adventtr

If Select Energy Services (NYSE:WTTR) successfully integrates the recent acquisitions announced in 2022, in my view, the stock price will likely trend north. I also believe that the current balance sheet would allow further M&A activities, which would imply a valuation of close to $25 per share. In any case, under two of my three case scenarios, WTTR appears significantly undervalued by the market. Even considering the risks from concentration of assets in North Dakota and potential changes in the regulation, Select Energy Services is a stock to follow carefully.

Select Energy Services: A Lot Of Acquisitions And A Stock Repurchase Program

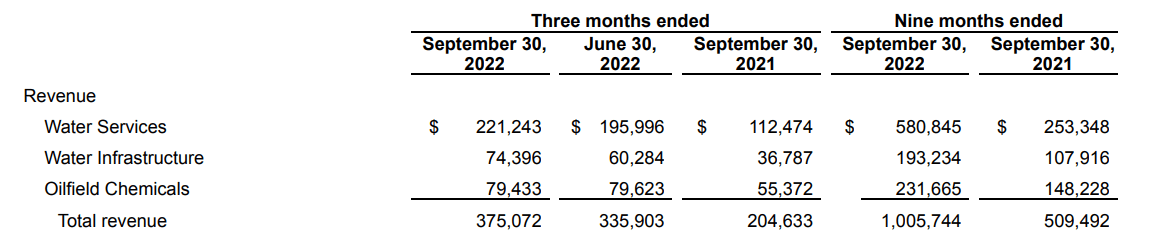

The company offers different services for energy producers including water services, water infrastructure, and chemicals.

Source: 8-k

Most of the revenue is generated in the Permian, but the company also operates in South Texas, the Rockies, and other regions. I believe that diversification is an asset for Select Energy Services.

