metamorworks

Analog Devices (NASDAQ:ADI) just reported its Q3 2022 results and the market did not like what it heard. Shares ended the day ~5% lower, with significant volume and volatility. We’ll go through the results and analyze the earnings call to determine whether such a strong reaction from the market was warranted, and whether we think more downside is in store related to the results.

For Q3 revenue was $3.1 billion, up 24% year over year, and above the midpoint of their previously shared outlook. Strength was broad-based with double-digit growth in every end market. Adjusted earnings per share of $2.52 made another new high. So, as we can see, actual results from the quarter were not what scared investors.

During the earnings call there were several comments on new design wins, some of the ones we found more relevant were battery management systems, including one for the wireless BMS solution. Other design wins mentioned were in smart grids and a wireless hospital monitoring system. The $1.5 billion-plus consumer franchise was highlighted, with the company saying that they are focusing on the high end of the market, where performance really matters.

What seems to have scared investors was a comment by CEO Vincent Roche, in which he said that orders had slowed down later in the quarter, and that there had been a modest uptick in cancellations:

I’d like to make some comments on the current business environment. Obviously, the macro backdrop is dynamic and it’s clear that we’re at an inflection point. Economic conditions are beginning to impact demand with orders showing — orders slowing later in the quarter and cancellations increasing slightly.

While it is important to take this warning seriously, and it could even represent a turning point in the cycle, it should also be put into context. In the third quarter the company’s order book remained strong and backlog increased to a new record, stretching well into mid-2023. It wasn’t until later in the quarter that orders moderated, and as a result, book-to-bill was down from a quarter ago but still well above one, which should cover the company well into 2023. Analog Devices also stressed that cancellations are a very small percent of the backlog. By market, strength persist in both industrial and automotive, which together represent over two-thirds of sales, while consumer and communications were the ones that were a bit softer. The cancellations issue was also addressed by CFO Prashanth Mahendra-Rajah during the Q&A session, where he seemed to realize that analysts were fretting about it and that maybe they were worrying about it more than they should. This is what he had to say about it:

I don’t want to mislead folks to think that cancellations are a meaningful concern. But again, in the spirit of transparency, we’re saying that they were up modestly.

Financials

On an adjusted basis, gross margin was 74.1%, up 250 basis points y/y, driven by higher utilization, favorable mix and synergy capture. Operating margin increased 650 basis points y/y, finishing at 50.1%. EPS came in at a record $2.52, up 47% versus the third quarter of 2021. Over the trailing 12 months, the company has generated over $3.7 billion of free cash flow, and bought back $4.4 billion worth of shares.

Balance Sheet

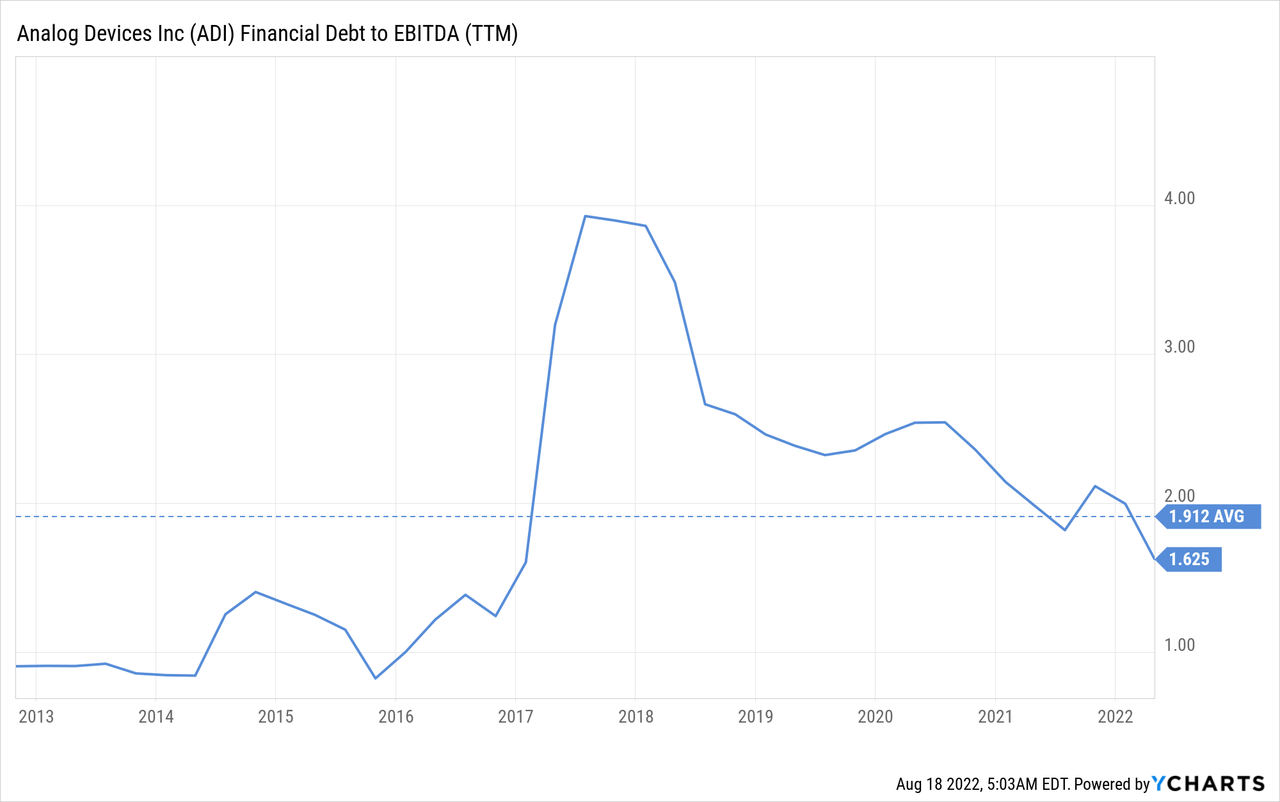

While the company continues to carry a significant amount of debt, at least it has good liquidity with $1.5 billion of cash and equivalents, and its leverage is still quite reasonable.

Guidance

Analog Devices is guiding for a slight sequential revenue growth to $3.15 billion, plus or minus $100 million, despite bookings, backlog, and higher supply that would all suggest stronger growth. At the midpoint, the company expects all end markets to grow quarter-over-quarter. Adjusted EPS is expected to be $2.57, plus or minus $0.10.

The company does not expect to see any meaningful downward pressure on prices even in a recessionary environment.

Valuation

If the company made an effort to reassure investors that the uptick in cancellations was very modest, and that the book-to-bill remains well above one, why did the market react so strongly? We believe the answer is that shares were over priced and therefore susceptible to any minor issue triggering a sell-off.

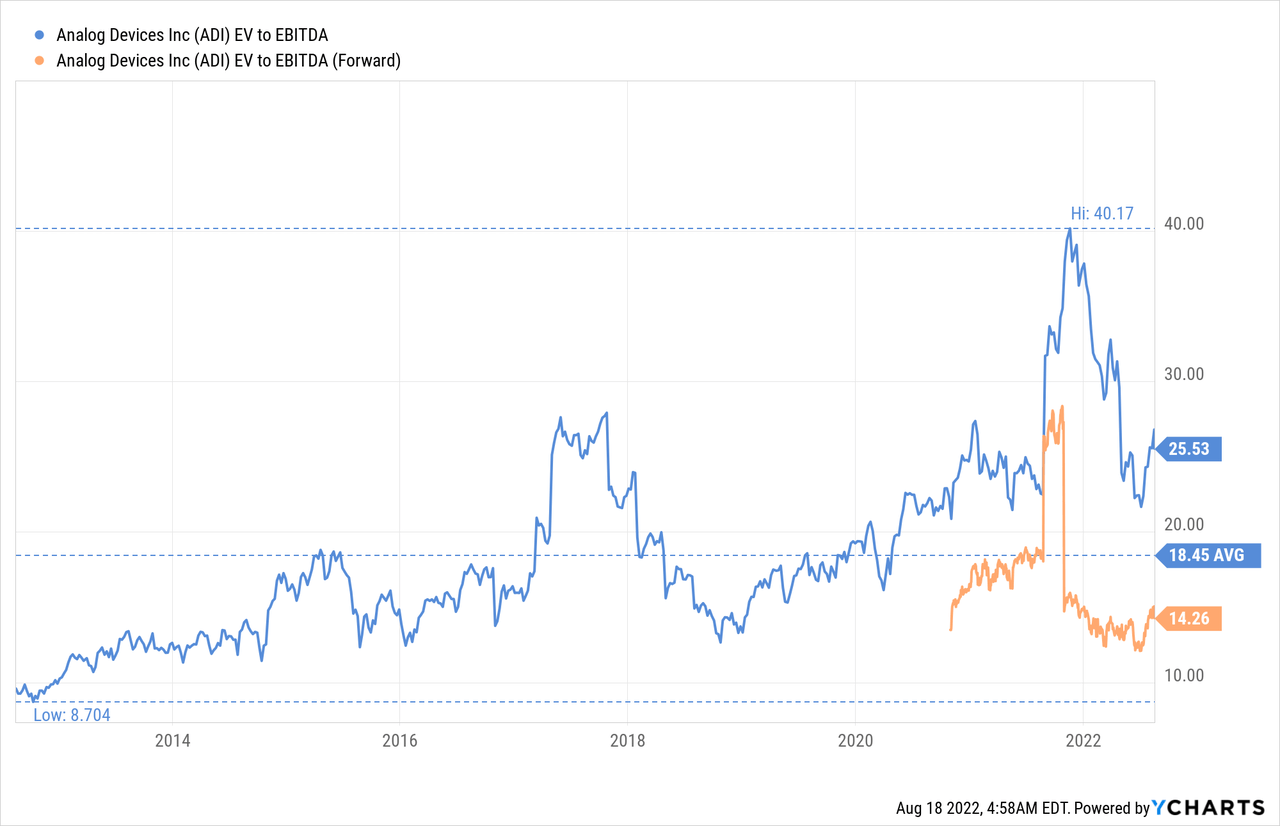

Analog Devices is more profitable than ever, the addition of Maxim is giving the company the benefit of scale, and the company has the benefit of a hybrid manufacturing model. For these reasons the company believes that it can manage to maintain through the downturn of a cycle a 70% gross margin floor. We therefore believe that the company does indeed deserve a valuation premium, just not such a big one as the current premium. EV/EBITDA remains considerably above the ten year average by a significant amount.

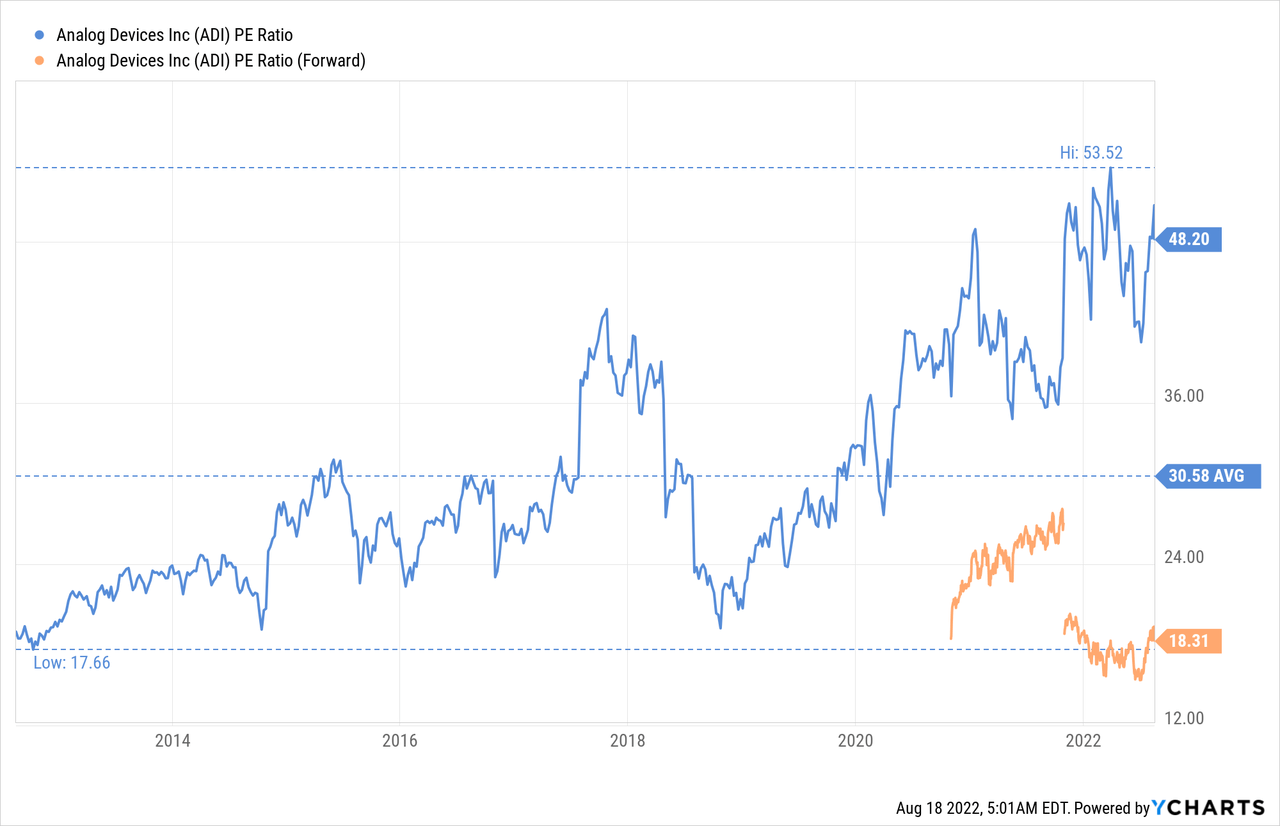

Similarly, the price/earnings ratio is much higher than the ten year average. We think this multiple is too high, even as earnings are expected to continue growing at a rapid pace.

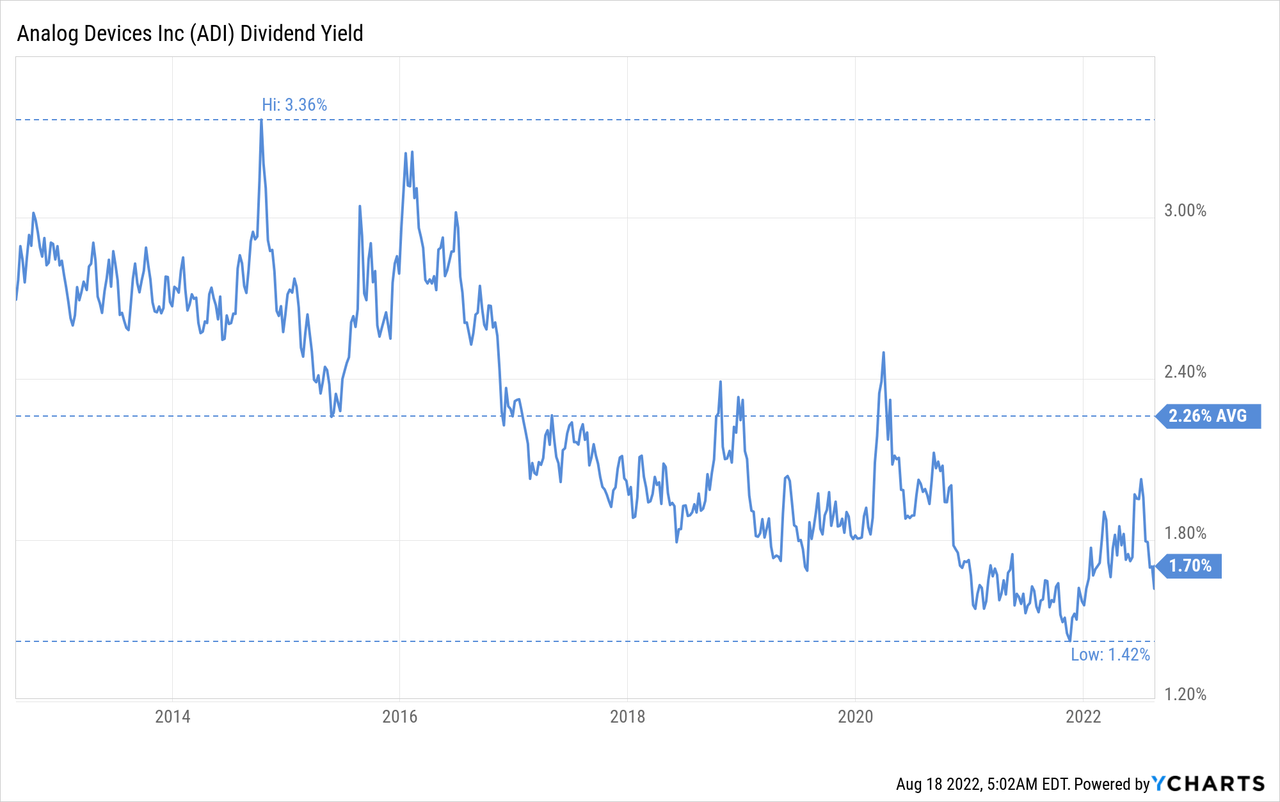

One place where it is clear that the valuation has become quite high is the dividend yield, given that shares are currently yielding considerably below the ten year average.

Risks

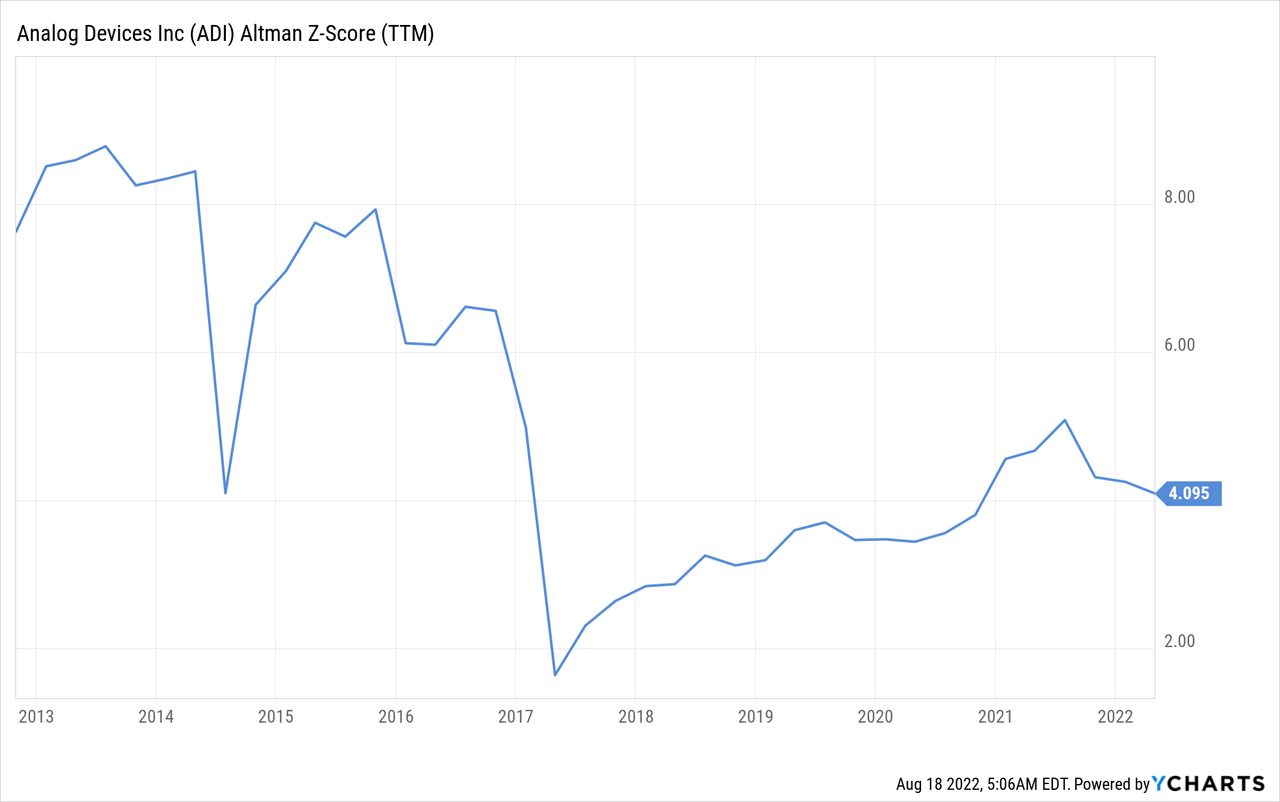

Given the strong market reaction we expected to hear more alarming things during the earnings call, however, it seems to us that for the time being there is just a slight moderation in demand, which given the macro-economic conditions is far from surprising. We believe that the biggest risk to the share price of Analog Devices is the high valuation, even after the pull-back following the quarterly results. We are changing our opinion on ADI to ‘Hold’, given the higher share price and increased uncertainty since the last time we analyzed the company. At least looking at the profitability and balance sheet of the company, we are reassured that the company remains on solid footing, which is also reflected by its high Altman Z-score.

Conclusion

Analog Devices just reported another strong quarter, but investors got scared from the company mentioning a slight moderation in demand and an uptick in order cancellations. From the comments made at the earnings call, especially during the Q&A session, we believe that this is not a significant issue at the moment, and that this moderation in demand is not that surprising given the macro-economic environment. We believe that the negative reaction by the market is due in large part to the very high valuation at which shares are trading, which leaves little room for error. At current prices, and with the increased uncertainty, we believe shares are a ‘Hold’.

Be the first to comment