Torsten Asmus

Recommendation: Based on the description presented below, I am advocating for the purchase of corporate bonds with a credit rating of BBB and above. The current developments with economic data in particular regarding the inflation statistics and Fed pivot present an attractive long-term investment opportunity for the fixed-income asset class.

Overview

The US central bank has two main mandates:

- Price stability (annual inflation growth of 2%)

- Full employment (a situation in which the labor market is balanced, there is no high level of unemployment, and the level of employment is not too high, where employers cannot find people and are forced to constantly raise wages.

To achieve the above goals, the Fed officials change the cost of capital through changes in interest rates (Federal Funds Rate) as well as through programs of quantitative easing (QE). By setting the upper and lower limits of the Federal Funds Rate, the Fed sets the price at which commercial banks will lend overnight. The FFR is a very important indicator because relative to it, investors project what the interest rate will be along the entire yield curve of government bonds, adding a premium for time risks and, in the case of corporate bonds, credit and liquidity risks.

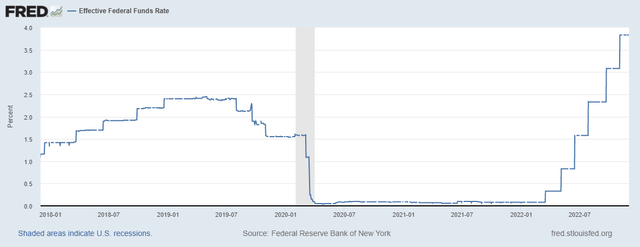

The current Federal Funds Rate is 3.83%.

FRED

The rate increase in recent periods is due to growing inflation in the US and the Fed‘s desire to influence economic activity by increasing the cost of credit, which in turn is meant to slow down demand and prices. It is worth noting that the Fed has full control over short-term interest rates, but not long-term ones. Long-term interest rates change in accordance with the stimulus programs (Quantitative Easing) conducted by the Central banks, as well as by current economic indicators, which in turn drive yields on the bond market.

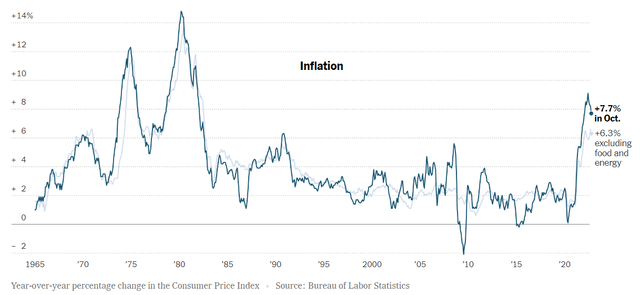

In October, annual inflation increased by 7.7%, which is 0.2% below expectations, but still the highest indicator in the last 40 years. Although a difference of 0.2% is not a large value, it changed the trend in the capital markets, opening the way to a potentially profitable long-term investment.

NY Times

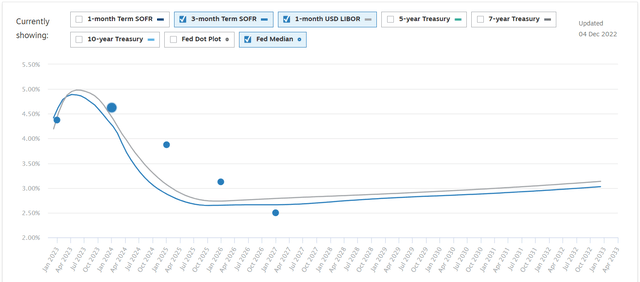

Understanding the trends, and dynamics of interest rate changes is an extremely important factor in making investment decisions, and for this purpose investors around the world use LIBOR futures.

Futures on short-term interest rates give an idea of what the interest rate will be in the future. The most popular short-term interest rate future is a 3-month LIBOR or Eurodollar Futures. This future shows the percentage at which banks can provide unsecured loans for three months. Since short-term rates are under the full control of the Fed, this future is essentially the market’s best guess as to what the Federal Funds Rate will be in the future. For example each year there are four main Eurodollar futures contracts (March, June, September, and December). Each of them shows the market’s expectation of what the Fed‘s interest rate will be at expiration. Eurodollar futures are a highly liquid instrument and are traded far into the future and are a very important tool for economic forecasting.