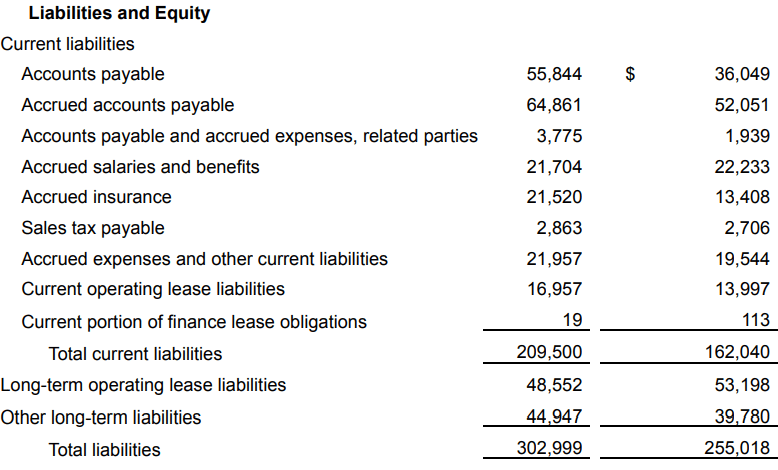

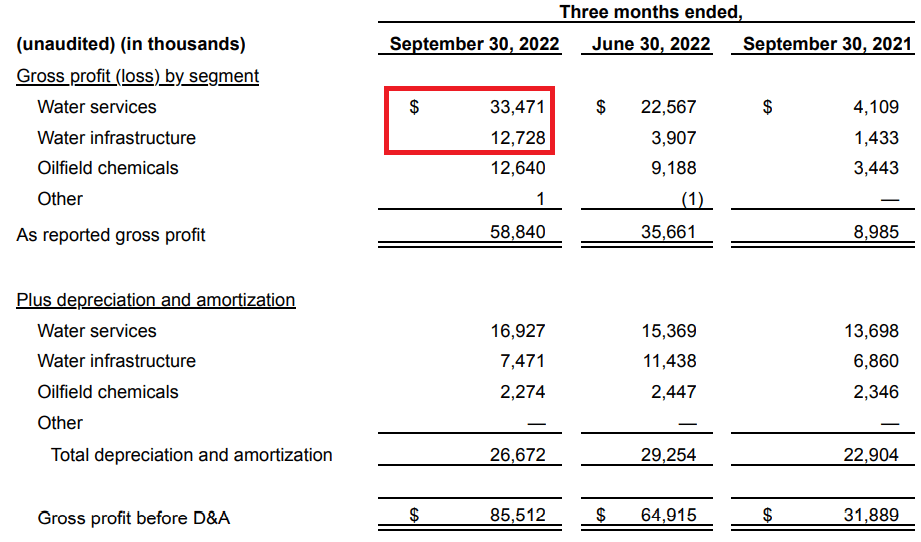

In the last quarter, quarterly revenue grew by 12% q/q. It is also worth noting that significant EBITDA margin is expected thanks to M&A activity, and cost synergies. Let’s keep in mind the acquisition of Breakwater, and that of Cypress.

With these additions, we have meaningfully enhanced our Water Infrastructure and Water Services footprints. We expect to see immediately accretive benefits from both acquisitions and believe we have a meaningful opportunity to invest organically around the acquired operations and asset footprints as well.

Looking at the fourth quarter of 2022, the Company expects to see relatively steady revenue and gross margins before D&A, as partial quarter contributions from Breakwater partially offset normal seasonal impacts to the base business. Source: 8-k

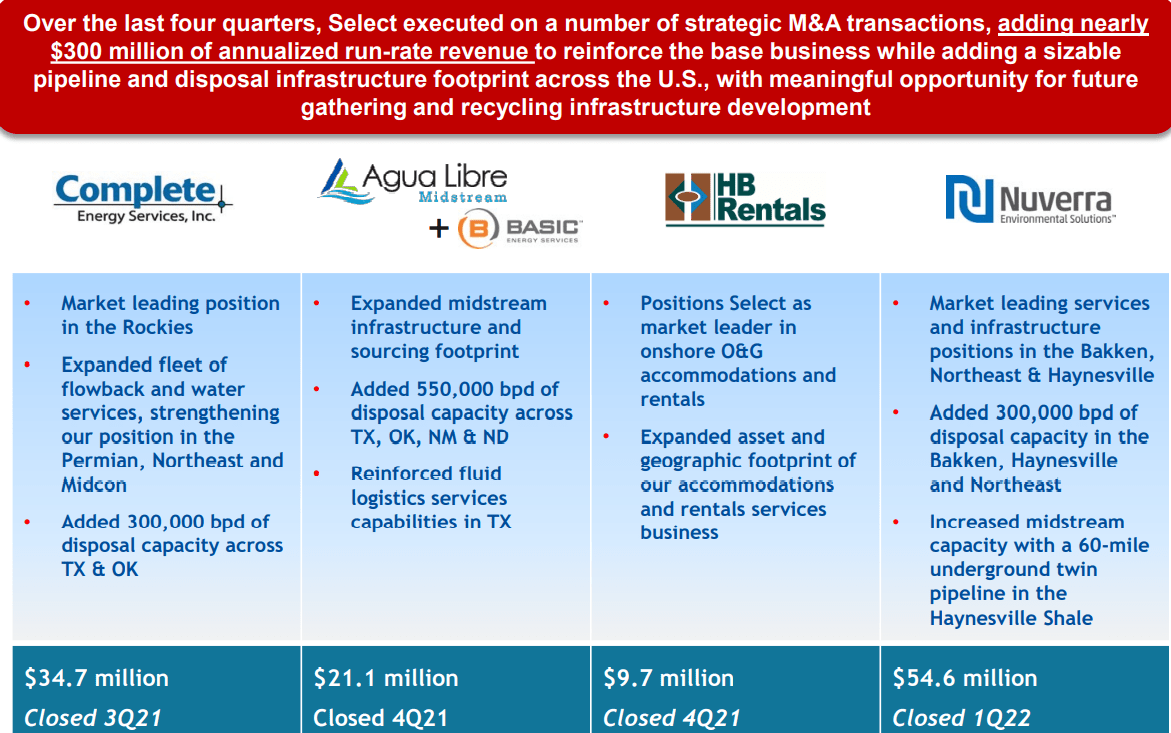

Select reported close to $300 million of annualized run-rate revenue thanks to M&A activities. In my view, in the future, if banks support more M&A activity or larger transactions, revenue growth could accelerate even more.

