2Ban/iStock via Getty Images

“If you don’t know history, then you don’t know anything. You are a leaf that doesn’t know it is part of a tree.”― Michael Crichton

Today, we take a look at a small dermatology focused concern. This company has just entered the commercialization stage with a promising new product and recently addressed all of its capital needs. An analysis follows below.

Company Overview

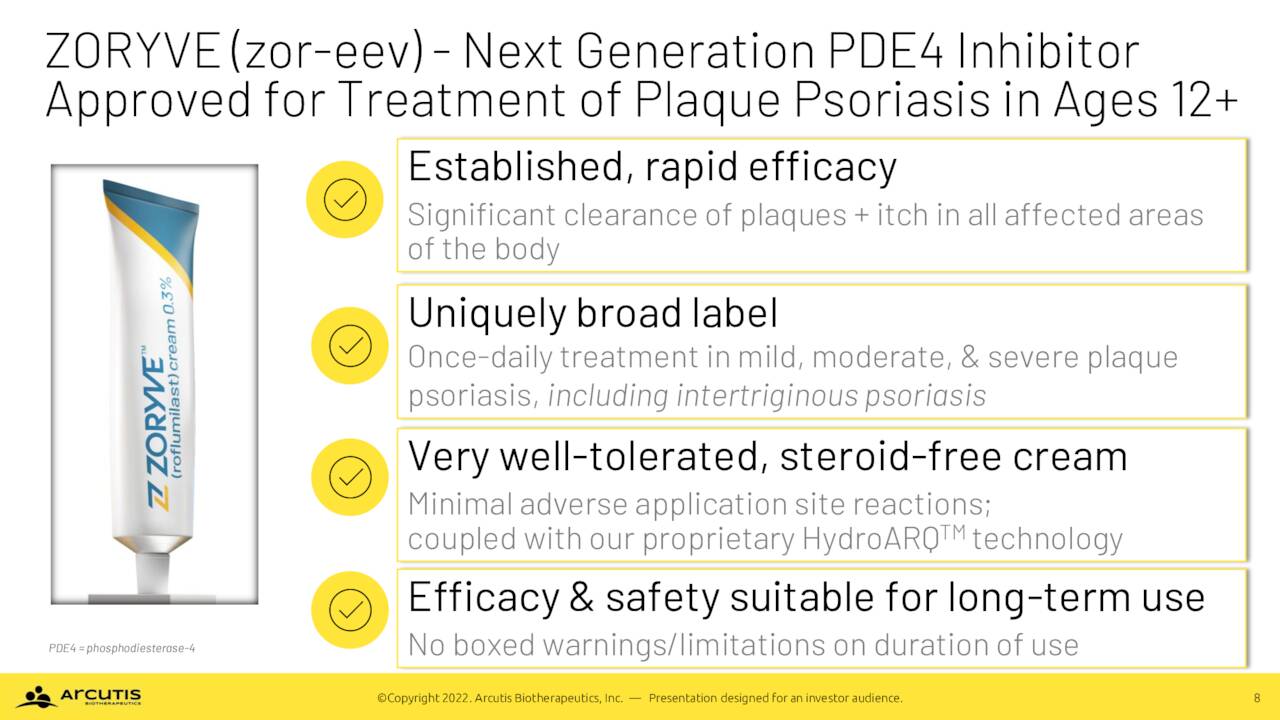

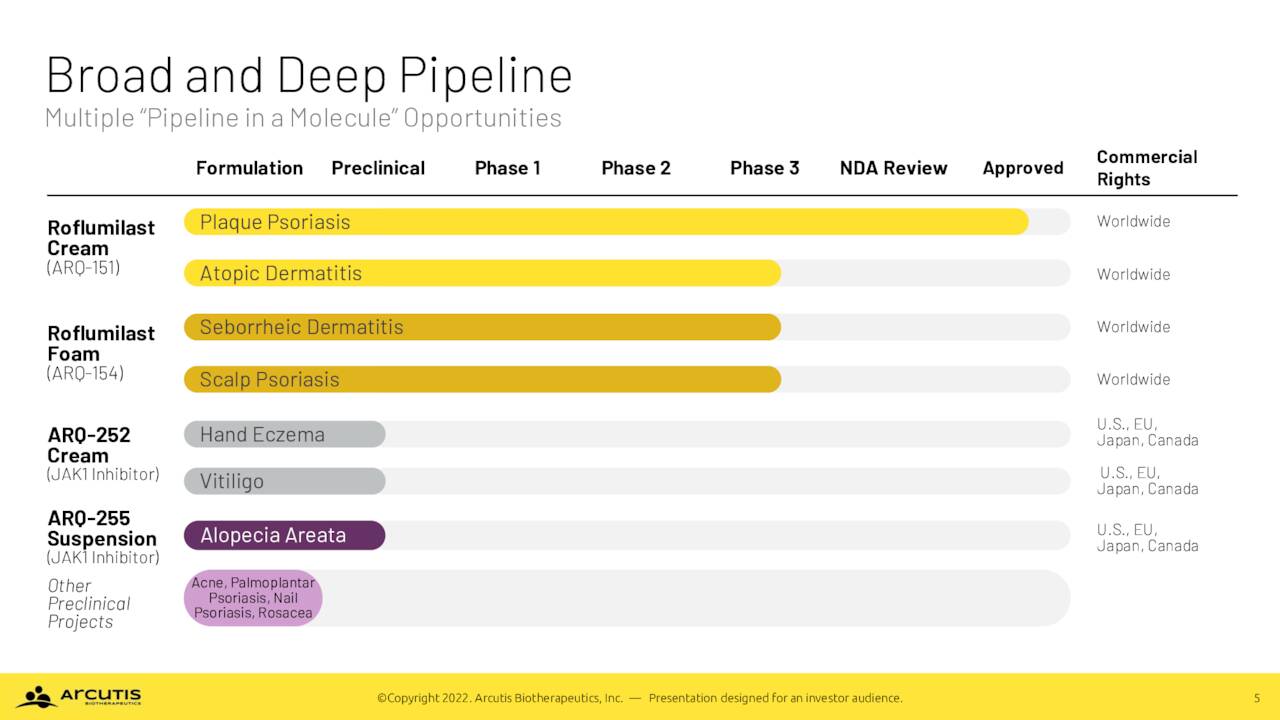

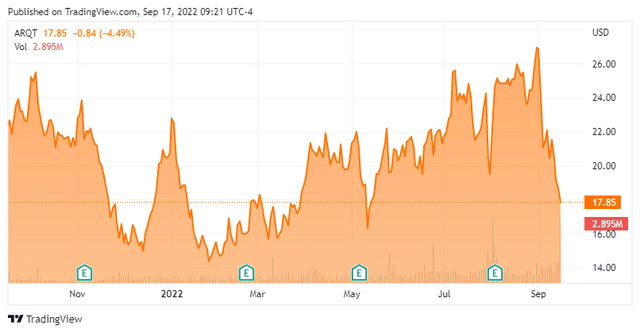

Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT) is a Westlake Village, California based early commercial-stage biopharmaceutical concern focused on the development of dermatological treatments in areas of high unmet need. The company’s lead product, ZORYVE (roflumilast) cream 0.3% was approved on July 29, 2022 for the treatment of plaque psoriasis. The company also has a foam formulation of roflumilast that is undergoing evaluation in late-stage clinical studies. Arcutis was formed in 2016 and went public in January 2020, raising net proceeds of $167.2 million at $17 per share. Its stock currently trades just under $18.00 a share, translating to a market cap just above $1.1 billion.

Product

ZORYVE. ZORYVE’s active ingredient, roflumilast, is a phosphodiesterase type 4 (PDE4) inhibitor that delivers the benefits of current plaque psoriasis protocols – namely, topical corticosteroids and vitamin D3 derivative calcipotriene – without their attendant side effects. The dermatological cream achieved Investigator Global Assessment [IGA] success rates – defined as a score of ‘clear’ or ‘almost clear’ plus a 2-grade improvement from baseline at week 8 – of 41.5% and 36.7% versus 5.8% and 7.1% for vehicle (p<0.0001) in two identical Phase 3 trials.

