I’m love photography and art. This is me./iStock via Getty Images

Arko Corp. (NASDAQ:ARKO) is a leading consolidator in the convenience store space, having completed over 20 transactions in the past decade. Convenience stores have been safe havens during the current bear market, with most operators outperforming the S&P 500 in the past year. Although ARKO benefits from positive investor sentiment towards the industry, its elevated debt levels make me hesitant to recommend its shares.

Company Overview

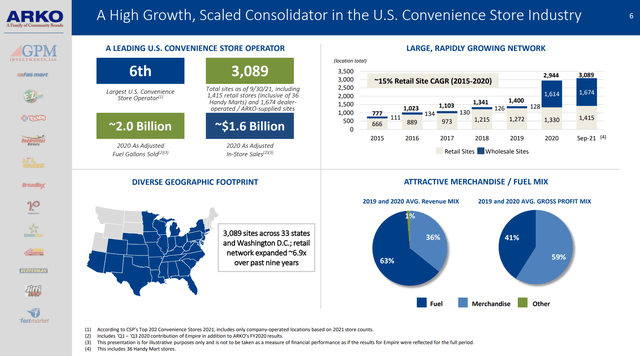

Arko Corp. is the sixth-largest operator of convenience stores serving over 3,000 locations (1,400+ operated, 1,600+ wholesale) in the United States. It operates through three segments: Retail, Wholesale, and GPM Petroleum.

Figure 1 – ARKO Overview (ARKO Investor Presentation November 2021)

The retail segment sells fuel and merchandise directly to consumers. The wholesale segment supplies fuel to third-party dealers and agents. The GPM Petroleum segment supplies fuel to independent dealers and bulk traders.

Shares Have Tread Water Since De-SPAC

ARKO came to the public markets via a Special Purpose Acquisition Company (“SPAC”) transaction in October 2020, when SPACs were all the rage. ARKO combined with Haymaker Acquisition Corp II (“HYAC”), a consumer-focused SPAC with $400 million in capital.

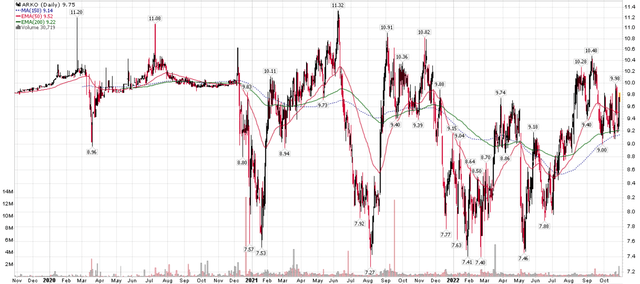

While the rest of the market had an explosive rally from the COVID lows to the end of 2021, ARKO’s stock has been treading water, trading at $9.75/share currently, not far from the de-SPAC price of $10. The stock experienced a large sell-off right after de-SPACing, trading as low as $7.50 in early 2021 as investors rushed for the exits (Figure 2).

Figure 2 – ARKO Stock Price (StockCharts.com)

In my opinion, the poor initial trading performance of ARKO’s shares could be due to the fact that ‘convenience store consolidation’ was not a sexy investment theme compared to some of the more well-received SPACs of this era like QuantumScape Corp. (QS) with its next-generation batteries or DraftKings Inc. (DKNG) with its angle on legal sports betting.

In hindsight, according to spactrack.io, ARKO has been the 11th best performing de-SPAC transaction from 2020 (out of 64), with a -2.4% equity return. While convenience store consolidation was not a sexy theme, at least it wasn’t an overhyped disaster like many SPACs of this vintage with negative standouts like American Virtual Cloud Technologies (AVCT) with a -99.2% return and 180 Life Sciences Corp. (ATNF) with a -95.5% return.

Large And Fragmented Industry Ripe For Consolidation

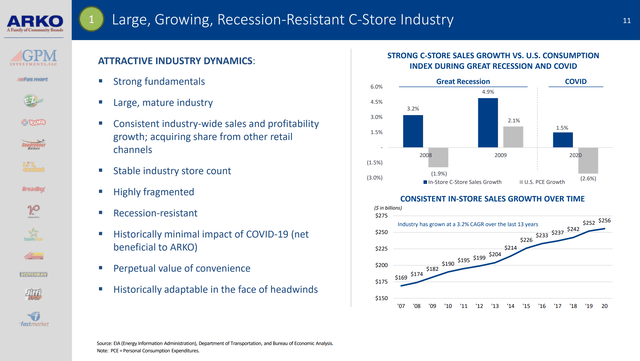

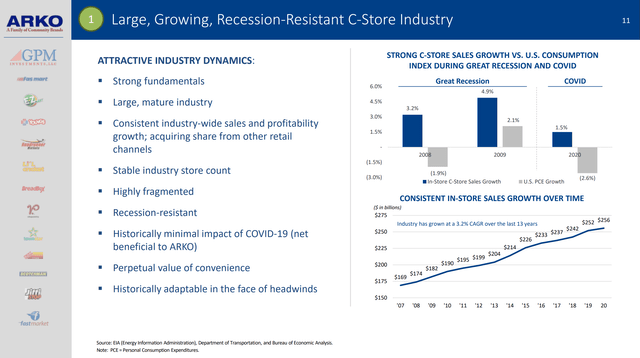

According to the National Association Of Convenience Stores, the U.S. convenience store industry has ~150,000 stores as of December 31, 2021 and remains highly fragmented as single-store operators accounted for over 60% of stores and the 10 largest operators accounted for less than 20% of the store base.

Figure 3 – Convenience Store Industry (ARKO Investor Presentation November 2021)

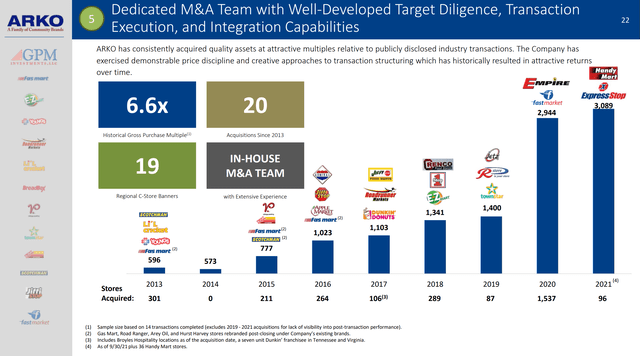

ARKO has been one of the most aggressive consolidators in this space, completing 20 acquisitions between 2013 and 2021 and growing the store count served from ~300 to over 3,000 (Figure 4).

Figure 4 – ARKO has been an active acquirer (ARKO Investor Presentation November 2021)

Latest Transaction A Model Acquisition

On October 24th, 2022, ARKO announced its latest acquisition of Pride Convenience for $230 million plus inventory. Pride operates 31 large format convenience stores in the U.S. North East, including two high-volume travel centers catering to long-haul truckers. Although the price tag was high ($7.4 million/store, 9.4x EV/EBITDA), if we look at the details, it is actually very accretive for ARKO.

ARKO is funding the transaction with $28 million of its own cash, and $202 million from Oak Street Real Estate Capital. In exchange, ARKO has agreed to lease the sites from Oak Street for $12.2 million in annual rent. The transaction is expected to add $12.2 million in adjusted EBITDA, after accounting for the lease payments. Hence, in effect, ARKO is paying 2.3x EBITDA ($28 million in capital outlay vs. $12.2 million in additional EBITDA) for the 31 sites.

Convenience Stores Are Safe Havens

Convenience stores have been a place to hide during the current bear market. This is because fuel remains one of the most stable and in-demand consumer products. Even during the 2008 Great Financial Crisis (“GFC”) and the 2020 COVID-pandemic, convenience stores saw positive sales growth (Figure 5).

Figure 5 – Convenience stores have been recession resistant (ARKO Investor Presentation November 2021)

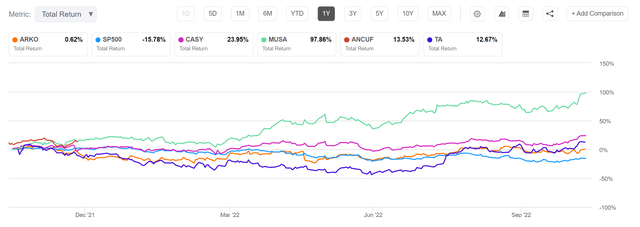

As seen in Figure 6 below, convenience store operators have returned 13% to 98% in the past year vs. -16% for the S&P 500. ARKO has been the laggard, with a 1% return in the past 12 months.