Source: Investor Presentation

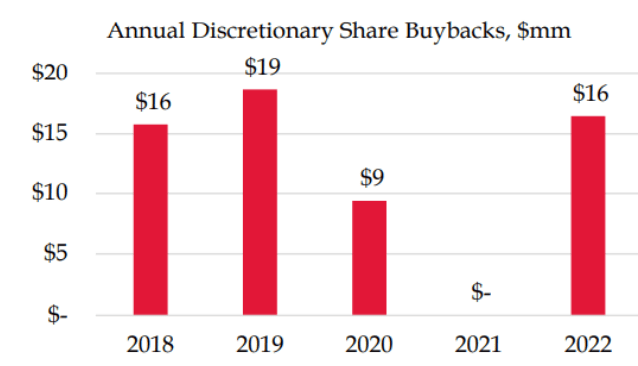

I also believe that investors will likely appreciate the stock repurchase program enacted by Select Energy Services. The annual discretionary share buybacks were worth $16 million for 2018, $19 million for 2019, $9 million for 2020, and $16 million in 2022.

Source: Investor Presentation

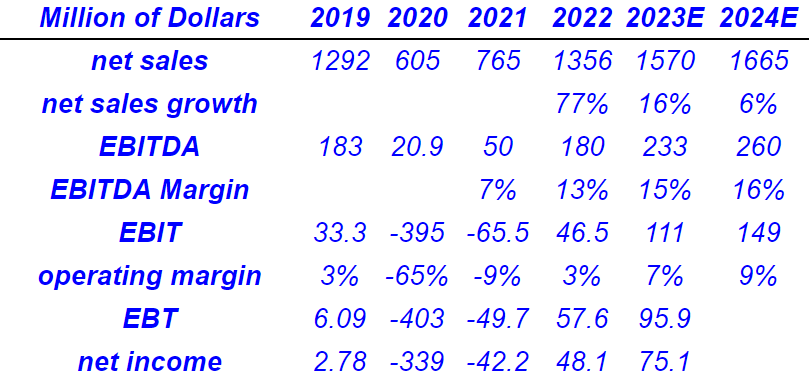

Estimates Include 16% Sales Growth In 2023, 16% EBITDA Margin In 2024, And Positive Net Income In 2023

Analysts believe that Select Energy Services could present, by 2024, net sales of $1.665 billion, with net sales growth of 6%. The company could report EBITDA of $260 million, with an EBITDA margin of 16%. In addition, 2024 EBIT would stand at $149 million, with an operating margin of 9%. 2023 net income would stand at $75.1 million.

Marketscreener.com

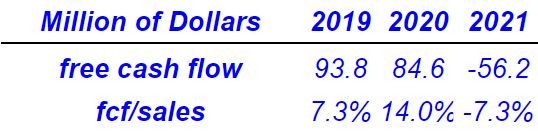

Finally, I couldn’t find information about the expected free cash flows for 2023 and 2024. However, 2020 FCF was equal to $84 million, and 2019 FCF was $93 million. With these financials in mind, in my view, management knows well how to deliver cash flow. I don’t see why this would not happen again in 2023 and 2024.