September Company Presentation

ZORYVE is a different formulation of a chronic obstructive pulmonary disease drug that was in-licensed from AstraZeneca (AZN) in 2018. In return, Arcutis has paid out $13.5 million in upfront and milestone payments and is potentially on the hook for an additional $20 million plus low to high single-digit royalties. To date, Arcutis has not outlicensed the commercial rights to ZORYVE or any other roflumilast clinical asset. Arcutis filed an NDS with Health Canada for the same indication and has received a target action date of April 30, 2023.

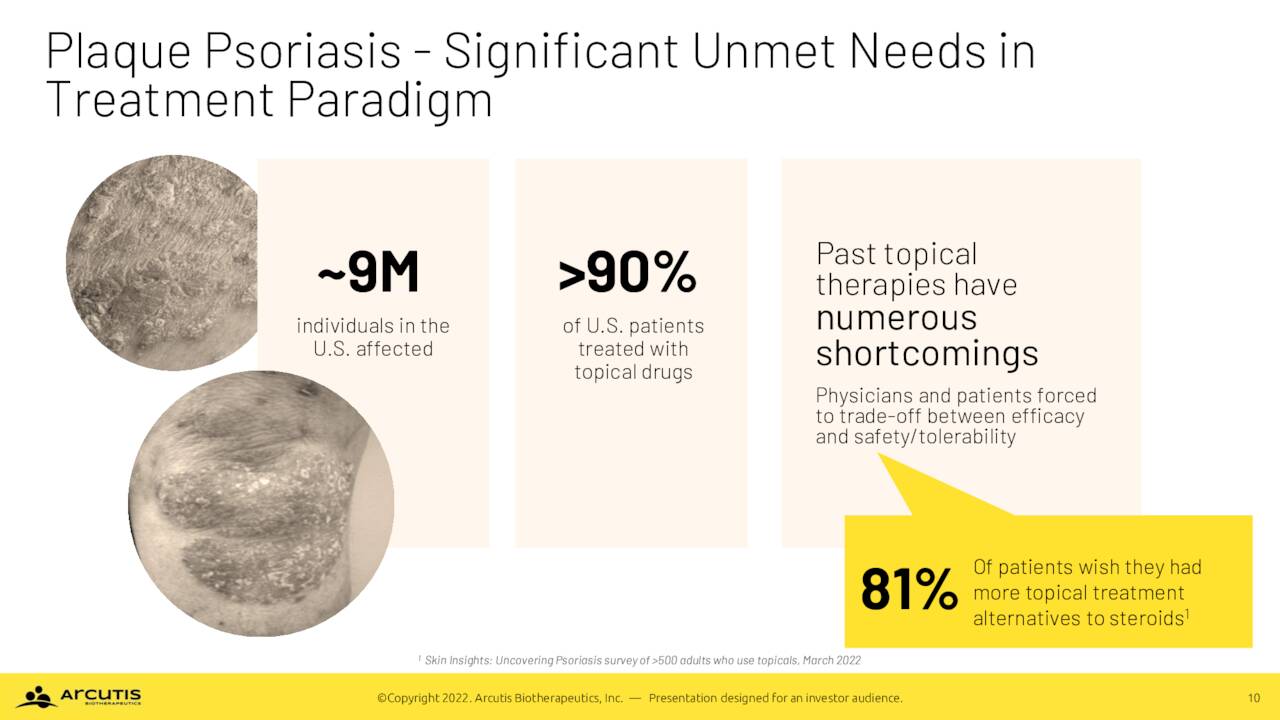

The domestic market for this indication is significant, with ~8.6 million Americans suffering some form of psoriasis. Approximately 90% have plaque psoriasis, a disorder characterized by raised, red areas of skin (plaque) covered with a silver or white layer of dead skin cells (scales) that can appear anywhere on the body. Of this subset, ~3.2 million seek treatment for the moderate-to-severe form of plaque psoriasis with ~2.0 million treated with a topical therapy prescribed by a dermatologist. However, owing to the shortcomings of current therapies, approximately four out of five patients on topical steroids long for an alternative, providing a significant unmet need and market opportunity for Arcutis.

September Company Presentation

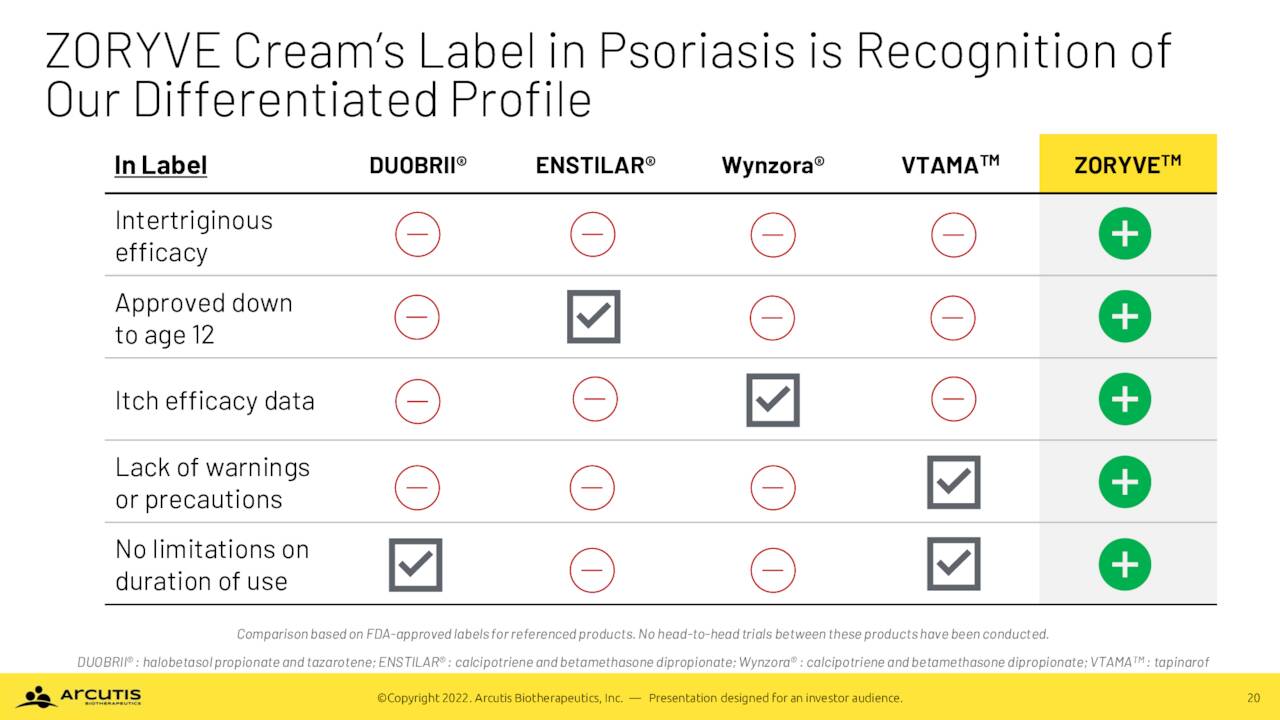

That said, ZORYVE is not the first approved non-steroidal cream for plaque psoriasis. It missed out on that distinction by a couple of months to Dermavant Sciences’ (DRMT) Vtama (tapinarof), an aryl hydrocarbon receptor agonist, which received the green light from the FDA in May 2022. Arcutis believes its product is superior to Vtama, as it has been proven to be effective in intertriginous areas (i.e. where skin rubs against skin, such as between the thighs or fingers), which is typical in two of three patients; and is approved for patients down to twelve years of age. Neither distinction is bestowed upon Vtama. To facilitate its broad coverage and adoption, Arcutis is pricing ZORYVE at $825 per 60-gram tube, notably below Vtama’s $1,325 list. This will result in relatively cheap commercial copays of $25 if the drug is covered and $75 if it is not. Furthermore, the pricing strategy should engender quicker reviews and approvals from insurance companies and is intended to avoid prior authorizations. Arcutis launched ZORYVE on August 10, 2022.

September Company Presentation

The cream form of roflumilast is also being investigated as a therapy in three Phase 3 trials (INTEGUMENT-1, 2, and PED) encompassing ~1,950 patients for the treatment of mild-to-moderate atopic dermatitis, a defect in the skin barrier that permits allergens and other irritants to enter the skin, leading to inflammation, rash, and damage from itching. It is the most common form of eczema, afflicting ~26 million Americans, of which ~6.7 million seek topical treatments for the mild-to-moderate form – 2.6 million via prescription from a dermatologist. Current topical prescriptions are dominated by steroids such as hydrocortisone, calcineurin inhibitors, Pfizer’s (PFE) PDE4 inhibitor Eucrisa – approved in 2016 – and Incyte’s (INCY) janus kinase inhibitor Opzelura – approved in September 2021. All of these treatments are riddled by efficacy or adverse event issues. Also, injectable biologics Dupixent, marketed by Regeneron (REGN), and LEO Pharma’s Adbry, as well as AbbVie’s (ABBV) oral biologic Rinvoq are approved for moderate-to-severe atopic dermatitis, but are restricted due to their indication and higher cost.

Top-line data from INTEGUMENT-1 and 2 are expected in 4Q22 and PED data are anticipated sometime in 2023. If approved for this indication, in addition to a (likely) more favorable adverse event profile, ZORYVE will be priced significantly lower than the $1,950 sticker for Opzelura.

Arcutis also possesses a foam form of roflumilast, which is being investigated in late-stage trials as a remedy for two other dermatological disorders: seborrheic dermatitis or SD and scalp and body psoriasis.

The Phase 3 SD trial (STRATUM) successfully concluded in 2Q22 with 80.1% of patients achieving IGA success at week 8 versus 59.2% on vehicle (p<0.0001) as well as demonstrating a robust itch response to roflumilast foam. SD is characterized by itchy red patches covered with large, greasy, flaking yellow-gray scales, appearing primarily on the scalp, face, upper chest, and back. The milder variant of SD is dandruff. Approximately ten million Americans suffer from this malady, whose pathogenesis is not fully understood except for the fact that an overabundance of the yeast Malassezia plays a role. It is currently treated with antifungals such as ketoconazole, topical steroids, and occasionally topical calcineurin inhibitors. Approximately one-third of patients do not respond adequately to therapy, providing Arcutis with an additional dermatological target. On the weight of STRATUM’s results, the company plans to submit an NDA for roflumilast foam in 1H23.

Arcutis has also completed enrollment in a Phase 3 trial evaluating roflumilast foam in the treatment of scalp and body psoriasis with topline data anticipated in late 3Q22 or early 4Q22.

In a classic case of sell the news, shares of ARQT fell 16% to $20.26 in the trading session subsequent to ZORYVE’s approval and continue to fall since.

Earlier this month, the company added to its pipeline assets by acquiring privately held Ducentis Biotherapeutics for an upfront cash payment of ~$16 million and Arcutis stock valued at ~$14 million, as well as future contingent payments based on development and commercial success. Ducentis’ lead compound is dubbed DS-234 and is targeting atopic dermatitis.

September Company Presentation

Balance Sheet & Analyst Commentary

Another likely reason for the selloff was the market’s correct anticipation of a secondary offering on the heels of ZORYVE’s approval, which occurred on August 2, 2022, when it raised net proceeds of $161.7 million (assuming exercise of greenshoe) at $20 per share. Combined with a $125 million drawdown of its debt facility, the company now holds cash of ~$570 million against debt of $200 million. Contingent on the speed of its ZORYVE ramp, Arcutis should not have to tap the equity capital markets again.

Analysts are very constructive on the company, with seven analyst firms including Needham and Goldman Sachs reiterating Buy ratings on the stock since early July. Price targets proffered range from $43 to $61 a share. On average, they expect ZORYVE to generate sales of $4.5 million in FY22, followed by $72 million in FY23.

Verdict

Employing a default market cap of five times peak sales and assuming three tubes a year per prescription, ZORYVE would have to reach ~245,000 prescriptions to justify $50 a share price objective. With ZORYVE destined to be a pipeline in a product, that level would amount to a ~12% market share of the prescriptions currently written by dermatologists for mild-to-severe plaque psoriasis, never mind mild-to-moderate atopic dermatitis or moderate-to-severe SD.

With one indication already approved and another one for SD likely 18 months away, one million annual scripts is within ZORYVE’s reach, justifying purchase of Arcutis stock. Initial rollouts are usually challenging in the beginning, so it is probably best to accumulate the name slowly. Arcutis would be a solid covered call candidate, but option liquidity is only so-so against the equity. That said, I was able to fill my covered call orders to establish a small ‘watch item‘ holding in this stock.

“The most effective way to destroy people is to deny and obliterate their own understanding of their history.“― George Orwell

Be the first to comment