Figure 6 – Convenience stores have outperformed S&P 500 (Seeking Alpha)

Financials Steadily Improving

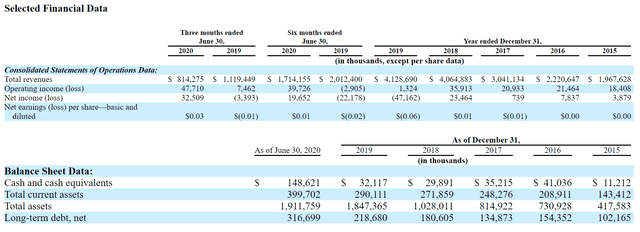

Arguably, ARKO was overvalued when it de-SPACed, as the company was barely breakeven at that point in time. In 2019, the operating business did $4.1 billion in revenues and recorded $47 million in net losses (Figure 7). However, the SPAC transaction valued the company at $1.2 billion. Unsurprisingly, about half of the SPAC’s $400 million in capital chose to redeem, forcing the company to raise $100 million in convertible preferred stock from MSD Partners L.P. to complete the transaction.

Figure 7 – ARKO SPAC financial summary (HYAC/ARKO 14A Proxy Statement)

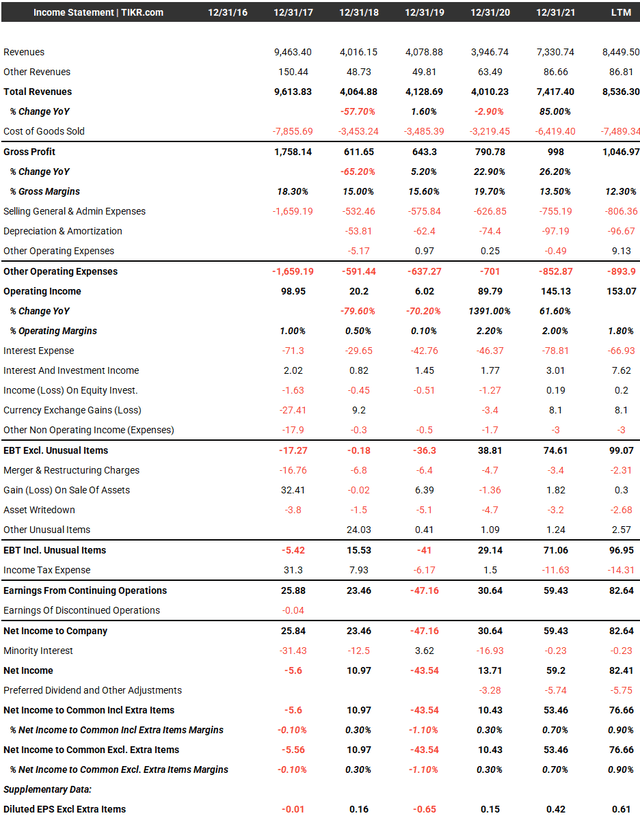

Since 2020, ARKO’s financial performance has steadily improved, with revenues topping $8.4 billion in the last twelve months and net income of $83 million. This was primarily driven by higher fuel prices and fuel margin dollars, as gasoline prices have staged a large post-COVID rally. The improving performance has allowed ARKO to ‘grow into’ its market cap, with a 16.0x LTM P/E (Figure 8).

Figure 8 – ARKO financial summary (TIKR.com)

Valuation

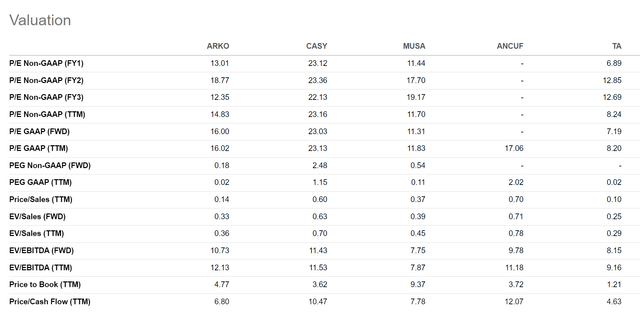

In terms of valuation, ARKO is now trading at 13.0x Fwd P/E, in the middle of the pack between industry leaders like Casey’s General Stores, Inc. (CASY) and laggards like TravelCenters of America Inc. (TA). On Fwd EV/EBITDA, ARKO trades at 10.7x, among the highest in the peer group (Figure 9).

Figure 9 – ARKO peer valuations (Seeking Alpha)

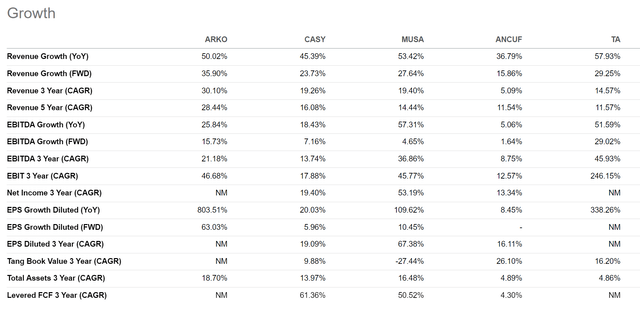

However, ARKO’s high valuation can be partly justified by its higher growth rates, with 3 and 5Yr Revenue CAGRs of 30% and 28% respectively, as it has been very active on the acquisition front in addition to benefiting from higher fuel prices (Figure 10).

Figure 10 – ARKO peer growth rates (Seeking Alpha)

Risks

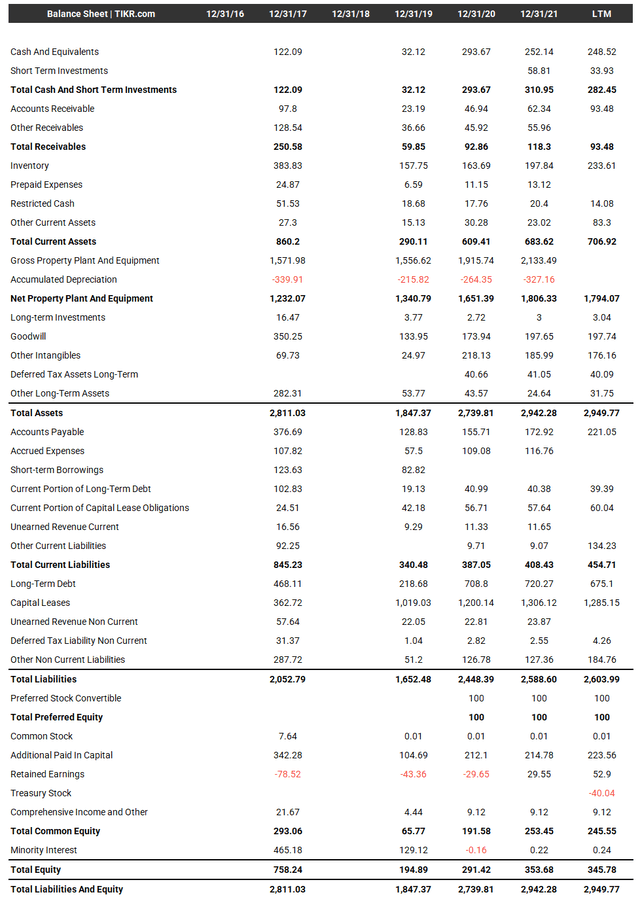

The biggest risk with any consolidation/roll-up strategy is that the company overpays for acquisitions or takes on too much debt in the process. For ARKO, this is a concern as the company has elevated debt levels of $714 million in long-term debt and $1.3 billion in capital leases, all before the latest Pride transaction mentioned above (Figure 11).

Figure 11 – ARKO balance sheet (TIKR.com)

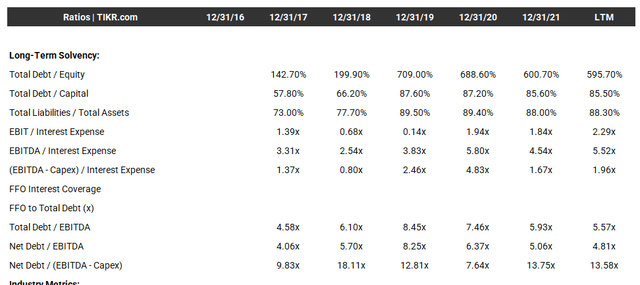

This gives the company a Net Debt/LTM EBITDA ratio of 4.8x, very high relative to peers (Figure 12). For comparison, CASY and MUSA have 1.6x and 1.7x Net Debt/EBITDA, respectively.

Figure 12 – ARKO Solvency Ratios (TIKR.com)

Conclusion

Arko Corp. is a leading consolidator in the convenience store space, having completed over 20 transactions in the past decade. Convenience stores have been safe havens during the current bear market, with most operators outperforming the S&P 500 in the past year. Although the company benefits from positive investor sentiment towards the industry, ARKO continues to trade at elevated valuation multiples when accounting for its peer high debt levels. I think the risk from elevated debt in a rising interest rate environment outweighs the potential benefits from higher fuel prices and margins.

Be the first to comment