Source:SA

No Debt And Healthy Balance Sheet

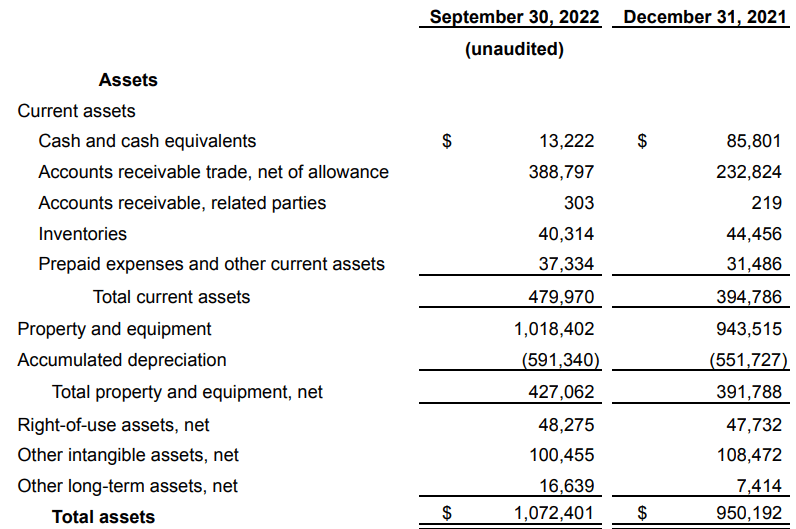

As of September 30, 2022, Select Energy Services reported cash worth $13 million, accounts receivables of $338 million, property, plant and equipment of $1 billion, and total assets worth $1.072 billion. With an asset/liability ratio close to 3x, in my view, the balance sheet looks in good shape.

Source: 8-k

Select Energy Services does not report financial debt, which appears beneficial. Total liabilities stand at $302 million, with long-term operating lease liabilities worth $48 million and current operating lease liabilities of $17 million.

8-k

The total debt is zero. Besides, Select Energy Services noted that liquidity may be higher than the total amount of cash in hand. Keep in mind the company’s revolver borrowing base of $220 million. In sum, if Select Energy Services decides to acquire a competitor, banks would most likely offer debt financing.

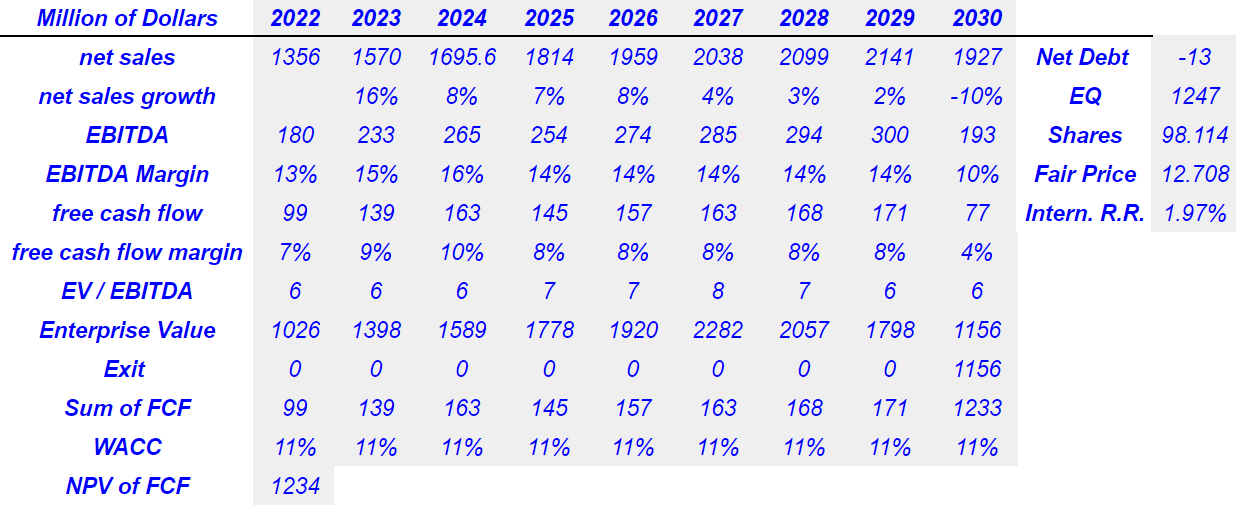

My Base Case Scenario Implied A Valuation Of $12 Per Share

I believe that the fact that Select Energy Services is mainly focused on the management of water and water logistics will most likely help find new clients. It means that many people inside the organization are studying how to make water logistics more efficient and profitable.

Source: 8-k

Under this case scenario, I also assumed that Select Energy Services will successfully obtain operational synergies. Besides, M&A integration would successfully deliver revenue growth and new service lines in the coming years. Let’s note that in this case, I didn’t include new acquisitions of competitors.

