SAV_____A

A Quick Take On GFL Environmental

GFL Environmental (NYSE:GFL) went public in March 2020, raising $2.2 billion in gross proceeds from the sale of subordinate voting shares at a price of $19.00 per share plus tangible equity units at $50.00 per unit.

The firm is a large environmental services company serving Canada and the United States with diversified waste collection services.

I’m cautious as I’m not convinced that inflation will come down very quickly, so cost pressures will remain in 2023.

My outlook is Neutral for GFL until we learn the trajectory of inflationary pressures on its businesses.

GFL Environmental Overview

Vaughan, Ontario-based GFL [Green For Life] was founded in 2007 to provide a range of waste management, remediation, and recycling services in Canada and 23 US states.

Management is headed by Founder, President, CEO and Chairman Patrick Dovigi, who previously worked at Lower East Capital Partners and has managed Waste Excellence.

The firm’s services and solutions include non-hazardous solid waste management, infrastructure and soil remediation, as well as liquid waste management services.

GFL’s solid waste management operations comprise the collection, transportation, transfer, recycling and disposal of non-hazardous solid waste for municipal, residential, and commercial and industrial customers.

Infrastructure and soil remediation includes remediation of contaminated soils and related services, such as civil, demolition, excavation and shoring.

The company’s liquid waste management business includes the collection, transportation, processing, recycling and/or disposal of liquid waste from commercial and industrial customers.

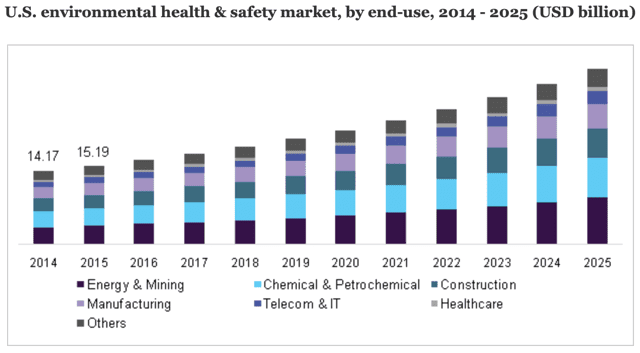

According to a 2016 market research report by Grand View Research, the global environmental health and safety market was valued at $49.8 billion in 2015 and is projected to reach $96.2 billion by 2025, nearly double that of 2015.

The main factors driving forecast market growth are the rising number of regulations imposed by environmental protection and governmental agencies globally.

The increasing risk of environmental damage due to poor compliance by players has led to more stringent regulations across industries.

As of 2015, the US was the largest market for environmental health and safety services and is anticipated to grow at a CAGR of over 8.5% between 2016 and 2025.

U.S. Environmental Health & Safety Market (Grand View Research)

GFL Environmental’s Recent Financial Performance

-

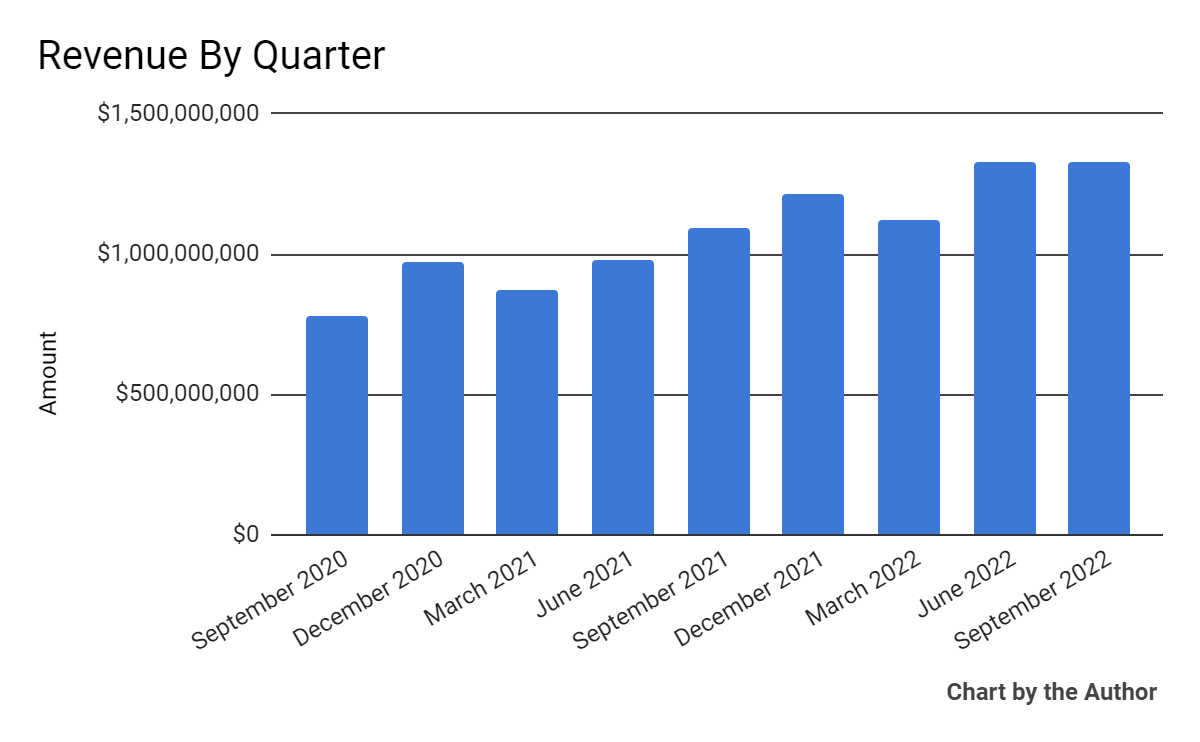

Total revenue by quarter has grown revenue per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

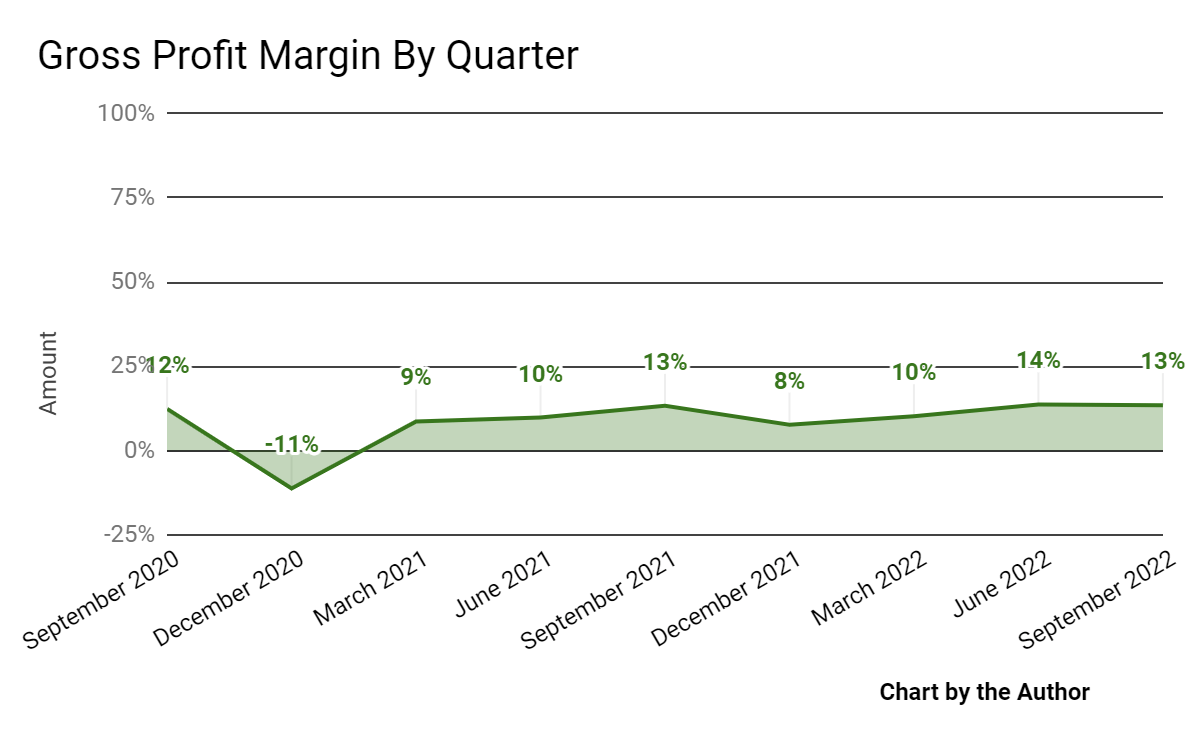

Gross profit margin by quarter has followed the trajectory shown below:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

