Massimo Merlini

All in all, we are pleased with the new CEO’s plan to expand the business while keeping exclusivity and defining a new driving experience as the company enters the electric car age. In the meantime, Ferrari (NYSE:RACE) closed its quarterly account with strong results. The solid order book is also a positive confirmation for 2023, even if the margins were slightly lower than in 2021, due to some raw material inflationary pressure and a less favorable price mix.

Q3 results

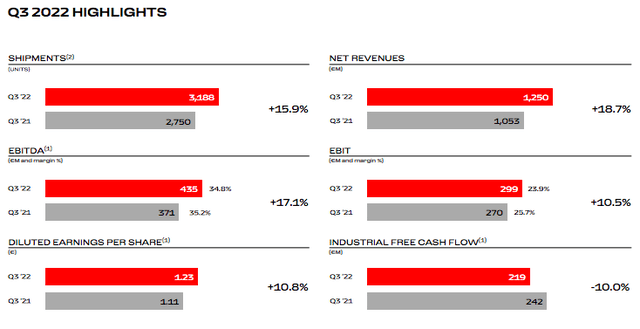

Numbers in hand, the company recorded a net profit of €228 million, an increase of 10% compared to a year ago. Top-line sales rose by 18.7% to €1.25 billion and car deliveries were up by 15.9% to 3.188 units. EBITDA margin stood at 34.8%, down from 35.2% versus the previous year (and EBIT margin followed the same trajectory). On the contrary, EPS and industrial FCF were up on a yearly basis. Looking at the geographical deliveries, in the EMEA region, units were down by 1%, whereas in the Americas and in China area, Ferrari achieved a plus 28% and 73%, respectively.

Looking at the car luxury sector, Aston Martin’s Q3 volume shipments were down by almost 4% on a yearly basis, whereas Ferrari’s supply chain problem seems to ease (also thanks to a vertical integration completed in the recent past that should be beneficial over the long-term horizon).

What are we forecasting?

- We are slightly raising delivery units in Q4. However, ex-currency development, revenue growth is implied at just +3%;

- We believe that inflation reached a peak in Q3 and we foresee improvement in Q4; however, based on the 2022 guidance, we expect a lower EBIT margin;

- We are raising our industrial FCF generation (in line with the company’s guidance);

- In the medium-term horizon, 2023 targets seem more achievable and our math suggests the following: volumes up by low-single digit, price up by mid-single digit, and a positive outcome from Supercar Mix and FX, up by 5 and 2 basis points;

- Monetizing a new market with the latest Purosangue was a key positive catalyst already accounted for in our forecasted numbers;

- There is full visibility on revenue for the next three years with more profitable cars coming online in 2023, unfavorable price mix will end in Q4 and we are expecting margins growth in 2023;

Conclusion and Valuation

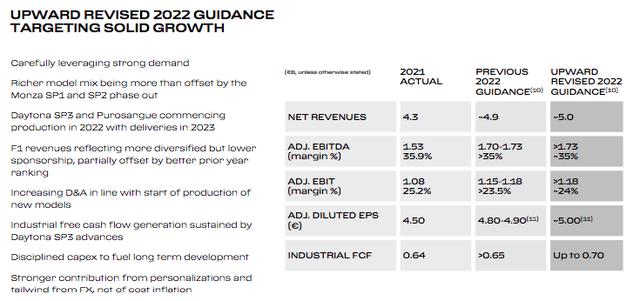

In light of these results, Ferrari now expects revenues of €5 billion (from €4.9 billion in the previous guidance), and an adjusted EBITDA greater than €1.73 billion with a margin exceeding 35%. Industrial free cash flow is expected to reach €700 million. Order intake across models and geo continues to be at historic highs. Here at the Lab, we continue to see an outperforming buy rating at €230 target price. We also see an upside to the current management forecast for €1.8-2.0 billion of EBITDA in 2023. We were already ahead of Wall Street; today, we are in line. Thus, we reiterate our €2 billion EBITDA in our 2023 forecast with a 23x multiple.

Be the first to comment