Sky_Blue

Looking for a piece of the LNG action? LNG has been a hot commodity in 2022, with Europe switching its supplies from Russia to other providers.

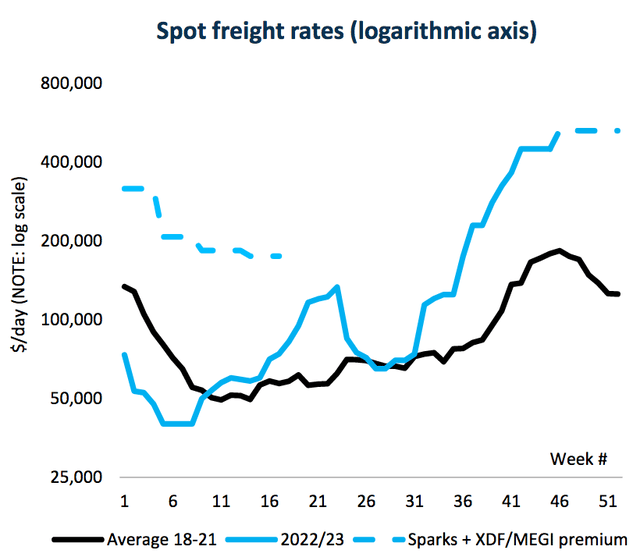

This has ramped up demand for LNG vessels, and has greatly benefited vessel owners, such as Flex LNG Ltd.(NYSE:FLNG), which have been enjoying strong freight rates:

Flex site

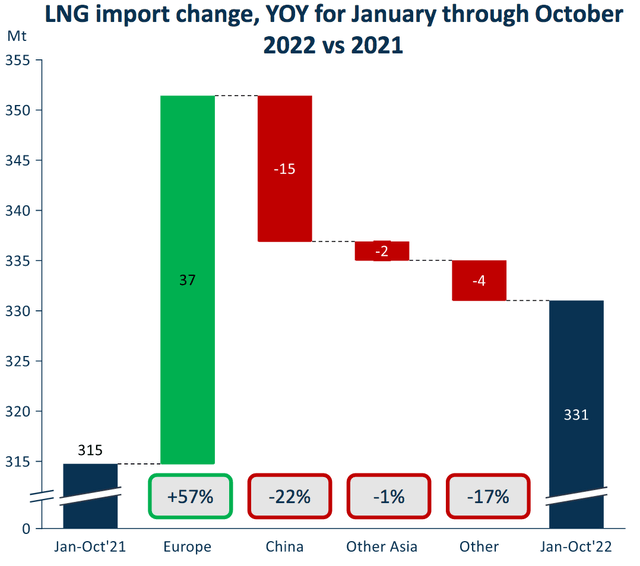

LNG import volumes have surged in Europe by 57%, offset by a -17% pullback in China, due to its COVID lockdowns, and -18% in other regions, resulting in a net 5% boost in Q1-3 ’22:

FLNG site

FLNG site

Company Profile:

Flex LNG Ltd.(FLNG), through its subsidiaries, engages in the seaborne transportation of liquefied natural gas worldwide. As of February 16, 2022, it owned and operated nine M-type electronically controlled gas injection LNG carriers; and four vessels with generation X dual fuel propulsion systems. It also provides chartering and management services. Flex LNG Ltd. was incorporated in 2006 and is based in Hamilton, Bermuda. (FLNG site)

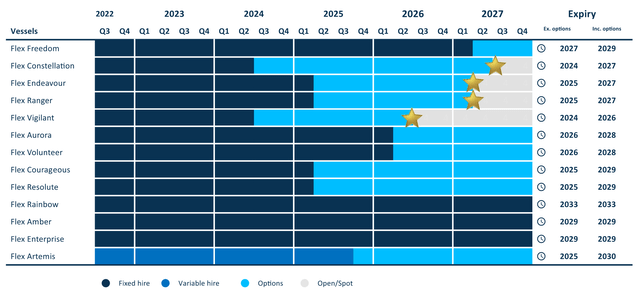

FLNG has one of the youngest fleets in the LNG shipping sub-industry – ranging in newbuild dates from 2018 to 2021, with an average age of three years. Its fleet has zero open days in 2022 and 2023, whereby one vessel is exposed to the spot market via a variable rate long term charter and 12 vessels are on fixed rate long term charters. The contract backlog for FLNG’s time charters is 49 years.

