Japanese Yen, USD/JPY, AUD/JPY, Chinese Retail Sales, Bond Yields – Asia Pacific Market Open

- Japanese Yen outperformed as sentiment soured and global bond yields fell

- Soft US consumer confidence and Chinese retail sales likely played key roles

- AUD/JPY may rise on RBA meeting minutes, undermining triangle breakout

The anti-risk Japanese Yen was one of the best-performing G10 currencies over the past 24 hours. A combination of souring market sentiment during Monday’s Asia and European trading hours, alongside a decline in global government bond yields, likely boosted demand for JPY. The Nikkei 225 closed -1.62% while the FTSE 100 dropped -0.90% to start the new week.

Traders were likely digesting a dismal US consumer confidence report that crossed the wires last Friday, during which APAC markets were already closed for the weekend. Disappointing Chinese data likely further amplified risk aversion. In July, Chinese retail sales only climbed 8.5% y/y versus 12.1% prior. While there was growth, it came in much worse than the 10.9% anticipated outcome.

This likely amplified concerns about slowing global economic growth amid the recent surge in Covid-19 cases. Hong Kong upgraded 15 overseas places to ‘high-risk’ categories, including the United States. This means that the government will tighten quarantine rules for those arriving from these locations. The Japanese Yen was thus quick to take advantage of weakening bond yields from its developed peers.

USD/JPY Technical Analysis

Despite the decline in USD/JPY, the pair continues to broadly consolidate. A bearish ‘Death Cross’ remains in play between the 20- and 50-day Simple Moving Averages (SMAs). Immediate support seems to have been reinforced at the 61.8% Fibonacci retracement at 109.07. Key resistance appears to be the 23.6% point at 110.67. Clearing the former may open the door to extending losses towards the 200-day SMA.

Tuesday’s Asia Pacific Trading Session – RBA Minutes, Australian Dollar

Investors bought the dip during Monday’s Wall Street session, sending the Dow Jones Industrial Average and S&P 500 to record highs despite initial losses. Traders may be awaiting a speech from Fed Chair Jerome Powell on Tuesday for further hints into what the central bank thinks about tapering policy. For now, monthly asset purchases are keeping credit conditions historically easy, aiding to push stocks into new highs.

The Australian Dollar could echo the reversal in market sentiment as it eyes the RBA meeting minutes. Investors were initially caught off guard earlier this month when the central bank disappointed rising expectations that it could reverse a decision to trim asset purchases amid surging local Covid cases. Today’s minutes could be another reminder that this plan remains in play, opening the door for AUD to rise.

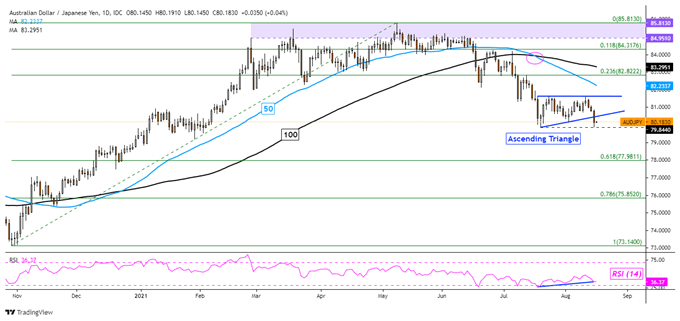

AUD/JPY Technical Analysis

AUD/JPY broke under a Descending Triangle, opening the door to resuming the downtrend that started in June. Still, confirmation is notably lacking, with key support at 79.84 still remaining in play. Taking out the latter could open the door to material losses. Positive RSI divergence does show that downside momentum is fading, which can precede a turn higher. As such, traders ought to proceed with caution.

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment