undefined undefined

By Alex Rosen

Summary

The past year has seen green funds take a beating partially due to global conflicts that have put both a greater demand on the overall need for energy consumption and diminished production of fossil fuels.

The world’s dependence on fossil fuels is akin to the junkie who keeps saying, this is the last time. Eventually they must get clean, or they might die.

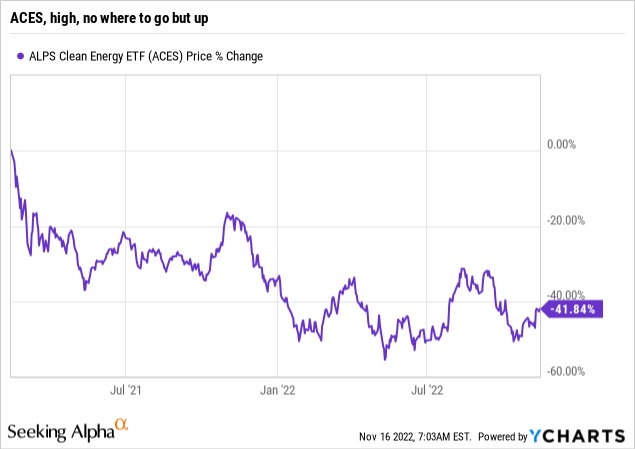

ALPS Clean Energy ETF (NYSEARCA:ACES) is what the junkie looks like along the way. Doing well, riding high, clean for a long time, and then suddenly he falls off the wagon and hits rock bottom. Eventually he recovers and maintains some semblance of normalcy, but always with the fear that tomorrow is the day another shock to the system sends him back into a downward spiral.

For now, we rate ACES a hold, as it appears to be climbing out of the hole and back on the wagon, but keep an eye out for signs of a relapse.

Strategy

The ETF offers investors access to a range of clean energy options in the U.S. and Canada with all companies involved in the clean energy sector eligible for inclusion in the fund. Any one holding is limited to a maximum 5% share of the fund’s holdings.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Aggressive

-

Sub-Segment: Clean energy

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

ACES is a fairly top heavy fund, with 51% of its assets concentrated in the top ten holdings, and 87% in the top 25 out of a total of 48 holdings. The main sector focuses are solar, wind and electric vehicles. These three sectors combined account for over 72% of the total funds holdings.

Overall, ACES is a pretty straightforward fund with a minimal dividend yield. The focus here is on total returns, and it has succeeded on that front despite the recent downturn.

Strengths

ACES focuses on what is unquestionably a growth industry. The future of energy is in renewables, and the sooner that future arrives, the better off everyone will be. At a time when oil companies are turning in record profit, the world is holding global summits to discuss how we can move away from fossil fuels and toward renewables. No country is asking for reparations to account for the loss of productivity due to the harmful effects of solar energy. Nowhere will you find entire mountains cut off, or gaping holes in the ground due to energy produced by wind farms, and not a single scientist will tell you that the production of energy from hydropower will contribute to global warming.

ACES definitely has a long-term sustainable model, even if the near future looks murky.

Weaknesses

The technology driving the clean energy sector is nowhere near sufficient to meet the demands of the overall energy sector. To go back to the junkie analogy from above, every time the world finds itself in an immediate energy crunch, the response is not to build more solar panels, but to burn more coal and pump more oil. Until this mindset changes, ACES will continue to be subjected to the geo-political realities.

Opportunities

“Buy high, sell low”. This quote was attributed to no one, because it makes no sense. However the opposite is investing 101. Currently ACES is on a downward trend. Since it’s peak in February of 2021, ACES has declined by over 40%. ACES may not have completely bottomed out, but given the underlying fundamentals, it is easy to make the argument that it’s more likely to rebound rather than continue to decline. Thus, if you are still holding shares in ACES, hang on to them, they may be switching from ACES low to ACES high fairly soon.

Threats

The green sector especially in the U.S. and Canada can be fairly volatile. One of ACES largest holdings for example is Tesla (TSLA). The CEO of Tesla is unpredictable to say the least. A recent article stated that Tesla’s top engineers have been loaned out to Twitter in order to prop up a $44 billion investment. Additionally, the debt service on Twitter is reportedly $1 billion annually. While it represents only 5% of the fund’s holdings, it is at the same time a posterchild for the green sector, and as they go, likely so does the whole sector.

While their is no indication that Elon Musk is borrowing from Tesla to support Twitter, stranger things have happened, and a $44 billion investment in Twitter could sink or severely damage Tesla, and by extension investment in the green industry if Twitter were to continue to show signs of instability.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

ACES has a sound investment strategy in an ever expanding sector. Anyone who says renewables are just a passing fad probably also said the same thing about the Internet and E-commerce twenty years ago. While the industry does have its share of mavericks and questionable technology (For example Trevor Milton the founder and former CEO of Nikola (NKLA) the second largest valued electric vehicle company in America was charged with fraud of over $1B and found guilty of misleading investors. Despite the headline grabbing stories, overall, the sector is healthy and getting back on its feet.

ETF Investment Opinion

While we do not rate ACES a buy due to the short-term volatility of the market, we do think the future is sunny and if you are still holding shares in ACES, hold them. Just keep an eye on Twitter and Tesla.

Be the first to comment