FLNG site

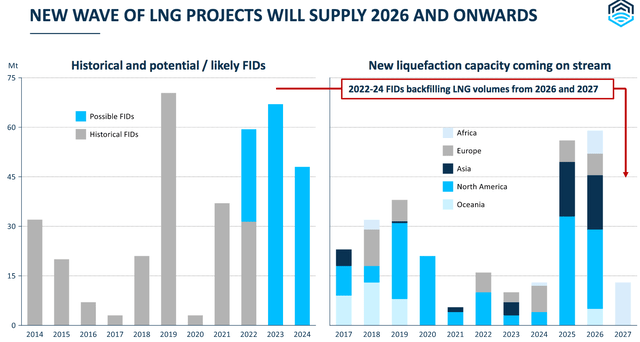

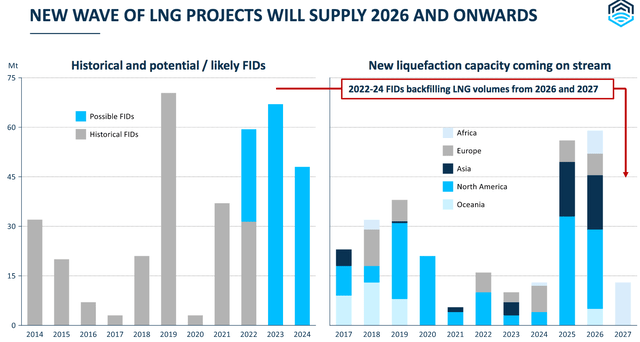

There are many LNG projects down the road in 2026 and beyond, which should support rechartering rates for FLNG and other LNG vessel owners:

FLNG site

Earnings:

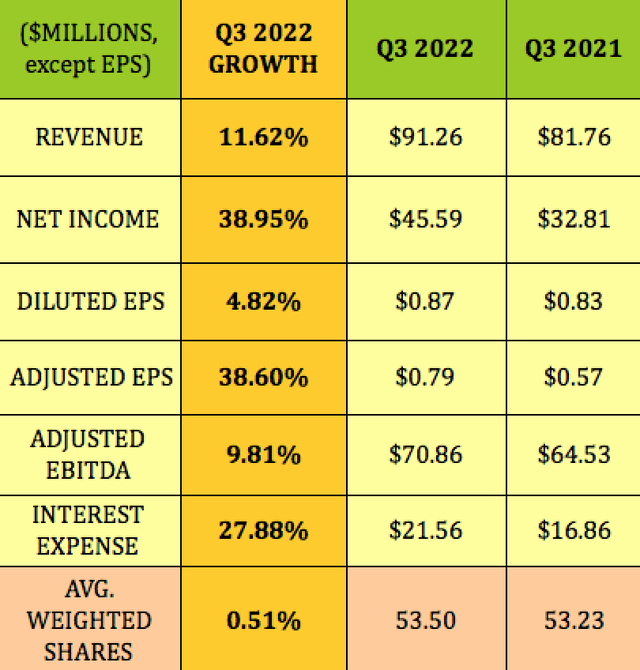

Q3 ’22 earnings growth was robust, thanks in part to the Flex Enterprise and Flex Amber vessels commencing their new seven-year Time Charters agreed to in June 2022. A rough spot was a big rise in Interest Expense, which jumped 28%:

Hidden Dividend Stocks Plus

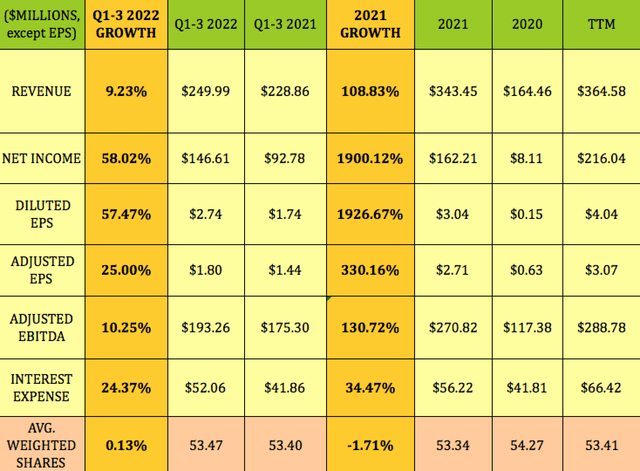

Looking back further shows very strong topline and earnings growth so far in 2022, but Interest expense has grown ~24% in Q1-3 ’22.