I forecast, for 2030, a net sales of $1.927 billion, with a net sales growth of -10%. I estimate EBITDA of $193 million, with an EBITDA margin of 10%. The free cash flow will likely be $77 million, with a free cash flow margin of 4%.

I also assumed an EV/EBITDA of 6x, which implies an enterprise value of $1.156 billion. In addition, the sum of FCF in 2030 would stand at around $1.2 billion. With a WACC of 11%, the net present value of FCF would stand at $1.2 billion. Finally, with a net debt of -$13 million, the equity valuation would be $1.2 billion, and the fair price would be $12 with an internal rate of return of 2%.

Bersit’s DCF Model

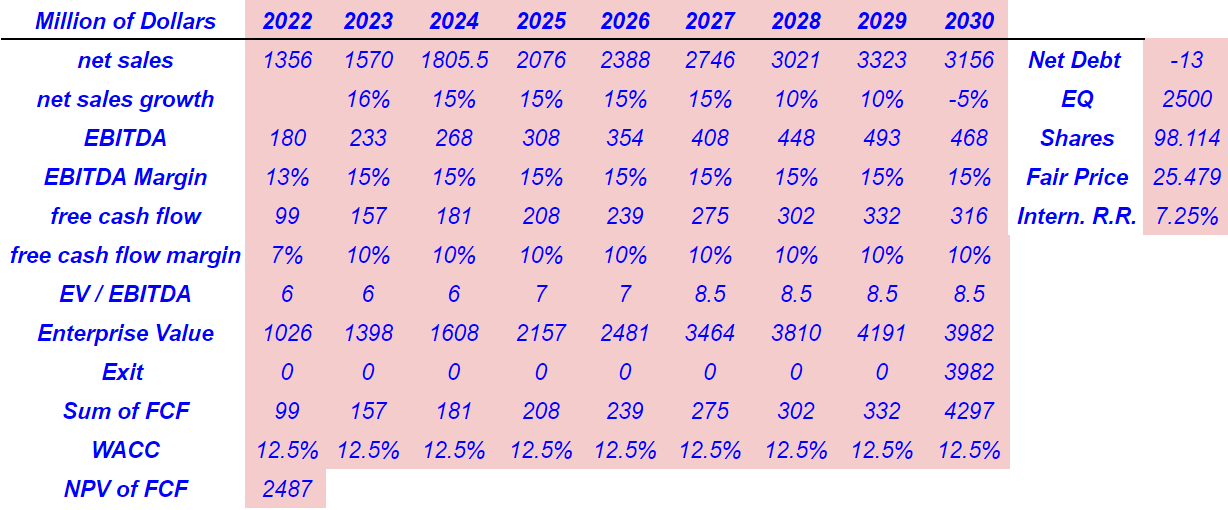

My Best Case Scenario Would Include More M&A Activity

Under my best case scenario, Select Energy Services would successfully integrate the new businesses acquired. I also assumed that management may find new businesses to acquire. As a result, the revenue growth will be significantly higher than that in the previous case scenario. I believe that my figures in this case scenario are achievable because Select Energy does report a balance sheet, which would allow new M&A activity.

Under this case scenario, I estimate that by 2030 the total net sales would be $3.1 billion. I also forecasted an EBITDA of $468 million, with an EBITDA margin of 15%. 2030 free cash flow would stand at $316 million, with a FCF margin of 10%.

If we assume a 2030 EV/EBITDA of 8.5x, I obtained an enterprise value of $3.9 billion. In addition, the WACC would stand at 12.5%, the net present value of future FCF would be $2.487 billion, and the equity valuation will likely be close to $2.5 billion. Finally, along with a fair price of $25, the internal rate of return would stand at 7%.

Bersit’s DCF Model

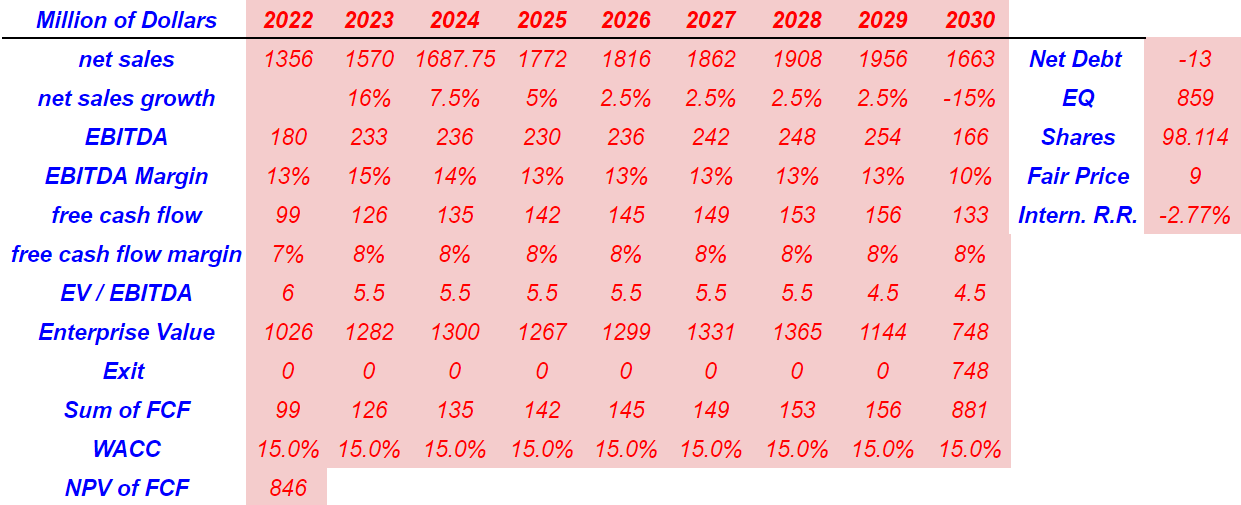

Select Energy Services Could Suffer From Concentration Of Water Services In North Dakota And A Decrease In The Expectations Of Oil And Gas Prices

Select Energy Services will report more revenue if clients make more capital expenditures. If clients believe that future oil and gas prices would decline in the near future, future capex would most likely decline. Besides, clients in the oil and gas industry may not have access to debt financing or equity financing, which may lower capital expenditures too. Under this case, I assumed that some of these factors would diminish the company’s revenue line.

Capital spending is generally dependent on our customers’ views of future demand for oil and gas and future oil and gas prices, as well as our customers’ ability to access capital. While initial customer budget indications for 2022 are generally positive, factors outside of our control can alter these budgets, or lead customers to underspend their budgets. Source: 10-k

Select Energy Services may also have certain exposure to changes in local laws and regulations mainly in North Dakota, where the company has a certain concentration of water permits. Management also noted that industrial accidents or labor difficulties could happen in these territories. In this regard, the following lines were reported in the most recent annual report.

The concentration of our water permits and significant infrastructure assets in North Dakota also increases our exposure to changes in local laws and regulations, including those designed to protect wildlife and unexpected events that may occur in this region such as seismic events, industrial accidents or labor difficulties. Source: 10-k

Under this case scenario, for 2030, I obtained the following figures. With 2030 net sales of $1.6 billion, I also obtained 2030 net sales growth of -15%. I obtained EBITDA equal to $166 million, together with an EBITDA margin of 10%. Free cash flow would stand at $133 million, with a FCF margin of 8%.

If we assume an EV/EBITDA of 4.5x, the 2030 exit would be close to $748 million. Besides, with a WACC of 15%, I forecast a net present value of future FCF of $846 million and an equity valuation of $0.89 billion. Finally, if we also include a share count of 98.114 million, the fair price would be close to 8.9 per share along with an IRR of -2.7%.

Bersit’s DCF Model

Conclusion

Select Energy Services delivered significant revenue growth thanks to inorganic growth. I believe that the current balance sheet would allow many more acquisitions in the coming years. In any case, if the recent acquisitions are successfully closed, I would expect a fair price that is significantly higher than the current market price. There are obviously risks from a decrease in the expectations of oil and gas prices and the changes in the regulations. With that, I do believe that Select Energy Services is undervalued.

Be the first to comment