bjdlzx

We have been covering Oil & Gas stocks because, in our view, the future of markets will be partially backed by energy commodities. We are bulls of energy and specifically on smaller companies such as Devon Energy (DVN), W&T Offshore (WTI), and Vista Energy, S.A.B. de C.V. (NYSE:VIST), and we have covered these previously on Seeking Alpha in the past 10 days (See Devon Energy article and W&T Offshore article). Here we are going to lay out a bull argument for Vista Energy. If you don’t already have a similar company in your portfolio, this is a strong buy. Let’s look at what research is out there first.

Research on Vista Energy

Vista Energy has been covered well here on Seeking Alpha, from a recent article:

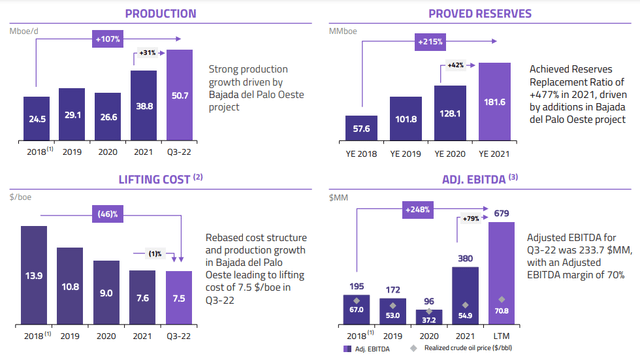

Vista Energy is one of Mexico’s largest independent oil and gas companies, not including the massive state-owned Pemex. Mexico is also a more prominent global oil producer and a net exporter. Of course, most of the company’s production is located in Argentina. In today’s precarious global oil market, Latin America’s status as a large producing region that is relatively free from US regulatory burdens and relatively neutral geopolitical stances make it a possible “haven” within the global energy market. Unlike most US oil companies, Vista has expanded production and reserves while decreasing per-unit costs over the past two years. See below:

Most US oil companies are currently experiencing some tightness as output growth stagnates and production costs soar with inflation. Vista’s position is far superior, continuing its growth and efficiency trajectory at a considerable pace.

Other authors on Seeking Alpha have provided excellent analysis of this stock as well, such as this one.

Also important, there are not analyst sell notes on the stock. It’s basically a covered bull argument that’s not getting the traction it deserves.

Macro Hypothetical

What if OPEC was totally cut off from North America? In reality, that’s unlikely to happen, but let’s engage in a thought experiment. If consumers in North America and allied economies relied on the US, Mexico, and Canada for Oil and Gas, it would certainly make companies like Vista Energy in the spotlight. While that’s an extreme example, since the war in Ukraine, buyers have certainly chosen more local options, and especially compared with Russian Oil and/or distribution with Russian involvement.

Fundamentals

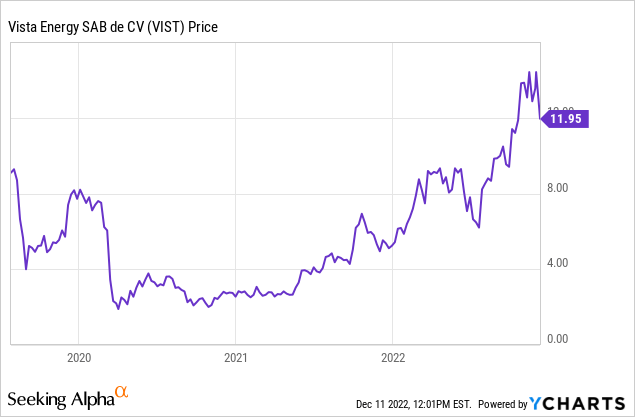

Let’s take a look at the chart:

Vista Energy is certainly outperforming some peers, which is a positive sign that Vista Energy is a strong buy. Of course, no one wants to buy the high, so legging into the trade may be wise. For example, if you wanted to invest $100,000 in Vista Energy, the strategy would be to buy now with $50,000 and another $50,000 should it settle back down to the $8 handle.

The market cap is $1.1 Billion, but that’s also due to a 20% run up in the stock this year, which is slightly more than some of its peers. P/E ratio is $6, but considering the higher price that will affect P/E as well. The company is rapidly expanding, and their overall cost of operations are lower than their peers; not only because they are in Mexico, but it helps.

Why Vista Energy and not others

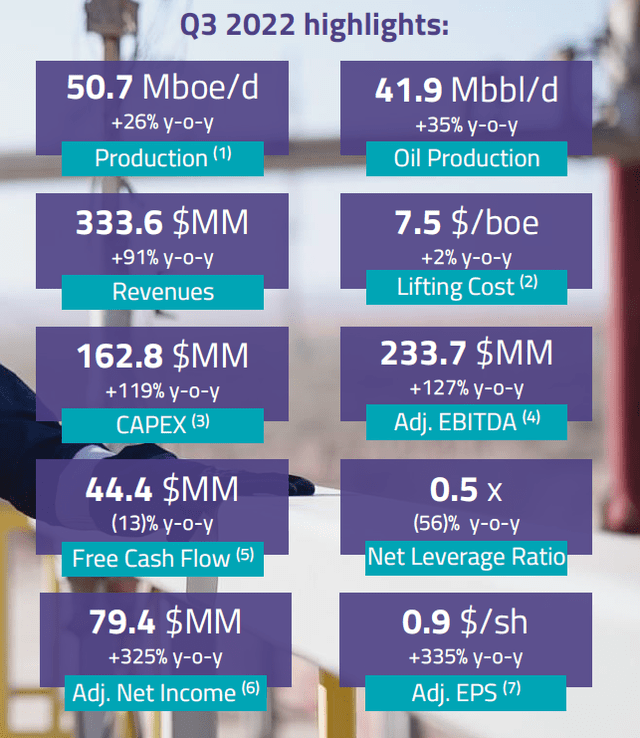

For one, the results are fantastic. See for yourself, download the latest financial report: Q3 Financial Report.

Here are some highlights, from the report:

Vista Energy Q3 2022 Financial Report

Vista Energy is operating the unique Vaca Muerta deposit in Argentina, and it is a recent discovery. There is a still a lot of Oil and Gas in the ground there, and they are cost effective at getting it out.

Risks for Vista Energy

Argentina is not a politically stable country. Their former President, Cristina Fernández de Kirchner, was just convicted in a bribe-corruption regime, from NPR:

Argentina’s vice president, Cristina Fernández de Kirchner, was found guilty of corruption in federal court Tuesday in a case dating back to when she was president. A three judge panel sentenced Kirchner to six years in prison and a lifetime ban from holding political office. Prosecutors say she worked with others to skim nearly $1 billion from fake contracts and bogus construction of 51 public works projects when she was president. Kirchner served as Argentina’s president between 2007 and 2015 and masterminded a political comeback in 2019, running for vice president with Alberto Fernández.

She claims that she is the victim of political prosecutions. Whatever are the details, there is the risk that such political disputes may impact Vista Energy’s ability to operate. We are not suggesting that is going to happen, or that it is possible to assign a probability, simply that the political risk is there. Also, there is a history of South American governments ‘nationalizing’ energy resources. Oil and Gas companies are almost used to dealing with difficult situations, and often have analysts on the payroll to help manage and mitigate the risks.

However, the Vaca Muerta deposit is also what makes Vista Energy stand out. Discovered only in 2011, engineers claim there are nearly 1 Billion barrels of proven reserves of Oil in the ground (reported by NY Times), and a total of 16 Billion barrels. There are 500 fracking wells near, and it is one of the most fracked sites outside of North America.

Conclusion

We think Vista Energy is a strong buy, to have an Oil producer in your portfolio and due to the geographic diversity of the field that it’s managing – Vaca Muerta.

Be the first to comment