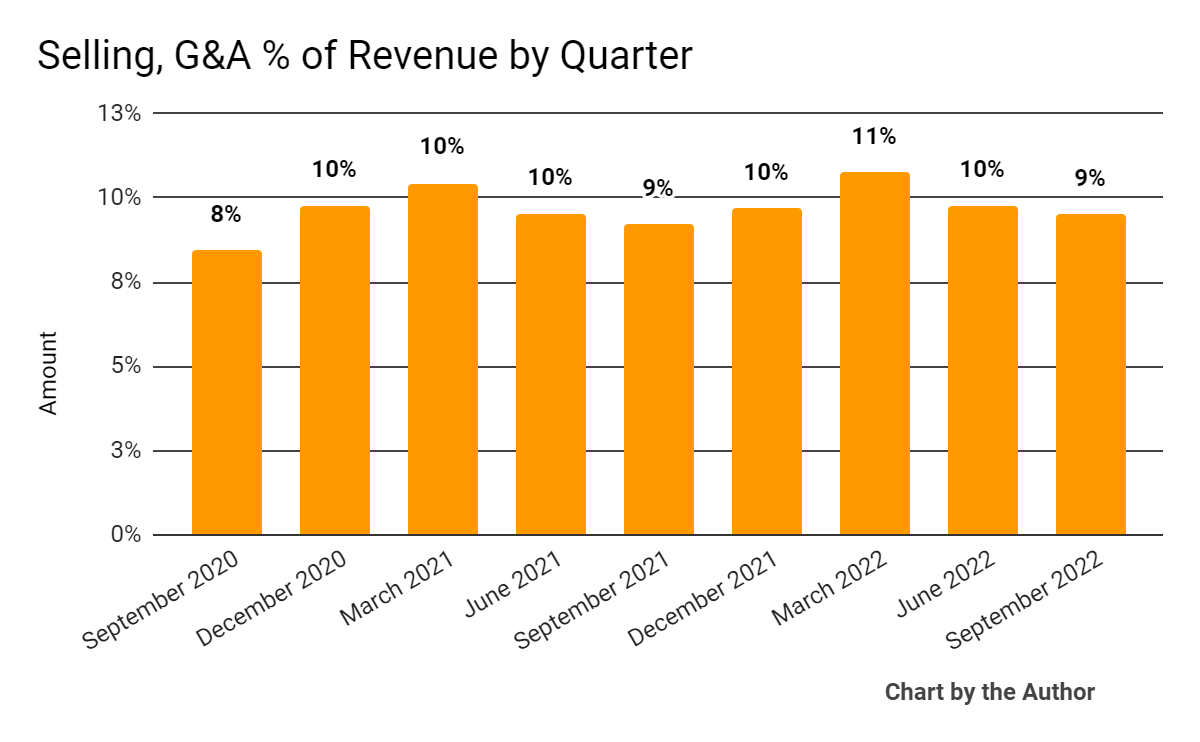

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

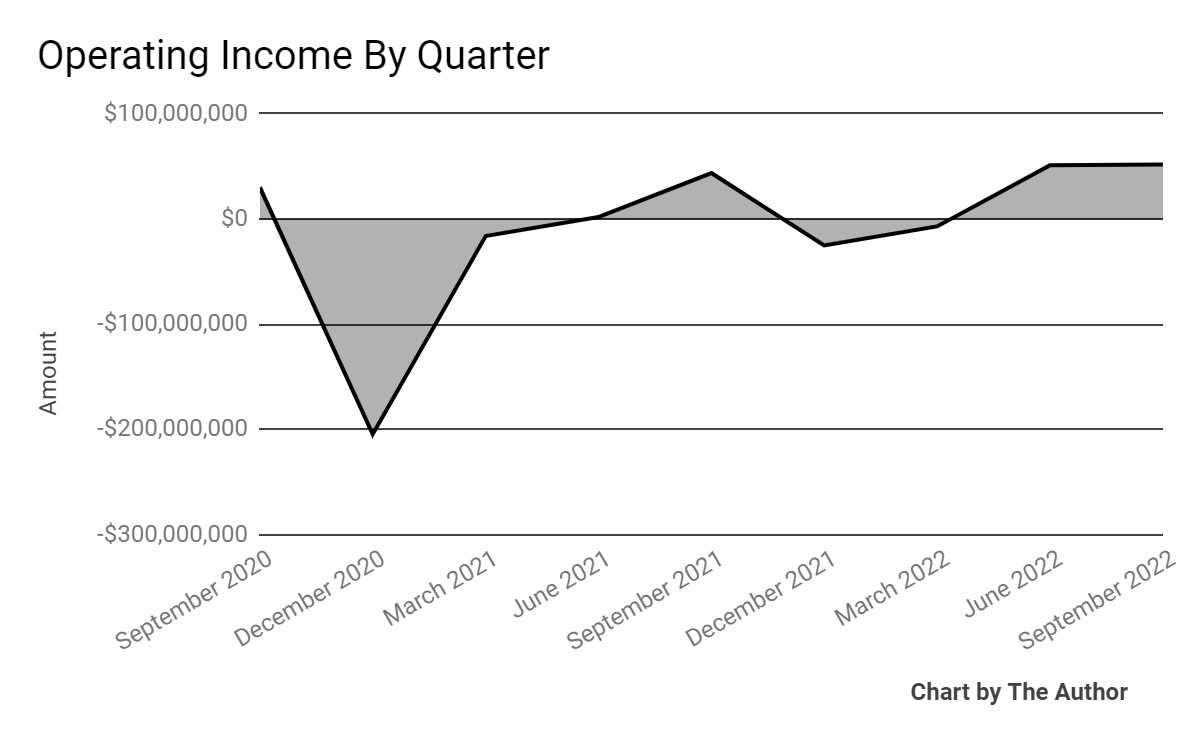

Operating income by quarter has risen in recent quarters, as the chart shows here:

