend At Risk Of Being Cut?

LEG is clearly an income play. L&P has always been a cyclical company, and capital gains are hard to come by. Investing in cyclical companies requires a lot of patience and the willingness and courage to buy when others are running for the hills. That way, substantial yields on costs can be locked in, which represent the major return potential of an investment in such a stock. Thus, to prove an acceptable long-term investment, it’s of utmost importance that management is committed to paying dividends even in stormy times, but of course the company also must generate sufficient free cash flow. Moreover, cyclical companies need an adequate amount of liquidity in tumultuous times, not only to finance investments, e.g. in working capital, but also to pay the dividend until free cash flow returns to normal levels.

As to the first aspect, the reader need only listen to almost any Leggett & Platt conference call, for example, the most recent one:

Our priorities for use of cash are unchanged. They include an order priority, funding organic growth, paying dividends, funding strategic acquisitions and share repurchases with available cash. […] At an annual indicated dividend of $1.76, the yield is 5.3% based upon Friday’s closing price, one of the highest among the dividend kings.

– Jeff Tate, CFO of Leggett & Platt

In my opinion, there’s nothing to add here – it’s very rare for management to highlight the dividend like this, while also referencing the current yield and dividend king status. At Leggett & Platt, however, this is the norm.

In the first nine months of 2022, the company failed to fully cover its dividend, paying out $170.8 million to shareholders while generating only $128.8 million in free cash flow, not even including $59.5 million in acquisitions (net of divestitures). In addition, management opportunistically repurchased shares for $60.3 million.

This significant net cash outflow seems scary at first, but it should be kept in mind that Leggett has increased its working capital by $214.9 million so far in 2022. While inventories are down slightly, receivables are up $79 million and payables are down $101 million, compared to year-end 2021. It seems only reasonable to expect receivables to decrease and payables to increase in the fourth quarter, resulting in a net increase in cash flow from operations. According to management, Leggett’s free cash flow in 2022 is likely to be only about $310 million, already factoring in lower expected capital expenditures of $115 million, resulting in a payout ratio of 73%, or 81% if the lower end of management’s guidance is used. From this perspective, the dividend is not at risk, and the fact that management has repurchased a significant number of shares and acquired three companies says a lot about the capacity of the company’s balance sheet. It’s important to understand that unlike many larger companies, management of LEG has acted prudently and opportunistically when buying back shares, as I discussed in my previous article.

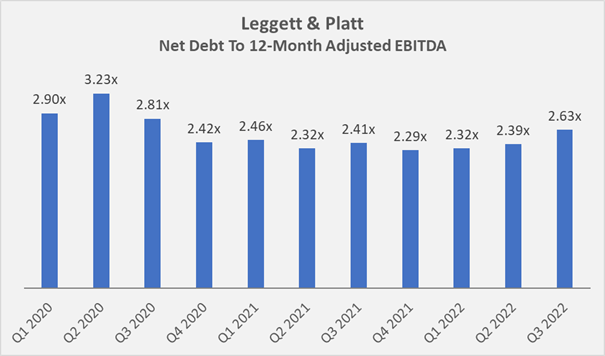

Finally, it seems worth noting that even after the recent acquisitions and share repurchases ($120 million combined), Leggett’s leverage ratio is still very moderate (Figure 1).

Figure 1: Leggett & Platt’s leverage ratio in terms of net debt to 12-month adjusted EBITDA (own work, based on the company’s Q1 2020 to Q3 2022 earnings reports)

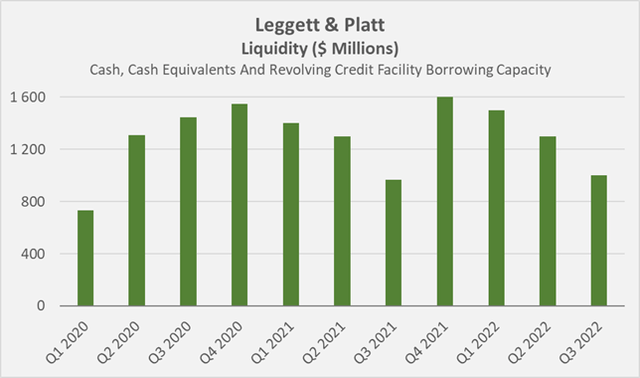

Since the company’s leverage ratio is still far from violating the debt covenants (which I discussed in detail in my last article), Leggett can be expected to continue to draw on its line of credit. The company has a strong liquidity position, as shown in Figure 2.

Figure 2: Leggett & Platt’s cash, cash equivalents and borrowing capacity under its revolving credit facility (own work, based on the company’s Q1 2020 to Q3 2022 earnings reports)

Quick Investor Takeaway

Leggett & Platt reported third quarter results that I consider robust for such a cyclical company that is heavily dependent on durable consumer products such as mattresses and furniture. Management lowered guidance ahead of the earnings release, which was hardly surprising given what has happened since the full year 2021 results were released in early February 2022. The company’s well thought-out product mix adds a lot of stability to the portfolio, and Leggett’s bold efforts to become a vertically-integrated bedding manufacturer will pay off in an increasingly deglobalized world. The dividend is safe not only from a full-year free cash flow perspective, but also after a review of the company’s solid liquidity position, which has been further strengthened post-pandemic thanks to improved debt covenants. Finally, the fact that the experienced management team spent $120 million on share buybacks and acquisitions in addition to the dividend, at a time that should be considered very difficult, speaks to management’s confidence in the business and its commitment to return cash to shareholders.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment