Cunaplus_M.Faba/iStock via Getty Images

Co-produced with Treading Softly

Regret.

It’s a powerful word and an even more powerful emotion. I’ve seen people make great and terrible choices due to bearing the heavy load of regret on their shoulders.

We often make even worse mistakes in the name of avoiding regret. “I don’t want to regret this decision in the future” so we make an even worse decision.

No one is an effective fortune teller. We cannot know the future. I once heard it said that we should never regret the past, as it made us who we are today. We can learn from the past and grow from it, but we can’t change it. We can only impact the unwritten pages of our future.

Looking to the market. The fear of missing out or the power of greed can lead us to make choices we may regret. We may regret not selling when we should have or buying when we should not have.

When it comes to real estate investment trusts (“REITs”), self-claimed experts are a dime a dozen these days. Everyone has big opinions and short track records. So investors must do their due diligence, look for answers, and weigh opinions. I do not want anyone to simply take my or anyone else’s opinion without carefully considering all views and coming to a personal decision. You are the ultimate captain of your portfolio.

We’ve seen some big opinions lately on some REIT investments that we see as excellent opportunities and income investments. So we decided to reiterate why we like them and why we remain invested in these opportunities.

Let’s dive in.

Pick #1: NLY – Yield 14.5%

Annaly Capital Management, Inc. (NLY) announced it will do a 1:4 reverse split. This means that every four shares investors have will be consolidated into a single share. If you have 100 shares before the close of business on September 23rd, then on Monday, September 26th, you will have 25 shares. If the calculation results in a fractional share, say you have 101 shares, then you will receive cash for that fractional share.

For example, if NLY’s share price is $6.20 after close on the 23rd, and you have 101 shares, then on Monday the 26th, you will have 25 shares of NLY that will be trading at $24.80/share, and you will receive $6.20 for the fractional share (0.25 X $24.80) so that you have the same total value post-split as you had pre-split.

Many shareholders hold a bias against reverse splits. You’ll see it in the comment about how reverse splits are “always bad.” This is likely due to one of the most common reasons for companies to do a reverse split, which is to maintain listing standards. Stock market exchanges require stocks to be trading over $1, and if they aren’t, the company will be delisted. So doing a reverse split to inflate the price over $1 is a common “last gasp” strategy for a company seeking to remain listed at all costs. Since the underlying problems weren’t resolved, the price keeps falling. While this is one of the more common reasons for a reverse split, it is not the only one.

NLY is in no danger of being delisted. Their share price would have to fall another 95% to even get a warning. In fact, NLY will be added to the S&P 400 Midcap Index on September 19th, which means that it will now be held in funds that follow the midcap index. So why is NLY doing a reverse split? From the press release:

The Company is implementing the reverse stock split with the objective of reducing Annaly’s number of shares of common stock outstanding to more closely align with the number of common shares outstanding for companies of a similar market capitalization. As a result of the reverse stock split, the number of outstanding shares of Annaly’s common stock will be reduced from approximately 1.8 billion to approximately 445 million. Furthermore, the Company believes the reverse stock split will make the common stock more attractive to a broader range of investors, which has the potential to reduce share price volatility over time.

REITs grow through issuing shares. This is especially true for mortgage REITs. Tax laws require them to distribute substantially all of their earnings, which means that they can rarely retain any meaningful amount of cash flow. Equity REITs enjoy all sorts of favorable tax treatment from real estates, like depreciation, which shields a significant about of cash flow from the taxman and distribution requirements. Mortgages don’t enjoy that favorable treatment. So mREITs grow by issuing new shares to raise more capital for future investments. The results of those investments are then passed along to shareholders as dividends.

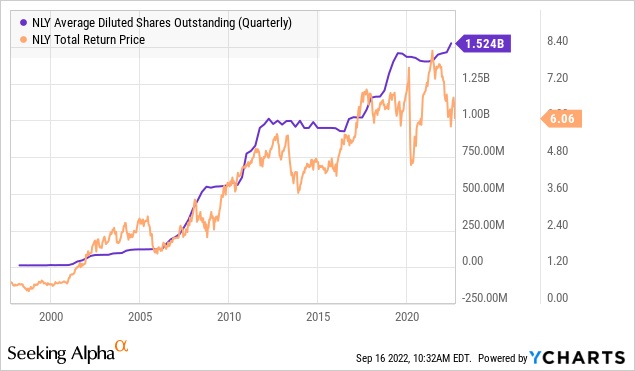

When we look at NLY’s historical returns, we can see that they all came from dividends.

Now part of this is due to timing. As recently as September 2017, NLY’s return on price was essentially zero, and NLY’s price has at times been as high as 65% above its IPO price. Yet even at that peak in February 2008, over 80% of NLY’s total return since IPO was dividends. In short, the share price has always been a rather minor contributor to NLY’s total return. Which is why we don’t worry about it. What is more important, the factor that contributes a 5-10% impact to your total return, or the factor that contributes 90-95%?

To achieve a market-beating 761% total return, NLY has issued a lot of shares over the decades. Note that issuing shares have generally preceded NLY having higher future returns.

The reason is simple and causal – NLY issues shares when they believe there are attractive investment opportunities. So investors should generally be happy when they see NLY issuing more equity, as it means NLY believes that future returns will be higher than current returns.

However, over time that has led to over 1.5 billion in shares, that’s a lot. How does NLY reduce that excess? A reverse split. It changes nothing mathematically for earnings, NAV, or the dividend. NLY will earn the same amount of money, have the same NAV, and have the same dividend. The only thing that changes is the share count.

Changing the share price does have a beneficial impact on volatility of the share price. Since most buyers/sellers tend to bid by full pennies, a one-penny difference for a stock that is trading at $6.20 is 0.16%. So if a buyer is bidding $6.19 and a seller is asking $6.21, the price difference is 0.32%. If the shares are $24.80 and a buyer is bidding $24.79, and a seller is asking $24.81, the price difference is only 0.08%. This reduces the temptation for day traders to try to profit from price swings of just a few pennies. Since NLY will still have 445 million shares outstanding, there will still be plenty of liquidity for trading.

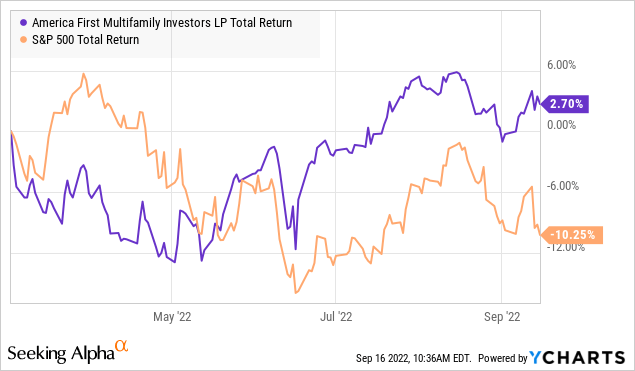

We’ve seen a few reverse splits in the HDO portfolio. Most recently was America First Multifamily Investors, L.P. (ATAX), which was announced on March 2nd and implemented on April 4th. Since the reverse split was announced and implemented, ATAX has outperformed the S&P 500 and has also increased its dividend as earnings continue to impress.

Many in the market view reverse split as an automatic negative. The reality is they are not. It is a buying opportunity if this causes any downward pressure on NLY’s share price.

Pick #2: AWP – Yield 10.2%

When there is a recession, when does the bottom come in for the stock market?

For COVID, the bottom came in on March 23rd. Seven days into “two weeks to flatten the curve”, which we now know those restrictions went on much longer.

During the Great Financial Crisis, the bottom came on March 6th, 2009, even as many economists predicted it would get worse.

The point is that we never really know when the bottom will occur. Sometimes it occurs early on while the recession is still happening and the news appears to be terrible. The best time to buy is often when things look the worst. Even when things do get worse, stocks often rebound, looking toward a brighter future.

In this case, we aren’t talking about the U.S., we are talking about Europe. It’s no secret that Europe is likely already in a recession, with energy supply becoming a major issue throughout the continent and the cost of living skyrocketing. Yet because it isn’t a secret, European-based companies have been hit hard.

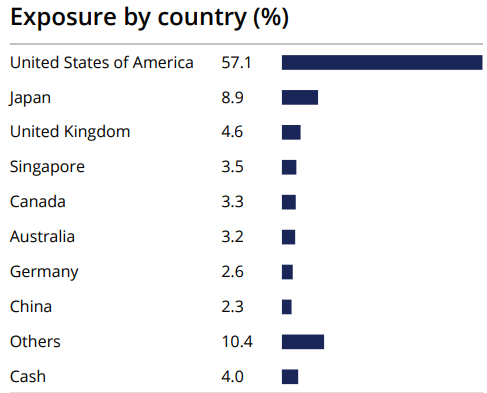

This has been impacting HDO holding Aberdeen Global Premier Properties Fund (AWP), which has about 57% exposure to the U.S. and the rest to various countries worldwide. (Source: Abrdnawp.com)

abrdn Global Premier Properties Fund

With much of Europe threatened with recession and a strong U.S. dollar, this international exposure has been weighing down AWP’s results relative to other REIT closed-end funds (“CEFs”) with a stronger U.S. focus. But it is quite possible that the bottom is getting near. European real estate is very attractively priced, having fallen substantially, reflecting the market’s expectations of difficult times.

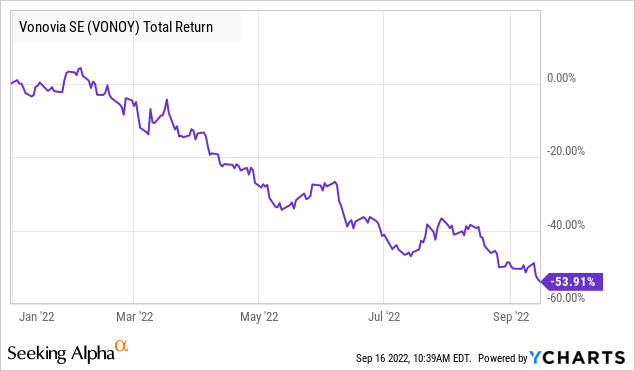

Consider Vonovia SE (OTCPK:VONOY), a German property company with an emphasis on apartments. At just under 2%, this is one of AWP’s largest non-U.S. investments. It has seen its price fall more than 50%, it is trading at its lowest price ever.

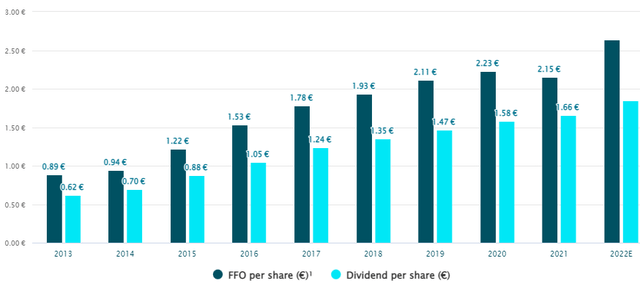

Vonovia has a great history of rising funds from operations (“FFO”) and consistent dividend raises.

Vonovia’s NAV is €62.54/share, while it is trading at a little over €26/share. Unlike U.S. REITs which calculate NAV by cost basis minus depreciation, in Europe, they are required to update using fair values.

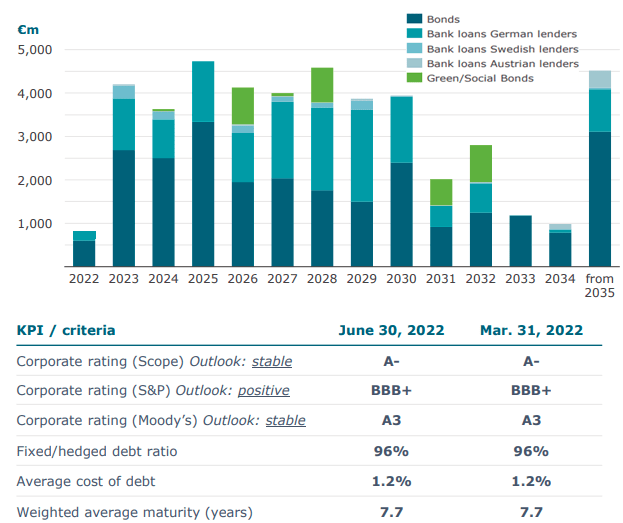

It is a high-quality property company with a very good history and expects to continue its growth despite the risk of a recession. Vonovia has an A-/BBB+/A3 rated balance sheet and good laddering of their maturing debt, with no more than 11% maturing in any year.

Vonovia Half 1, 2022

This means that Vonovia will have time to deleverage or increase rents to offset the expense of higher interest rates as they refinance. In short, during a recession, this is the kind of company we would have on our short-list to buy. There is little doubt that it will survive and come out the other side of the recession just as strong as before.

AWP provides us exposure to these kinds of companies that we don’t see with other U.S.-centric CEFs. Is the bottom in for Europe? We don’t know. But with the prices of these investments down 50%, the valuation is definitely attractive. At HDO, we prefer to be overweight with U.S.-based investments, but we also know that recovery will happen, and we want a taste. AWP provides us that taste with exposure to numerous companies like Vonovia that will bounce back when the market turns optimistic about Europe’s future again.

The best part is that AWP provides that exposure while also having larger exposure to U.S. REITs, which helps protect us from the risk that things get worse overseas. We can collect a generous dividend today, secured by the stronger performance of U.S. REITs, and realize price upside whenever the international market recovers. I love getting paid to wait!

Shutterstock

Conclusion

We all have regrets, but we shouldn’t let other people – especially anonymous online ones – decide if we have them or not. That is something you can decide on your own, and trust me, we are historically our own harshest critics.

I don’t buy anything I don’t understand or do not believe in its ability to pay me a strong income. With NLY and AWP, we see that voices of disagreement arise, and I welcome well-informed discussion of the future outlook. Likewise, I disregard backward-looking, poorly researched hit pieces. The best time to buy is when prices are lowest, and the past returns look the worst.

We must all know our own investing goals and how we will achieve measured success. No one else can do that for you. For me, my focus is on building an income stream. Not trying to flip a stock for a quick profit but to buy investments that will provide significant recurring cash flow into my portfolio.

Your retirement is yours to live, no one else’s. Find the investing method that works for you. Find the investments that meet your method and goals. Keep tabs on them and ensure they’re still doing what you need to meet your needs.

For many, it’s simply getting the income they need to pay their bills and enjoy retirement. For others, it’s pulling the arm of the market’s slot machine hoping they can beat the average.

Keep on gathering your income and growing your income stream, we’re all in this together!

Be the first to comment