9 Quarter Operating Income (Seeking Alpha)

-

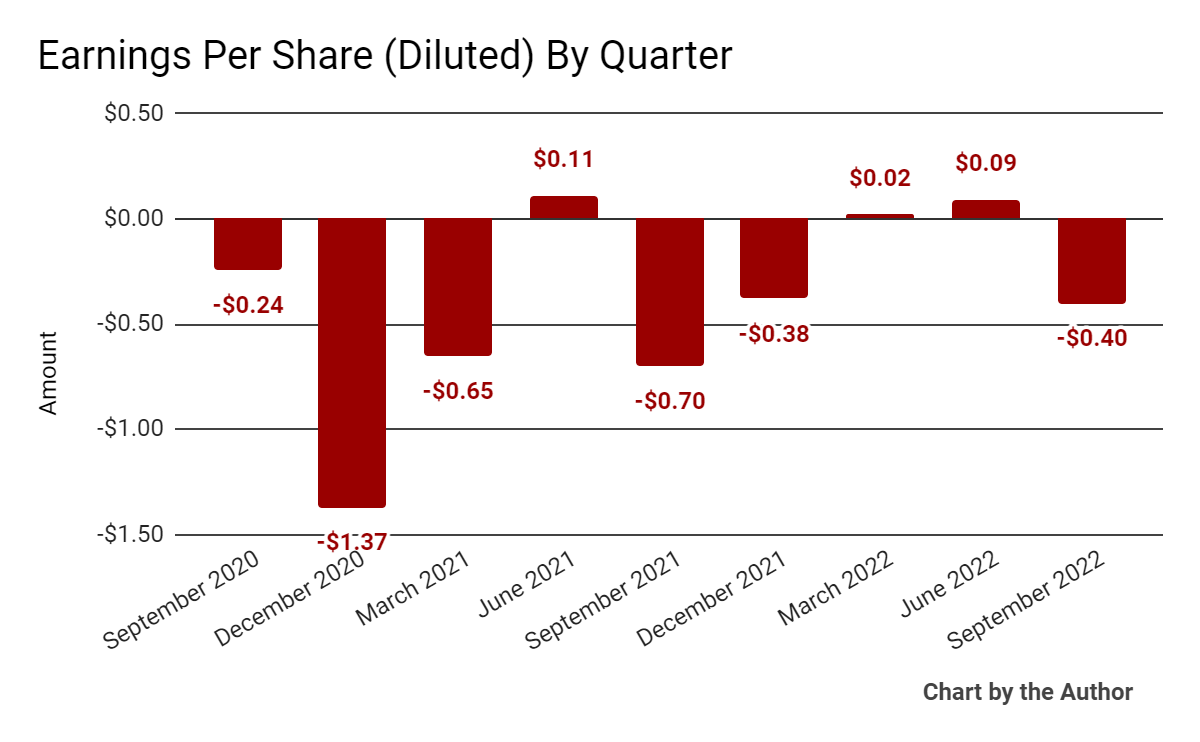

Earnings per share (Diluted) have fluctuated materially, as shown below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

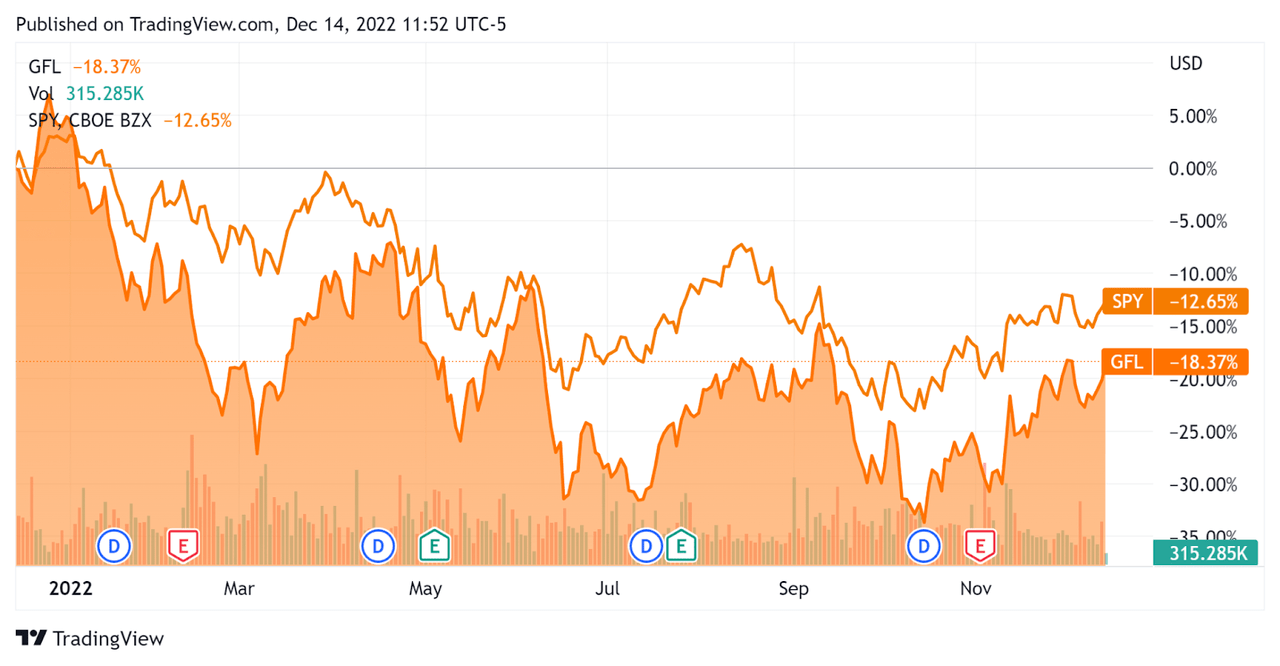

In the past 12 months, GFL’s stock price has dropped 18.4% vs. the U.S. S&P 500 index’s drop of around 12.7% but has largely tracked the index, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For GFL Environmental

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.4 |

|

Enterprise Value / EBITDA |

15.1 |

|

Revenue Growth Rate |

37.2% |

|

Net Income Margin |

-2.5% |

|

GAAP EBITDA % |

22.7% |

|

Market Capitalization |

$9,778,924,500 |

|

Enterprise Value |

$16,812,090,400 |

|

Operating Cash Flow |

$707,448,830 |

|

Earnings Per Share (Fully Diluted) |

-$0.67 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Waste Management (WM); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Waste Management |

GFL Environmental Inc. |

Variance |

|

Enterprise Value / Sales |

4.2 |

3.4 |

-19.1% |

|

Enterprise Value / EBITDA |

15.4 |

15.1 |

-2.0% |

|

Revenue Growth Rate |

12.3% |

37.2% |

203.8% |

|

Net Income Margin |

11.6% |

-2.5% |

–% |

|

Operating Cash Flow |

$4,480,000,000 |

$707,448,830 |

-84.2% |

(Source – Seeking Alpha)

A complete comparison of the two companies’ available performance metrics may be viewed here.

Commentary On GFL Environmental

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the inflationary impacts on its business that ‘have persisted far longer than we originally anticipated.’

But, the firm has instituted a variety of pricing adjustments to recover higher costs via policies such as fuel surcharges.

Management is beginning to see the signs that unit rate cost inflation is moderating and supply chain disruptions are starting to ease.

As to its financial results, organic revenue growth was 15% year-over-year, while gross profit margin was flat at 13% year-over-year.

SG&A was flat as was operating income, while earnings per share improved but were still heavily negative at ($0.40).

For the balance sheet, the firm finished the quarter with cash and equivalents of $171.9 million and $6.8 billion in debt.

Management said two-thirds of its debt is fixed rate with ‘over five years of average term remaining.’ The company has ‘no significant maturities for three or four years and that the majority of the amounts coming due in ’25 and ’26 are floating rate debt and therefore, already largely priced to current market conditions.’

Over the trailing twelve months, free cash flow was $148.3 million, of which capital expenditures accounted for $559.1 million of cash used during the period.

Looking ahead, management expects ‘a minimum of 12% topline growth […] we believe ’23 will be a year of outsized margin expansion opportunity as the strength of recent pricing, together with the rollout of our surcharge programs continue against the moderating level of cost inflation.’

The primary risk to the company’s outlook is the potential for continued inflationary pressures coupled with potential difficulty in passing along price increases without a reduction in margin revenue.

Regarding valuation, the market is valuing GFL at similar valuations as Waste Management, while GFL is growing revenue at a higher rate of growth, so prospective investors may see an opportunity there.

However, I’m more cautious as I’m not convinced that inflation will come down very quickly.

My outlook is on Hold for GFL until we learn the trajectory of inflationary pressures on its businesses.

Be the first to comment