The line on the graph is the futures price for each contract for the next 10 years, which can be interpreted as the market’s expectation of the Fed‘s interest rate at a specific time in the future. The blue dot represents the Fed Committee’s average interest rate expectation. By analyzing the graph, it is possible to state that the expectations of the market and committee members of the Fed for the next three years coincide, which indicates that all future interest rate increases are already reflected in the current price of bonds, with FFR peaking at around 5% in May 2023. Thus, raising the Federal Funds Rate above the market expectations will only hurt bond prices. The divergence between expectations begins only in January 2025, where according to the members of the Fed, the interest rate should be around 3.75%, although market players see the interest rate close to 3%, this is due to the difference in the vision of economic indicators of the market and Fed officials.

Chatham FINANCIAL

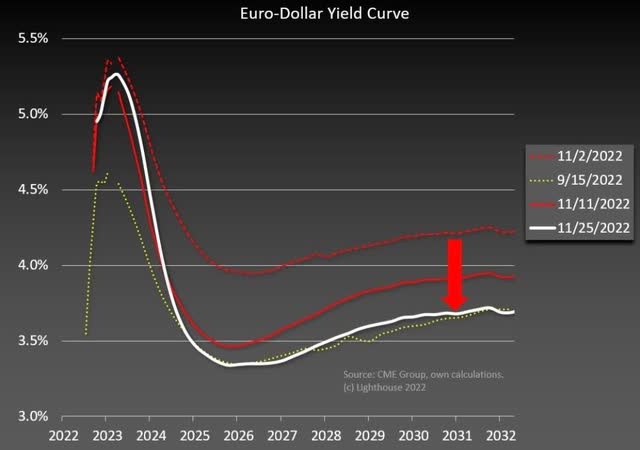

A below-expected inflation rate by itself did not affect bond prices, but it did trigger a reassessment of expectations about future interest rates which in turn triggered a rally in the S&P and Bond markets.

The essence of the idea of buying bonds can be seen when comparing the lines from 11/11/2022 and 11/25/2022 VS the line from 11/2/2022. After the 11/10/2022 inflation news, the market began to reprice futures to the downside across the entire yield curve, with the most pronounced difference starting from 2025. This revaluation indicates that the current level of the interest rate curve in the debt market is sufficient to have an impact on the reduction of demand and, as a result, prices, thus lower rates are likely to emerge going forward.

On the other hand, against the background of the growing cost of lending, obvious improvements in the supply of many groups of goods: energy components, transportation services, chips, rents, etc. affect investors’ expectations for lower inflation rates in the future and, accordingly, a lower FFR from the Fed.

If we sum up the above, then in these circumstances we can say that the peak of the increase in the Federal Funds Rate has passed, which implies that the prices of the Fixed Income securities bottomed. The recent speech by Fed Chairman Jerome Powell on November 30, supports the market expectations for the pivot.

Since the price of a bond is a derivative of interest rates, this means that a lower rate of increase from the Fed will have a positive effect on bond prices (lower % rate = higher bond price) so prices should rise.

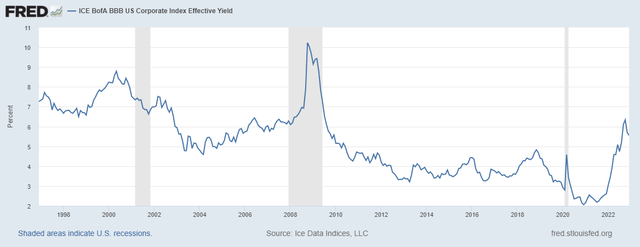

Investment Implications: Considering the above, I recommend buying commercial long-term bonds with the highest duration. Long-term bonds are the most volatile, so this will provide the maximum return on invested capital. In the corporate segment, I would look closely at the bonds of companies with a rating of BBB and above, because the yield to maturity of these bonds is the highest in the last 13 years (5.55% YTM), and even higher than during the pandemic when the world economy was in a troubled position.

FRED

Given that the U.S. economy is performing among the best in decades and corporations are earning record profits, the risks of bond defaults are low.

Risks: A sharp rise in energy prices due to a global military conflict or a cut-off in supplies from the Russian Federation. This will lead to the resumption of inflation growth in the US and the world, as well as the exit of investors from fixed-income assets due to expectations for a higher FFR in the future.

Be the first to comment