Full year 2021 had triple-digit growth in revenue, adjusted EPS and EBITDA, with net income soaring by 19X. Interest expense rose 34.5% in full-year 2021.

Hidden Dividend Stocks Plus

Looking forward to Q4 ’22, management expects slightly better numbers, driven by the Flex Artemis vessel, FLNG’s only ship on a variable higher time charter. With spot markets booming, they are making more money on this vessel. Q4 ’22 revenues are expected to be ~$95 to $98M, in line with management’s previous guidance of $90 to $100M.

Profitability and Leverage:

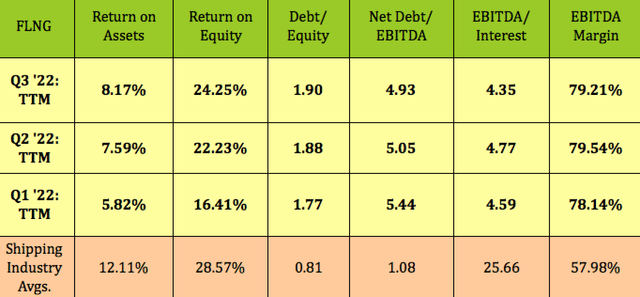

FLNG’s ROA and ROE continued to improve in Q3 ’22, while its EBITDA margin, which is much higher than the industry average, was steady.

While Interest expense has risen strongly over the past seven quarters, FLNG has been able to maintain EBITDA/Interest coverage above 4X so far in 2022 due to ongoing EBITDA growth. This also enabled its net debt/EBITDA leverage to improve sequentially, moving from 5.44X in Q1 ’22, down to 5.04X in Q3 ’22.

It may surprise you that the marine shipping industry has some major players with very low debt, and very high interest coverage, which is why the average interest coverage for the industry is 25.66X:

Hidden Dividend Stocks Plus

Debt:

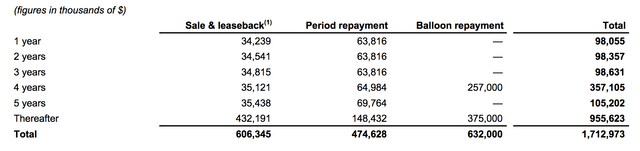

FLNG has roughly $98M, ~6% of its debt, due in each of the next three one-year periods, with $357M, ~21%, not due until four years. Management has a Balance Sheet Optimization plan, which completed Phase 1 in July where they raised $137M of fresh cash by refinancing six ships.

Under Phase 2 they plan to optimize financing for the remaining seven ships in the fleet, with a target of increasing FLNG’s cash position by a further $100M, while at the same time improving its overall financing terms. They have now secured refinancing for four of the seven ships, with net proceeds of $110M.

FLNG site

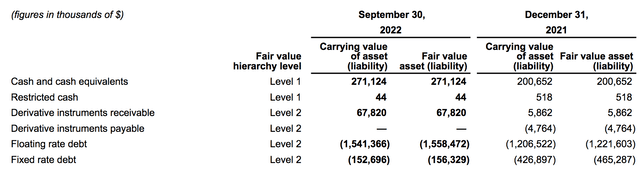

~90% of FLNG’s debt is at floating rates, which would normally raise a red flag in our current rising/higher rate environment.

FLNG site

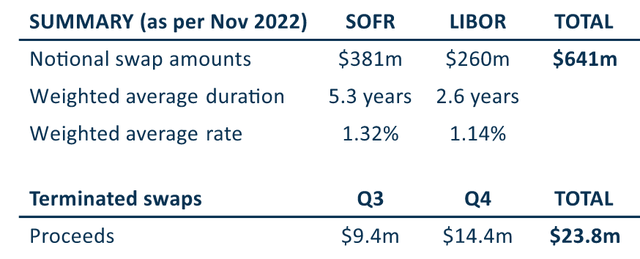

However, management has been quite adept at hedging FLNG’s interest rate exposure, having made $93M on interest rate swaps since 2021. Its current hedge ratio is ~47%.

