resulmuslu/iStock Editorial via Getty Images

Introduction

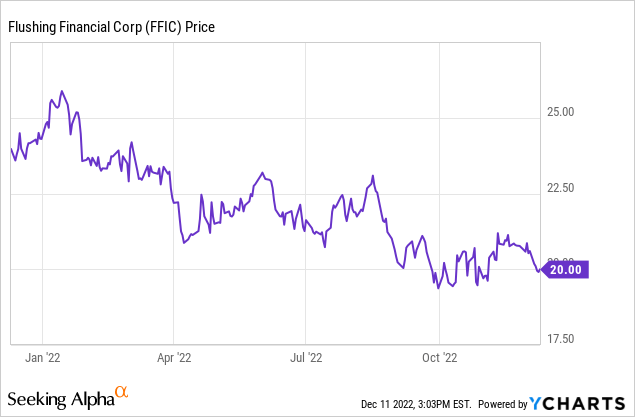

As it has been over six months since I last discussed Flushing Financial (NASDAQ:FFIC) here on Seeking Alpha, I feel an update is warranted as a lot has changed in the banking landscape over the past six months. Interest rates are on the rise and this has had a very negative impact on the value of the securities available for sale of most of its peers, Flushing has actually done an amazing job at keeping the impact on its book value and tangible book value limited. This article is meant as an update to previous articles which you can read here and here to get a better understanding of the bank.

The Q3 results show the impact of increasing interest rates

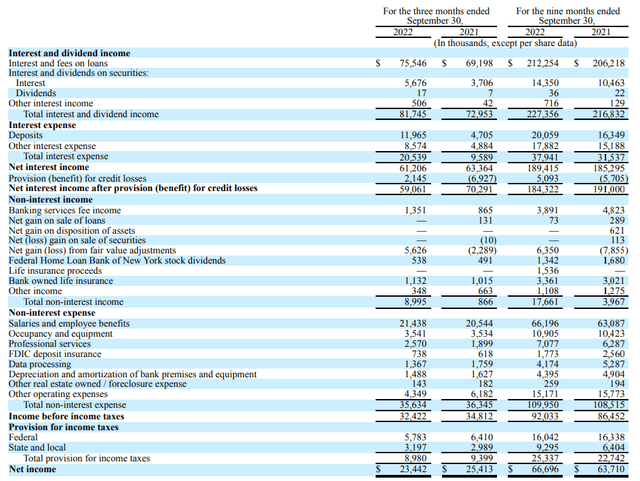

During the third quarter, Flushing Financial reported an interest income of almost $82M, that’s an increase of approximately $9M compared to the interest income in the third quarter of last year. Unfortunately the interest expenses more than doubled which resulted in a 2.5% decrease in the net interest income.

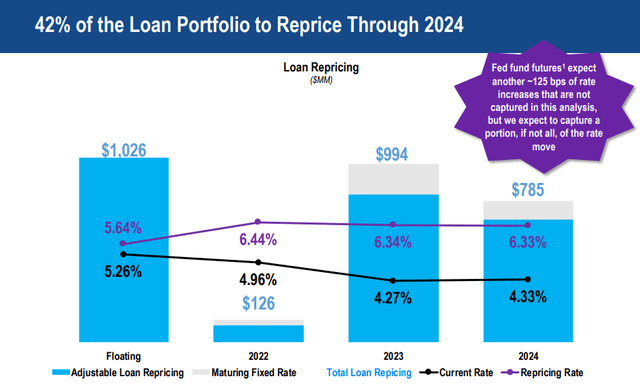

That’s still nothing to be too worried about as I expect the net interest margin to slowly increase again from the 2.96% reported in the third quarter of this year. As you can see below, the average interest rate on the loan portfolio will continue to increase as FFIC estimates about 42% of the loan portfolio will be repriced between now and the end of 2024. This should increase the interest rate by – on average – 200 basis points based on the September index values, and likely even higher if the Fed continues to hike rates.

This is where it gets interesting. We know the loan book stands at $6.9B and 42% of that amount represents $2.9B. If we apply a 200 basis point interest rate increase on these loans (assuming a 225 bp increase on the 2023 and 2024 repricings and about 75 basis points on the floating rate loans), the net interest income will increase by $58M per year or almost $15M per quarter and that would provide a major boost to the net interest income and the net income. So while the decreasing net interest margin is a disappointment, this should be temporary as the average interest income will slowly increase. And I can be patient.

The total net non-interest expenses were just over $26M resulting in a pre-tax and pre-loan loss provision income of $34.5M. Flushing Financial had to put $2.15M aside in loan loss provisions resulting in a pre-tax income of $32.4M and a net income of $23.4M for an EPS of $0.76. Needless to say that a $14M pre-tax income increase on the back of repricing the loans could actually help to push the quarterly EPS to in excess of $1/share. But it will take some time.

Flushing Financial currently pays a quarterly dividend of $0.22 for a dividend yield of 4.4%. And considering the payout ratio is just under 30%, the dividend is considered pretty safe.

Despite having $800M in securities available for sale, the fallout remains limited

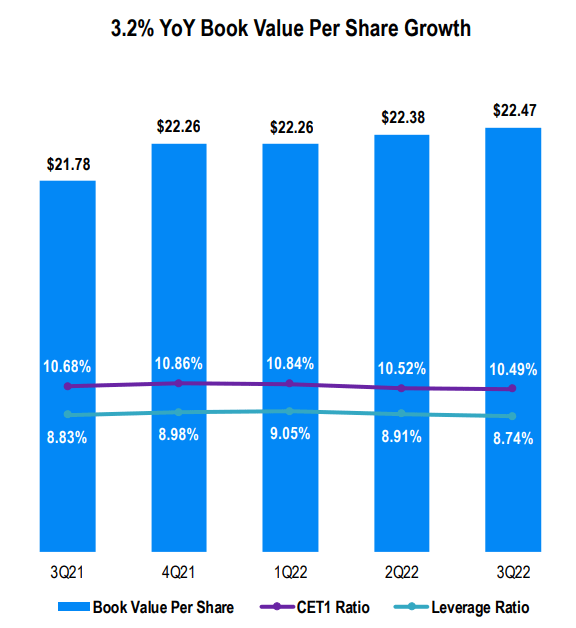

One of the main elements why I like Flushing Financial is its ability to protect its book value. The increasing interest rates have a substantial negative impact on the book value of the bank as higher interest rates result in a lower market value of those securities.

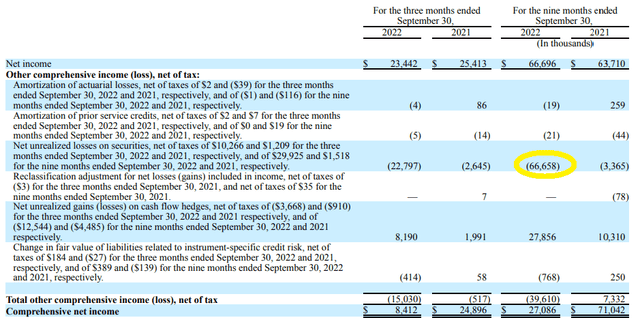

The value decrease is not recorded in the ‘normal’ income statement, but can be found in the so-called comprehensive income statement. Despite having a sizeable portfolio of approximately $800M in securities available for sale, the comprehensive income statement shows a loss of just over $66M which is pretty good.

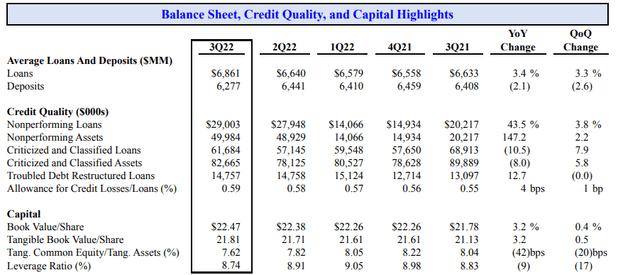

This also means the retained earnings almost fully compensated for the value loss of the portfolio of securities available for sale. As of the end of the third quarter, the TBV per share was $21.81, which was actually up from the $21.61 reported as of the end of last year.

This means the current share price of $20 represents a discount of approximately 8% to the tangible book value. And as the interest rate increases should decelerate from here on, I expect Flushing Financial to continue to increase its TBV per share from here on.

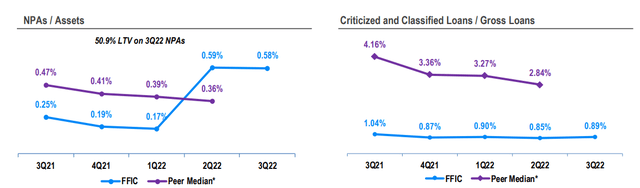

That being said, we need to keep an eye on the total amount of non-performing loans and assets which increased to respectively $29M and $50M. I’m not too worried about the total amount of non-performing assets (which stood at 58 basis points) as the company disclosed on its conference call the average LTV ratio of these assets is just 51%. This means Flushing Financial should be able to keep the damage limited and recoup most of the money at risk.

Not only is the LTV ratio quite low, the coverage ratio of the non-performing loans is approximately 142%. It explains why FFIC had to add a few million dollars to its total provision, but it should be manageable. The capital ratio also remains pretty robust with a quarter-end CET1 ratio of 10.49%.

FFIC Investor Relations

Investment thesis

Flushing Financial is getting pretty interesting at its current share price. While some loans are in default, the low LTV ratio should help Flushing to avoid massive losses on those loans. The net interest margin should start to increase from either this quarter or next quarter on as a bunch of loans will be repriced next year.

I like the bank’s earnings profile, its discount to the tangible book value and the very low LTV ratio on the real estate portfolio which came in at less than 37% at the end of the quarter. And the 4.4% dividend yield is a nice compensation to wait for the share price to increase.

Be the first to comment