AntonioSolano

Description

I recommend going long on MarketWise (NASDAQ:MKTW). MKTW is a platform for subscription services with many different brands. The company aims to empower retail investors by providing them with institutional-quality research at affordable prices, and has invested in customer relationship management systems and artificial intelligence to grow its number of subscribers. I believe MKTW is well positioned to continue capturing the new wave of retail investors that are set to come onboard in the future.

Company overview

MarketWise, Inc. is a platform for subscription services with many different brands. The company offers a subscription-based business platform that gives its customers access to high-quality financial research, applications, training, and resources. MarketWise’s primary market is American consumers.

Retail participation in the stock market is real and growing

Retail investors have always looked to traditional investment managers for guidance, and they continue to do so today. However, over the past two decades, retail investors have become more active in managing their own accounts. Multiple factors are contributing to this development, in my opinion. Following the financial crisis of 2008, investors grew increasingly wary of traditional financial institutions and their advisors. Meanwhile, the rise of online trading and the availability of financial information via the Internet have empowered individuals to take charge of their own financial futures and invest autonomously. Additionally, investors can now make trades for free or at a very cheap cost thanks to online brokerage platforms, which have reduced the cost of managing a personal trading account.

In my opinion, these elements have amplified the drive for individual investors to take charge of their portfolios. Individual investors who wish to manage their own portfolios but lag behind market benchmarks often consult with financial advisors in order to catch up. Increasing numbers of people are taking charge of their financial futures by investing on their own, which has led to a surge in interest in investment advice, training, and market data.

Additionally, a major demographic shift is underway. Around 1 in 5 Americans are 65 or older. And with roughly 10,000 Americans reaching retirement age every day, that population is growing rapidly. Large retirement funds are vital to the daily lives of many of these people. Additionally, there has been a rise in interest in investing among the younger generation. Seventy-two percent of millennials consider themselves “self-directed” investors, per the MKTW prospectus. Since Millennials’ disposable income and savings are expected to increase in the coming years, I think MKTW can capitalize on this demographic shift and expand their business.

MKTW empowers retail investors

MKTW brands are run by seasoned analysts who use a unique set of investment techniques and tenets. It’s a smart move on MKTW’s part to take this tack, as it suggests that the publication publishes a variety of viewpoints, suggestions, and plans rather than a single, unified one. In my opinion, the subscribers of MKTW would benefit greatly from this strategy because of the increased diversity of options it presents through its use of multiple franchises.

In reality, individual investors do not have the same access to resources and funding for research as institutional investors. Therefore, I think it’s important to provide retail investors with institutional-quality research at affordable prices. Traditional institutional research is much more expensive and inaccessible than MKTW’s alternatives. They are written with the intention that subscribers who are not finance professionals will be able to understand the content. Additionally, the products feature helpful, high-quality content.

I believe MKTW’s subscribers will become better investors over time, renew their subscriptions, and become loyal customers if the company keeps publishing research to help them succeed in the financial markets. MKTW has maintained a stable customer base over the course of its 20 years in business, providing strong evidence in support of the claim.

Data-backed go-to-market strategy to grow number of subscribers

To better reach its target audience, MKTW has invested heavily in customer relationship management [CRM] systems across the company, artificial intelligence [AI] for subscriber data analysis, and a comprehensive database of customer details. This allows MKTW to track and record how customers react to various marketing initiatives, down to the level of individual ads. Based on this tried-and-true method, MKTW has created its own unique customer acquisition practices that, in my opinion, make it stand out from the competition.

This reminds me of the virtuous flywheel effect, as MKTW builds relationships with its customers by learning more about their product preferences, customer service experiences, and thoughts on both free and paid offerings. This information is then used by MKTW to provide a better service to customers and provide recommendations for additional products that the subscriber is more likely to be interested in.

In essence, MKTW’s expansion will allow them to better gauge the preferences of their subscribers and other retail investors, allowing them to better anticipate which products will be the most successful. As a result, this provides a substantial competitive advantage:

- With this, MKTW could improve its subscriber base and keep more of its current audience.

- Money could be saved by MKTW by reducing the number of “trial and error” launches of products that subscribers might not want.

Strong track record of M&A to accelerate growth

Through both internal growth and strategic acquisitions, MKTW has steadily increased its content catalog, brand recognition, and subscriber base. For example, since acquiring TradeSmith, Bonner and Partners, Carey Research, and Investor Place, MKTW has seen substantial growth in billings across the board.

While I expect MKTW to maintain its emphasis on organic growth through the recruitment of top-tier content creators and marketers, I do think that the company’s going public marked a turning point in its approach to mergers and acquisitions. In addition to raising MKTW’s profile and reputation, by being a public company, it gives the company access to much needed public currency, which can be used to fund larger acquisitions.

Stock price has been massively beaten down

The stock chart shows that MKTW’s price has dropped significantly over the past 12 months. The fastest increase in interest rates in a decade has been a major factor, as many retail investors are experiencing the market’s “bubble burst” for the first time. This narrative has influenced MKTW in a significant way.

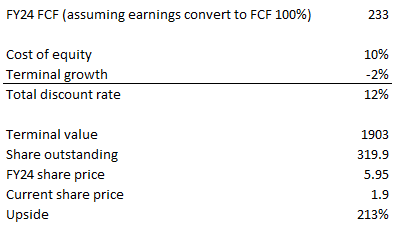

It seems to me that the stock price is already factoring in all of the bad news that can be written about the company and all of the negative expectations that investors can have. From here, any good news or change in growth trajectory could easily cause a huge swing in stock price. Assuming a bear case scenario where MKTW’s growth perpetually declines at 2% annually and its margin remains at 43% in post FY24, the stock is still worth $1.9 per share, or 2.13 times its current price.

Own estimates

3Q22 results discussion

Weak revenue and earnings were reported by MKTW in the third quarter as volatile markets continued to discourage retail investors from putting money to work. Even though I believe the next few quarters for MKTW will be volatile, I continue to be bullish on the stock because I believe the risk-reward is in MKTW’s favor due to the company’s deeply discounted valuation, spotless balance sheet, and robust cash flow generation. Though I anticipate the volatile investment sentiments to continue to dampen revenue growth in the near future, I am still confident that the business will rebound when market conditions improve. Due to its solid financial position and proactive cost management program, I have faith that MKTW will survive the NT storm.

Valuation

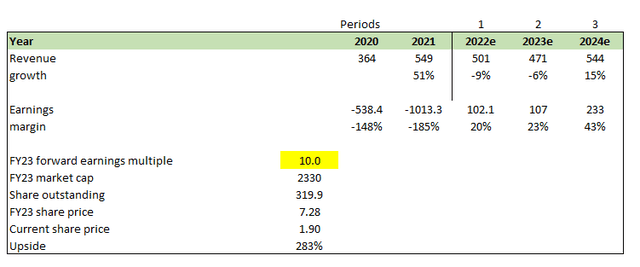

In my base case scenario, I believe MKTW is worth USD7.28/share in FY23, representing 283% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue will follow consensus estimates until FY24, where revenue will decline until FY23 before experience a recovery. This is fair as I believe the fear in retail investors will linger for a while, which makes them stop investing, until the next bull market starts.

- I expect MKTW to go into cost saving mode (i.e., reduce promotions) to generate as much cash as possible, hence, I believe margins should go up to similar level as what consensus estimated

- In terms of valuation, I am being very conservative by using a 10x forward earnings multiple in 2023, which is a multiple that is typically used for melting ice cube type of businesses.

Key Risks

Retail investing may never come back again

Even though I think the trend is strong and I’m hearing and seeing more retail investing going on all around me, I worry that the size and volume of retail trades may never return to their pre-recession highs because retailers may be more afraid of losing money again than anyone anticipates.

Competitive market

Given that most products on the market are “good enough” to serve retailers, it is difficult to offer a highly differentiated product offering. At some point, all of the product offerings would be similar, and I’m not sure how MKTW could differentiate itself from the competition other than by offering price discounts.

Summary

I recommend buying MKTW. MKTW is a subscription-based platform that provides retail investors with institutional-quality research at affordable prices. I believe MKTW is well positioned to capitalize on the growing number of retail investors in the future.

Be the first to comment