FLNG site

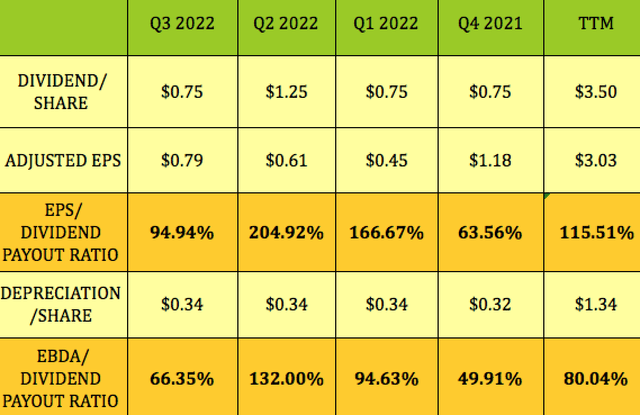

Dividends:

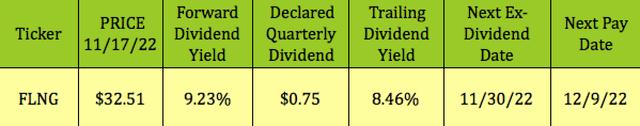

FLNG’s board declared another $.75 dividend, which will go ex-dividend on 11/30/22, with a 12/9/22 pay date. Its trailing dividend yield is 8.46%, and its forward yield is 9.23%.

Management’s consensus for FLNG’s Q4 ’22 dividend also $0.75, bringing the last 12 months dividend to $3.50 in total.

Hidden Dividend Stocks Plus

FLNG’s Adjusted EPS Dividend Payout ratio is 115.51%, however, EPS includes a great deal of non-cash depreciation and amortization. After adding the D&A amounts back to EPS, the trailing EBDA dividend payout ratio is a more reasonable 80%:

Hidden Dividend Stocks Plus

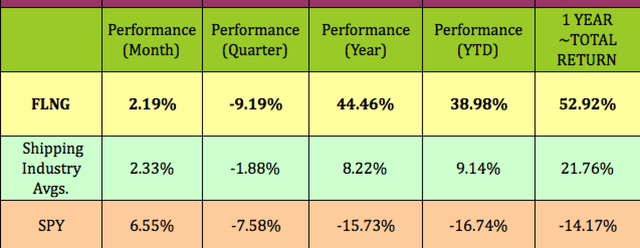

Performance:

While FLNG has lagged the shipping industry and the S&P recently, it has still outperformed them both by big margins over the past year and so far in 2022. Its ~one-year total return has also dwarfed those of the shipping industry and the market.

Hidden Dividend Stocks Plus

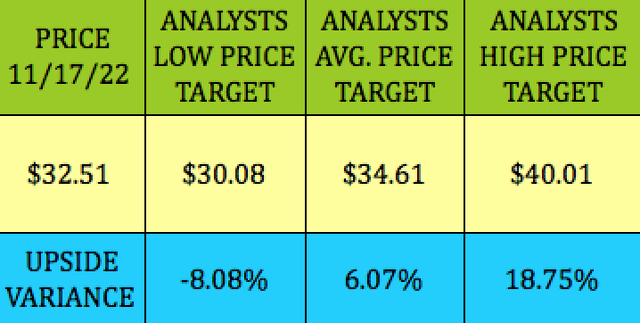

Analyst Targets:

At its 11/17/22 price of $32.51, FLNG was 8% above the $30.08 lowest price target, and 6% below the $34.61 consensus price target.

Hidden Dividend Stocks Plus

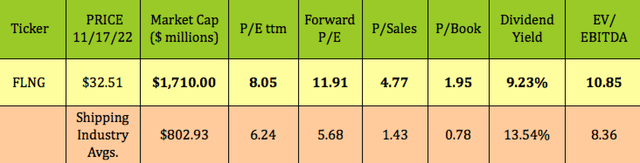

Valuations:

With its outperformance, FLNG’s valuations have raced past industry average valuations on a trailing and forward P/E basis, and P/sales, P/book, and EV/EBITDA basis. While FLNG has a very attractive 9.2% dividend yield, investors have come to expect very high dividend yields from this volatile industry, resulting in an industry average dividend yield of 13.54%.

Hidden Dividend Stocks Plus

Parting Thoughts:

We suggest adding FLNG to your watch list. While its prospects for the future remain good, sooner or later the market will pull back again, and offer this winner at a better price.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment