baona/iStock via Getty Images

When it comes to exciting business models, many might not initially think that the billboard space would be all that appealing. Having said that, the industry is highly fragmented, which leads to the opportunity for growth. In addition, the companies that lead this market have a solid track record of steady growth and robust cash flows. A great example of one of the industry leaders in this space is Lamar Advertising (NASDAQ:LAMR). In recent months, the company has continued to outperform the broader market, even as shares look rather pricey compared to similar firms. Although I acknowledge that this is not exactly a value prospect at this time, I do think that for such a high-quality business with such a nice track record, that additional upside for investors could very well be on the table. Because of that, I do believe that it warrants a soft ‘buy’ rating even after rising nicely since I last wrote about it earlier this year.

Positive signs

Back in June of this year, I wrote an article that took a rather favorable stance on billboard and digital signage operator Lamar Advertising. In that article, I talked about how the company had recently underperformed the broader market. At the same time, however, I said that although the firm could face some pain in the event that the economy tips into a recession, that its overall financial condition was robust and that performance achieved by management was promising. I was also encouraged by how affordable shares were, leading me to rate the business a ‘buy’ to reflect my view that it should outperform the broader market for the foreseeable future. Since then, the company has managed just that. While the S&P 500 is up by 3.2%, shares of Lamar Advertising have generated a return for investors of 9.6%.

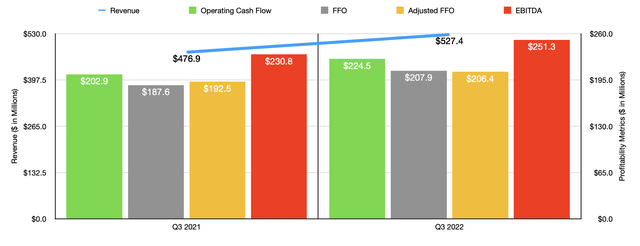

Such a return disparity has not been without cause. To see what I mean, we need only look at the most recent data available. This covers through the third quarter of the company’s 2022 fiscal year. For context, when I last wrote about the company, we only had data covering through the first quarter of 2022. For the third quarter, revenue with the company came in at $527.4 million. That’s 10.6% higher than the $476.9 million generated at the same time last year. This increase was largely due to a rise in billboard net revenues of $41.3 million. A total of $29.8 million in additional revenue came as a result of acquisition activities, with $22.8 million of it coming from billboards and the remaining $7.1 million due to transit net revenue activities.

For a company like this, it makes sense for much of its growth to come from acquisitions. After all, the market for billboards is fairly mature, leaving only growth by the purchase of other companies as the primary means of expansion. This does not mean that the company is not focused on innovative ways to expand. Like other players in the space, management has been pushing hard to transition more to digital billboards. Though these are higher-cost items, they also bring with them more revenue than traditional billboards. That’s why, in the latest quarter alone, the company spent $19.2 million on digital billboards, up from $15.4 million one year earlier and compared to the $12.2 million spent on traditional billboards.

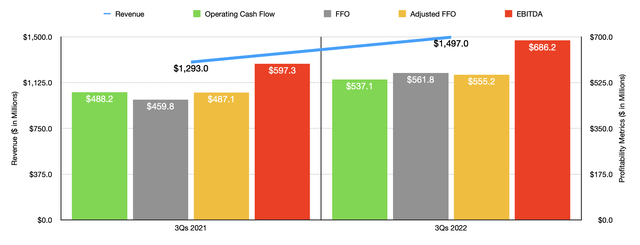

On the bottom line, the picture for the company has also been positive. Operating cash flow, for instance, rose from $202.9 million in the third quarter of 2021 to $224.5 million the same time this year. That’s an increase of 10.6% year over year. FFO, or funds from operations, grew from $187.6 million to $207.9 million. On an adjusted basis, this metric rose from $192.5 million to $206.4 million. Meanwhile, EBITDA For the company also improved, climbing from $230.8 million to $251.3 million. As you can see in the chart above, robust financial performance was not confined to the third quarter alone. Results so far in 2022 have been robust. Revenue of $1.50 billion beats out the $1.29 billion reported one year earlier. Again, much of this increase can be attributed to acquisition activities. Meanwhile, operating cash flow grew from $488.2 million to $537.1 million. Other profitability metrics followed suit, with FFO climbing from $459.8 million to $561.8 million, while the adjusted figure increased from $487.1 million to $555.2 million. EBITDA also increased, growing from $597.3 million to $686.2 million.

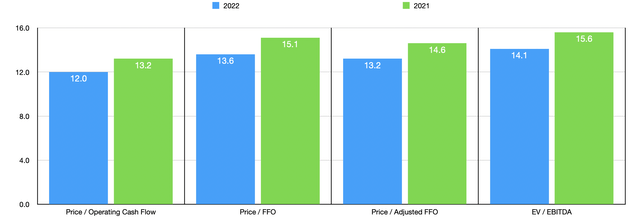

The only real guidance that management has offered for the 2022 fiscal year in its entirety is for adjusted FFO per share. This is currently forecasted to be between $7.20 and $7.35. At the midpoint, that would translate to a reading of $739.8 million. If we assume that other profitability metrics will increase at the same rate, then we should anticipate FFO of $712.9 million, operating cash flow of $813.7 million, and EBITDA of $916.6 million. Given these numbers, the company is trading at a forward price to operating cash flow multiple of 12, a forward price to FFO multiple of 13.6, a forward price to adjusted FFO multiple of 13.2, and a forward EV to EBITDA multiple of 14.1. As you can see from the chart above, each of these is a bit lower than what we would get if we used data from 2021. Also, as part of my analysis, I compared the company to two similar businesses. These firms had rather significant price differences when it comes to the price to operating cash flow approach, with one having a multiple of 3.8 and the other one having a multiple of 12. That 12 reading matches what we get when looking at Lamar Advertising. Meanwhile, the EV to EBITDA multiples for these companies is closer, coming in at 9.7 and 13, respectively. In this case, Lamar Advertising is the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Lamar Advertising | 12.0 | 14.1 |

| Outfront Media (OUT) | 12.0 | 13.0 |

| Clear Channel Outdoors Holdings (CCO) | 3.8 | 9.7 |

Takeaway

Certainly, Lamar Advertising looks to be more expensive than its peers for the most part. Having said that, this is a major player in the industry and it continues to grow nicely even during difficult times. I definitely would not call the enterprise a value prospect. Having said that, shares are definitely appealing for such a steady firm with a nice track record of robust cash flows. Given broader economic concerns and the fact that shares have risen in recent months, I am not as bullish as I was previously. But I am still bullish enough to rate the company a soft ‘buy’ at this time.

Be the first to comment